Tope Idowu received a credit alert indicating a transfer of ₦560,000 into his Guaranty Trust Bank (GTB) savings account by Engineer Olufemi Akosile on December 11, 2021. Two hours later, ₦500,000 was erroneously deducted from the account, and has not been returned since then.

Akosile, Idowu’s boss, told FIJ the money belongs to him and he is ready to sue GTB for an unauthorised deduction.

“The money is mine. I stay in the United States. Tope Idowu is my aide. So, I sent a total of ₦500,000 to him to buy some bags of rice during yuletide. Just within two hours of receiving the money I sent to him, the whole money was deducted from Idowu’s bank account,” Akosile told FIJ.

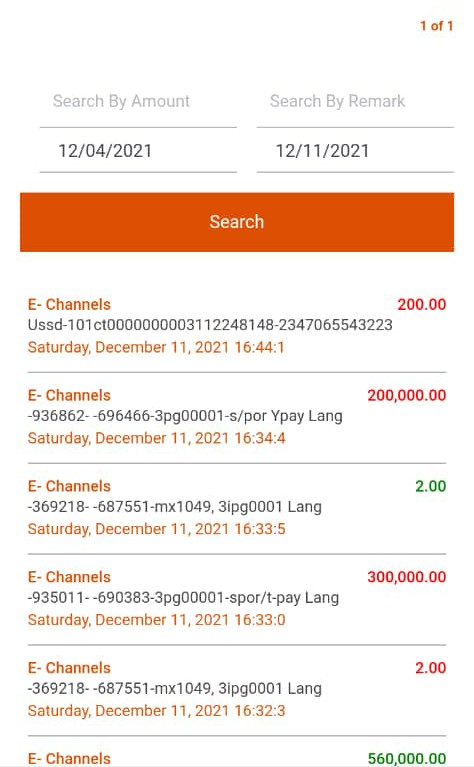

“First, ₦300,000 was deducted, and then ₦200,000. We have followed them and had a lot of back and forth with the bank. After so many tries, no feedback or response from the bank and that’s the reason I’m filing a lawsuit against them.”

Idowu’s savings account is domiciled at a GT Bank branch in Ilesha, Osun State. He received the ₦560,000 credit alert around 2:42 pm after one-time-passwords were sent to him as though he was about to make a payment using his mobile phone.

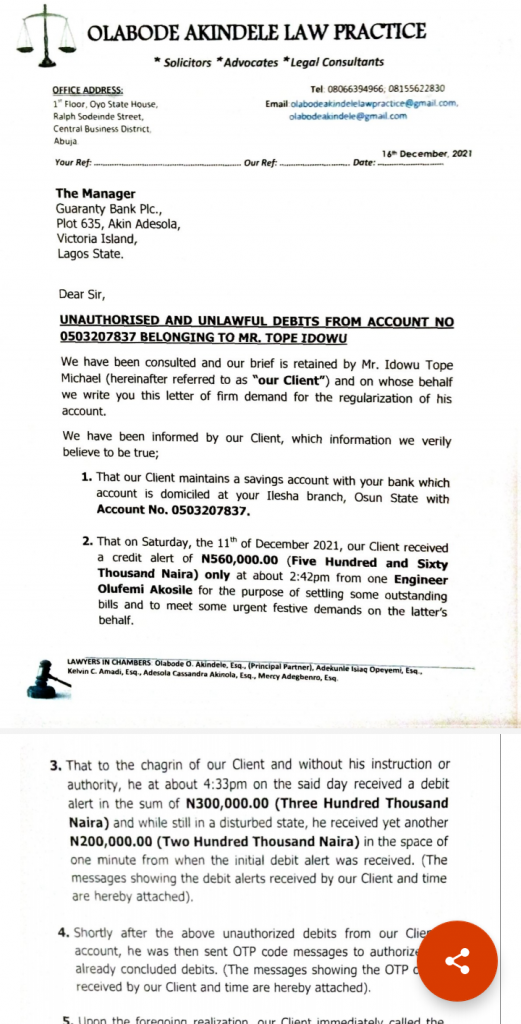

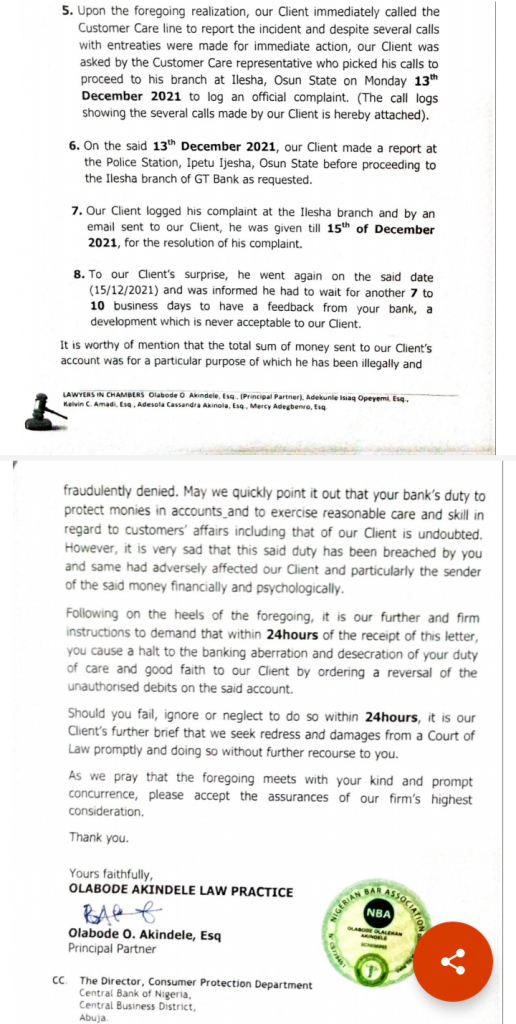

The shocked customer quickly made a phone call to the customer service hotline to let his bank know of the erroneous deduction of funds from his bank account. GTB customer care advised Idowu to go to his bank in Ilesha on Monday, December 13, 2021, to lodge a formal complaint.

In Ilesha, Idowu was told to exercise patience, as his money would be reversed by December 15. Idowu also alerted the police of the irregularities. On December 15, GTB asked Idowu to wait for another seven or 10 days to get the money back into his savings account.

READ ALSO: One Arrested As GTB Refunds Customer’s Missing N2.95m After FIJ’s Story

At this time, the bank had already admitted that there was truly an erroneous deduction, but was unsure of how long it would take them to return the missing N500,000.

“I procured the services of a lawyer on Idowu’s behalf,” Akosile said.

However, GTB is yet to make amends two months after getting a notice from Idowu’s legal representatives.

“Nigerian banks are fond of this terrible behaviour. If we are trusting a financial institution to keep our monies safe, they must do a good job of employing trust worthy persons to keep our funds safe. This is not the first time this is happening, and I am very disappointed,” said Akosile.

“If this money was meant to help someone suffering a health crisis, would this not cost a life? I had plans to use the money to get rice for those at home, but that was disrupted. They failed to respond to our lawyers too; we are charging them to court for this.”

Cornelius Onuoha, a GTB spokesperson, asked to be given 24 hours to comment when FIJ contacted him on Monday. More than 24 hours later, he has not responded to our enquiries.

Subscribe

Be the first to receive special investigative reports and features in your inbox.