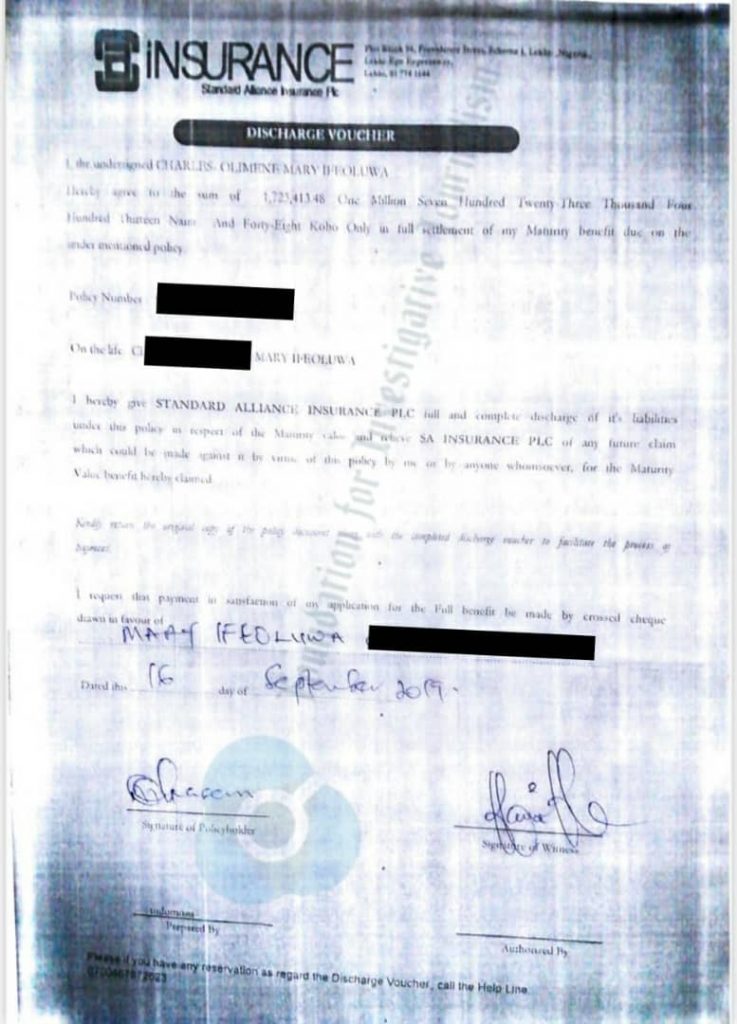

Mary Ifeoluwa, a Port-Harcout-based banker, has narrated how Standard Alliance Assurance, a Nigerian insurance company, refused to pay her policy fund worth N1.72 million after maturity.

Ifeoluwa told FIJ that she had subscribed to a five-year insurance plan with Standard Alliance in June 2014, and the plan was to mature in June 2019.

READ ALSO: Standard Alliance Insurance Company Fails to Pay Investor for 3 Years

She said she subscribed to the insurance policy basically for savings as she wanted something she could fall back on after five years.

“I did it for myself because I just wanted something I could fall back on at the end of five years. I didn’t want to just put my money in the bank where I could access it. So it was more like a savings plan,” said Ifeoluwa.

She said she put N30,000 into a policy plan monthly but stopped in August 2018 before the plan reached its maturity stage.

“I had continued the plan for only 49 months as against the 60 months of the plan,” she told FIJ.

“I was hearing rumours and I didn’t want to continue with the plan. All I wanted was for the plan to mature so I could get my money.

“When my plan expired the following year, Standard Alliance Assurance sent me a discharge voucher informing me that my plan had matured and that I paid N1.4 million for the 49 months but with interest, it was about N1.72 million.”

Ifeoluwa said she contacted the insurance company after her plan matured, but they’re yet to pay her a dime.

“It has been one excuse upon the other,” she said.

“Whenever I call the number registered in their name, the response I get is funny because it’s usually a little child who picks and then says ‘my mummy is not at home’. The child repeats this line every time.”

When our reporter attempted to reach Standard Alliance Assurance via the phone number provided by Ifeoluwa, she was told it was a wrong number.

A text to the company via the messaging system made available on its website had also not been responded to at press time.

FIJ had reported how Standard Alliance shut down their offices after denying investors their funds.

Subscribe

Be the first to receive special investigative reports and features in your inbox.