“My questions and concerns with this trend of occurrence are: Why will a total stranger outside GTB be so current of the happenings to a particular account or account holder to the extent that the said email will come through with the exact GTB official email address?”

On Tuesday, January 10, Oluyemisi Adebayo, a Canada-based Nigerian tried to use her Guaranty Trust Bank (GTB) account and mobile bank application for the first time since April 5, 2022, when N900,000 fraudulently disappeared from her account.

In the process, she realised that her account was deactivated after she reported the fraud and that she only had restricted access. Adebayo said that to gain full access to her account, she was asked to change all her passwords via an email correspondence. She told FIJ that she responded stating, “all have been done” although she did not change her passwords.

“I felt the changes done months earlier should still suffice,” she added.

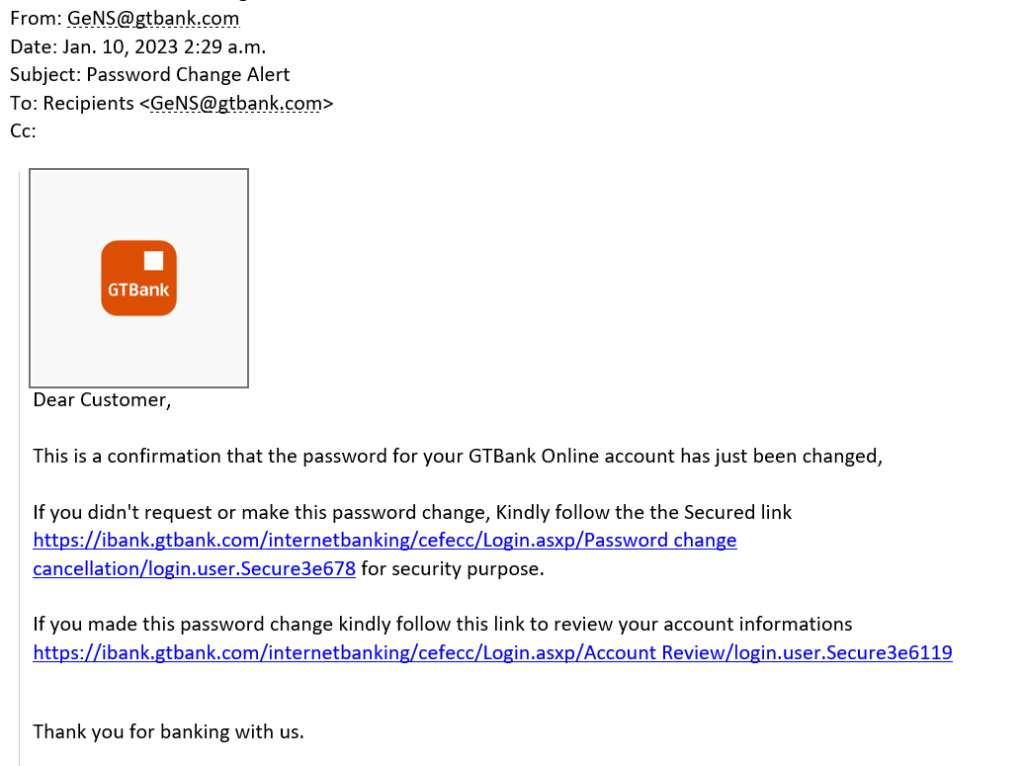

She said that few hours after, she received a mail from GTB notifying her of a password change. The mail also contained two “secured links” that she was instructed to click on whether or not she initiated the password change.

While this could be perceived as a harmless security update provided by GTB, to Adebayo, it was a fraud alert.

This was the exact sequence of action that led to the disappearance of N900,000 from her account nine months ago.

Adebayo said she did not change her password and she was convinced that someone from GTB had fraudulent access to her account.

On Wednesday, June 15, 2022, FIJ reported how N900,000 was wiped from Adebayo’s account while she was attempting to set up a PIN for her GTB mobile application.

READ ALSO: Customer’s N900,000 Disappears While Activating GTB Mobile Application

Prior to this incident, the Canada-based Nigerian used a token to perform her mobile application transactions. However, following an earlier consultation with her account officer, Oluyemi Oluwole, in November 2021, she decided to activate a PIN for her mobile app transactions.

It was in the process of activating a PIN that she received a notice that she would receive an email with which she would proceed with the configuration.

Adebayo told FIJ that she checked her email and saw the message supposedly from GT Bank. She said that the subject of the email was “password change alert” and that it contained two links.

According to her both links came with a command to click on the first if she did not initiate the change or click on the second link if she initiated the password change.

Adebayo clicked the second link confirming that she initiated the action and was redirected to a “seemingly GTB platform”. She said “it asked for my token, my security question and the last six digits on my card, but when I input the last six digits, it told me it was a wrong number.”

Discouraged by the process, Adebayo said she discontinued the PIN activation process and closed the link to the commercial banking website, choosing to continue to use her token for transactions.

Adebayo said exactly three hours from her attempt to activate a PIN on her mobile app, she received a debit of N900,000.

She reported the transaction to GT Bank’s electronic fraud team and was told that the N900,000 was moved to a Stanbic IBTC account named Chidi Ugo Alex.

On the e-fraud team’s advice, Adebayo reported the matter to the police anti-fraud unit in Eleweran, Abeokuta, Ogun State. She, however, abandoned seeking police help when she was asked to pay N200,000 to secure an injunction from the court requesting access to the Stanbic IBTC account where her money had been moved and consequently withdrawn from.

READ ALSO: Police Demand N200,000 to Track GTB Customer’s Missing N900,000

She told FIJ, “I believe a court injunction was necessary, but at what cost? They said the least they would collect was N150,000 after trying to negotiate. Still too high, I backed off.”

Seven months since FIJ’s first report, there has been no progress on tracking Adebayo’s missing funds.

Adebayo told FIJ that GT Bank insisted that she gave out her information to “unauthorised links” but that she had never shared her account information with anyone other than her account officer.

She is convinced that the disappearance of her funds is orchestrated by an “insider”, more so with the January 10 GTB mail she received while trying to reactivate her account.

“My questions and concerns with this trend of occurrence are: Why will a total stranger outside of GT Bank be so aware of the happenings to a particular account or account holder to the extent that the said email will come through with the exact GT official email address?” She asked.

“I mean, what are the odds of me getting such emails once PWs are being changed or they (GT staff) think they have been changed? Note: In months (Since May 2022), I never received such.”

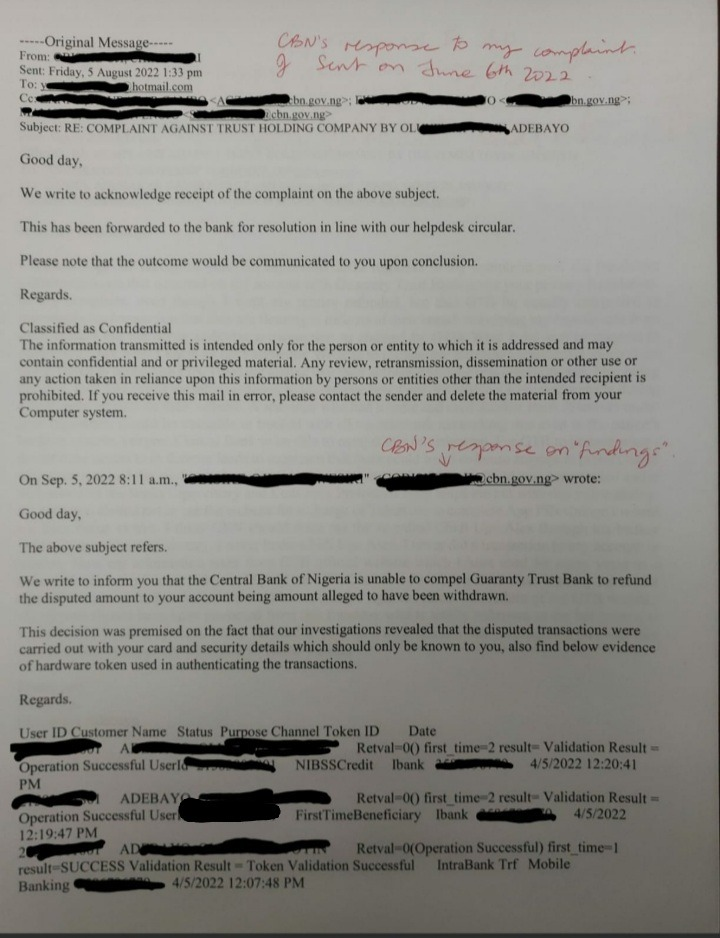

Adebayo said she reported the transaction to the Central Bank of Nigeria (CBN), and that the CBN told her it could not compel GTB to refund her money because the transaction was carried out using her card and security details. According to CBN’s mail, the information should be known to Adebayo alone.

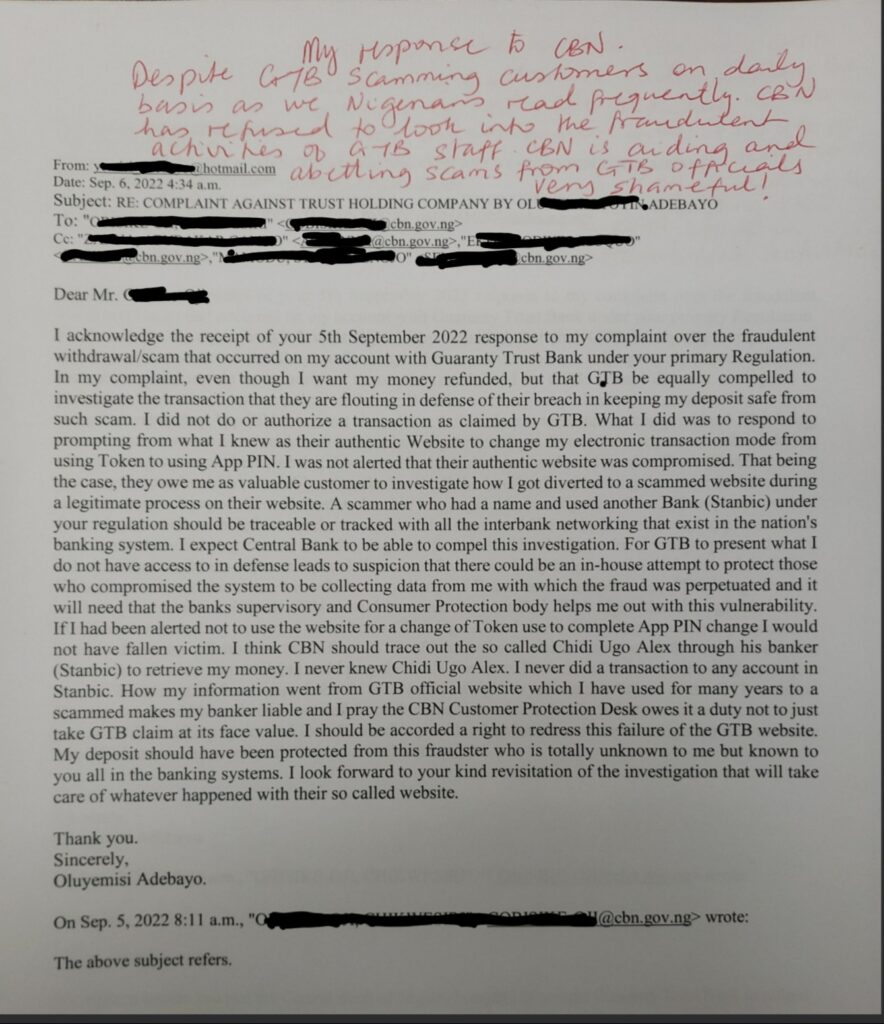

Adebayo, in her response to CBN, stated that she did not compromise her account in any way and that she only clicked on the link sent to her by GTB, which redirected her to the bank’s website.

She added that it must be the bank whose site was compromised and that they owed her an investigation.

Oluwole, who is no longer Adebayo’s account officer, told FIJ that GTB could not demand more information from Stanbic IBTC on the Chidi Ugo Alex account and investigate further without an injunction from the court.

Subscribe

Be the first to receive special investigative reports and features in your inbox.