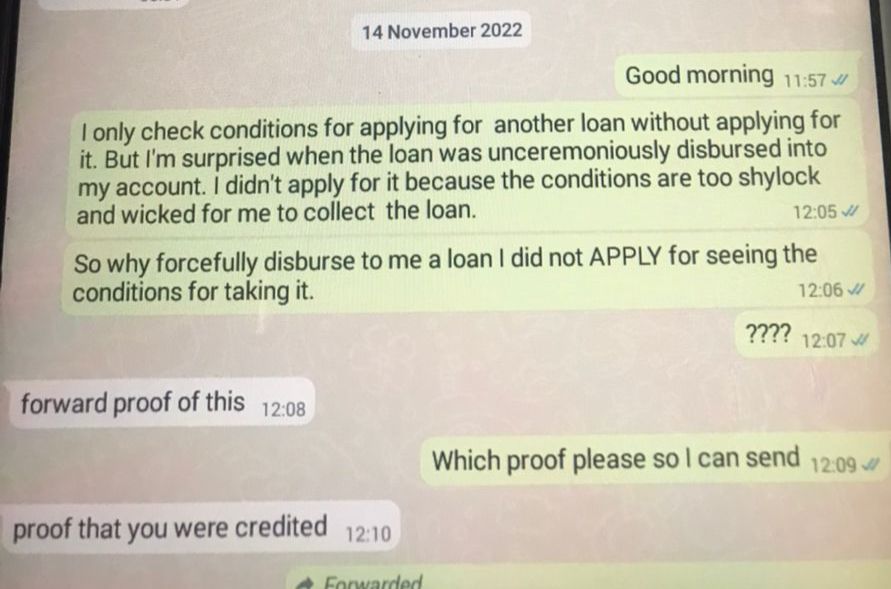

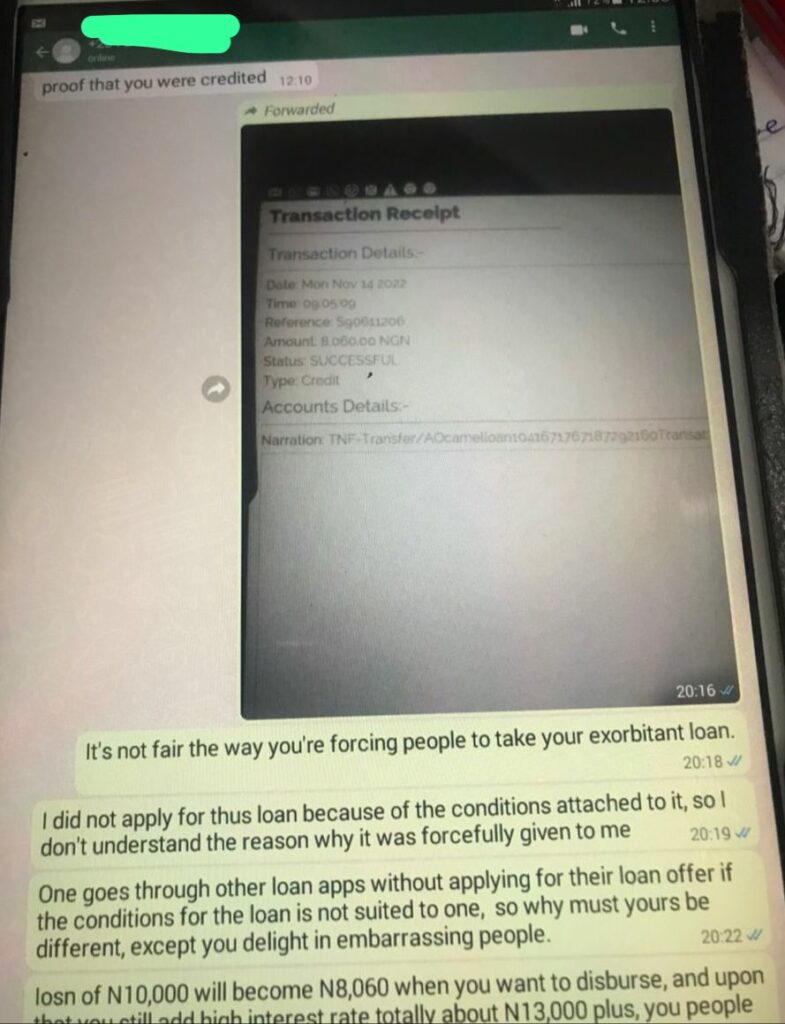

Adelaja Oluwabukunola has reported to FIJ how loan app CamelLoan forced a loan of N8,060 on her on Monday, November 14.

Oluwabukunola said she opened CamelLoan’s app to access a loan but decided against it because of their stringent terms and conditions, as she was expected to pay an interest of almost N6,000 for a loan of N8,060 in one week.

Seeing that she could not accept the terms and conditions, Oluwabukunola said she quickly closed the app without confirming the loan, but 15 mins later, she received a credit alert of N8,060.

READ ALSO: Palmcredit Threatens To Defame Woman Over N54,500 Loan She Did Not Ask For

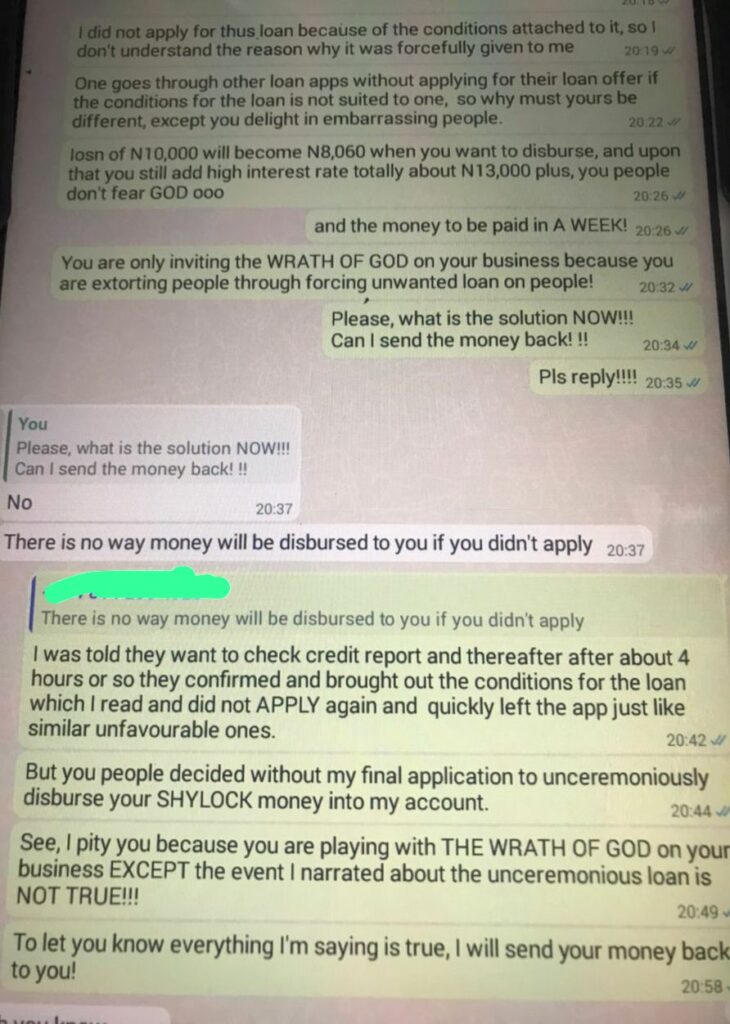

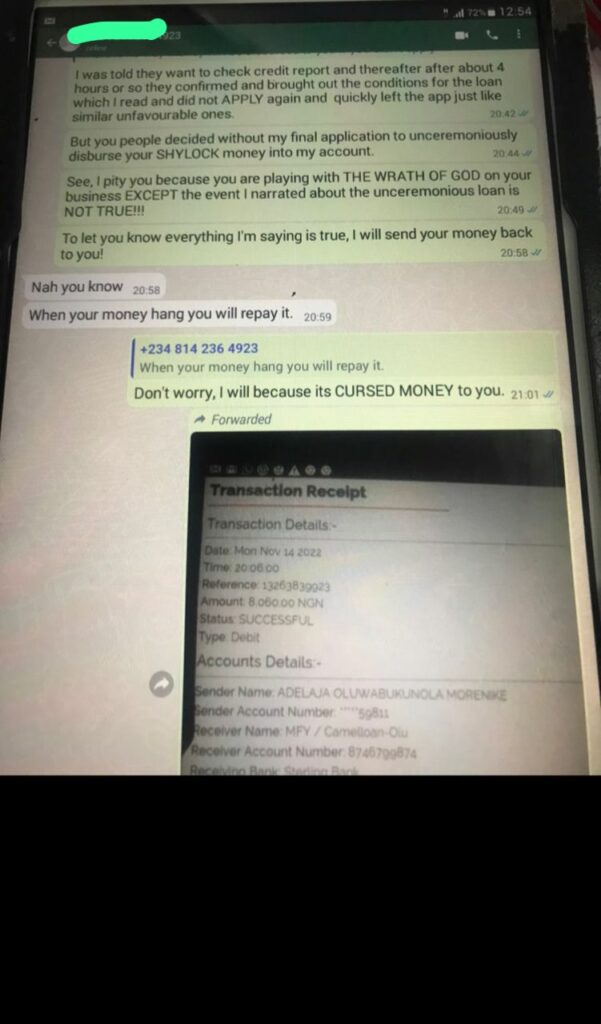

She said she contacted the agent who had earlier chatted with her online to complain that she did not approve the loan because of the conditions attached to it, and that she would refund the money. She said she repaid immediately.

READ ALSO: Over N12,000 Loan, Cash Mall Sends Defamatory Message to Customer’s Contacts

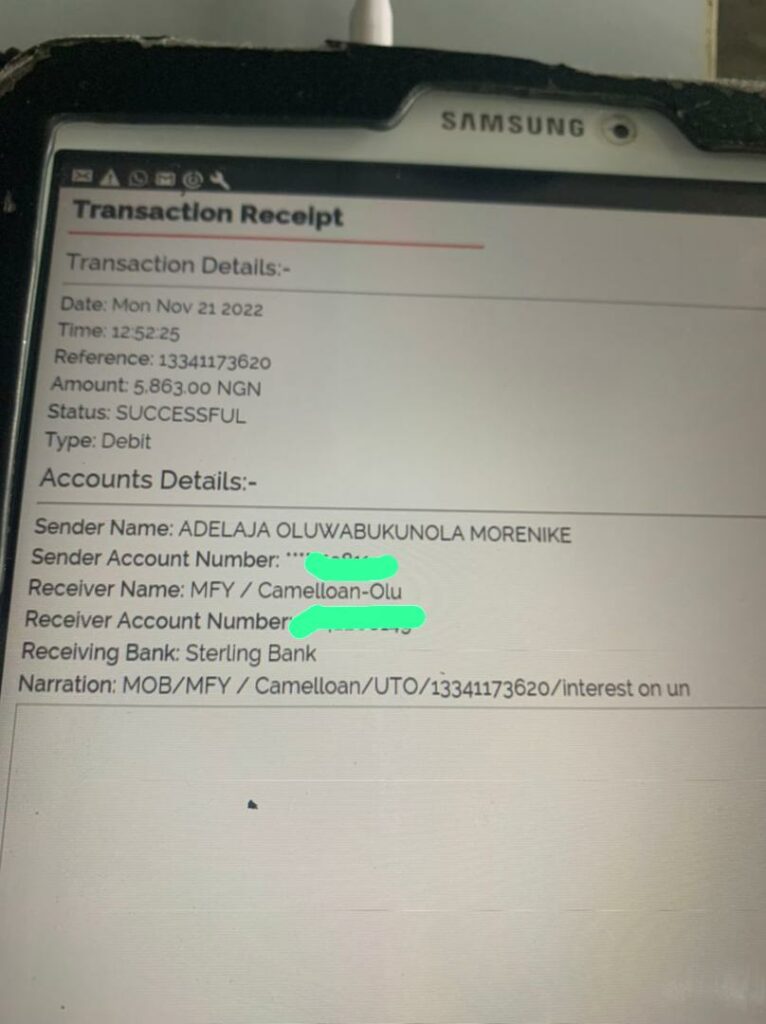

But a week later, on November 21, a female agent from the loan company contacted Oluwabukunola about the payment of an interest of N5, 863 for the N8,060 loan, which she refunded on the same day it was sent to her, and told her that her payment was due on that day.

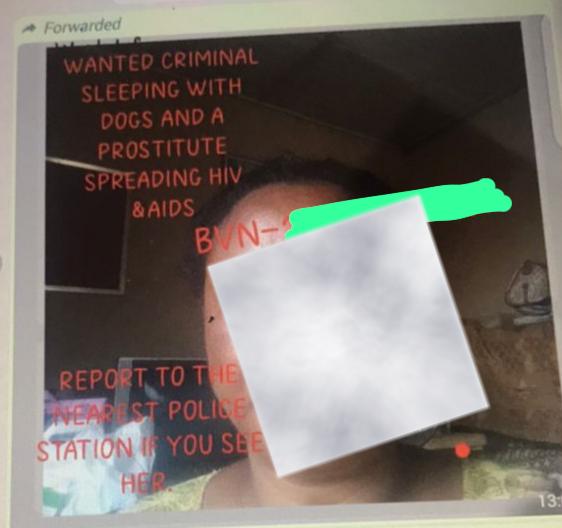

She said she was upset and had an altercation with the agent, but the loan shark insisted that she pay the interest, and that despite not defaulting yet on that day, the agent sent her picture, name, and BVN to her contacts, claiming that she was a prostitute who slept with dogs and that she had HIV/AIDS and went about infecting people with it.

“As a woman in my 50s, I don’t understand why I should be subjected to such demeaning treatment,” Oluwabukola said. “I paid the interest yesterday and I now want to make official complaint.”

Oluwabukunola said she tried to contact the Federal Competition and Consumer Protection Commission (FCCPC) to lay a complaint, but has not received any response yet.

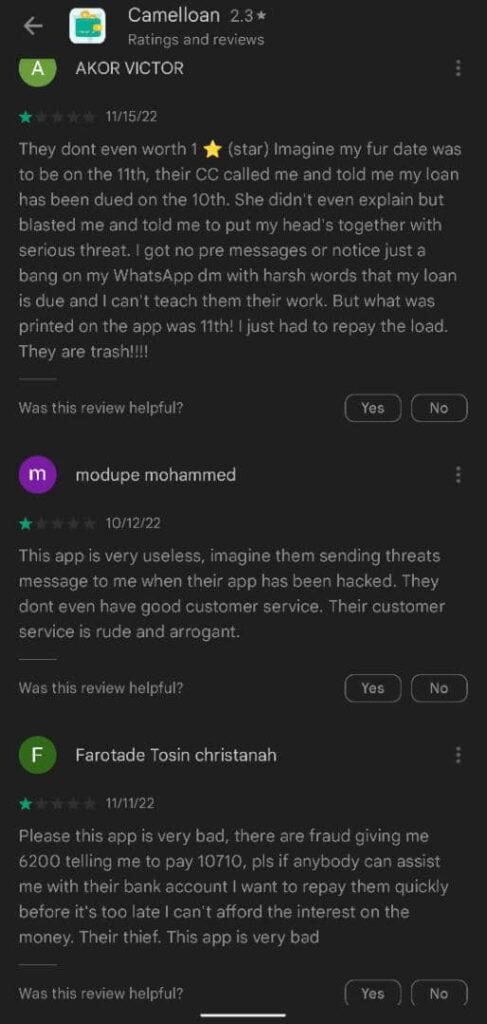

The loan app does not seem to have any digital footprints other than their app on the Google Play Store. They also had mostly negative reviews on the platform.

After several attempts, FIJ finally reached the agent who contacted and circulated Oluwabukunola’s photo, Bank Verification Number (BVN), and false information about her via phone call, but the agent kept asking if she contacted us, and when we responded negatively and explained the reason for the call, she hung up. A message sent to her immediately after the call was not responded to.

Subscribe

Be the first to receive special investigative reports and features in your inbox.