Abdulmujeeb Abioye Tadese, a customer of OPay, a fintech company located in Lagos State, has obtained a court judgement against the company for freezing his account for no just reason.

The judgement, delivered by the Federal High Court sitting in Osogbo, Osun State, on December 6, 2022, mandates the financial technology company to pay N1 million in damages to Tadese.

Tadese, an undergraduate at the University of Ilorin, instituted the matter before the Justice N. Ayo-Emmanuel-led court on September 27, 2022, via a motion on notice duly served on OPay as the second respondent and Sterling Bank, the first respondent.

Upon the response of the counsel for Sterling Bank, the court stated that the bank had no liability in the case and as such struck out its name from the case.

READ ALSO: Opay Denies Student Access to N26,000 Project Fee

The applicant had included in his prayers that the court determine whether the “unilateral freezing of his account by OPay since September 1, 2022, till date” was lawful and legal, praying further that the court declare such as an infraction of his constitutional right.

He also asked that the court award N100 million as compensation and N1 million as the cost of prosecuting the case to him, while asking for a relief of “perpetual injunction restraining the respondents freezing” his account indefinitely without a lawful order.

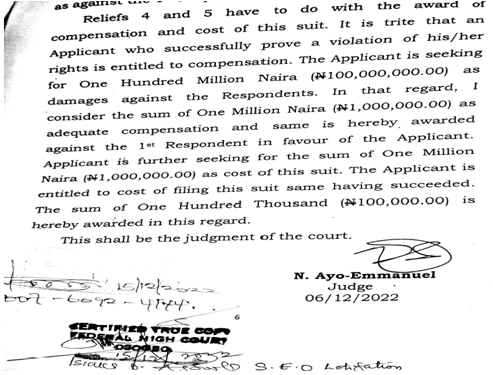

According to the certified true copy of the judgement delivered by Justice Ayo-Emmanuel and exclusively obtained by FIJ, the court cited relevant precedents and proclaimed that the failure of OPay to file a defence to the application despite fair hearing extended to it was an admission of the facts and submission of the applicant.

“….an evidence not challenged by the party that had opportunity to do so should be ordinarily believed and awarded credibility,” the court said, quoting a legal authority.

In the wisdom of the court, five of the six reliefs prayed for by Tadese were wholly granted by the court. Throughout the proceedings, the company did not make any appearance despite being aware of the case.

“I consider the sum of one million Naira (N1,000,000.00) as adequate compensation and same is hereby awarded against the first respondent in favour of the applicant,” the court ruled.

“The applicant is also entitled to cost of filing this suit same having succeeded. The sum of one hundred thousand (N100,000.00) is hereby awarded in this regard. This shall be the judgement of the court.”

BACKGROUND OF THE CASE

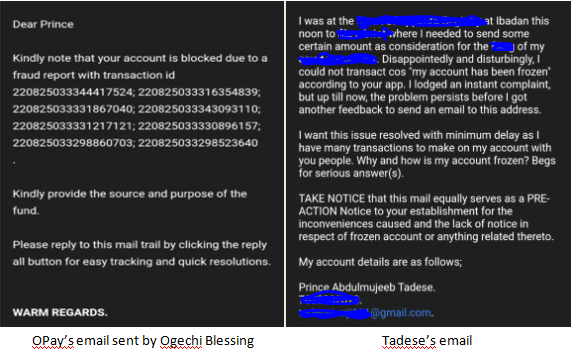

Speaking with FIJ on what pushed him to approach the court for resolution, Tadese said the company had contacted him in late August that he provide an explanation on a suspicious transaction that occurred on his account.

He added that he immediately emailed the mobile bank with his response, clarifying that his account, with N299,000, was not involved in any questionable transaction.

READ ALSO: OPay Denies Customer Access to Old Account With N31,000 Balance

“I was to transfer some money to a government institution in August, but I got to see that my OPay account had been frozen. That day was terrible for as the dealing I was to finalise was time-bound. I had to contact my boss who then made a direct payment to the concerned office,” Tadese told FIJ.

Tadese told FIJ that “after seeing the freezing statement, he sent an email to the company but did not get a reply until three days after”.

The reason, according to OPay, was that Sterling Bank wrote to them about a customer who had complained that a fraudulent transaction linked to an OPay account took place on his account on August 27, 2022, and the amount involved was N30,000.

Tadese, a student of English, continued, “It is very instructive to point out the transaction OPay identified as fraudulent had taken place between me and the Sterling Bank’s customer on August 21 and the amount was N80,000.

“To add to that, the Sterling Bank’s customer is my biological father. I was the one who wrote the letter he took to his bank to complain and after this issued played out, he informed his bank that the affected transaction was the one that happened on August 27.

“My father then instructed his bank to tell OPay to unfreeze my account, which the bank has done. Having exhausted my patience, I resorted to seeking the judicial interpretation of their illegal action and intervention.

“We also reached out to the Central Bank of Nigeria (CBN) for assistance before heading to court, but I didn’t get a response from them.”

“OPAY IS DISRESPECTING THE COURT”

Tadese told FIJ that he had furnished OPay with a copy of the judgement but got no response.

“I sent them an email the day the court delivered judgement. I have also sent it to them three times thinking they would at least respond, but no response till date,” he said.

“Despite this subsisting court order, they are still holding on to my N299,000 by not unfreezing my account.”

“I think OPay is intentionally disrespecting the court of law. Their body language is clear. An organisation registered under the laws of Nigeria should pay a better disposition to a court order such as this.”

READ ALSO: Opay Blocks Customer From Accessing N106,889 Released to Him by Jumia

OPay is owned by Opera Group and its president in Nigeria, Olu Akanmu, is a former director at First City Monument Bank.

At press time, the company had not responded to FIJ’s email sent on Tuesday.

Subscribe

Be the first to receive special investigative reports and features in your inbox.