Oluyemisi Adebayo, a Canada-based Nigerian, has recounted how N900,000 was fraudulently taken from Guaranty Trust Bank (GTB) account on April 5.

Adebayo told FIJ that the money left her account while attempting to set up PIN option of GTB mobile application.

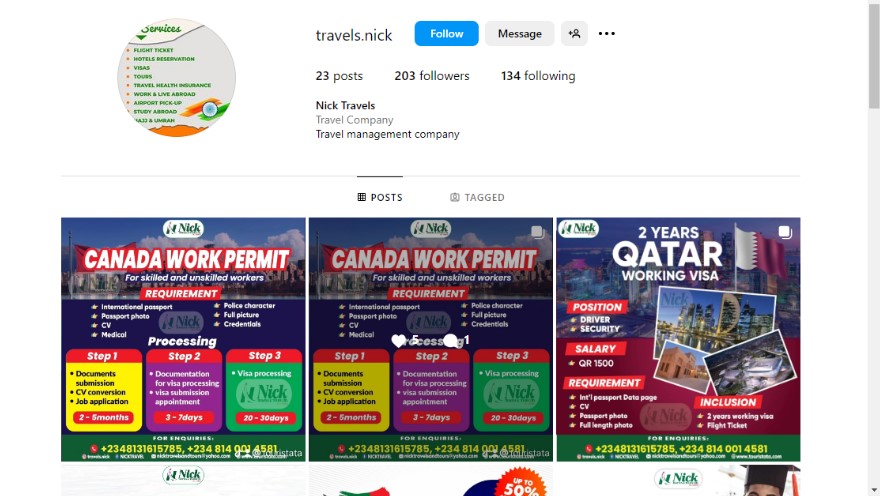

“Shortly after I procured a bank card in October 2021, I started having series of Banking related issues, one of such necessitated me getting in touch with these two account officers, Yemi Oluwole and Seun Ogunye, through email. Yemi Oluwole was introduced to me as another account officer by Seun Ogunye (my very first account officer) via GTB email, ” she told FIJ.

“Oluwole however responded by introducing a WhatsApp number to me as a better way to communicate. Once contacted via WhatsApp, part of his resolution to that particular banking issue was to ask me to set up the GTB Mobile application as a more user friendly platform, that on it, there is a choice of using a Token or PIN if I am in pocession of a bank card, his reference to card led me to share the card with him since at that time I did not know the card he was talking about. Over the course of couple of months, he continued to be my ‘go to’ GT account officer any time I had bank issues. These in turn made him to have more knowledge of my banking details.”

Adebayo said she continued using the GTB Mobile application for transactions with her token and decided to switch to a PIN option instead as earlier informed by the account officer.

“He had sent me guidelines on how to set it up. This was my first time of ever doing anything like this. While going through the process, I was asked to input my pin, which I did,” she said.

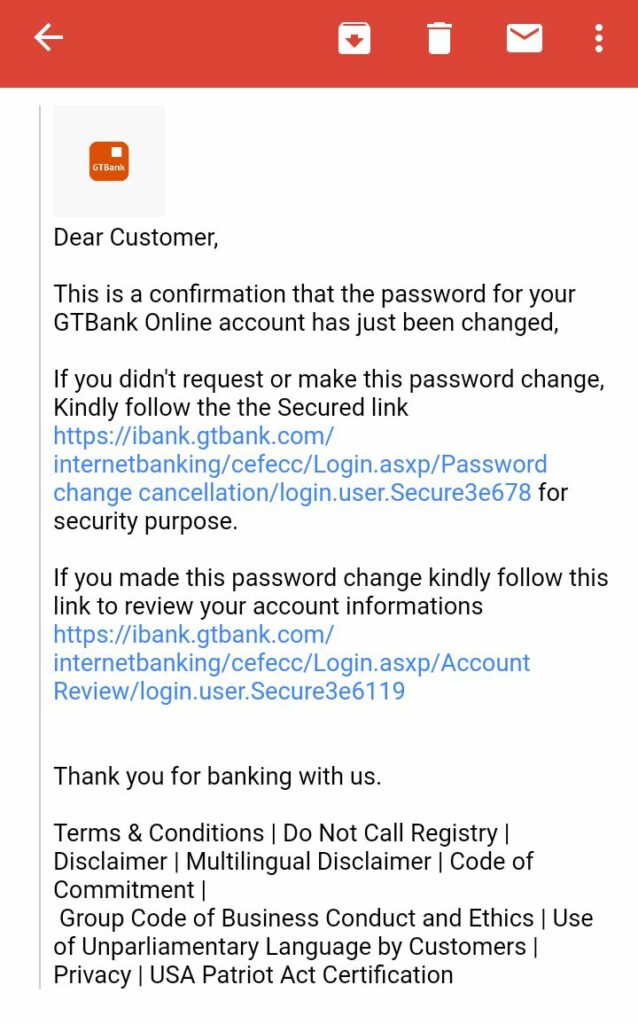

Adebayo stated that after entering the PIN, she received a notice that she would receive an email with which she would proceed with the configuration.

“I checked my email and I saw the message supposedly from GT Bank. The subject of the email was password change alert. There were two links with a command attached to each. It said I should click the first link if I was not the one who initiated the change or click the second link if I was the one,” she said.

Adebayo said she clicked on the second link. “It took me to a seemingly GTB platform. It asked for my token, my security question, and the last 6 digits on my card. But when I input the last six digits, it told me it was a wrong number.”

She said at that point, she was discouraged by the process, she closed the link to the commercial banking website, choosing to continue to use her token for transactions.

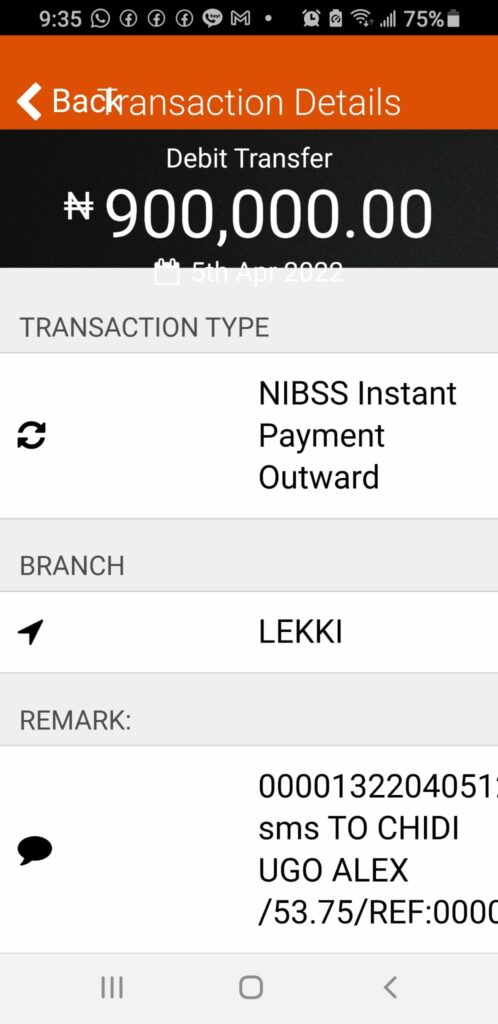

“Exactly three hours later, I noticed N900,000 debit from the account, and my heart raced in shock and worry,” she said.

READ ALSO: Two Years After, GTBank Continues To Keep Mum Over Civil Servant’s N540,000

Adebayo called Oluwole, her account officer, and he told her it had to be a case of e-mail compromise. The bank agent told Adebayo to get in touch with the GTB electronic fraud team while he proceeded to lock the account to prevent further debits.

She said GTB e-fraud assured her that she would get feedback and that they would communicate with Stanbic IBTC, the receiving bank. FIJ learnt that the N900,000 was in a Stanbic IBTC account named Chidi Ugo Alex.

“I strongly believe there is a fingerprint of an insider into the incident. And to prove to you that I didn’t make the transaction, whenever I initiate a transaction I usually add a remark, but the debited N900,000 had no remark,” said Adebayo.

She told FIJ that she allowed the e-fraud team to investigate while calling them regularly for follow-up and sending them all the necessary information.

She said she also contacted her first account officer at GTB, Seun Ogunye, who assured her that she would follow up with Stanbic IBTC. At the end of the investigation, the e-fraud team reported that Adebayo was the one behind the transaction.

GTB e-fraud said they could not proceed, and that Stanbic IBTC said the money had been withdrawn. She was advised to report the case to the police for further investigation.

When FIJ contacted Cornelius Onouha, a spokesperson of the GTB, he said he was on the road and asked to be contacted again. However, he did not answer or return subsequent calls. A message sent to him had also not been returned as of press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.