For three years, Femi Olude (not real name) has waited to get back his N204,000 invested in the premium plan of the Standard Alliance Insurance Company.

In November 2017, Olude struck a deal with Standard Alliance following persuasion by Tolulope Akande, one of the company’s account officers.

This was not the first time he subscribed to one of the company’s investment plans. His first was between 2015 and 2017, and he got his capital and returns in full.

Knowing he would leave Nigeria for the United States in 2018, he told Akande he would invest on a condition.

READ ALSO: National Assembly Watches as Standard Alliance ‘Escapes’ with Investors’ N14.6m

“I told her I would only agree to invest again if they had a yearly plan as I looked at only 12 months. She said the company had a plan for a year and it was a new package,” Olude said.

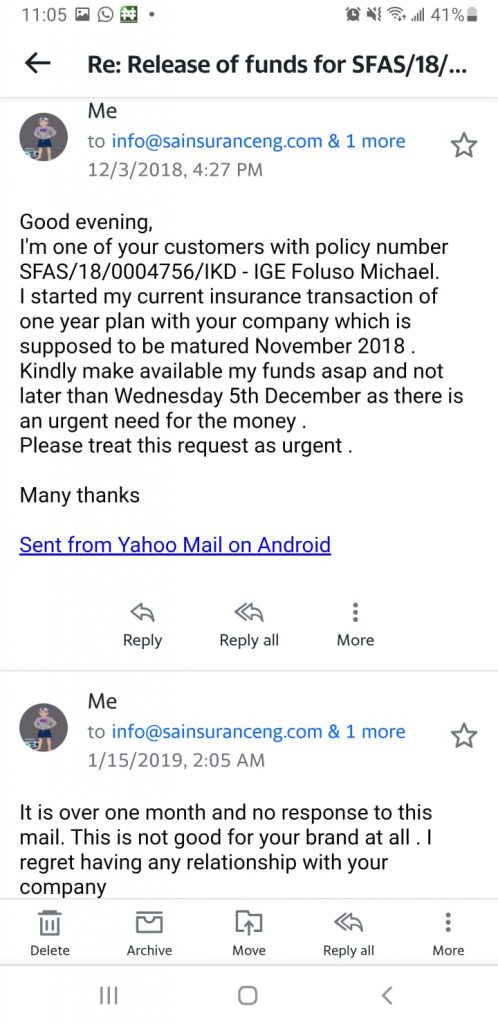

On the 17th day of every month, beginning in November 2017, he would make a payment of N20,000 to Standard Alliance. In November 2018, when it was time for Olude to get both his capital and the return on investment, the company did not turn up.

“On November 20, 2018, when the claim was due, I started asking my account officer about my claim, but she would tell me to sign a document or fill a form. All this was to waste my time because neither she nor the company could provide the money.

“I needed the money to buy a few things while preparing for my journey, but it was not forthcoming. When I got to the US after I had settled down in 2019, I started calling my account officer, but she would not pick up because she knew I was not in the country,” he said.

He reached out to Standard Alliance in the US, but to no avail.

“I emailed and even called their head office at Lekki, but there was no response. So I became worried. I didn’t default on payment for once. Now that they didn’t do their part, I saw it violated the agreement we had. The agreement was that I would pay a premium and, at the end of the contract term, they would pay me my money alongside my interest. I paid N204,000, ” he said.

Olude sent a friend to the Standard Alliance branch in Ikorodu, Lagos, where his account was domiciled, for enquiries. At the branch, one Oyelola Adeleye promised to reach Olude but never did.

READ ALSO: Without the Bible or Hijab, I Couldn’t Enter an Army Cantonment

Olude found the contact of Bello, a worker in the company, online and reached out.

“Mrs. Bello told me the company was having some challenges and that they would come out of it. She collected my details and said she would prioritise my transactions and would make sure I had access to my money. All the while, Tolu didn’t get back to me,” he said.

Bello would later tell Olude that the company had some difficulties because of an ‘investment gone wrong’.

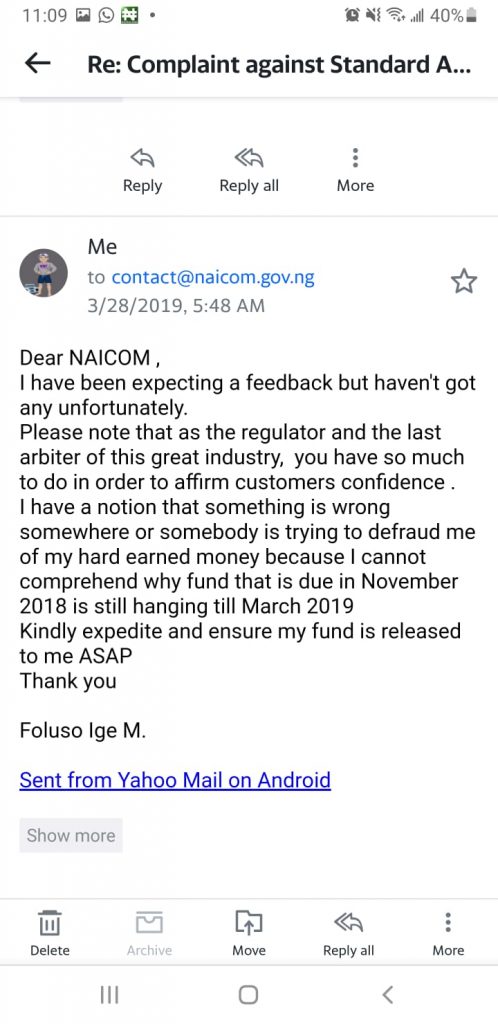

Later, Olude reported the development to the National Insurance Commission (NAICOM) and, on February 17, 2019, the commission told him to send his details, which he did. But nothing happened after that.

On June 1, 2021, weeks after complaining to them, the Federal Competition and Consumer Protection Commission (FCCPC) asked Olude for his details. But like NAICOM, FCCPC ignored him afterwards.

When FIJ contacted Standard Alliance via one of the phone numbers displayed on their website, the company’s customer care said the delay in payment resulted from unforeseen problems that wrecked the company.

“We’ve had financial issues since late 2016, but we are still running our business. We did not expect the problem to linger for this long, but we hope to pay. NAICOM is aware of this issue. From 2018 to 2019, we did not have a managing director because of the problems we were having,” the customer care representative said.

The representative also told FIJ that since June 2021, the company had been paying people who invested in 2016 but could not pay everyone once.

“Everyone the company owes would be paid before the year runs out,” she said.

Subscribe

Be the first to receive special investigative reports and features in your inbox.