Akinkuotu Feyisola Fredrick, a manufacturing project manager, has narrated to FIJ how FairMoney Microfinance Bank is wrongfully and forcefully imposing payment of a N250,000 loan he knows nothing about on him.

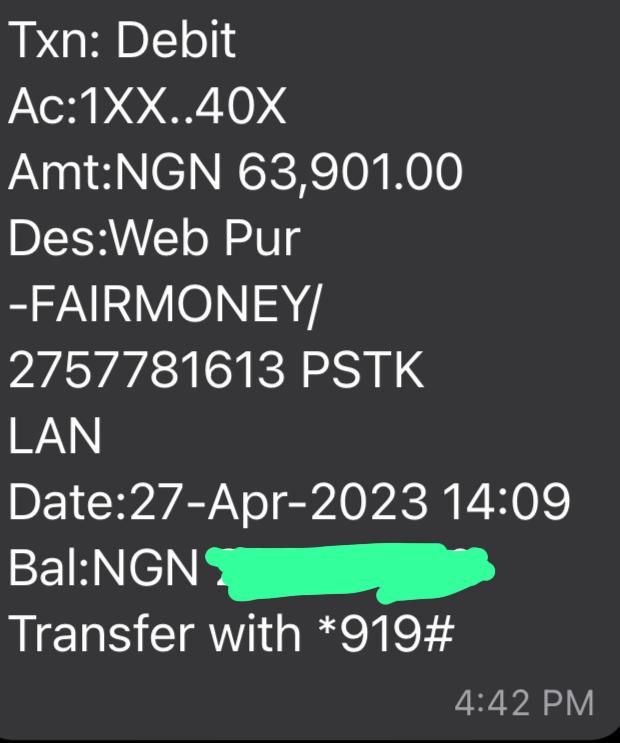

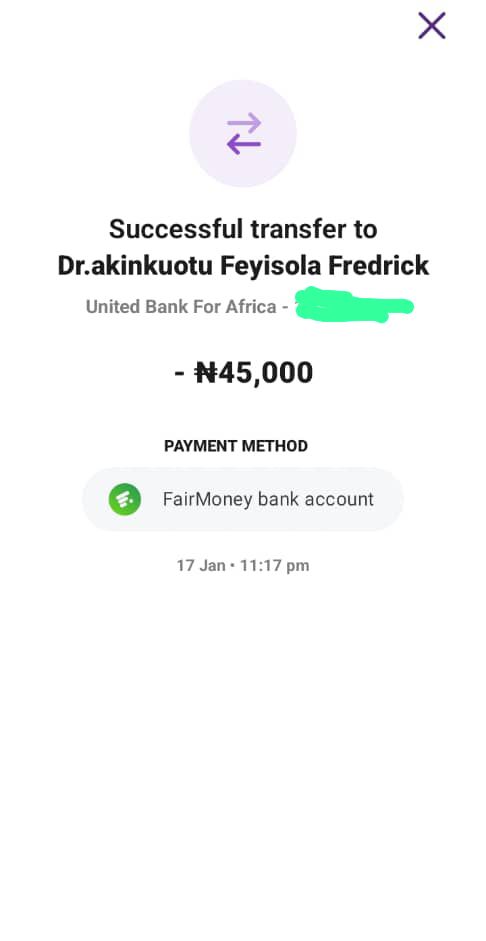

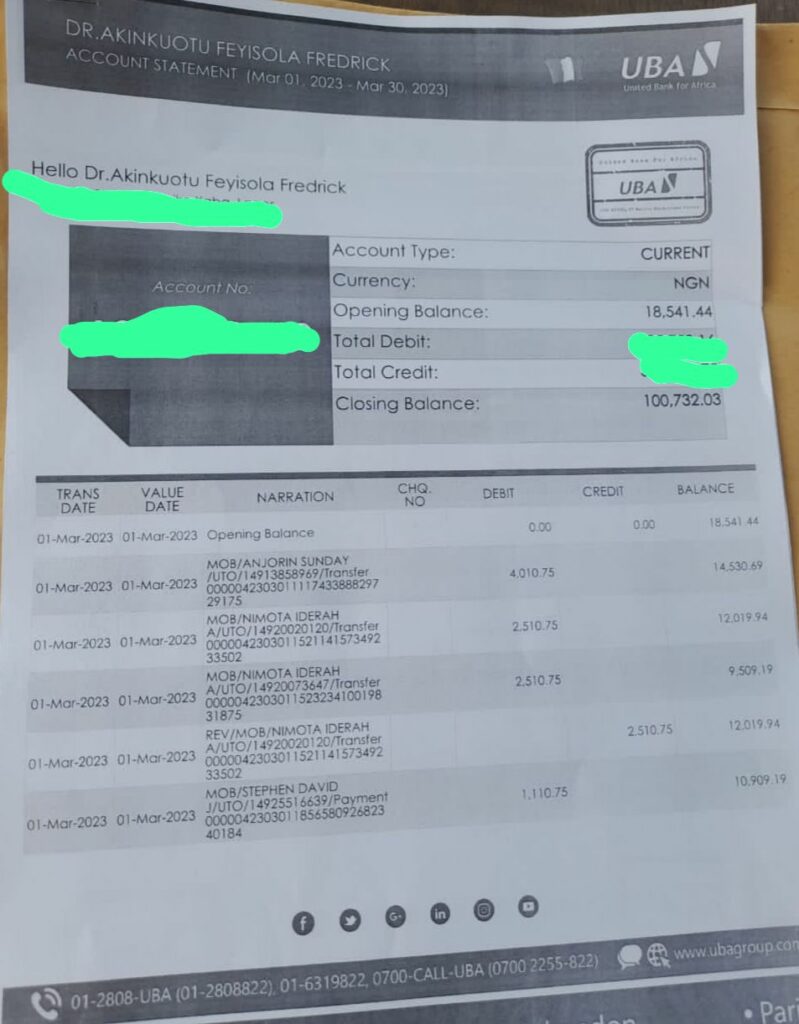

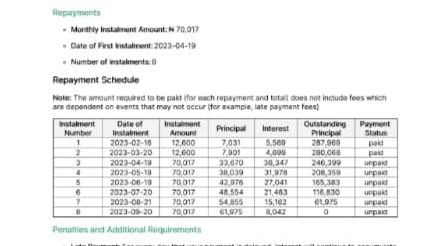

On January 17, Fredrick applied for a loan of N70,000 from Fair Money but was granted only N45,000 due to his credit limit. Frederick was to repay his loan in installments of N12,600 in four months, from February to May. In April however, Fair Money deducted a combined total of N70,765 from both his UBA and Zenith Bank accounts.

This was alarming for two reasons: the glaring one being that FairMoney had deducted over quintuple his monthly repayment fee, and the second, FairMoney drew money from his Zenith Bank account, even though he had linked only his UBA account with them for the purpose of his earlier loan.

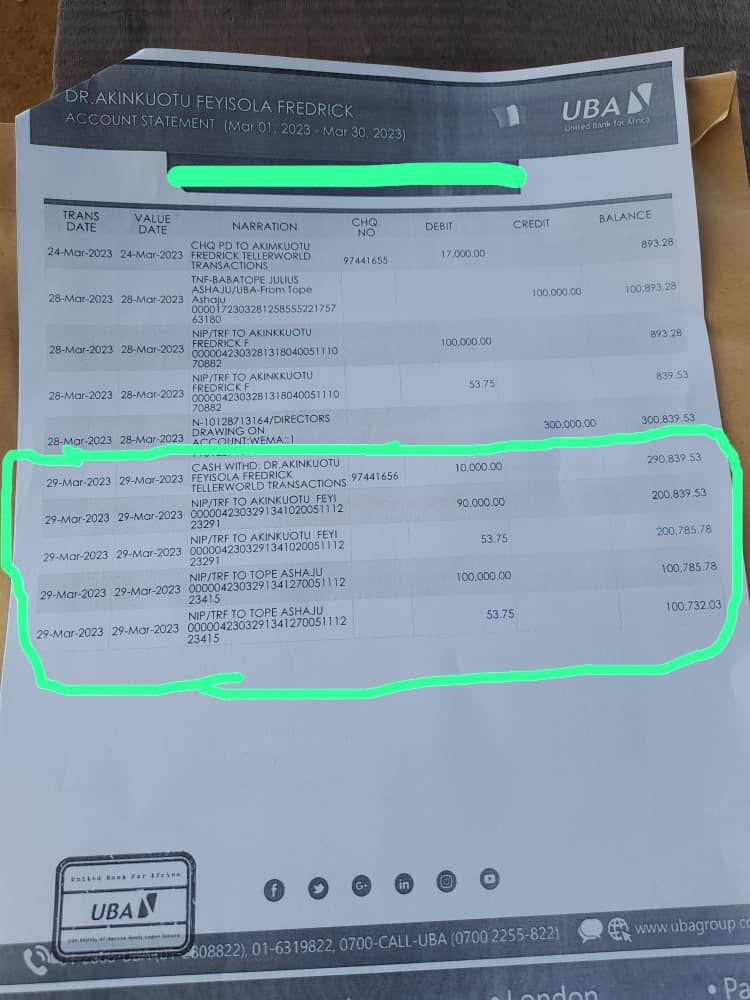

FairMoney claims that Fredrick requested a top-up loan of N250,000 on March 29. Fredrick denies making any such request or receiving that amount from them.

“How can they increase my credit rating from N45,000 to N250,000 while I am still repaying the N45,000?” He asked, adding that he had only gone halfway with the N45,000 loan repayment.

READ ALSO: Dana Air Cancels Family’s Flight, Withholds N179,280 Ticket Fee

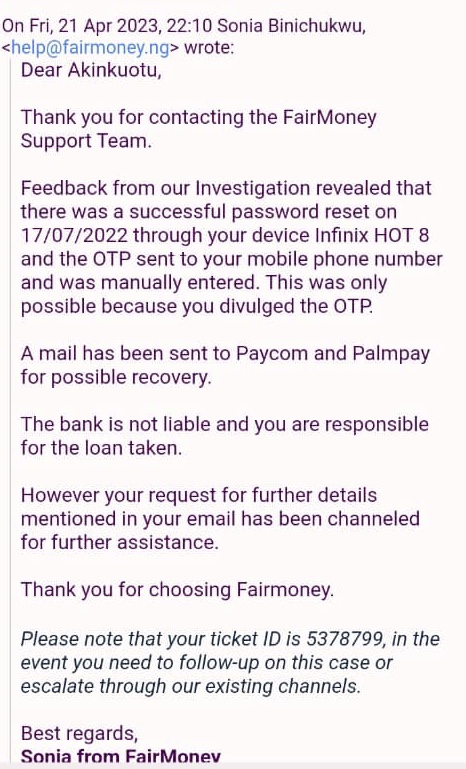

When confronted, FairMoney told Fredrick that their investigations showed that on July 19, 2022, he performed a password reset through his Infinix Hot 8 device and that he divulged his OTP.

“The bank is not liable, and you are responsible for the loan taken,” Fair Money wrote in their email to Frederick.

Fredrick, however, told FIJ, “I confirm that I have never used an Infinix phone of any type.”

READ ALSO: Nigerian Student in UK About to Lose Admission Over UBA’s Failure to Process His Tuition

Fredrick has asked FairMoney to furnish him with the account to which the N250,000 loan was sent but has yet to receive it.

“My request to FairMoney Microfinance is to let us know all transaction numbers and bank account details associated with that transaction,” he said.

“If you disbursed money to one account, show the account that benefited from the disbursement and the bank that received it.”

He is apprehensive that, having ceded all liability to him, FairMoney would draw another N70,950 from his bank accounts. He has asked the bank to return the money wrongfully taken from him.

FIJ sent an email to FairMoney on the allegations but received an automatically generated email that promised to have a customer representative respond within 24 hours. At press time, FIJ had not received a response.

Subscribe

Be the first to receive special investigative reports and features in your inbox.