The news of the astronomical increase in fees by the Kaduna State Government on all government-owned tertiary institutions came with shock to many across the country. The Kaduna State University had asked the public to disregard the figures peddled on social media. These figures were however correct; from N26,000 and N36,000 students were going to pay as high as N150,000, N170,000, N200,000, N250,000, N300,000 and N500,000, depending on their faculty.

What many failed to realise, however, was that the plan to increase the school fees had been in the works for over a year. FIJ spoke to a student of Kaduna State University, who said they had planned to hold protests but the presence of police on campus made them rethink the decision. He also stated that boycotting the loan scheme was an option that could be explored. However with students in their penultimate and final years, the decision to drop out from school or transfer to another school won’t be an easy one to make.

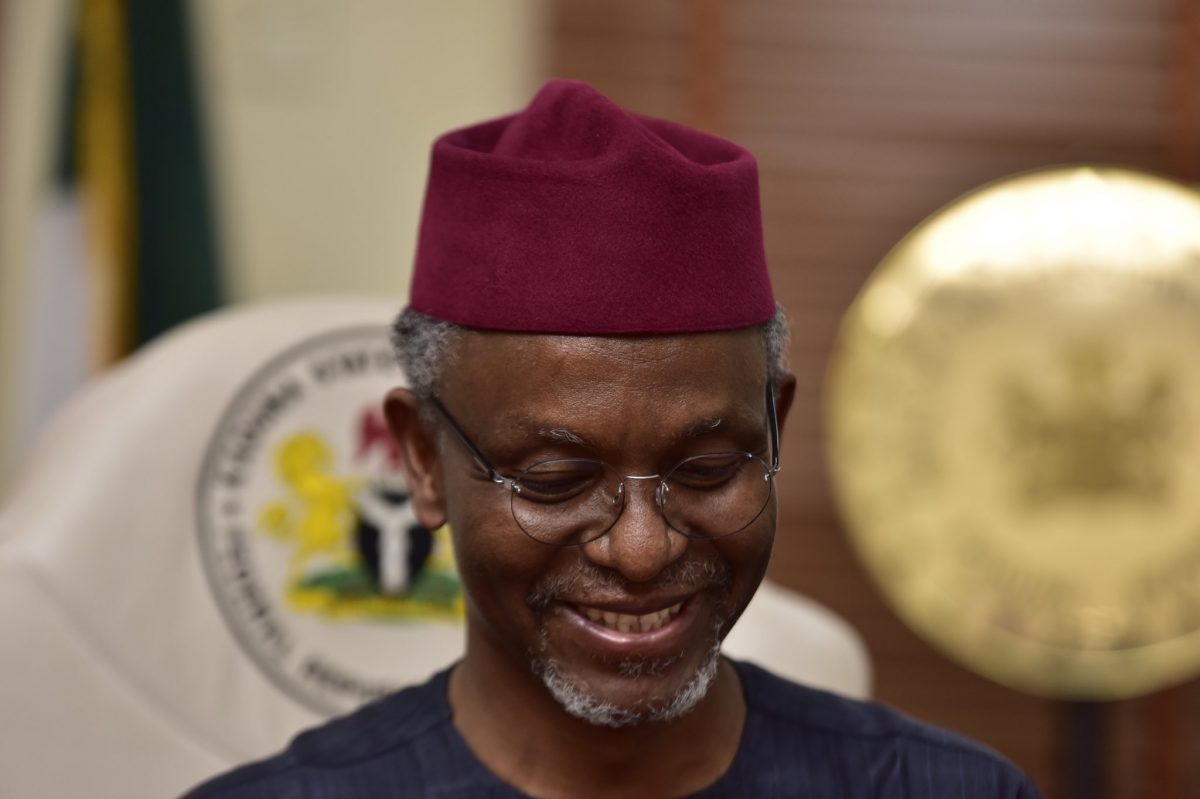

Governor Nasir el-Rufai had revived the Kaduna State Scholarship and Loans Board in 2019. In April 2020, the application was opened for education loans of up to N5million. The solution to the fee increment would be for students to take loans. With many students left with little or no options, it is either they drop out of school, work more hours and more jobs or take the loan.

READ ALSO: Kaduna State University Hikes Tuition Fees From N26,000 to N500,000 for Non-Indigenes

Part of the loan requirements include that a student must be employed or a non-employed student’s sponsor (anybody who is willing to collect and repay a loan for the student’s education) can apply. Candidates must have an admission in a tertiary institution. Sponsor(s) and the student must be a Citizen of Kaduna State either by residency or by State of Origin. Students or their sponsors must have a consistent source of income that can repay the Loan over a maximum period of five years.

The loans however must be repaid over a period of five years at eight per cent interest rate. With an unemployment rate of 44.35 per cent according to Statista, and a minimum wage of N30,000, the new tuition fees students are to pay will lead to a debt burden. The tuition fees would be paid directly to the school’s account while only upkeep requirement will be credited into the student’s account monthly.

READ ALSO: Kaduna Commissioner for Education Confirms Students Will Pay Hiked Fees

While the scholarship and loan board gives N109,000 as bursary to its tertiary institution students annually, the increment in fees won’t cater for this. For National Certificate in Education (NCE) and National Diploma (ND) students, beneficiaries are being paid N76,000 under the Athletic scheme, N76,000 under the Individual School Scheme, while all 26,000 is given to NCE beneficiaries under the Merit scheme.

With a rise in inflation, and with Covid-19 having hit the economy and the livelihoods of majority of people, loans might be the only option left for students to continue their education.

Subscribe

Be the first to receive special investigative reports and features in your inbox.