Ayomide Adeyemi (not real name), a Kwara-based agricultural marketer, has joined the list of customers accusing Oxford Green Farms Ltd., a division of Oxford International Group, an investment company, of failing to refund his money.

Adeyemi told FIJ that the investment company had continued to hold on to the N1 million capital he and his wife paid to the company in July 2021.

“In July 2021, we got a publication that presented Oxford International group as a duly registered investment company that was into mortgaging, estate, agricultural and oil and gas investment,” Adeyemi said.

“That month, my wife and I invested N1 million in one of the company’s subsidiaries’ packages, Oxford Peak Platinum Agrovest, through Oxford Green Farms Ltd.”

FIJ found that Oxford Agrovest deals in commodities including turmeric, ginger and pepper, and gives investors the choice of investing in any of the commodities through weekly, annual and monthly investment contracts.

The company provides a 35 percent return on investment (RoI) on all of its investment products with a 12-month tenure and a 41 percent RoI on all of its investment products with a 14-month tenure.

READ ALSO: Agropartnership Founders Uyi Osayimwense and Osayi Osazuwa ‘Flee’ With Investor’s N2.25m

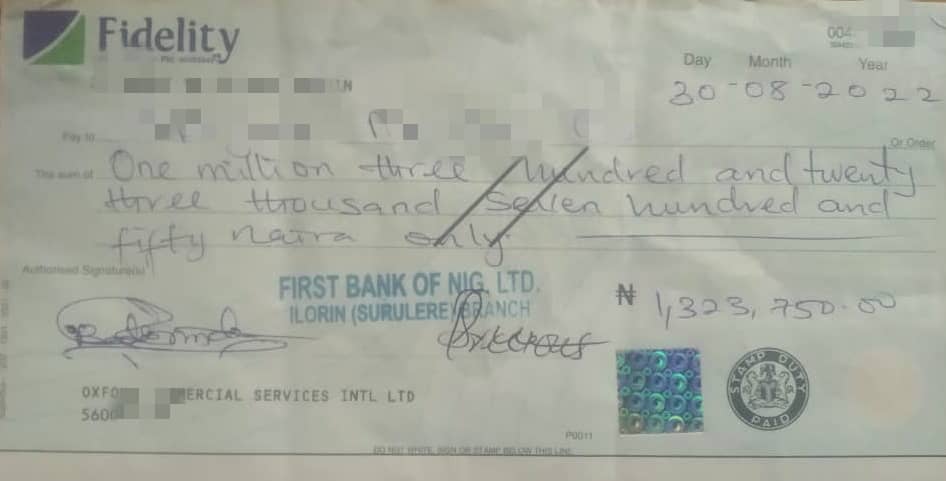

Adeyemi told FIJ that he and his wife chose the 12-month tenure plan and anticipated receiving their capital by August of the following year, as well as the RoI of N323,750, following a 7.5 percent administrative charge deduction.

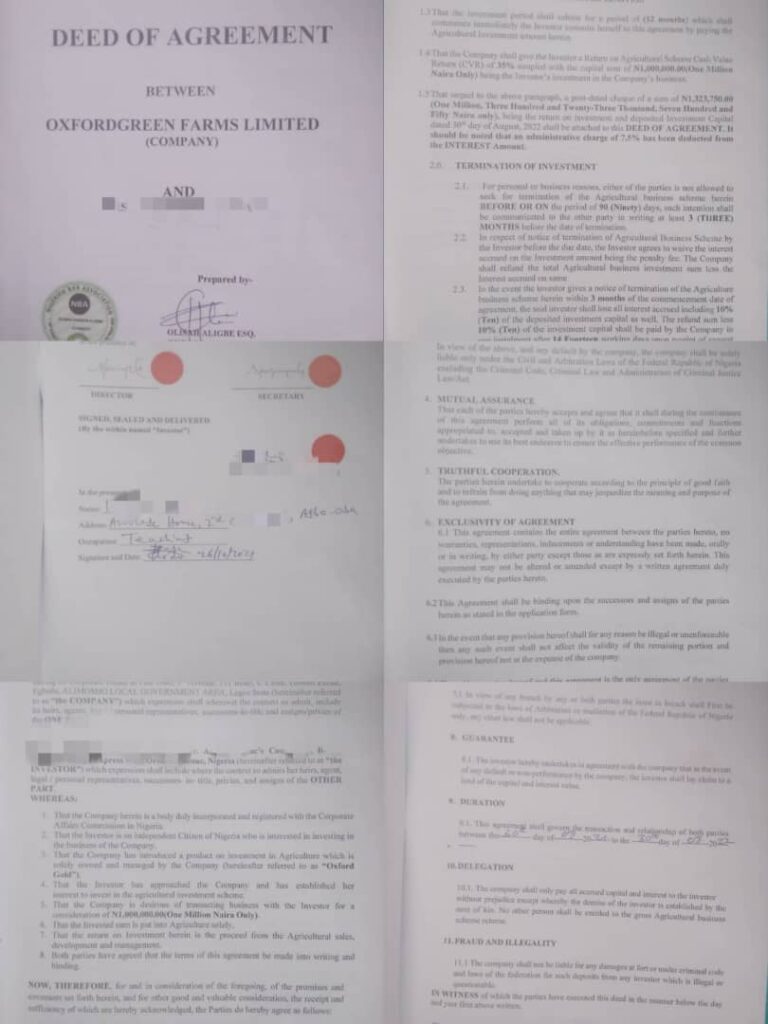

According to Adeyemi, the investment was made in his wife’s name and the company sent them a post-dated cheque and a deed of agreement. He, however, said that they got nothing after the maturity date.

“After the investment was done in my wife’s name, she took the post-dated cheque to her bank, First Bank, in Surulere, Ilorin, on August 31, 2022, a day after the maturity date, but the cheque was rejected.

“A few days later, my wife and I went to the bank to find out why the cheque was rejected. When we asked why, we were informed that the company’s account was subject to a restriction order. We tried to reach the company after leaving the bank that day and were told to check our emails.

“When we checked the email, we had no idea that my wife had received a message earlier advising her not to deposit this cheque into the bank because there was a problem with the company and that her money would be paid when it was due.”

Adeyemi said one of the emails indicated that the company encountered issues with the Securities and Exchange Commission (SEC), the authority responsible for regulating companies, in March 2022, and this prevented the company from being able to access its bank account and disburse funds to the investors after that time.

Adeyemi further told FIJ that a new management was put in place to get the company out of the problem and that investors were promised payment within six months.

“The six months ended on April 23, and we have not received anything from them,” said Adeyemi.

He further said that he called the lawyer that prepared the deed of agreement and got a response to scan and forward the post-dated cheque, which he did, but still got nothing.

“I’ve been trying to reach the company through its solicitors, and it’s been excuses upon excuses.”

FIJ had earlier reported how Oxfordgold Integrated Ltd., another subsidiary of Oxford International Group company, failed to refund Deacon Olaleye Olawode, whose investment money it held for months after the due date.

The company, however, refunded Olawode a few days after the story was published on April 23.

FIJ’s report revealed that the company’s offices were sealed for conducting investment-related businesses without regulatory approval.

FIJ had contacted Barrister Olisah Aligbe, the company’s legal advisor, under whom the deed of agreement between the company and investors was made, and he stated that the company had begun the process of paying investors their dues.

When Dalopo Oyawole, a lawyer and one of the solicitors hired by the company to handle the problem, was contacted by FIJ on May 3 about Adeyemi’s case, FIJ received confirmation that the company had SEC issues in March of last year, for which the case went to court. Oyawole pointed out that the company was bound by an agreement to return investors’ funds interest-free.

According to Oyawole, the company engaged her chambers’ service to pay the investors in batches on behalf of the company and it was currently doing that.

Subscribe

Be the first to receive special investigative reports and features in your inbox.