Oluwasola Eniola, a Lagos State resident, has narrated how Palmpay, a mobile money financial service provider, locked him out of his phone over a ₦2,500 loan someone else got.

Eniola told FIJ he was surprised the action was taken after he had told the company he didn’t take a loan from them.

“Though I have the Palmpay app on my phone, I have never used it to borrow money before,” Eniola said.

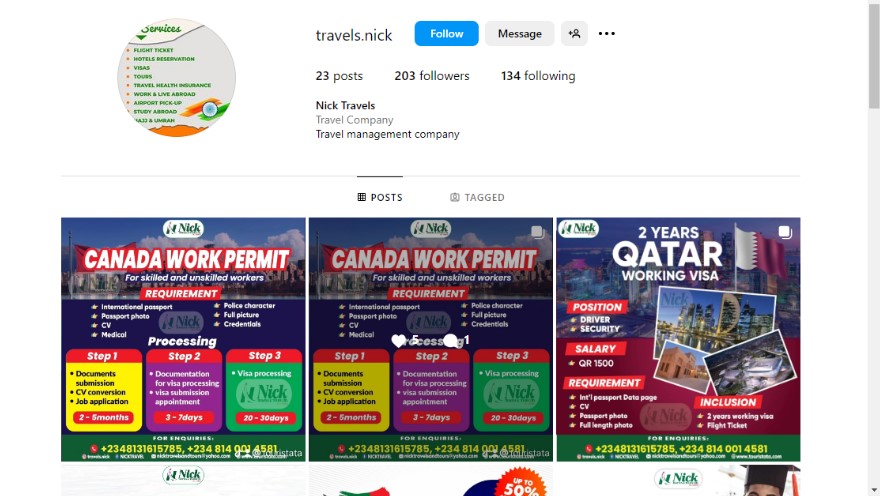

“Imagine my surprise when I got a message out of the blues around June that I was owing ₦5,000 for a ₦2,500 loan I had collected from them. I wasn’t aware of any money that was borrowed.

“When I got the message, I contacted a Palmpay mobile promoter in my area. She said I shouldn’t bother myself with it after checking my account. I don’t know what she did but the message cleared off that day.”

READ ALSO: After FIJ’s Story, Palmpay Refunds N40,000 Held for Over a Month to Designer

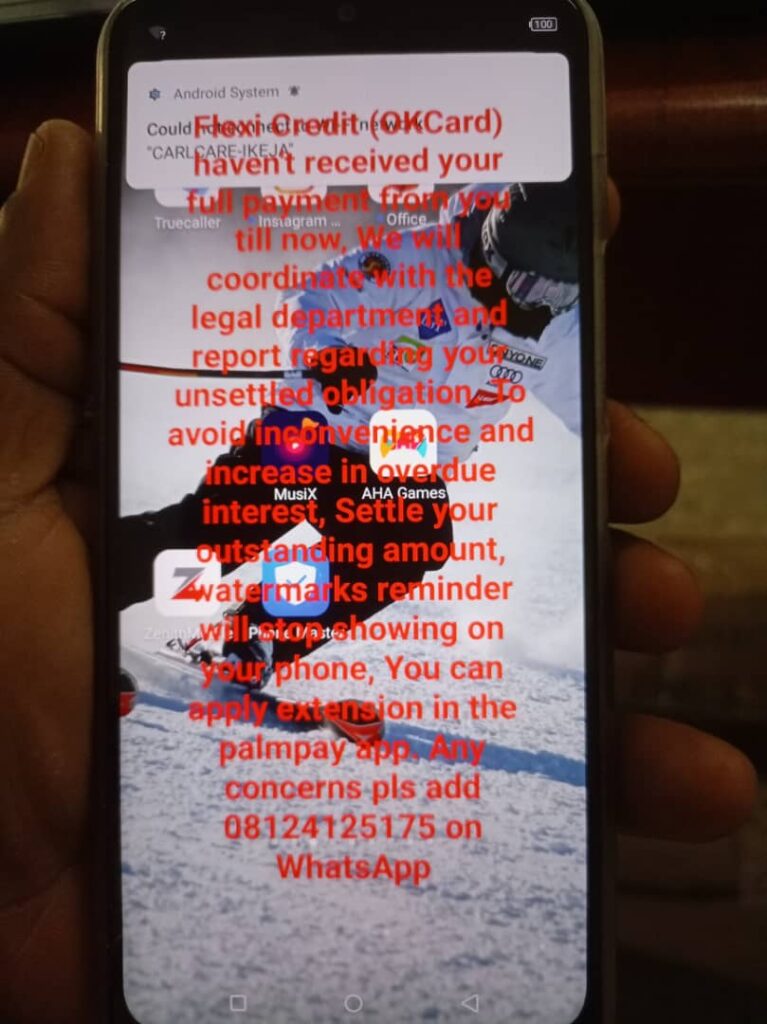

Eniola said after a while, the message was sent to him again and this time he couldn’t access his phone.

“I decided to go to the Palmpay office at the end of June, and I was told to pay off the ₦5,000 or legal actions would be taken,” Eniola told FIJ

“I told them I couldn’t pay any money since I wasn’t the one that burrowed the money. I even told them to check the BVN and information of the person that borrowed the money and contact them.

“Why should I be held responsible for the offence of another person?”

READ ALSO: Customer Wants to Pay Off Loan, But Palmpay Has Locked Him Out of His Phone

Eniola said the company locked his mobile phone because of his refusal to service the loan.

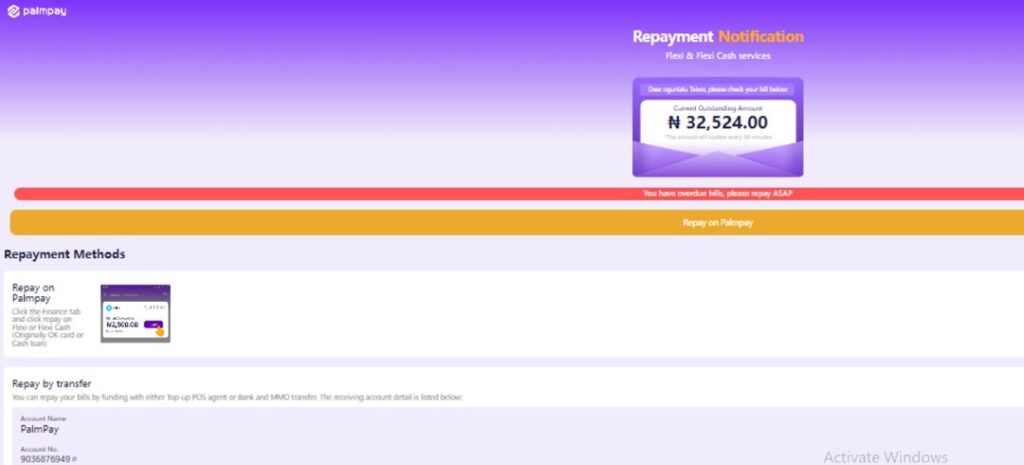

“When nothing was done after I complained at their office, I decided to contact their customer care again after a while. I was asked to pay ₦19,000 to clear off the loan,” Eniola said.

“I was speechless, because I thought since I had made a complaint earlier, they would have frozen the interest rate then try to get the actual person that burrowed the money.

“As I’m speaking, the money is now ₦32,000, and I still can’t access access anything on my phone. I don’t even have access to the account that was used to carry out the said transaction since it’s not mine.”

READ ALSO: Between Palmpay and Microvest, How Designer’s N40,000 Vanished

When FIJ contacted Palmpay, an agent who identified as Edith explained how the mobile money app works when there is a payment default.

“The way Palmpay works is that we don’t work with SIM cards, rather we work with the phones. This is because a SIM is very easy to get, so it’s easier to discard whenever a customer doesn’t want to repay a loan,” Edith told FIJ

“However, what some people do is that they borrow loans and refuse to pay back. Instead of them to pay back their loans once the repayment date is due, they sell the phone to innocent people.

“These innocent people will be the ones to suffer for the locked phones and sometimes pay back the loans.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.