The United Bank for Africa (UBA) has been accused of fraudulently withdrawing the sum of N200,000 from the account of a worker at the Federal Polytechnic, Ilaro, Ogun State.

Niyi Solanke, a member of the administrative staff of the polytechnic, said he was forced to report the fraud case to the Ilaro Divisional Police Station when it appeared like the branch of the bank within the campus was deceiving him.

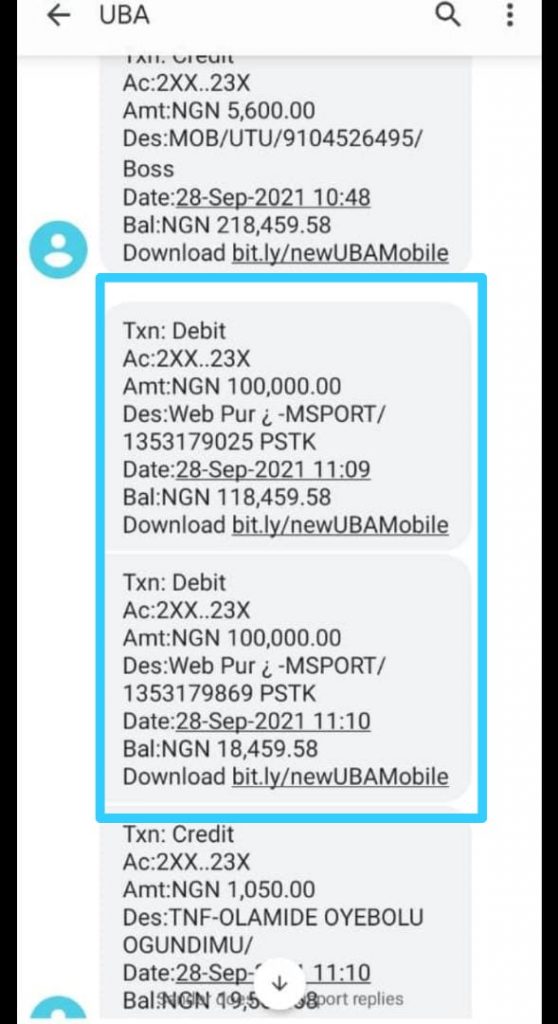

“I had just received a loan of N210,000 from the school’s cooperative society through my bank, UBA, when this issue happened in September,” Solanke told FIJ. “A few minutes after receiving the credit alert for the loan, I received another two debit alerts of N100,000 each from the same UBA.”

“When I went to lodge a complaint, a bank attendant told me to come back in 14 days as they would send my complaint to the headquarters.”

At the expiration of the 14 days, Solanke stated, Tolulope Akinyemi, the bank manager, again told him to return after “over 100 days” as they were yet to resolve the matter.

READ ALSO: Six Months after, UBA Silent on Pa Anyaka’s ‘N3.5m’ Held Since 1982

After reporting the case to the police, Odutola Olusegun Victoria, a policewoman from Ilaro division, phoned the bank manager immediately. However, Solanke said he was not satisfied with the handling of the case.

“The police officer told me that the bank manager said someone had used my account for online trading,” Solanke told FIJ. “The bank also claimed that I carelessly gave my ATM card to someone who bought something online with it, but that is not true.”

“None of my children lives with me, because some of them are observing the mandatory national youth service somewhere far from here and the last child is also in another school. I run a POS business on a part-time basis and that’s the only place I use POS for personal withdrawal. So, no outsider has access to my ATM card.”

Solanke lamented having to refund N30,000 monthly despite not having access to the money.

“I planned to use the loan to settle family bills, such as my children’s accommodation, but had to borrow money elsewhere,” he complained to FIJ. “From the end of this month, the cooperative society will begin to deduct at least N30,000 from my salary account, although I am yet to enjoy the loan.”

When contacted, Akinyemi absolved UBA of any wrongdoing, adding that it might take up to six months before Solanke would know his fate.

“Whatever happened could be a fault from his end,” the bank manager told FIJ. “His ATM card was used to do that. It was a POS transaction that occurred on his account. Notwithstanding, we have lodged the complaint. It is not something we can resolve internally or at the branch level.

“Once it is a web fraud, it goes to the forensic department and would take three to six months to resolve. So, we are following up on this for the updates.

“He needs to be patient and ask around for the people he likely divulged his ATM details to. He must have been careless with his ATM card and pin, because the transaction was not an in-branch transaction or ATM withdrawal.”

Meanwhile, a banking expert told FIJ that the fraud was likely perpetrated by a worker in the bank.

“It happens in banks. Fraudulent workers change a customer’s phone number to theirs on a computer software called Financial Oracle (FINACLE), used by most Nigerian banks,” he told FIJ. “Then they create mobile banking accounts through which they empty their victim’s account, using the One-Time Password (OTP) they receive and other banking details at their disposal.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.