Francis Modu (not real name), 38, a gardener, resorted to borrowing money from LCredit, a quick loan company, when he had financial challenges in November 2021.

To get the over N50,000 he was expected to pay back within two weeks, Modu planned to harvest and sell the produce from his cassava plantation in Ilaro, Ogun State, his home town.

“Unfortunately, during harvest, the Cassava was affected by mosaic disease and I could not even make any sale out of it. I was only eventually able to make garri for my immediate family consumption, out of the very few tubers I was able to salvage from the loss,” Modu told FIJ.

READ ALSO: Quick Loan Company Announces Customer’s Obituary for Missing Payment Deadline

Knowing he was close to the deadline of the loan repayment, Modu called the company to beg for an extension of the deadline.

“Despite the explanation I gave to the agent about what happened to my produce, she said I was lying, and that I should pay the money immediately or they would deal with me,” he said.

“I was frightened, having heard that they usually send messages to people’s contacts to defame them. So, I spoke to friends, but no one was able to help.”

READ ALSO: Despite Gov’t Fine, Sokoloan Defames Debtors, Brands Them Criminals

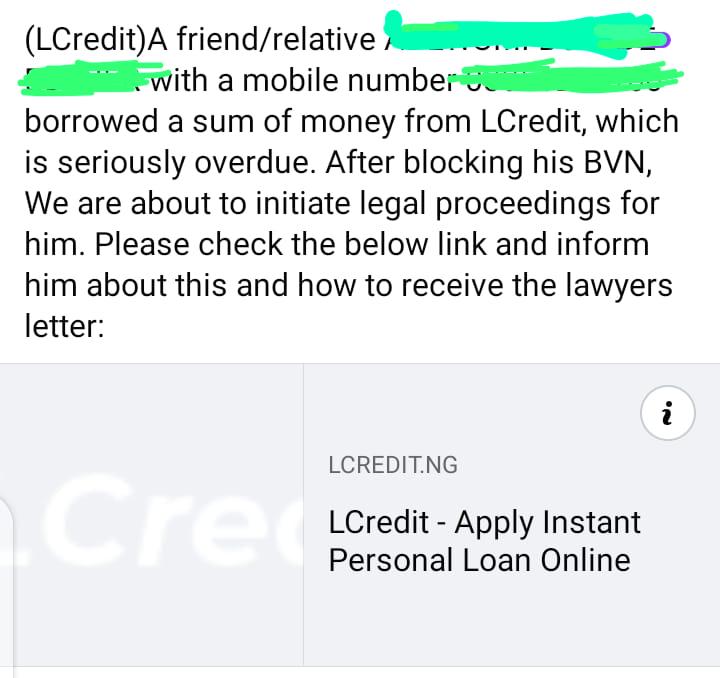

A few days after the deadline, his contacts received messages from LCredit, stating that he borrowed a loan and it was now overdue.

“After bearing the shame for days from family and friends, who were contacts on my phone, I made up my mind never to pay back a penny. They have done their worst already.”

But Modu would continue to get calls from the agents of the company.

“One Saturday, their call came in as my son was playing a game on my phone. He innocently answered it and later handed the phone to me. When I saw that it was from LCredit, I hissed and wanted to end the call, but my wife encouraged me to hear what they had to say,” he said.

“A lady said she was calling to remind me that I was still owing them. In anger, I told her I was no longer willing to pay back a penny considering the humiliation I suffered in their hands.

“She apologised for the action, stating that most of the messages the company send out are as a result of the level of pressure they get from their Chinese owners when it comes to loan recovery. She said, ‘The pressure we get from our Chinese owners forces us to defame our debtors’.

“She also told me that their Chinese bosses don’t care about the means of recovery. All they care about is the result. If you can’t recover the money, it will affect your employment status.

READ ALSO: Nairaplus, 9Cash… Quick Loan Apps Driving Nigerians to Suicide

“Because of the polite way she spoke to me, I have changed my mind. I will pay back the money, but the repayment will only happen when I have the money. I won’t be pressured to pay it back. Not anymore.”

Findings revealed that LCredit is actually run by Cashigo International Ltd., a Lagos-based company headed by Yun Tao Cong, a Chinese national.

FIJ also found that iMoney, Xcredit and OKash, other leading quick credit outfits in Nigeria, are also run by Chinese owners.

FIJ recently reported how a quick loan outfit announced the obituary of its debtor despite a recent statement by the Federal Competition and Consumer Protection Commission (FCCPC) announcing the commencement of an investigation into privacy rights violations in the money-lending industry.

Last year, Sokoloan, another money-lending outfit was fined N10,000,000 by the National Information Technology Development Agency (NITDA), for breaching its customers’ data privacy.

Subscribe

Be the first to receive special investigative reports and features in your inbox.