Chidinma Ade (real name withheld), a resident of Ogun State, has accused Leadway Assurance Company, a Nigerian insurance corporation, of denying her access to her deceased father’s annuity.

An annuity is an income purchased from a life insurance company, which provides monthly or quarterly income to a retiree (annuitant). The annuitant can decide to leave an income stream to a beneficiary after his or her death.

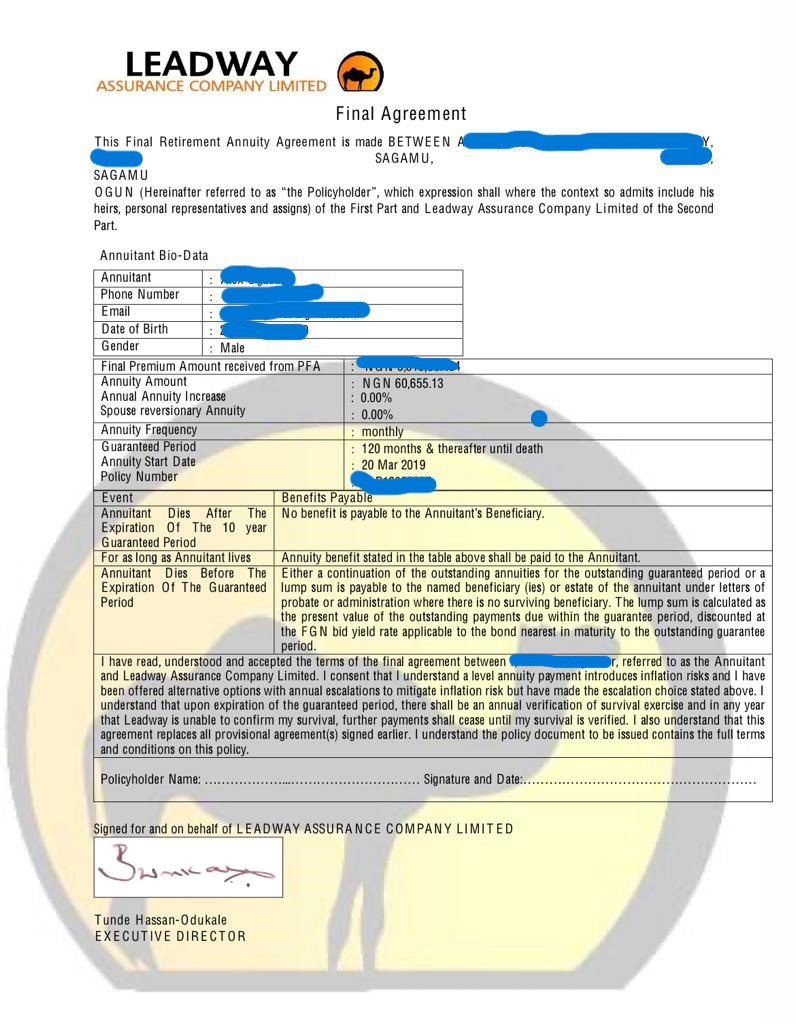

Ade told FIJ her father initiated the purchase of his life annuity worth N5.8 million in December 2018, with Leadway Assurance as the provider.

In a contract Ade’s father signed with Leadway, FIJ learnt that the insurance company was to remit N60,000 into his bank account every month within the agreement period.

A document obtained by FIJ revealed that the annuity, which guaranteed period was for 120 months and thereafter until death, did not start counting until March 2019.

“After my father’s death, Leadway Assurance still paid the N60,000 for December, but they stopped after I informed them about his death. I know because his phone was with me. From January 2023 to date, they have not paid a dime,” said Ade.

READ ALSO: Between Craig Barisuka and Anita Ijeoma, Liberia-Based Nigerian’s N33.5m Is Hanging

Ade said she visited the company’s Sagamu office as a beneficiary on December 22, 2022, after her father had been buried, to inquire about his annuity.

“My father made my mother and me his beneficiaries, but my mom died before him. My father died in November 2022 and was buried on December 2 of the same year,” she said.

“I did not know anything about his pension until 2018 when he got his life annuity at Leadway Assurance’s branch in Sagamu, Ogun State. He had to use my email address then.”

When Ade first visited the office in December, a female employee called Judith confirmed that she was a beneficiary.

She told FIJ that the lady asked for certain documents to ascertain her father’s death, all of which she said she submitted promptly.

“I was asked to submit his death certificate, obituary poster indicating his death, a letter of attestation from the church that did the burial, a letter of administration for my mom, who was a co-beneficiary but died before him, and a letter of administration for him, which I obtained from the ministry of justice.

“I submitted all the documents in December, except the letter from the ministry of justice which I submitted in March. I also filled a form where I had to input his Bank Verification Number (BVN) in December.”

Ade said the company had been unable to provide updates on her father’s retirement benefits despite submitting all the required documents.

“A customer service lady attending to me kept saying they were having network issues and she couldn’t provide any update. Their response has been network issue all this while. And it sounds funny coming from a prestigious firm like Leadway,” said Ade.

READ ALSO: One Month on, Niger Insurance Yet to Pay Dietitian’s N360,000 Withheld Since 2018

During a phone call with Leadway Assurance on Thursday, a customer care representative identified as Ayo told FIJ that the company had been experiencing some network challenges.

“We have been having some network challenges. But we are already working on it, and it might take a while because we also have to verify and process some things the moment we are notified of the death of a client,” he said.

In response to how long it would take for Leadway to resolve the issue, Ayo said “as long as she has submitted all the required documents, she should be able to get the benefits within a month”.

Subscribe

Be the first to receive special investigative reports and features in your inbox.