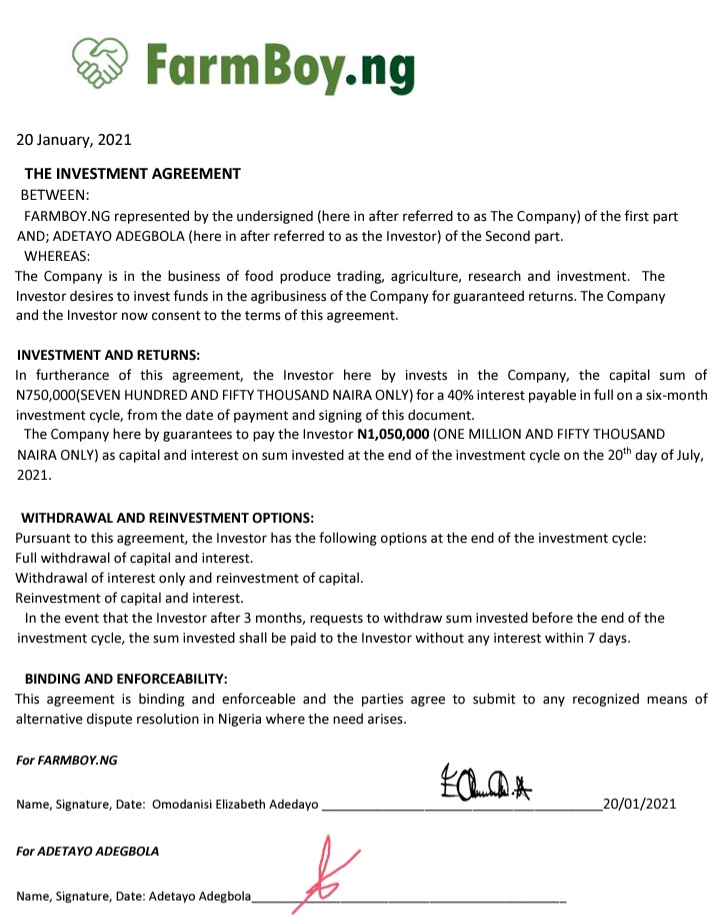

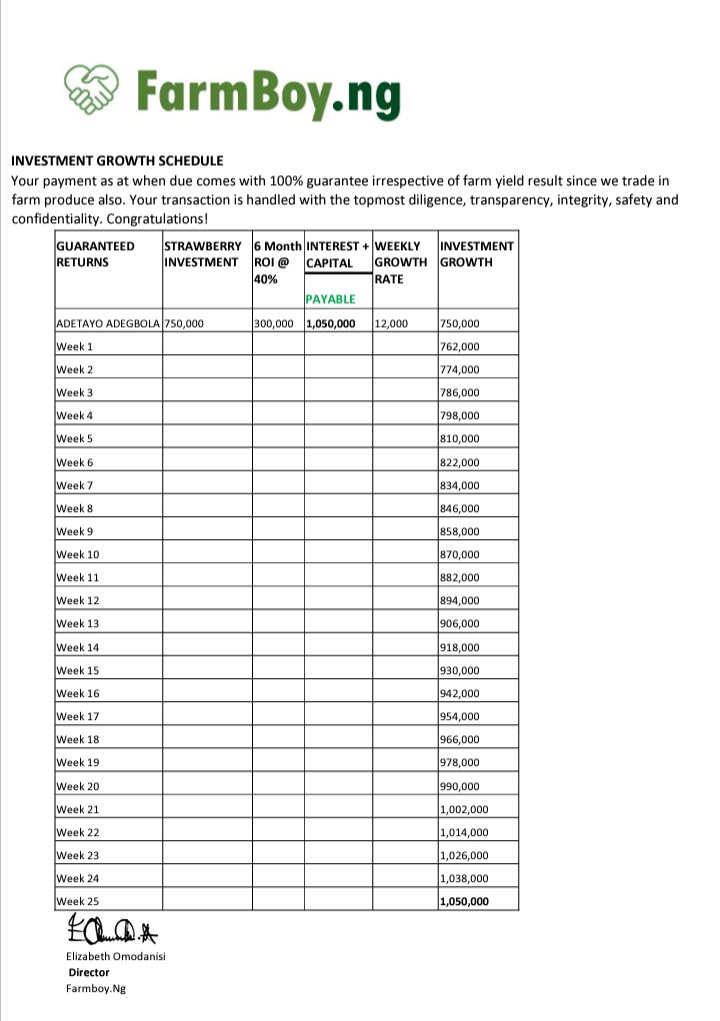

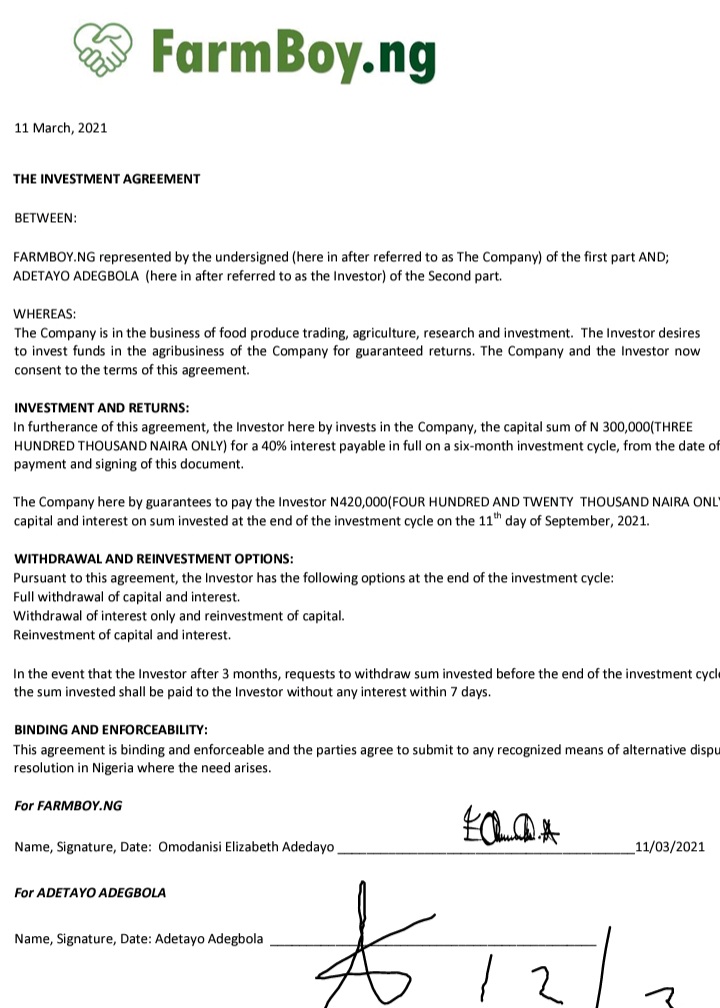

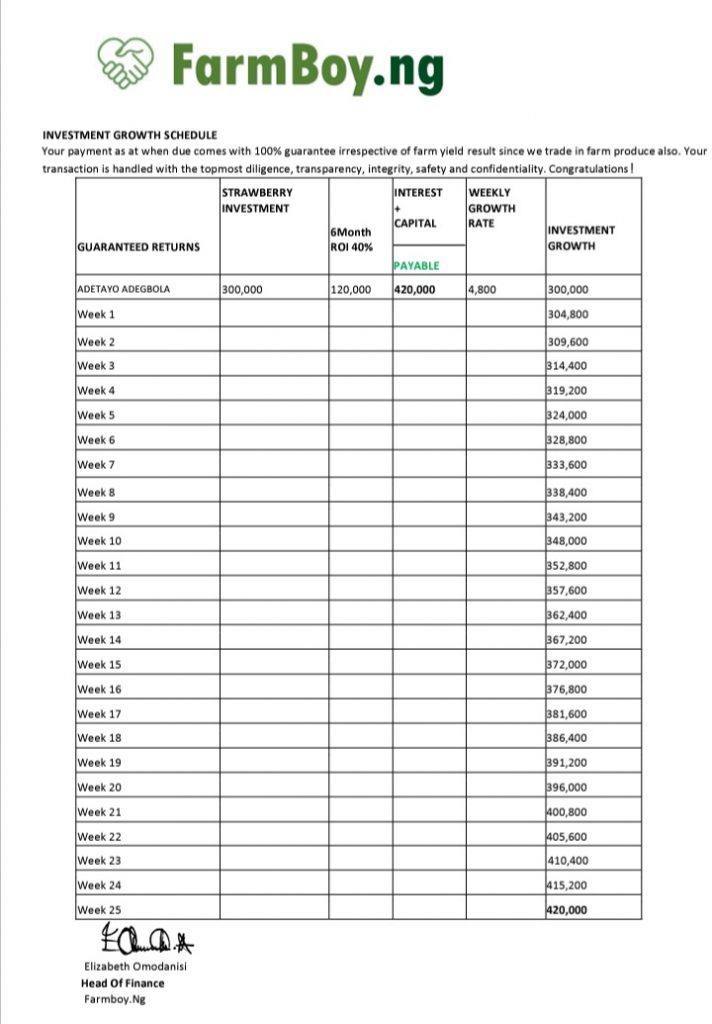

In January and March 2021, Adetayo Adegbola invested N750,000 and N300,000 respectively with the Industrial Farmboy Ltd., a company belonging to Ope Omodanisi, with a guarantee of 40 percent yield within six months.

In August 2021, a month after her first investment was due for payment, she complained to Farmboy’s customer service. In response, she got N150,000 (out of 1.05 million) as part payment, with an excuse that the company incurred a loss during the recent Plateau crisis.

“We await the payment of the property we put up for sale so we can balance up,” Farmboy said in a text message. “We haven’t got the money yet, but we are doing all that we can and looking for every means to sort out this situation.”

In September, when the second investment was due, the company sent a long email to Adegbola, with the same old story of “herders, bandits and three-month-long attacks in Plateau State” as the reason for its default. However, Farmboy noted in his email that there was a “Plan C.”

READ ALSO: Dapo Abiola’s Voltac Global Capital Robs Investors, Including Students, of N1.8bn

“We have insisted that every investor would get their capital back, hence we have put out 10 plots for sale in Abijo, Lekki Lagos. We expect payment from buyers of the land so that all are sorted in less than 90 days,” the company said in an email.

Though Farmboy wants its investor to wait for 90 days, Adegbola believes Omodanisi is only trying to buy time to scamper.

READ ALSO: Freed by a Court, ‘Tush Farmer’ Comfort Ogunlade Disappears With 300 Investors’ N400m

A check by FIJ on the website of the Corporate Affairs Commission (CAC) revealed that Industrial Farmboy Ltd., is inactive. Meanwhile, the company, according to the information on its website, claims to be active from 7 am to 8 pm daily.

“INSURED,” YET A SCAM

“Should they ever run into a loss?” Adegbola asked. “The company claimed its cash crops and commercial farms were insured by the Nigerian Agricultural Insurance Corporation (NAIC).”

READ ALSO: Armed EFCC Officials Raid KWASU, ‘Kidnap’ Students During Night Party

When FIJ contacted Lagos NAIC to verify Farmboy’s claim, it requested a policy number that would have been given to the company if it was really insured.

FIJ made several calls to Farmboy for this number, but they were not answered. A test message sent to the company’s phone also got no response.

“That speaks volume,” NAIC Lagos’ representative said. “Be wary of your dealings with such an outfit.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.