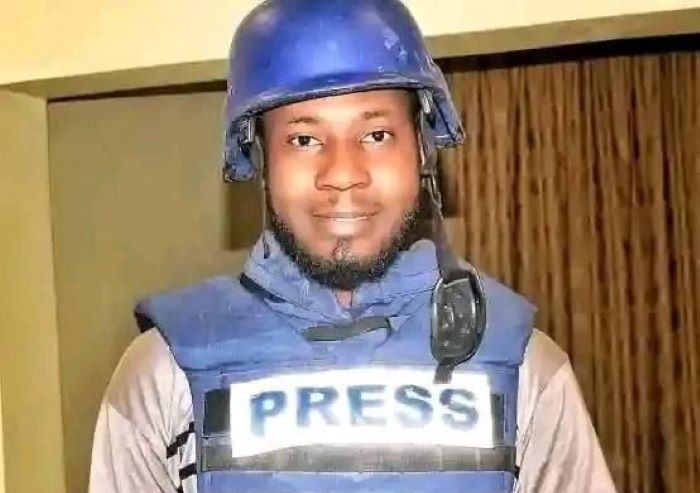

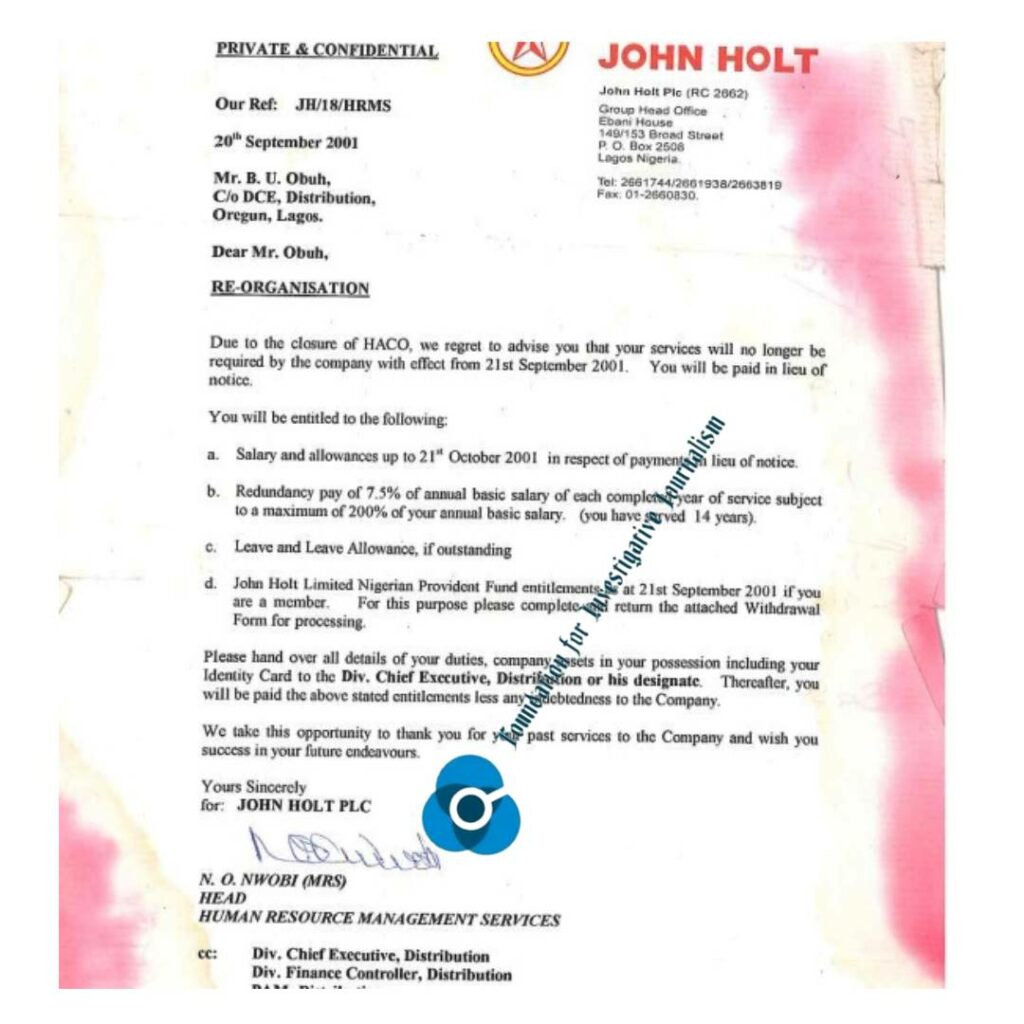

Basil Obuh spent 14 years of his life working for John Holt PLC in Lagos State. And from each monthly salary he received from 1987 to 2001, the company deducted his pension contribution.

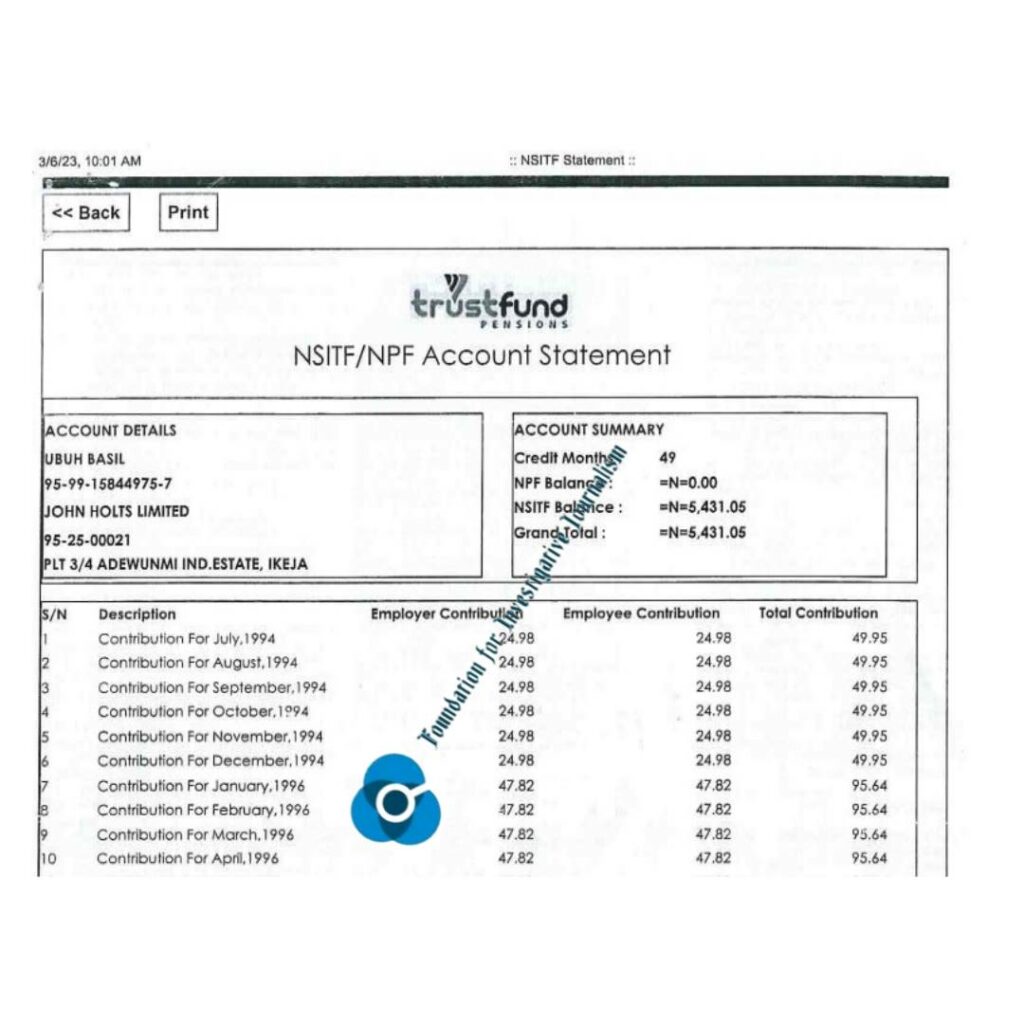

Obuh told FIJ that he needed to withdraw his pension contributions to meet his latest challenges but what he found plastered a shock on his face — N5,431 for a job he did for 14 years.

John Holt PLC is a Nigerian conglomerate that engages in the assembly and distribution of power generators, leasing, distribution of fire-fighting equipment, logistics, boat building and fabrication of industrial and agricultural equipment.

READ ALSO: Since 2019, Kuddy Cosmetics Has Held Former Employee’s 3-Month Salary

“I was employed in 1987, and I was retrenched as a warehouse manager in 2001,” he said.

“I visited my Pension Fund Administrators (PFA) in March to check my balance, only to discover that there was only N5,000 in my account balance.”

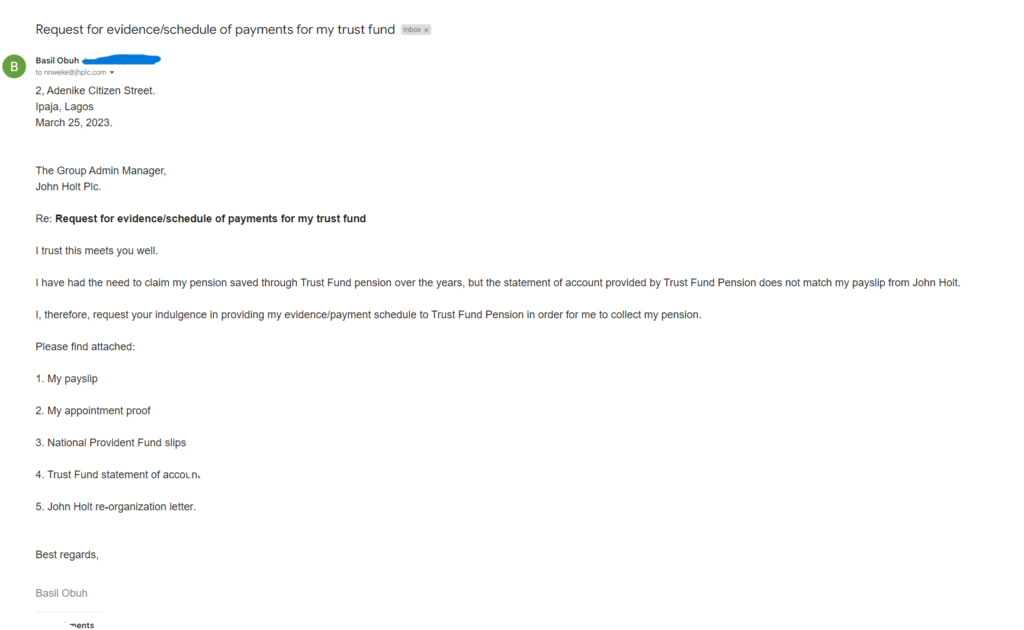

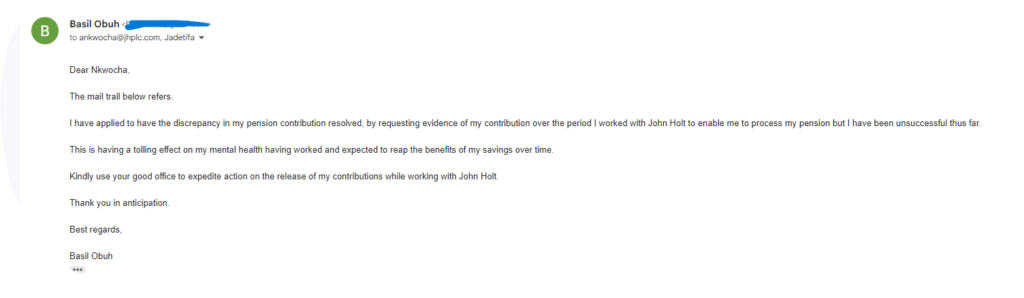

Obuh contacted the company, asking them to post his pension contributions over the years, but John Holt PLC ignored his request.

“I sent several emails to remind them, but they have not been forthcoming,” he said.

“It has been over three months now since I requested my statement of contributions to the PFA, and nothing seems to be in the offing.”

“At this stage, I don’t want to wait until eternity because I am sensing foul play. This is because my contributions from my payslip don’t match what is stated in the PFA statement.”

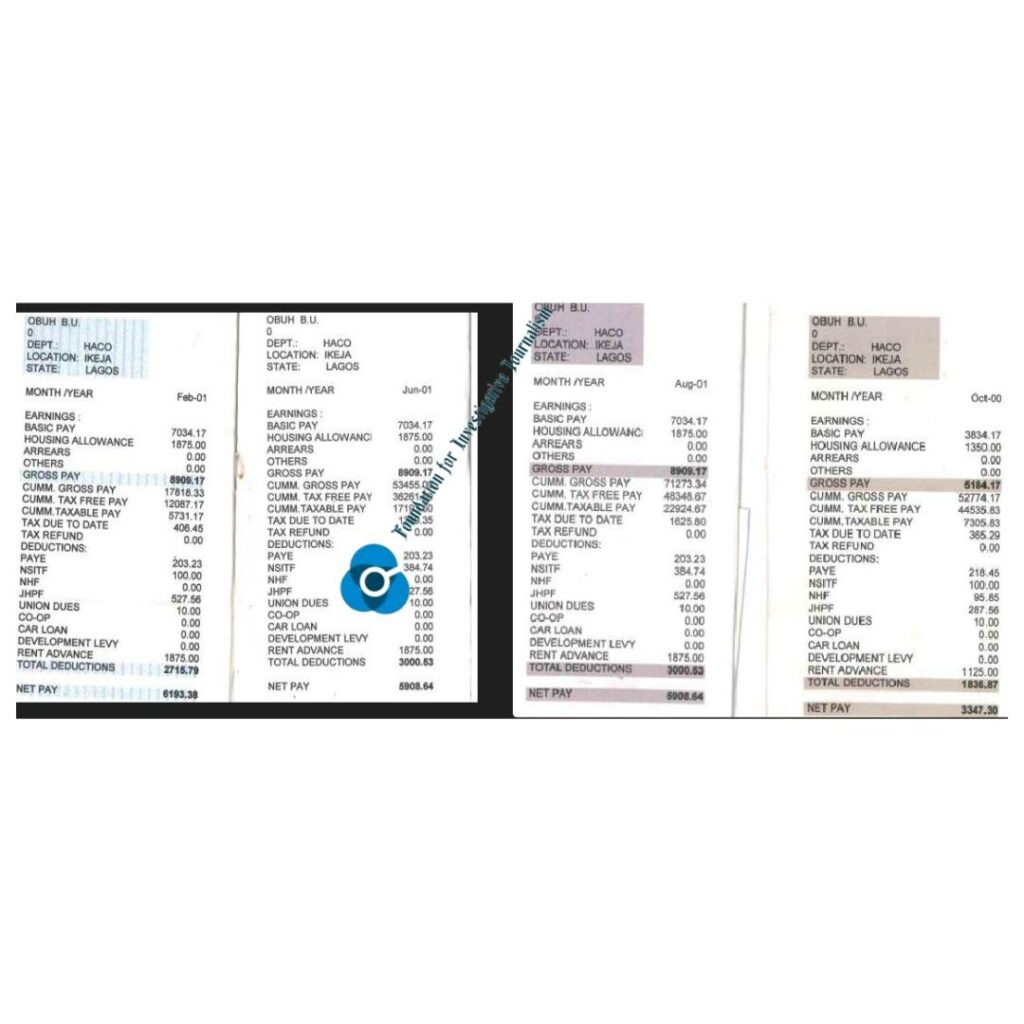

Checks through some of the documents showed some discrepancies in the amount deducted from Obuh’s salaries and the amount remitted into his pension account.

For instance, some of his monthly payslips showed a N100 pension deduction while others showed N384 deduction.

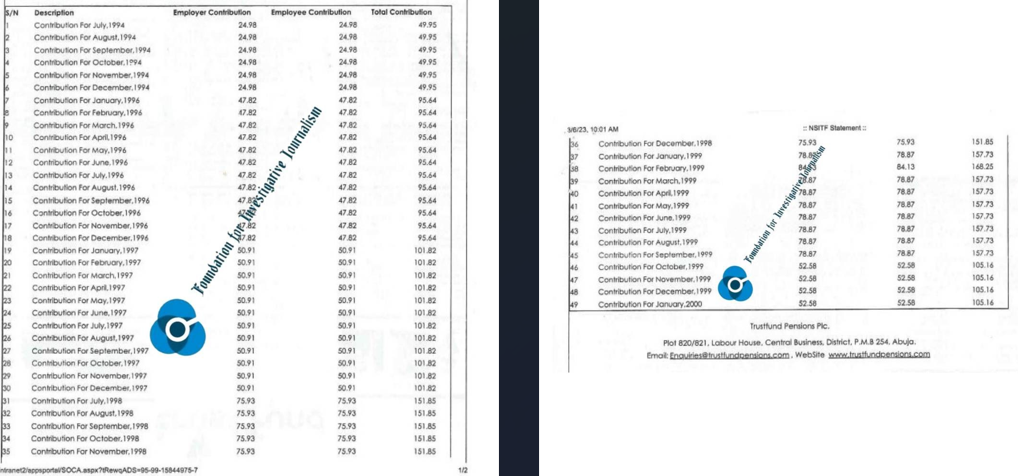

But FIJ discovered that the highest contribution made by the employee to his pension fund was N84, as reflected in the pension account statement. This means that the company underpaid his pension.

Also, FIJ found that the company only credited Obuh’s pension account for 49 months from July 1994 to January 2000, as shown in the account statement.

FIJ also found that Obuh is not the only former employee who has encountered pension issues with John Holt PLC.

In a 2018 report, Kode Ayodele, who worked with the company for about 23 years, accused his former employer of withholding his retirement benefits. Another media publication in 2020 reported how one Martin Nwabuwa accused the company of holding on to his N22.9 million retirement benefit.

When FIJ called the telephone line obtained on the company’s website on July 14, the customer desk officer, who answered the phone, told this reporter to send an email to the head office.

An email was subsequently sent to the company the same day. Nkem Nweke, the company’s human capital manager, who acknowledged the mail, noted that the claim was being verified.

Nweke’s response on July 20 reads: “We acknowledge receipt of your inquiry regarding the remittance of an ex-staff NSITF contribution during his service with our company. We understand your concern and have thoroughly reviewed the available records to provide a response. However, due to the substantial time lag of approximately 21 years since his exit from the company, we regret to inform you that we are unable to retrieve detailed information on the specific NSITF contributions during his employment.

“Nonetheless, based on the information you have provided, which includes his payslip and the statement of account, we have conducted an internal analysis. We observed that his payslip reflects a deduction of N100 from July 2000 to February 2001, a period not covered in the statement of account. Additionally, the deduction N384.74 from June 2001 and August 2001, as indicated on the payslip, is not reflected on the statement.

“While we acknowledge the discrepancies between the payslip and the statement of account, we regret that without comprehensive records, we are unable to provide further clarification on the specific NSITF contributions during the mentioned period. We understand the importance of resolving this matter and will continue to explore avenues to obtain any additional information that may assist in addressing your concerns and would appreciate your understanding of the challenges posed by the time lag.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.