Daniel Chibuzor, a Port Harcourt-based plumber, has been a United Bank for Africa (UBA) customer since 2005, and all through those years, he never encountered any issue with the bank. One could then imagine his shock when he woke up on April 11, 2023, to an unauthorised N1.2 million deduction from his bank account.

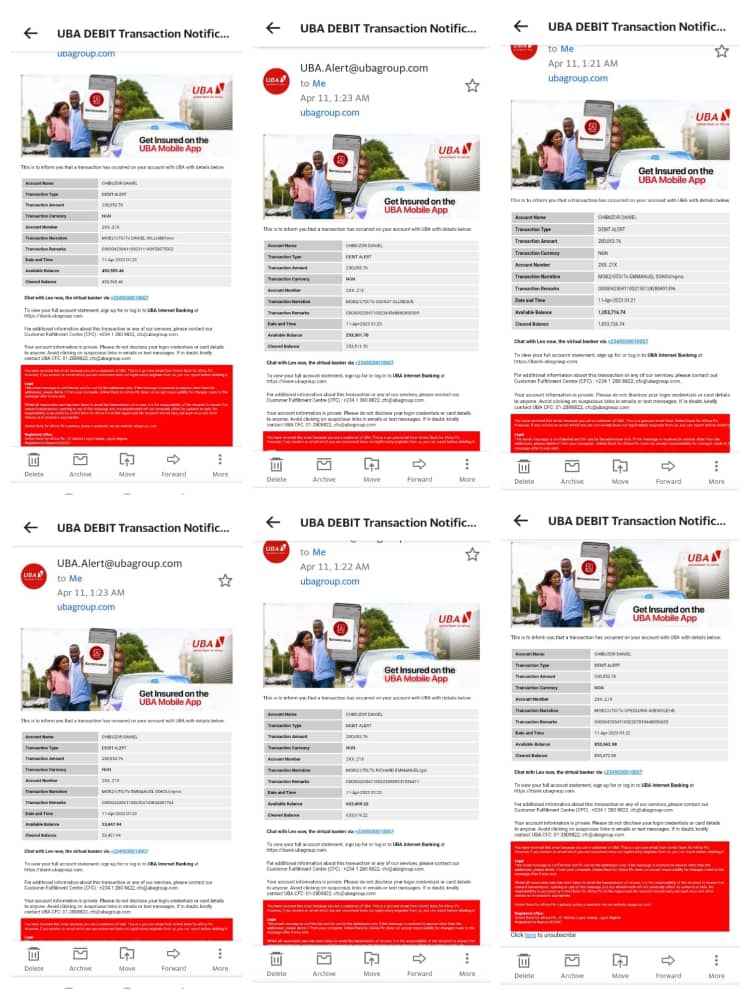

Chibuzor told FIJ that he woke up around 3:00 am on that fateful day in April and saw so many debit alerts on his phone.

“I had to look at them very well; they were truly debit alerts whose transactions I neither authorised nor initiated. The N1.2 million was money that people gave me to do a job. I was sweating all over my body,” he said.

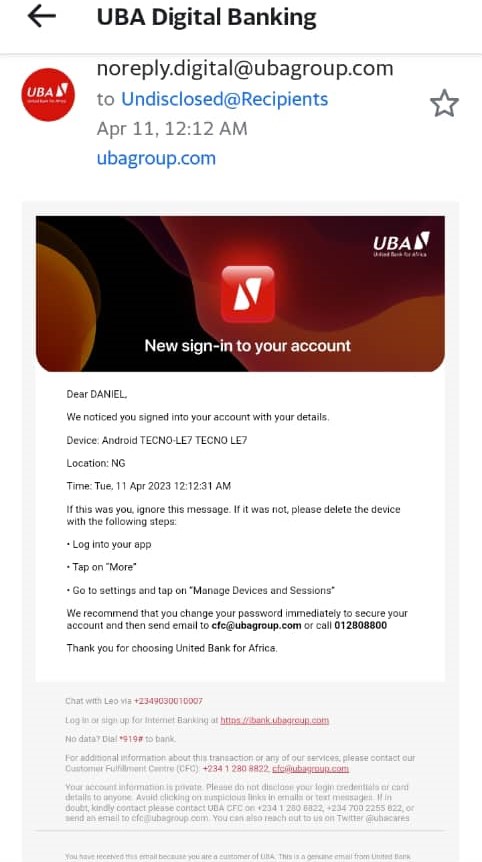

He also saw an email that UBA sent around midnight to state that a new device had signed into his digital banking account with his details.

FIJ learnt that this new device was what was used to process the unauthorised transactions.

READ ALSO: Months After Retirement, Ex-UBA Employee Hasn’t Got His Pension From ARM Pension Managers

“I immediately contacted UBA fraud desk that early morning. I explained what happened, and the man who picked confirmed the transactions. He said he was going to log in a complaint for investigation to commence,” Chibuzor told FIJ.

“He said the process of lodging the complaint required him to first delete the new device, Tecno LE7, that the person used to carry out the transaction so as to prevent another fraudulent transaction on the account because I still had some money there.

“He said the second step was that he would block all my access to that account, and I gave him the go-ahead as long as it would help me recover the stolen money.”

But from the time Chibuzor called the bank that early morning, he found that UBA had not blocked his digital banking details because he could still access the banking app until afternoon.

“I had to call them back to know why they had not taken the proposed steps. They eventually blocked my account,” he explained.

Chibuzor said he went to his branch in Port Harcourt about two days after the incident, and he was directed to the fraud desk. There, a bank staff told him that the head office had already started investigation.

“From that April to May, UBA was calling me and I was calling them. They said they were working hard, that there was a possibility of reversing my money and I should not worry,” Chibuzor noted.

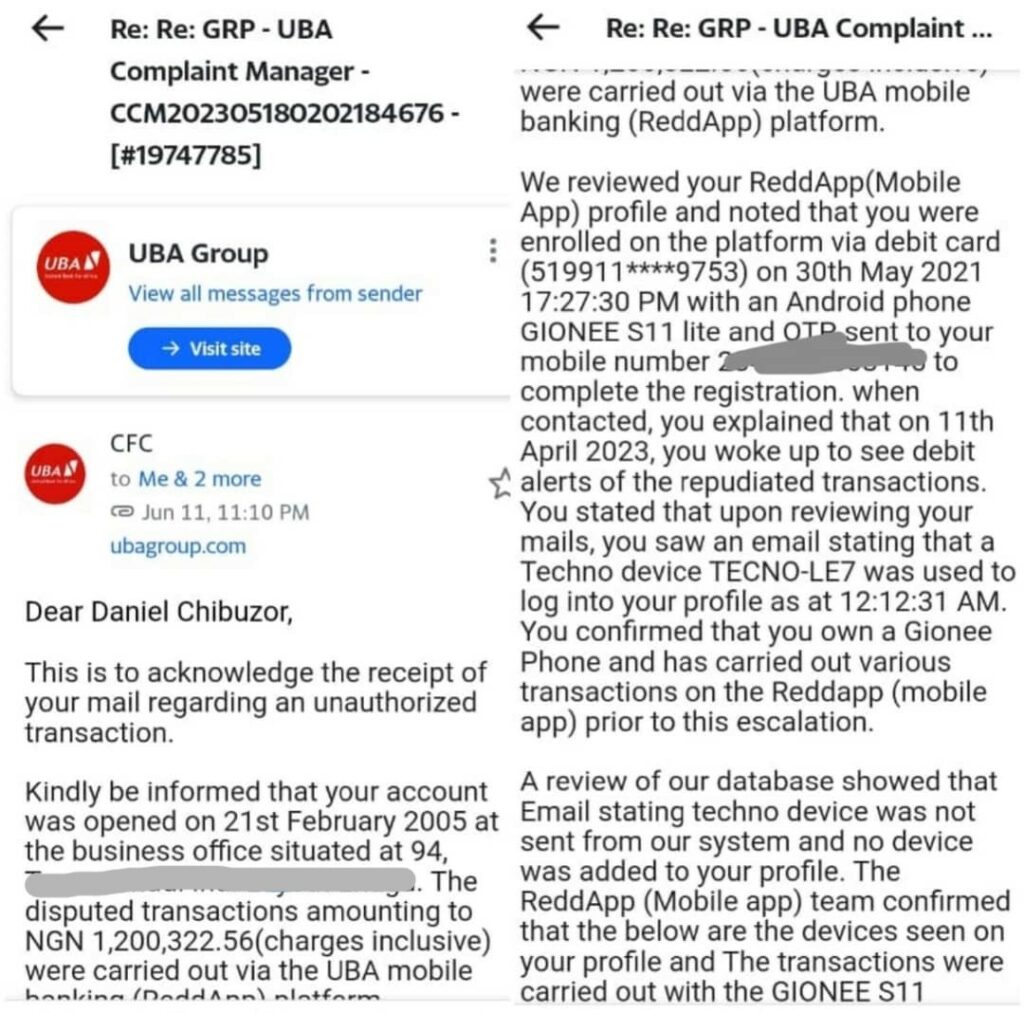

“Another day, one lady called me from the head office. She said she was the one handling my case. She said she could not see the email showing that a Tecno device was used to log in to withdraw the money. That they could not see it on their platform.

“I had to visit my branch to show the customer representative the email. Then the woman who said she was handling my case told me I would get my money.”

“YOU ARE NOT QUALIFIED FOR REFUND”

He said that the bank kept updating him, telling him to be patient while assuring him that they were working to resolve the whole issue.

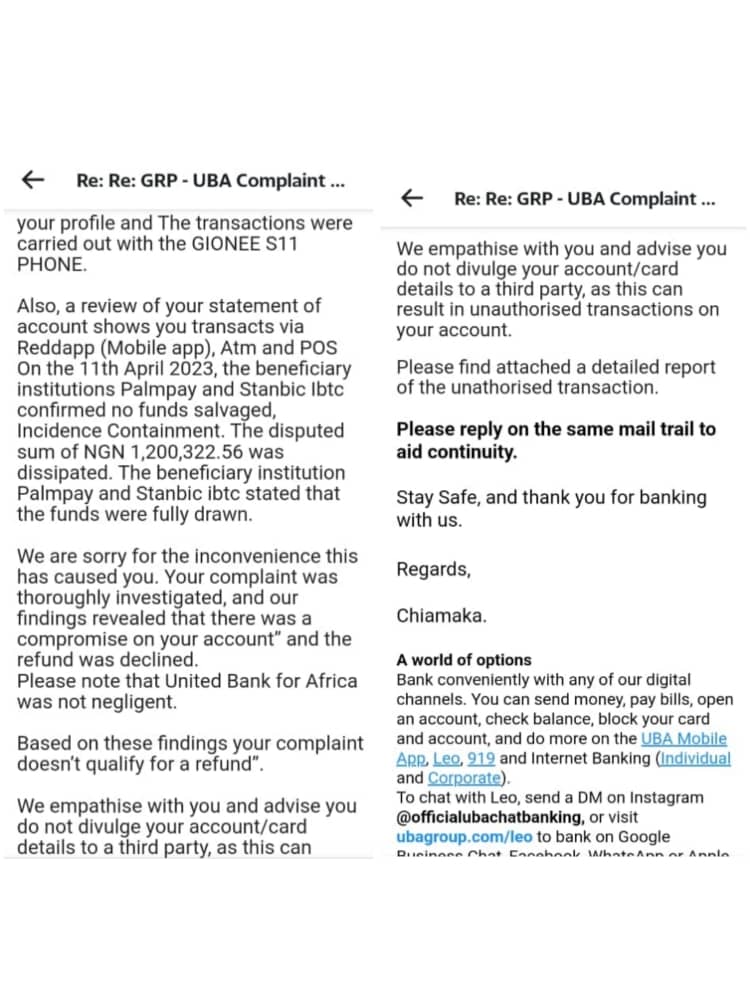

However, to his greatest surprise, UBA sent an email in June, stating that the bank was not liable for his loss, and consequently, his complaint was not qualified for a refund.

FIJ learnt that UBA declined Chibuzor’s refund because the bank’s investigation revealed there was a compromise on his account. The bank then absolved itself of being responsible for this compromise, saying, “…United Bank for Africa was not negligent.”

“THERE IS A CRIMINAL BEHIND THIS”

In a voice laden with emotions over the sad incident, Chibuzor said, “That account is over 19 years since I opened it with them, and this kind of incident has never happened to me. I did not compromise my banking details. I did not misplace my phone or ATM card.

“Despite complying with all the security measures as a UBA customer, how did someone bypass my account? When the person logged in to my account with a new device, UBA never sent me an OTP to authenticate the new device.

“My transaction limit on that account on the app is N200,000 per day. How come someone was able to move N1.2 million within five minutes?

“With the whole story surrounding this thing, I strongly suspect that a UBA insider is behind all this thing that is happening. They have a criminal in their midst that is doing this.”

READ ALSO: ‘Do Your Worst,’ UBA Tells Customer Who Asked for N302,000 Stolen From His Account

In response to FIJ’s inquiry on Monday, a customer care representative identified as Oluchi wrote: “We humbly crave your indulgence to please be patient while we provide feedback by September 04, 2023.”

Also, when FIJ called Ramon Nasir, the head of media and external relations at UBA, the calls were unanswered. A follow-up text was also sent to him, but no response had been received at the time of publication.

Subscribe

Be the first to receive special investigative reports and features in your inbox.