Chiamaka Ogudo, a Lagos State-based educational consultant, has narrated how N229, 599 was debited from her mother’s Access Bank account for an unauthorised transaction.

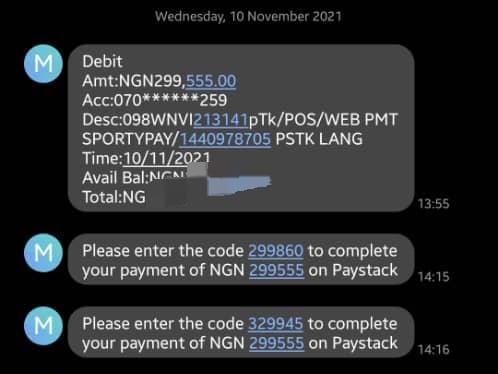

Speaking with FIJ, the consultant said that Uche Ogudo, her mother, had received a strange one-time password (OTP) in November 2021 but chose to ignore it. The consultant further said that some minutes after her mother had received the OTP, her account was debited by an unknown person.

READ ALSO: Economist Can’t Explain How N100,000 Left His Access Bank Account

“My mother was on her way to the bank to withdraw some cash on that day when she received an OTP. The moment she received the OTP, someone also ‘flashed’ her phone number but she ignored both incidents because she wasn’t transacting at that time,” Ogudo said.

“The debit alert revealed that N229, 599 had been deducted from her account. This was on November 10, 2021.

“The beneficiary used a SportyPay account to perpetrate the fraud and we have been to Access bank to make several complaints, but the bank has refused to take any action on the incident.”

Ogudo, who is also a former banker, described the bank’s lackadaisical attitude towards recovering the money as “intentional”, claiming the debit leg of the transaction had a digital footprint that could be traced and used to recover the money.

“The debit has a digital footprint which can be traced through the transaction’s reference number. This reference number can also lead to the beneficiary’s account number and then to the BVN,” she said

“All Access Bank would have to do is place a lien on the beneficiary’s BVN, which implies that all accounts linked with to the BVN would be placed on hold until the victim is able to recover her money.”

Ogudo further accused Access bank of covering it up because their staff members were fully involved in the action that led to the “disappearance of her mother’s money”.

“The unauthorised withdrawal is something Access bank can track but they are nonchalant because their staff members are involved. The money is something they can retrieve, they don’t just care.”

The consultant said she also reached out to SportyPay, but was told that it was only her mother’s bank that could trace the transaction.

“I reached out to SportyPay and they said it is only Access bank that can track the transaction. They added that every detail I need about the customer would have to be provided by Access bank,” she said.

“We have visited Access bank numerous times, wrote countless emails but all the efforts we made have been futile.”

READ ALSO: N22m Stolen from Customer’s Car Parked Inside an Access Bank Branch in Kaduna

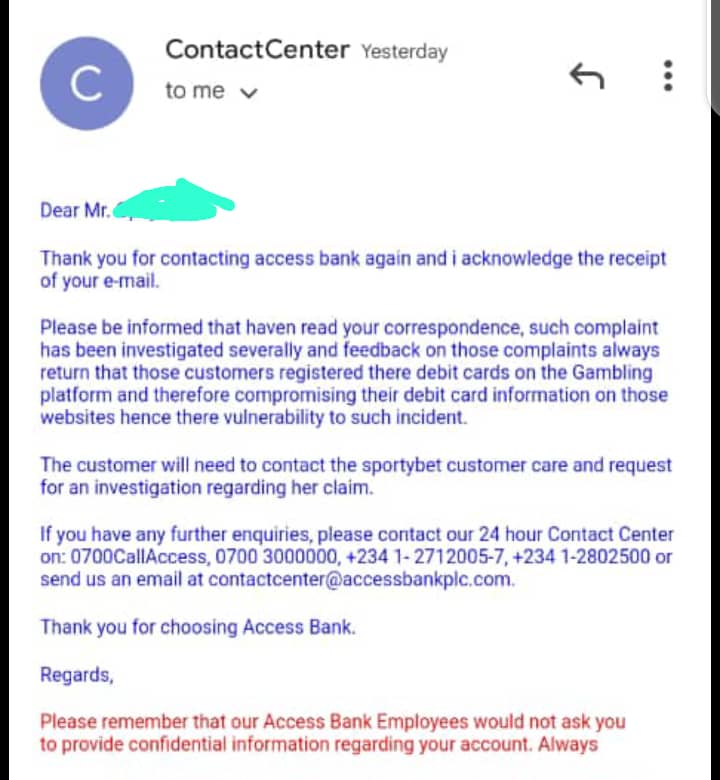

When FIJ contacted Access Bank for comments on the matter, the financial institution said Uche Ogudo “must have compromised her debit card details”.

“Please be informed that having read your correspondence, such complaint has been investigated severally and feedback on those complaints always return that those customers registered their debit cards on the gambling platform and therefore compromising their debit card information on those websites, hence, their vulnerability to such incidents,” the bank wrote.

“The customer will need to contact the Sportybet customer care and request for an investigation regarding her claim.”

In her reaction to the bank’s latest response, the consultant said the assumption made by the bank was incorrect.

“The bank is wrong in its feedback. My mother is quite elderly and the day the incident happened was actually the first time she would be making use of the card,” she said.

“Also, she does not know anything about sports betting and does not have anyone around her that could have used her card details for such. Access Bank have not been helpful on this matter.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.