Enoho Emeje, a Lagos-based banker, has accused Palmpay of forcing him into borrowing from them despite having some money in his wallet.

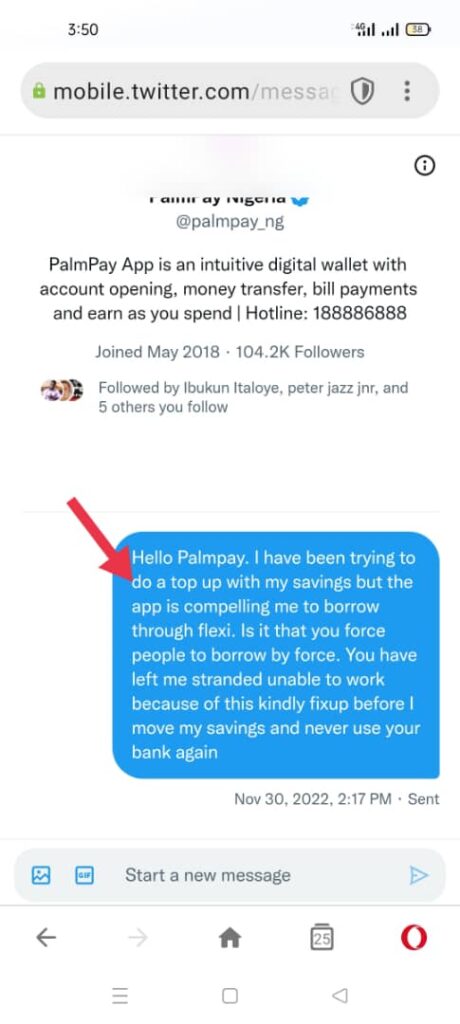

The banker told FIJ he contacted Palmpay on Twitter in November after observing some oddities on the Palmpay app but got no response.

He said what he found odd was Palmpay displaying a subtle message on their app, asking him to borrow when he wanted to recharge his MTN line from the app despite having over N20,000 in his account.

Tired of waiting to hear from Palmpay, Emeje reluctantly recharged his phone from the Palmpay app on credit on December 15.

READ ALSO: Customer’s Cash Hangs Between Access Bank and PalmPay

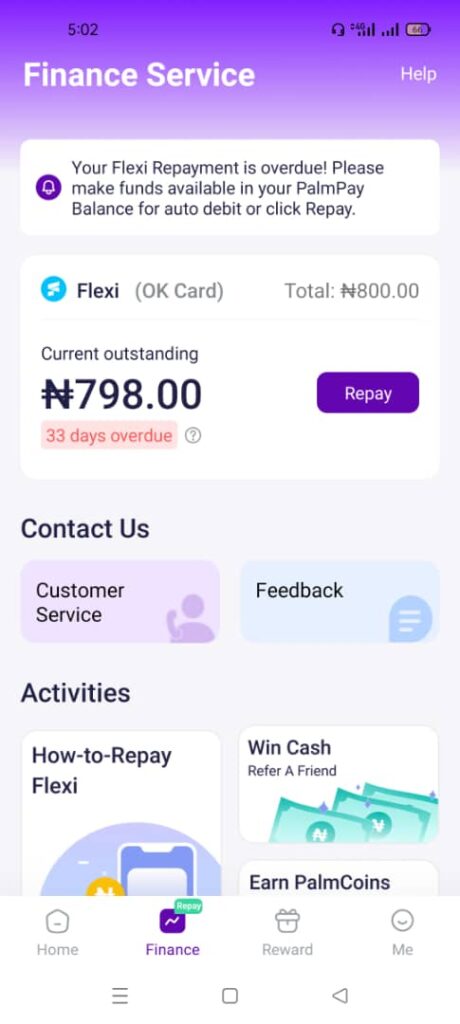

“Why should I borrow from them to recharge when I have money in my account? For days, the app kept reflecting ‘flexi-borrow’. Reluctantly, I borrowed N500 from Palmpay to recharge my line,” Emeje told FIJ.

The banker said days after borrowing from Palmpay, he received several calls from asking him to settle his loan.

“I was shocked because they forced me to borrow the money and it was just 24 hours after I borrowed from them. They did not inform me there would be additional charges on the loan. They imposed it on me,” he said.

“Since December 15, Palmpay has been adding N7 to the N500 daily. They didn’t explain the loan terms, they just started adding interests at a ridiculous rate on it.”

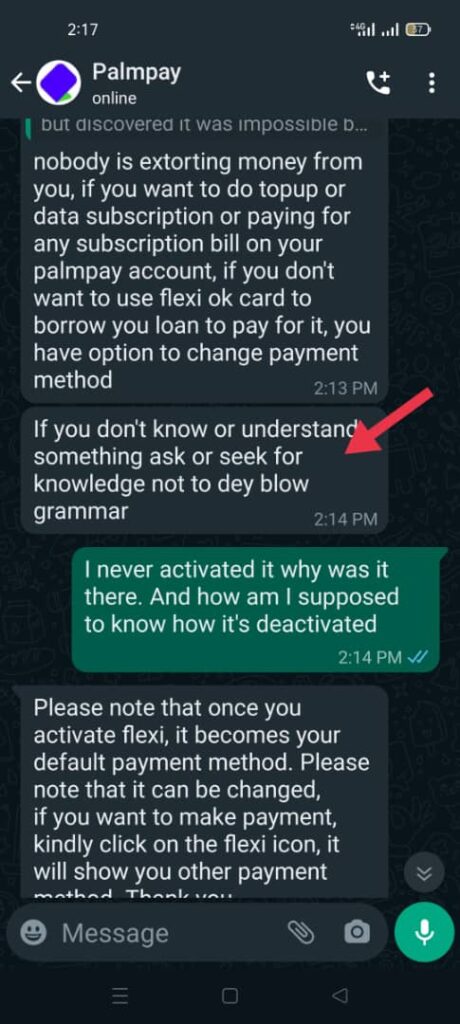

Emeje said he contacted Palmpay’s on WhatsApp to help him mitigate the issue but the admin said he was “just blowing grammar”.

READ ALSO: Palmpay Locks Customer Out of Phone Over Someone Else’s Loan

“I have tried to contact them several times to change what I am experiencing with them, but they have refused to do so. As a result, I won’t pay the interest because it was a forced credit loan,” he said.

“How do you force a customer to borrow and then start imposing interest on the principal with no prior explanation? Now, they have even disabled me from using some apps like Phoenix already.”

When FIJ called Palmpay, a call representative said there was no such thing as an outstanding debt after this reporter called out the source’s account number.

However, when this reporter asked the representative what the source should do the next time anyone from Palmpay calls, she did not respond.

Subscribe

Be the first to receive special investigative reports and features in your inbox.