On January 4, Bright Abegunde (not real name), knowing the money he borrowed from Deloan, a quick loan company, was due, contacted friends and neighbours for help, but he was not able to raise more than N4,000 out of the N12,000 owed.

The 25-year-old job seeker paid all he had and explained his situation to one of the company’s liaison officers. But hours later, he started getting panic calls from friends and family members. They had received messages from the money-lending outfit, announcing his obituary.

READ ALSO: What Happened to Koo, FG’s Hand-Picked Replacement for Twitter?

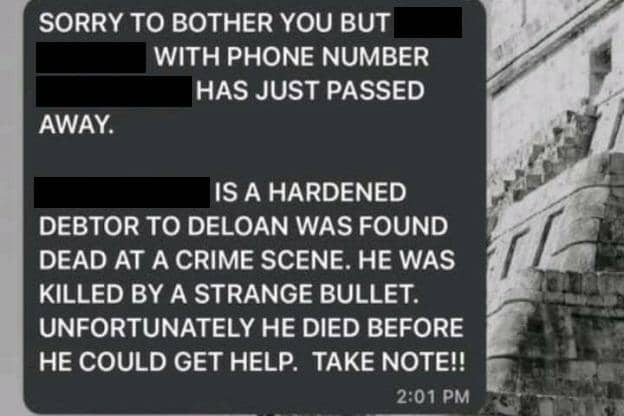

“They sent messages to my family members and friends, telling them I had been hit by a stray bullet,” Abegunde told FIJ.

FIJ obtained a copy of the message sent by Deloan, and it partly read, “He was killed by a strange bullet. Unfortunately, he died before he could get help”.

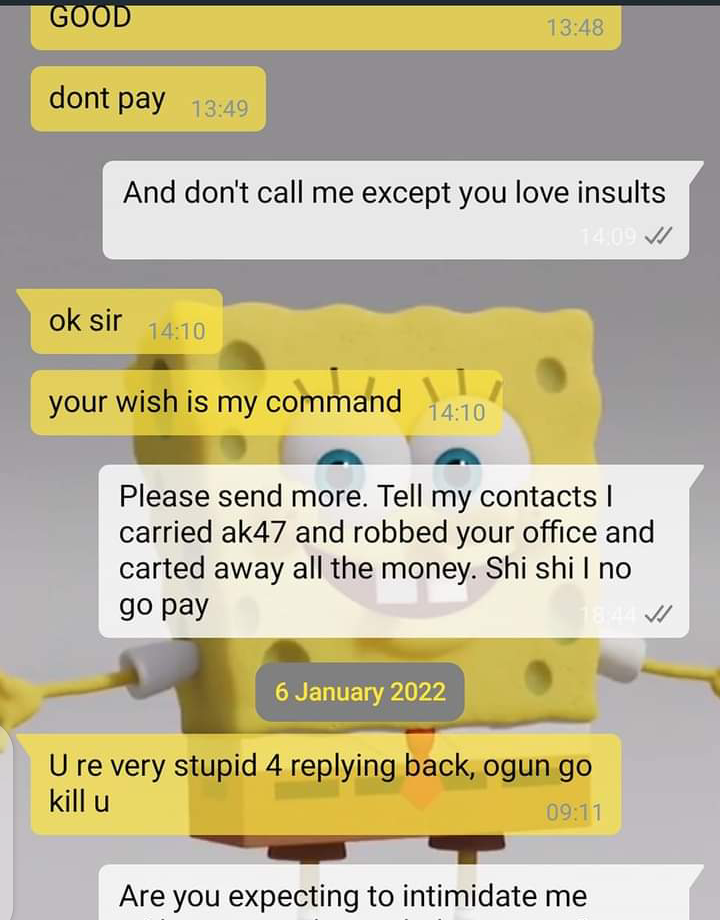

Another customer, who simply identified as Adamu, said his brother received serious threats from GoCash, another lending company, when he could not pay back his debt before the deadline.

“When we started receiving damning messages from GoCash, I had to quickly seek permission from work before heading straight to his place. When I saw him, my brother was already in a miserable state,” he told FIJ.

READ ALSO: From Ogunlesi to Bashir, Five Govt Supporters Worst Hit by Twitter Ban

“The exact message I received had been sent to his other contacts and it ended up having a negative effect on his psychological wellbeing. I had to quickly rally round to make sure he cleared the debt.”

On November 15, 2021, the Federal Competition and Consumer Protection Commission (FCCPC) issued a statement announcing the beginning of an investigation into rights violations in the money-lending industry.

This came after the National Information Technology Development Agency (NITDA), fined Sokoloan, another moneylender, for breaching its customers’ data privacy.

READ ALSO: REIGN OF TERROR: Inside Plateau Communities Where Army Helps Killer Herdsmen

Despite the fines and sanctions, the lending firms have continued to devise new means of harassing their debtors.

FIJ made several calls to the service lines of Deloan and Gocash, but they were not answered. Text messages sent to them were also not responded to.

Subscribe

Be the first to receive special investigative reports and features in your inbox.