Ola Jolaoso, a Lagos-based student, has narrated how some credit companies sent numerous threats to him over loans he took in March.

Jolaoso took loans from a number of quick loan apps on his phone between March and April. When he defaulted on repayment, some threatened to ruin him.

“I took loans on different apps. The initial loan I took was N20,000 at the end of March. As a student, I was hoping my allowance would come in and I would be able to repay my debt. But I was unable to pay the initial loan I took,” Jolaoso told FIJ.

“So, they pressured me and kept calling me to pay. When I pleaded with them to be patient and they didn’t listen, I went to take another loan from another app. I saw a 91-day tenor as the duration for repayment. So, I took this type of loan on two different apps.”

READ ALSO: ‘He’s a Ritualist’ — Loan Company Sends Defamatory Messages to Defaulter’s Contacts

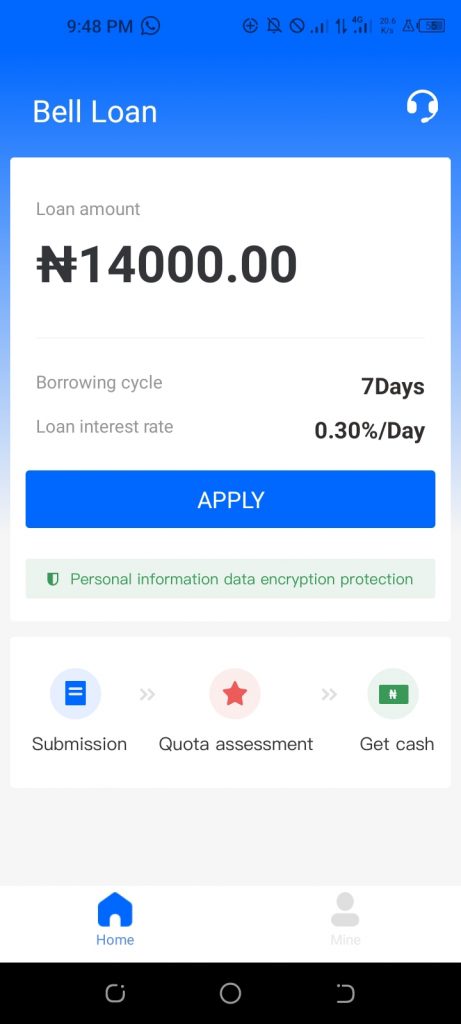

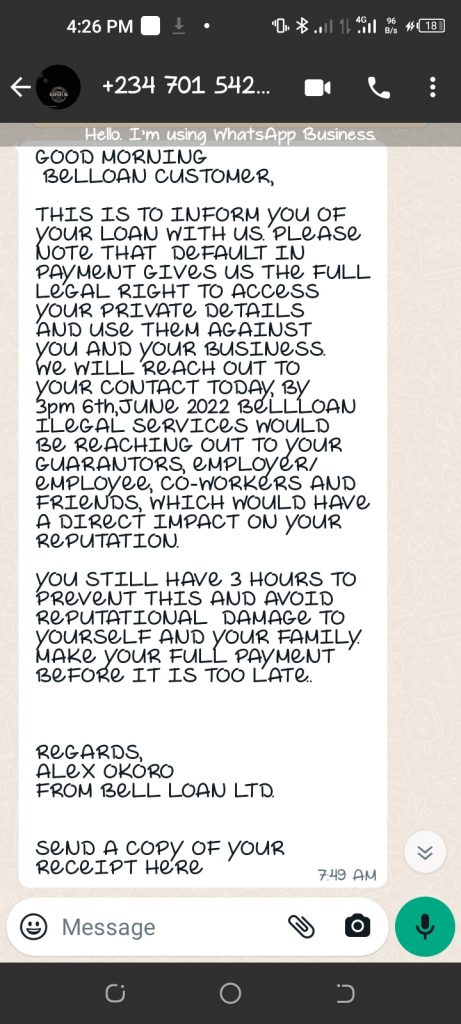

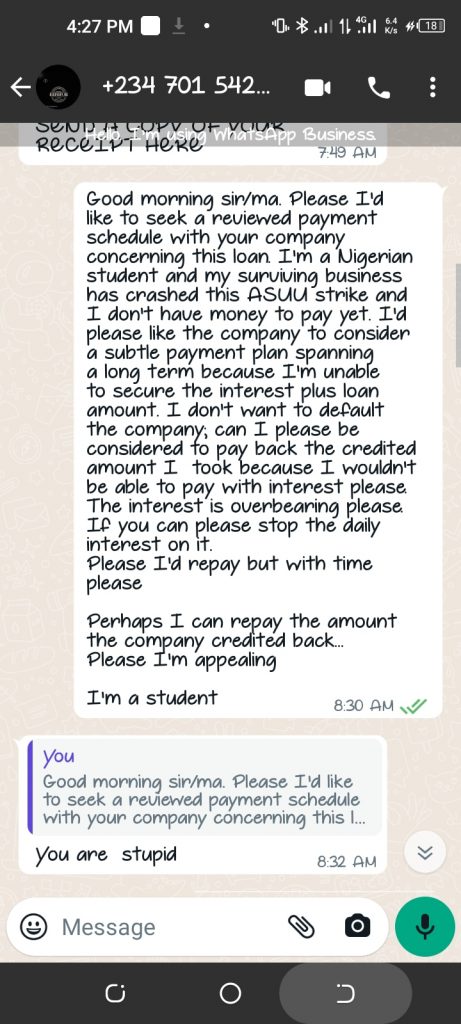

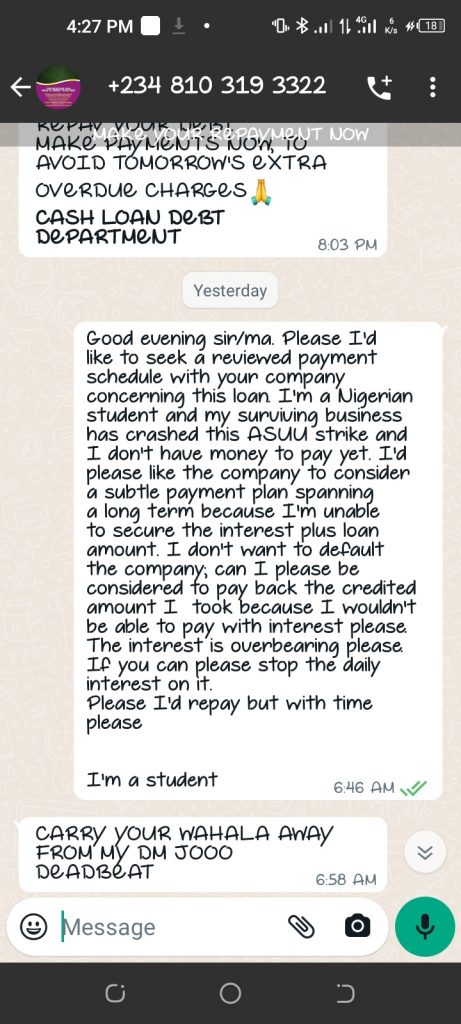

Jolaoso said he took more loans to repay the ones he collected previously. For instance, he took N15,000 from Bell Loan. Unfortunately, the Academic Staff Union of Universities (ASUU) went on strike and he stayed at home without receiving allowances. He pleaded with the loan app agents and asked for an extension, but got no positive response.

Alex Okoro, a Bell Loan agent, continued to send threats to Jolaoso even as he asked him to review his payment structure.

Other loan agents working for Zuma Cash and Cash Loan also sent threats to Jolaoso.

“Carry your wahala away from my DM jooo. Deadbeat,” one of the agents told Jolaoso.

When FIJ asked Okoro on the phone why Bell Loan threatened a debtor, he said the company simply expects borrowers to pay on time.

“Can I ask you a question? When they took a loan – maybe they took it for a business – did they not receive profit on whatever they invested the money in? So, why can they not pay back?” Okoro asked.

He said Bell Loan does not have any extension arrangements for defaulting lenders.

“No, no. We don’t extend here,” he said.

The Cash Loan agent who insulted Jolaoso did not answer phone calls from FIJ. They had also not responded to text messages sent to them at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.