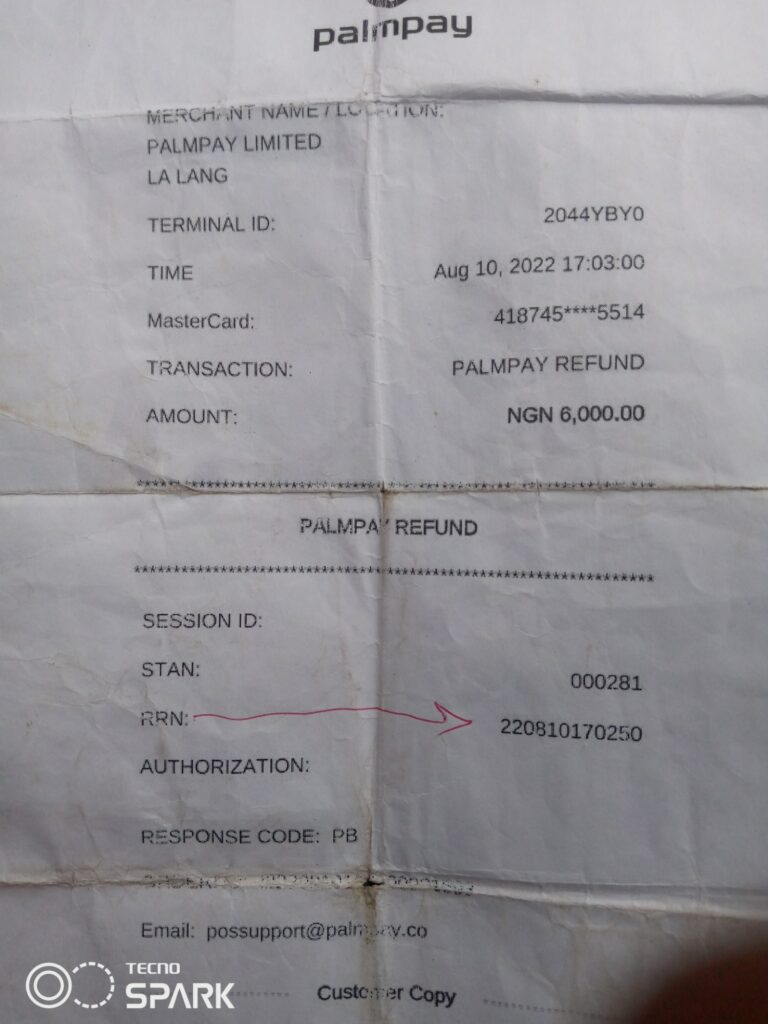

Edynoke Robert, a Delta State resident, has accused both Access Bank and PalmPay of holding on to his N6,000 after the failure of a cash transaction he made in August.

Robert told FIJ he had attempted to make a withdrawal of N6,000 from his Access Bank account on a PalmPay Point-of-Sale (POS) machine on August 10 but the transaction was declined.

Robert also said that after the first transaction was declined, he made a second attempt at withdrawing the same amount and it was successful.

READ ALSO: UBA Created an ‘Invalid’ Domiciliary Account for Customer. Now, His $1,500 Is Hanging

However, instead of receiving just one debit alert that was supposed to reflect the transaction that was successful, he received two. This meant the first N6,000 transaction that failed had also been debited from his account.

READ ALSO: Customer’s N250,000 Still With Wallets Africa Days After Failed Transaction

“When the first transaction failed, I asked the POS operator to try the transaction a second time, and he did, and I was paid,” Robert said.

“As soon as I got the money and was about leaving the shop, I got debited twice. This means I got debited for the first transaction that failed and the second one that was successful.

“So I went back to show the operator the alerts and he asked me to wait for 24 hours, that the money would be reversed. I waited for 24 hours but I got nothing.

READ ALSO: N1.6m Vanishes From Health Worker’s GT Bank Account

“Afterwards, I went to Access bank, and filed a complaint, and they told me they would work on it. When I returned 14 days later, they gave me a paper that showed that one of the transactions had been successful while the other had failed.

“They also claimed they had written to PalmPay to refund the transaction that had failed.

Robert further said the Access Bank officials told him that his money was with PalmPay.

“So I went back to the POS operator but he also said the money was not in his possession,” he said

READ ALSO: N40,000 ‘Mysteriously’ Disappears From Realtor’s FairMoney Account

“After he said this, he gave me a form to fill which I did. He then called PalmPay to inquire about the status of the transaction but they insisted that the money was not with them.

“Till date, my N6,000 is yet to be reversed into my account.”

FIJ sent emails to both Access Bank and Palmpay for comments on the matter, but they had not been responded to at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.