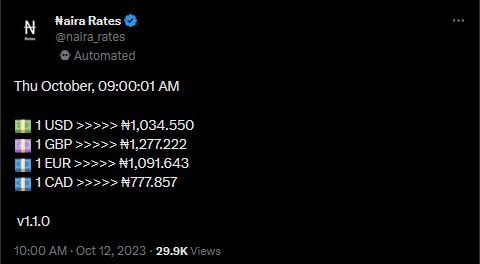

Nigerians were paying about N1,034 to get a dollar on Thursday. On Tuesday, the naira slipped to 1,025 USD. Wednesday maintained the same suboptimal slip.

All reports, and Nigerians by extension, worked with the 1,025/$ rate which came from Bureau de Change (BDC) operators on Tuesday. The Central Bank of Nigeria (CBN) is, however, working with a very different exchange rate.

The CBN stated that the naira was 759/$ at the foreign exchange market on Tuesday and 758/$ on Wednesday. The difference between the CBN and BDC rates is so wide that it is clear both financial entities live separate realities.

Why are BDC rates so high? Do they reflect the naira closer to its actual foreign exchange value compared to the CBN? Why should the parallel market exist? Was it not abolished some months ago?

There are many implications of the forex disparities, including an immediate fact, for example, such as needing to pay N2,050,000 for a 2023 MacBook Pro.

READ ALSO: EXPLAINER: I&E Window Isn’t Naira Devaluation. What Does It Mean?

UNDERSTANDING BDCs

BDCs are a global phenomenon in the financial sectors of many countries. A BDC is an establishment or enterprise where customers exchange the currencies of different countries.

These enterprises have become viable businesses in most countries they operate. The BDCs go by different names such as ‘exchange’ and ‘counter’.

BDCs target foreigners, business people, importers, frequent travellers and individuals with a demand for foreign currency.

The CBN supervises BDCs in Nigeria and has a framework on which this supervision works.

Both the CBN Act (Decree No 41 of 1991) and the Banks & Other Financial Institutions Act (BOFIA) recognise BDCs. Section 28 (1)b of the former states that the CBN may “issue guidelines to any person and any institution that engages in the provision of financial services, including operators of bureaux de change”.

WERE BDC OPERATORS BANNED, WHY ARE THERE PARALLEL MARKET RATES?

President Bola Tinubu said that the CBN must work towards a unified Investors and Exporters (I&E) window in May.

“Monetary policy needs a thorough housecleaning. The Central Bank (of Nigeria) must work towards a unified exchange rate,” Tinubu said on May 29.

“This will direct funds away from arbitrage into meaningful investment in the plant, equipment, and jobs that power the real economy.”

Tinubu’s statement was followed by a devaluation of the naira that saw the currency dip from a previous official rate of N463/$1 to N755/$1 within two weeks.

Nigerians were under the impression that the unified I&E window eliminated the parallel market after Tinubu assumed leadership on May 29.

BDC operators were never banned and the parallel market never went away.

READ ALSO: Despite CBN Order, Lagos Banks Starve Customers of Cash

Segun Ajibola, the Institute of Chartered Institute of Bankers of Nigeria’s former president and chairman of council, told FIJ that the parallel market was a product of necessity.

“Nobody sets up parallel markets. A parallel market emerges spontaneously when the official market is unable to cope with the demand for a particular commodity,” Ajibola told FIJ on Thursday.

“So, it’s like when there is a scarcity and people go behind to buy and, there is an element of rationing. In Nigeria, when there were products like fertilisers which the government used to provide, there was usually a parallel market for fertilisers. More recently, in petroleum markets, those who sell in containers by the roadside and on the highway create an example of a parallel market. When people cannot find the fuel, they go to buy from the highway.

“It is the same thing that occurs in the foreign exchange market because what is available officially is not enough. People then start to find a way when they need it and they cannot get it officially. For instance, somebody wants to travel but they cannot get the dollars they need from their bank and they must travel. Such a person will look for another way to get the dollars. That’s how the so-called parallel market emerged.

“So, it has always been like that since 1986 when Nigeria introduced the Structural Adjustment Programme (SAP) and the dollar became a commodity rationed, and when you are rationing and people cannot get enough, they start looking for other ways to get it. Those who used to export used to buy and sell foreign currencies, but now you will see them on the road.”

Ajibola also explained that the parallel market permitted some untoward practices such as speculation to occur. Those in the parallel market now speculate the worth of a currency.

So, if a dollar is worth N1035 today, by next week, it could be N1100 or N1200, depending on the demand for the dollar. People also hold on to dollars while speculating a possible raise in value just to resell for a profit in the parallel market.

It is no secret that the BDCs buy the dollars from the CBN, just like the commercial banks. These BDCs sell currencies at the unofficial rate and in a control environment where demand is very high, effectively maintaining the parallel market.

READ ALSO: Free Float of Naira. What Does It Mean?

WHY THE NAIRA IS PERFORMING POORLY

The value of a currency is primarily linked to the forces of demand and supply.

“This is about the forces of demand and supply. When more people want a currency but it is not available, those who are desperate to have it will begin outpricing themselves. So they claim that they are ready to pay more for scarce currency. The solution for us is to see what we can do as a country to increase the supply of that commodity so that the value will be stable,” Ajibola explained.

To outprice is to undermine the value of the currency used to buy the currency in high demand by offering more in exchange. To put it simply, 10 potential dollar buyers will pay more naira than usual to secure limited dollars available to just four buyers.

In what seems to be an auction process, the highest bidders will get the dollars. Since they bid with the naira, the value of the naira takes a hit.

Countries understand that “supply and demand are influenced by a number of factors, including interest rates, inflation, capital flow, and money supply” so governments try to regulate these factors using monetary and fiscal policies.

Once the wrong fiscal policies are implemented, or the right fiscal policies are wrongly implemented, the demand-supply aggregate goes awry and the currency concerned suffers devaluation.

For instance, exchange rate systems are often fixed rate or floating rate systems. Nigeria chose to float the naira this year and the effects of that policy are being felt under the peculiar circumstances in the market.

READ ALSO: FLASHBACK: In February 2017, Tinubu Said He Was Not Worried About Naira’s Free Fall

POLICIES WILL HELP, BUT NOT JUST ANY POLICY

Ajibola, who is also a professor of economics, told FIJ that policies can help the naira recover some of its value.

“Yes, policies that can help us will diversify our economy so that we don’t rely only on crude oil as source of foreign exchange earnings. So, we need policies that can help us industrialise our economy and diversify it into non-oil exports,” Ajibola said.

“If we can have policies that will reduce our reliance on some imported items so that we use locally made items like the clothes we wear, the food we eat, like the raw materials we use in our factories instead of importing them. This was what we used to pursue, called the import substitution strategy in those days. So, we can have such policies on ground, and that will reduce the demand of foreign exchange and help us to strengthen our domestic currency. Then policies that will also encourage foreigners to come to Nigeria in foreign direct investment; they can bring their dollars to Nigeria instead of we spending dollars.

“For us as a country, the only solution for us is to look for how we can increase the dollar earnings so that the currency can go round or reduce the gap. So long as there is a gap between what is available officially and what people need as a demand, a parallel market will thrive. The dollar is a currency that links us with the rest of the world, so that is why the issue has been more pronounced when it comes to the foreign exchange habit.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.