Chinonso Obidi (not real name), a Lagos State-based businessman, has narrated how Sterling Bank failed to honour its own end of an agreement signed when he invested in one of the financial institution’s savings contract.

Obidi told FIJ that he was at his place of work in early 2019 when a Sterling Bank marketing agent, who simply identified herself as Sarah, approached and persuaded him to open an account with the bank.

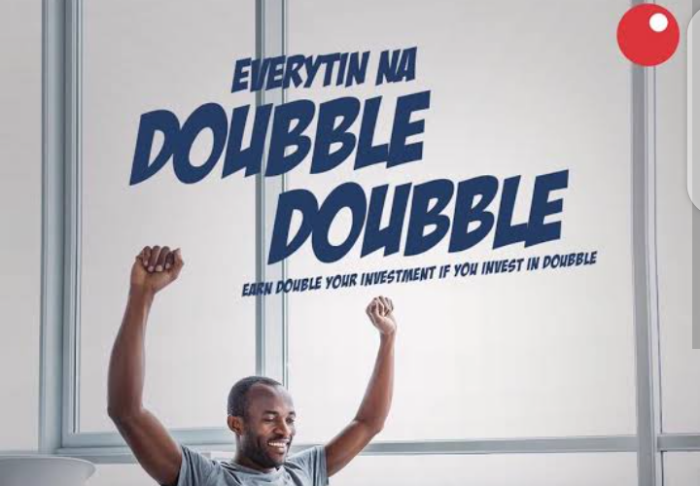

She also advised him to sign up for the Sterling Doubble savings plan, a new package launched by the bank at the time.

Obidi said he initially had doubts about the package being sold to him but would later show interest when Sarah said he would get double of whatever capital he invested at maturity.

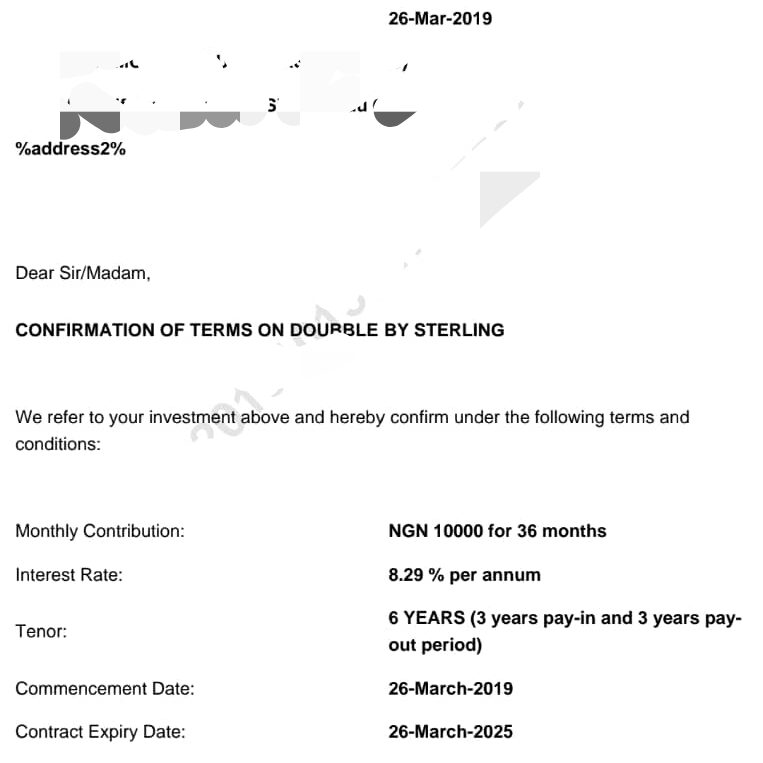

In the end, Obidi started the Sterling Doubble monthly contract savings investment in February 2019.

He also signed up for the investment with an arrangement that N10,000 be deducted from his account every month.

READ ALSO: Months After Due Date, ‘Investors’ N180m’ Still With TTragricultural

“I made sure to deposit enough money into that account, but after the first deduction, I noticed they did not deduct another money. I kept calm thinking they had another way of running the package. Also, I was still getting monthly emails from Doubble, appreciating me for the progress in my savings journey,” said Obidi.

“Later, when I didn’t notice any further deduction in my account for more than a year, I visited the bank and asked my account officer if the money was meant to remain in my account or would still be deducted every month, and she confirmed the latter to me. I then told her they hadn’t been deducting the agreed N10,000 on a monthly basis from my account and she promised to look into it.”

Obidi said he later received an email from the Doubble team in January 2021, stating that Sterling Bank had been compelled to review the interest rates on the plan due to changes in the economic situation of the country.

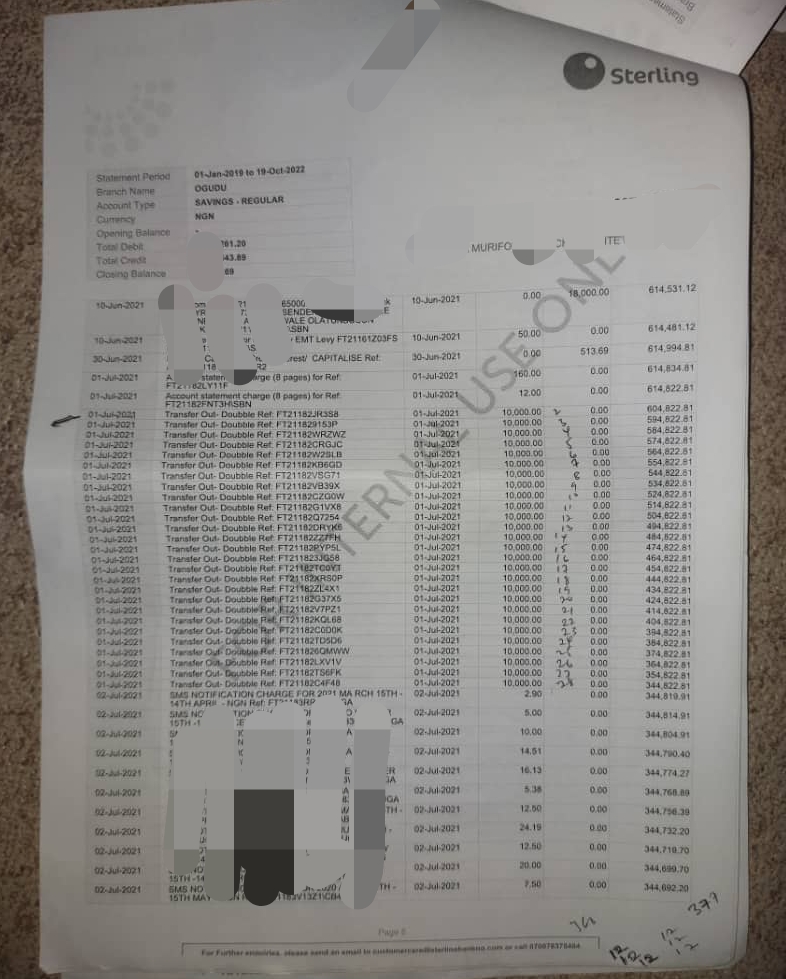

On the July 1, 2021 however, and following Obidi’s complaint, he received 27 debit alerts of N10,000 within an hour. The debit alerts came with the narration ‘Doubble’.

The bank then deducted another N10,000 during the same month and subsequently continued the monthly deduction as agreed on the contract. The regular deduction spanned into February 2022, the last deduction date on the contract.

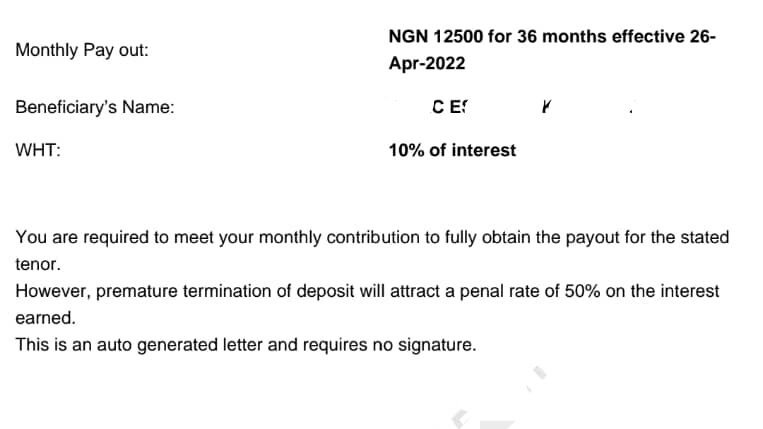

“In March 2022, Sterling Bank commenced paying back N12,500 on a monthly basis into my account and this continued until June 2022, when I went to the bank to opt for a bulk repayment option. This option was supposed to allow me receive my repayment at once, and not on a monthly basis,” Obidi said.

“The bank processed my application and later sent me N327,581.90 at the end of July 2022.

“When I added the sum that was paid to the initial four months payments I had received, I arrived at N377,581.90.

“I became worried because from my calculation, and according to the Doubble savings terms, I was meant to be paid N12,500 multiplied by 36 months, and that should be N450,000.”

Obidi told FIJ that he again visited one of the bank’s branches to lodge a complaint.

“At the Customer Care Unit, they printed my account statement and used a pen to highlight all the deductions and repayments made, starting from 2019,” said Obidi.

“They later found out that they had indeed not fully paid me the total amount I was entitled to.

“They said they would write to the head office to know what went wrong but I never heard from them. I later went back to their branch and met with the branch manager who asked me to write a letter.

“Since then, I’ve not seen that same manager again. The phone number he gave me is also rarely available. Whenever I called, someone would pick and tell me the manager was not around.”

READ ALSO: N258m New Naira Notes Found Hidden in Sterling Bank Head Office

When FIJ contacted the Sterling Doubble team via their official email, the bank replied insisting that they had the right to review and change interest rates whenever necessary.

“Our terms stipulate that the bank has the right to review and change rates, with customers being notified in advance,” wrote Demola Adesina, the official who responded to the mail.

The bank, however, failed to respond to the question seeking to know the exact amount accrued by Obidi as per the savings plan he signed up for, and in relation to the interest rate which promised to pay him N12,500 monthly, and upon maturity.

Subscribe

Be the first to receive special investigative reports and features in your inbox.