Heirs Holdings, an investment holding company owned by Tony Elumelu, has been found to have secured loans totalling N41.823 billion from the United Bank for Africa (UBA) at 15 percent interest rate.

The Central Bank of Nigeria (CBN)’s monetary policy rate (MPR), the benchmark for all interest rates in the economy, currently stands at 18.75 percent. This means any bank lending below the benchmark is doing so at below the cost of funds.

The cost of funds is the amount of money financial institutions must pay in order to acquire funds.

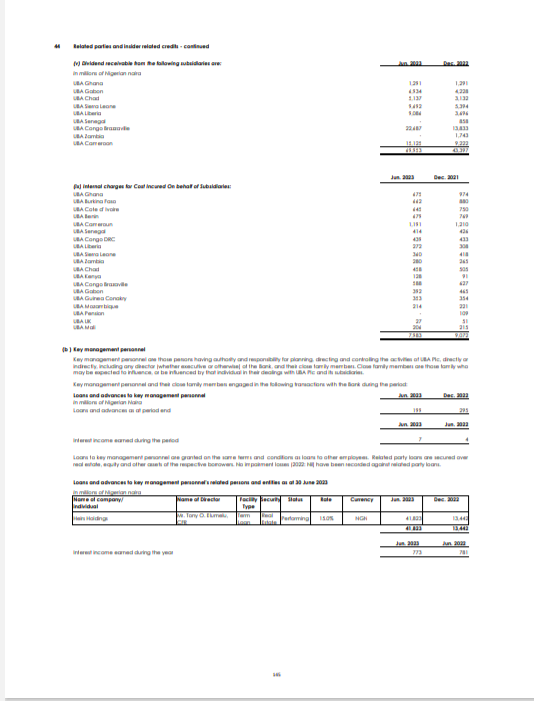

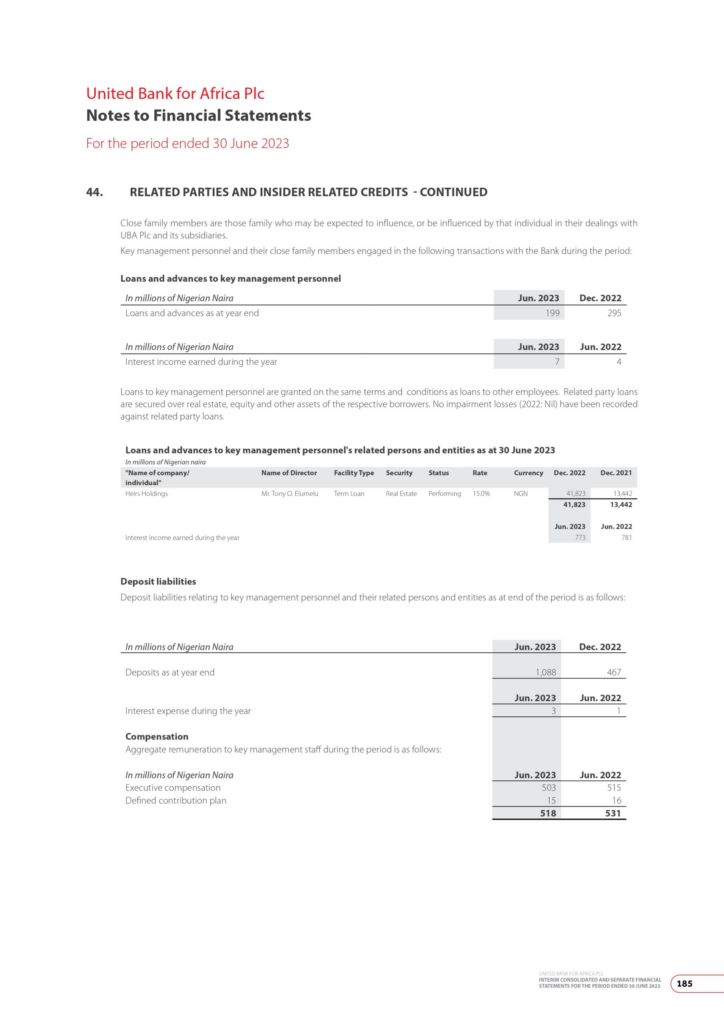

According to ICIR and Economy Post, Elumelu’s Heirs Holdings owed UBA N13.442 billion as of December 2022. The investment company’s debt to UBA, however, rose to N41.823 billion by June 2023.

READ ALSO: Fraudster Hijacks US-Based Nigerian’s WhatsApp Line, Asks Contacts for Millions

This showed that the firm had borrowed an additional N28.381 billion from UBA between January and June 2023.

The interesting part, however, is that, while the loans borrowed by Heirs Holdings from UBA rose by 211.137 percent between January and June 2023, the interest rate remained static at 15 percent.

The MPR benchmark as of December 2022 stood at 17.5 percent. This clearly meant the additional N28.381 billion the investment firm obtained from the bank between January and June 2023 were obtained below the set benchmark and market rates.

UBA’S ‘SHYLOCK’ LOAN INTEREST RATES

Presently, the market rate of loans in Nigeria is between 20 and 30 percent.

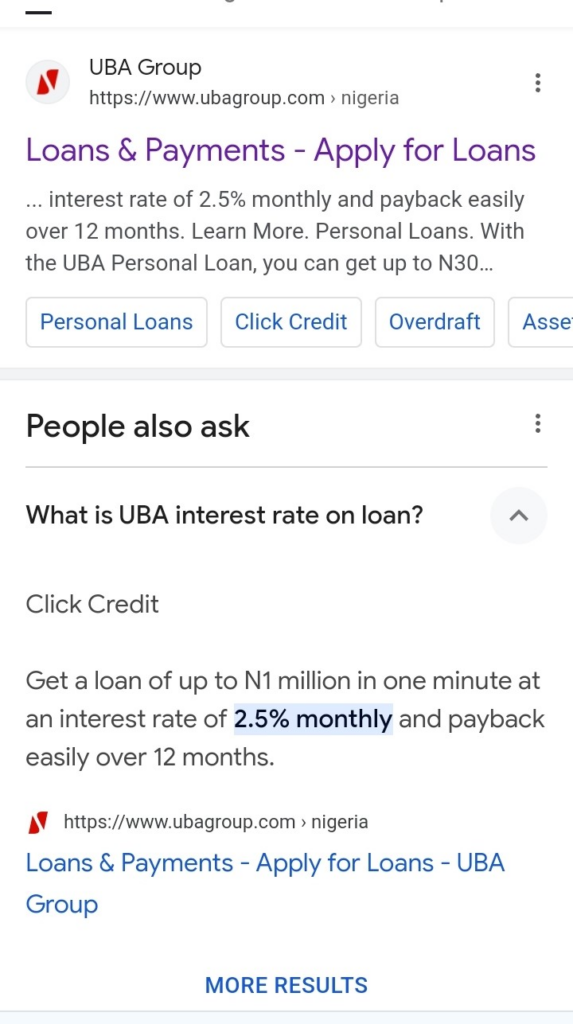

Interestingly, UBA presently gives loans to its customers at a rate far higher than 15 percent. The bank’s personal loan products cost 2.5 percent interest rate monthly or a 30 percent rate annually.

READ ALSO: Tinubu, Shettima Take N12b to Renovate Residences… What’s in Nigeria’s N2.17tr Supplementary Budget?

Before the CBN rate increases began in the middle of 2022, the bank’s personal loan product called Click Credit attracted a 23 percent interest rate annually.

In addition, UBA personal loans currently attract a one-off management fee of one percent. This means a borrower is expected to repay the principal amount at 31 percent interest and management rates.

As a result of the high interest rates the loan it offered its customers attracted, UBA earned N428.292 billion from interest income in June 2023 as against the N257.361 billion it recorded in June 2022.

Interest income represents earnings from loans to third parties, including customers and corporate organisations. Loans to customers, corporates and other entities at UBA were nearly N3 trillion as of June 2023.

FINANCE EXPERTS AND BUSINESS OWNERS’ REMARKS

Finance experts and small business owners say it is not a good practice for banks to issue loans to related parties at cheaper rates while offering Shylock loans to small businesses.

They added that the discriminatory nature of loans offered to members of the public by banks is hurting the economy.

“If big and connected companies are getting loans at lower interest rates while small businesses are getting them at far higher rates, how then would anybody expect an even development? It is actually the small businesses that should be getting loans at 15 per cent, not big businesses or connected firms,” said Theresa Owene, a Lagos-based small business owner.

Daniel Obiora, a finance expert, said the situation must be checked by the CBN.

READ ALSO: CBN Deputy Gov Nominee Emem Usoro Is UBA’s ‘Superwoman’

“There is nothing wrong with anybody getting a loan from a bank which he or she chairs. However, there is a moral burden on a bank when its related parties are getting loans at cheaper rates. Money in a bank is a liability, so it belongs to depositors. Hence, these depositors must be considered first before even the staff or directors,” said Obiora.

“It is not right for directors or bank management to obtain finance at far cheaper rates – even when several depositors cannot get loans from their banks. I think the CBN must begin to check this kind of practice because it creates an unequal society where the rich get richer, and the poor get poorer.”

Otienne Maxwell, a former staff member of a Tier-1 bank, described the matter as a normal practice in deposit money banks.

“It is nothing strange in banks. If a bank decides 4 or 15 per cent is good for its staff, it is not a problem. However, it is absolutely wrong to give out depositors’ money at low rates when the repo or benchmark rate is nearly 20 per cent. It is often meant to compensate staff or directors for their efforts, but it is discriminatory.”

Elumelu is the chairman of both Heirs Holdings and UBA.

Subscribe

Be the first to receive special investigative reports and features in your inbox.