The Central Bank of Nigeria (CBN) has released a guide for customers of commercial banks and other financial institutions to lodge complaints.

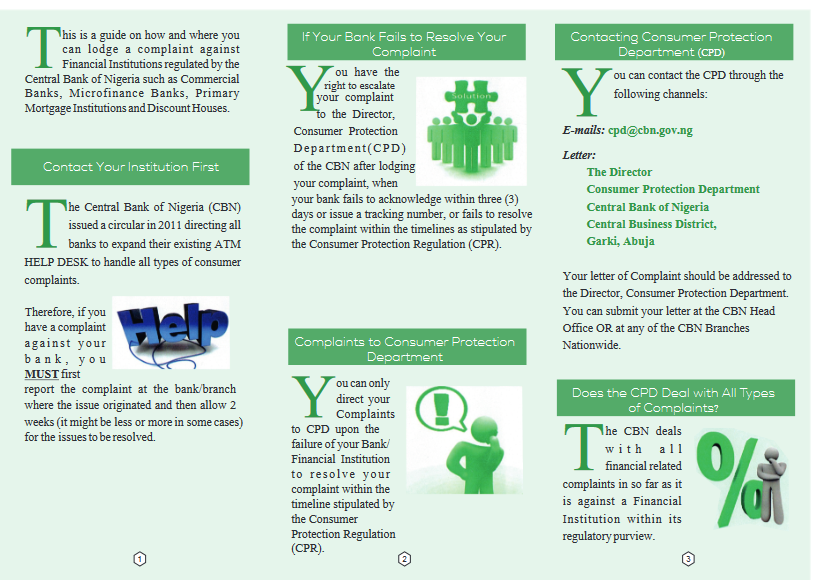

In a circular published on the CBN website, the bank directed that dissatisfied customers complain to their banks and then wait for two weeks. If the bank fails to resolve the matter, it can be escalated to the Director, Consumer Protection Department (CPD) of the CBN.

READ ALSO: CBN Tells Nigerians: Defend eNaira, Even After Experiencing Losses

“If you have a complaint against your bank, you must first report the complaint at the bank/branch where the issue originated and then allow 2 weeks for the issues to be resolved,” the circular read in part.

“You have the right to escalate your complaint to the Director, Consumer Protection Department (CPD) of the CBN after lodging your complaint, when the bank fails to acknowledge within three (3) days or issue a tracking number, or fails to resolve the complaint within the timelines as stipulated by the Consumer Protection Regulation (CPR).”

The CPD, according to the CBN, can be reached via [email protected].

The CBN, in another circular, warned that banks that do not register complaints and provide complaint codes to customers will be fined one million naira.

READ ALSO: CBN to Sanction Micro-Finance Banks Dealing in FX Transactions

The directive read, “Banks are required to log every complaint received from their customers into the Consumer Complaints Management System (CCMS) and must generate a unique reference code for each complaint lodged, which must be given to the customer. Failure to log and provide the code to the customer amounts to a breach and is sanctionable with a penalty of N1,000,000 per breach”.

On numerous occasions, FIJ has reported instances of customers suffering suspicious debits that were not resolved by their banks.

Subscribe

Be the first to receive special investigative reports and features in your inbox.