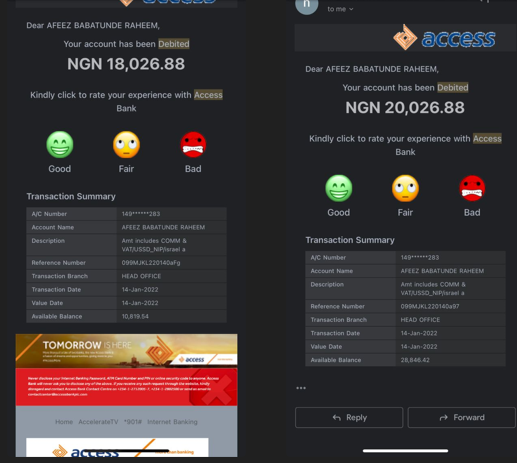

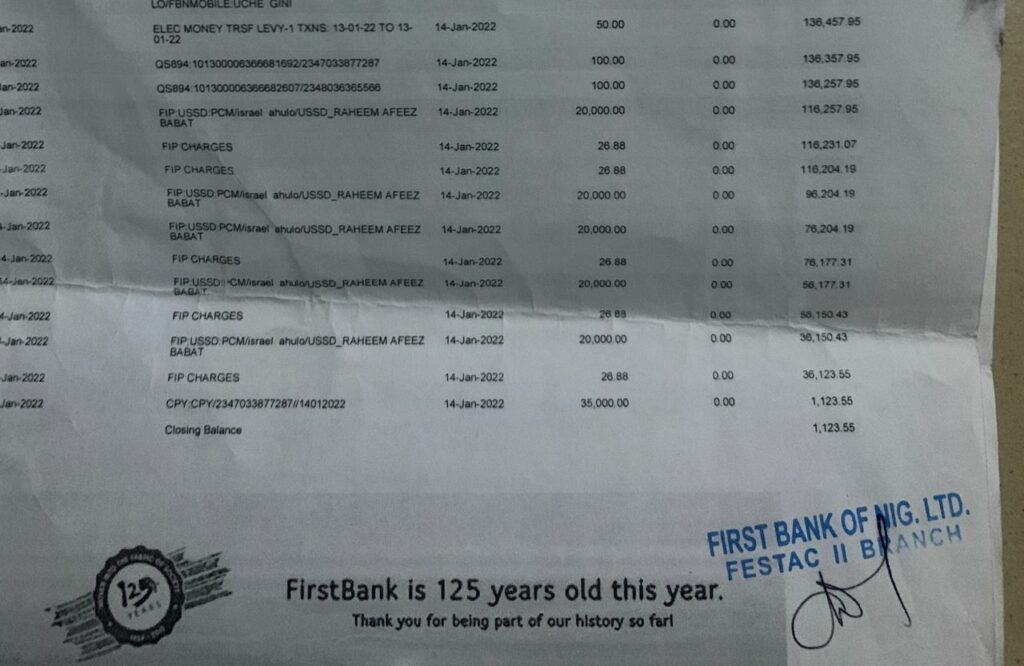

Raheem Afeez, a Lagos State resident, has narrated how thieves stole his phone in 2022 and transferred N245,000 from his First Bank and Access Bank accounts.

Afeez told FIJ that he was sleeping on January 14, 2022, when the thieves stole his smartphone through the window of his house. He noted that he was charging the phone at the time it happened.

He said by the time he woke up, the thieves had stolen N135,000 and N110,000 from his First Bank and Access Bank accounts respectively.

In a bid to see if he could recover the stolen N245,000, the Lagos resident reported the incident to both banks, but they said there was nothing they could do to help.

READ ALSO: Consultant Risks Arrest as Client’s N200,000 Vanishes From His Zenith Bank Account

“I immediately reported to the two banks at their branches in Festac, and they promised to contact the receiving financial institution, which was an Opay account. They said they would get back to me after two weeks.

“I was surprised when I went to Access Bank two weeks later and the customer care representative said there was nothing they could do about it. She said the money was gone, and that they could not chase the account.

“The bank said if I wanted them to reveal the identity of the recipient, I should get a court order and inform the police. First Bank told me the same thing too,” said the Lagosian.

Following the response from the two banks, Afeez called Opay’s customer care line, and the official said he would not be able to divulge the details of the Opay user.

He was told that his banks were in the best position to contact Opay to block the account number and possibly reverse the stolen money.

READ ALSO: 2 Months After Wedding, N115,000 Meant for Groomsmen’s Clothes Still Held by GTB

“I went back to both banks and told them what Opay said to me. But they have done nothing since then,” he said.

“First Bank told me they had contacted Opay, and that Opay had blocked the account, but to my surprise, I have not received a reversal one year after the incident. The two banks have not even contacted me personally since then.”

When contacted for comments, First Bank told FIJ that Azeez would have to seek the help of the law enforcement agencies, adding that the bank could not independently debit the Opay account.

“We advise that you lodge a formal complaint with any of the Nigerian law enforcement agencies who are constitutionally empowered to investigate such matters,” the bank said.

“Furthermore, as a bank, we do not have authority to debit the account of any customer without due instruction from the account owner or a Nigerian court of competent jurisdiction.”

Access Bank, on the other hand, could not be reached for comments, as all its customer care representatives were busy when FIJ contacted the bank via its live chat channel. Also, all the messages sent to the bank had not been responded to at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.