Ijegede Isaiah Oluwaseun, a resident of Lagos State, has narrated to FIJ how a thief stole his Motorola Stylus 5G phone on November 7, 2022, and used his personal information to take a loan of ₦173,200 from MIGO, a Fintech company based in Nigeria.

Speaking with FIJ, Oluwaseun, a health practitioner, said the phone was stolen in Oshodi in the morning of November 7 and upon realising that the phone had been stolen, he quickly withdrew all he had in his UBA Bank account.

“On November 7, I lost my Motorola Stylus 5G phone in Oshodi. As soon as I discovered my phone was missing, I quickly withdrew the ₦14,000 I had in my account,” Oluwaseun told FIJ.

READ ALSO: Customer’s Cash Hangs Between Access Bank and PalmPay

To his bemusement, the fraudster used his phone and account numbers to borrow a loan from MIGO, which he then transferred into Opay, Palmpay and one Esther Bose Emmanuel’s accounts.

“Having withdrawn all my credit balance, my mind was at rest that they could not carry out any nefarious activity on my account,” he said.

“On November 10, I did a welcome back of my line, and the next day, I was shocked when I received an alert on the loan and got some debits alerts from UBA.

“This led me to obtain my statement of account and I saw that the thief who stole my phone had used my information to obtain a principal loan of ₦115,400 with an interest of ₦57,800.

“I have complained to my bank many times. The first time I lodged my complaint, they promised to investigate. At another time, the bank told me they had sent a mail to both OPay and Palmpay and was awaiting a response.”

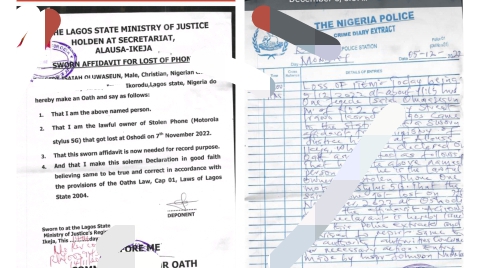

The young medical expert said he obtained a court affidavit dated November 14 and a police report dated December 5 from Ladipo Police Station, all in an effort to duly document the event with relevant authorities.

He wondered how the fraudster got to know the personal identification number (PIN) used to authorise the transactions.

He said, “As I’m speaking with you, I don’t have the capacity to repay that loan. The interest placed on the loan is too high and MIGO has sent a message that I must repay it in 25 days.

“On December 7, I received a reminder message to pay ₦57,706.”

When FIJ sent an email to the money-lending firm on Saturday, it said a representative would provide feedback on the mail within 24 hours.

Subscribe

Be the first to receive special investigative reports and features in your inbox.