Oghenetega Blessing, a job applicant living in Port Harcourt, has narrated to FIJ how she lost over N248,000 when her phone was stolen after her wedding thanksgiving service in October.

Blessing told FIJ that the money left her account in unauthorised bits of airtime, loans and debits.

“It was on a Sunday; I went to church. I had just concluded my wedding ceremony on the 27th of October. So, during the thanksgiving service on October 30, someone stole my phone. I tried calling the phone after the service but no one answered. The phone rang throughout that day but no one picked up the phone. I thought that I had misplaced the phone. The next day, it dawned on me that the phone was stolen,” Blessing told FIJ.

“I tried to call MTN to help me block my SIM card but the customer care centre took so much time without helping me. I went to an MTN office on October 31 before they could help me block the SIM card. No one could have access to my phone or bank services on my phone after that.

READ ALSO: At First Bank ATM Man Charms Civil Servant, Takes Over N1m From Her Account

“On Friday, November 4, I had to check a mail from a contact and I logged in using my spouse’s phone. It was at that point that I found notifications of transactions on my Access Bank account in my email. Loans had been taken using my bank account. The thief did a recharge of N39,900 from my account, took a loan of N120,000 from Access Bank, took a loan of N30,000 from Palm Credit and also some loans from Palmpay, which I don’t even know the amount. They also did a transfer of N59,000 to their account.

“I went to complain to my bank as soon as I saw these transactions. The bank noted my complaint and blocked my bank account. A few days later, I got a bank account statement from Access Bank. The bank told me to get an affidavit and a police statement before it could review the fraud.”

Blessing told FIJ that the loan companies had begun to ask her to repay the loans.

Blessing said the bank did not tell her she would get her money back.

“The bank did not give me any assurance,” she said.

READ ALSO: After FIJ’s Story Access Bank Wipes Off Customer’s Loan Originally Obtained by a Thief

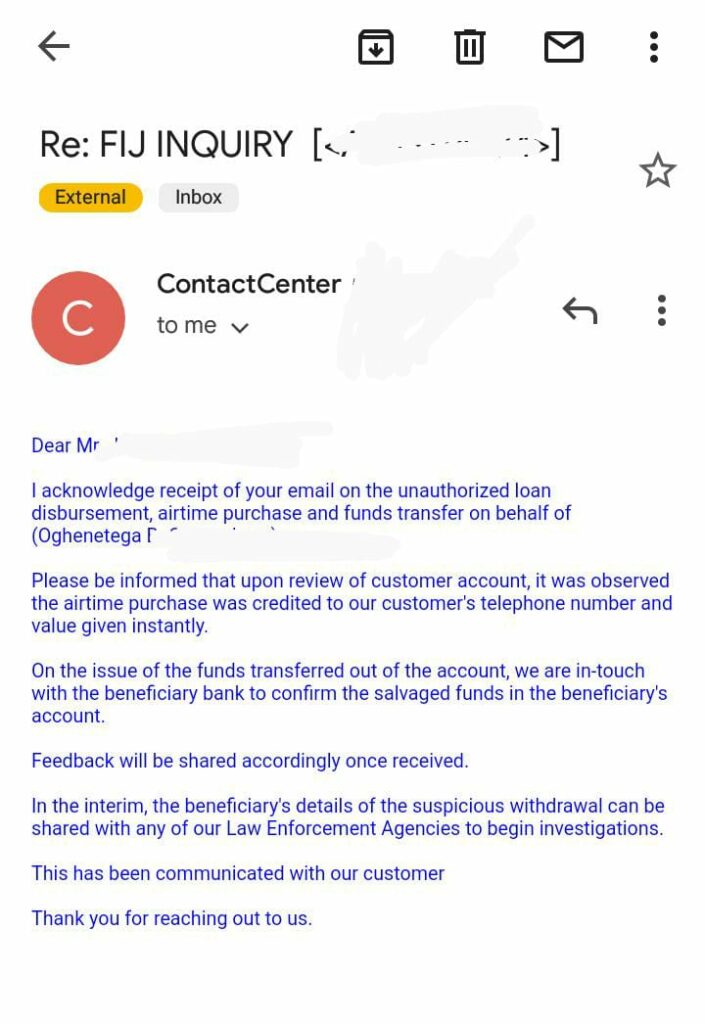

Access Bank said that the N39,900 airtime purchase was credited to Blessing’s stolen phone.

“On the issue of the funds transferred out of the account, we are in touch with the beneficiary bank to confirm the salvaged funds in the beneficiary’s account,” Access Bank told FIJ in an email.

“Feedback will be shared accordingly once received.

“In the interim, the beneficiary’s details of the suspicious withdrawal can be shared with any of our law enforcement agencies to begin investigations. This has been communicated to our customer.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.