Nantap Samson, a Lagos State resident, has narrated how the Nigeria Social Insurance Trust Fund (NSITF) failed to honour the agreement that was supposed to make it pay her late husband’s full life insurance benefits to her.

Samson told FIJ that the government institution reneged on its promise when it found out she was still gainfully employed.

The widow said NSITF stopped paying her the benefits after its officials paid her a visit in March 2021.

She said NSITF first contacted her in February 2017 after the death of her husband, a Julius Berger staff member, and subsequently paid her N3.6 million.

Samson would be paid another N1.9 million benefit on June 15, 2017.

In September 2017, NSITF paid her N85,280, a monthly benefit she was entitled to receiving until her daughter turned 21.

Samson had given birth to her daughter eight days after her husband’s demise.

According to the widow, the NSITF continued to pay her the stipulated N85,280 from 2017 till the period its officials visited her in 2021.

“In March 2021, they came to visit me. This was after I had received a call from the NSITF office. They said it was their policy to visit their client. In April, NSITF paid me N85,000. But by the second month, and after their visit, they cut the payment down to N50,000. And this was without a prior notification,” Samson told FIJ.

She also claimed the name of the sender of the N50,000 was different from the name that had been sending previous benefits to her.

“In May, they also paid me N50,000. I had to go to my bank to confirm because I didn’t understand what was going on. At the bank, they told me it may be from the same source, although with a different name,” Samson said.

NSITF would stop paying Samson the benefits in July, 2021. The government institution did not also give the widow any explanation for its decision to discontinue payment.

“I called the person in charge of the insurance in Julius Berger and told him what I noticed and he asked that I give him time to investigate the issue,” Samson.

Samson said the official she contacted at Julius Berger later told her the NSITF stopped the payment because they discovered she was “gainfully employed” when they visited her.

“So, from July to November 2021, I didn’t receive a dime from them. By December, they had further slashed the monthly benefit to N30,000. And it has remained that way ever since,” said the widow.

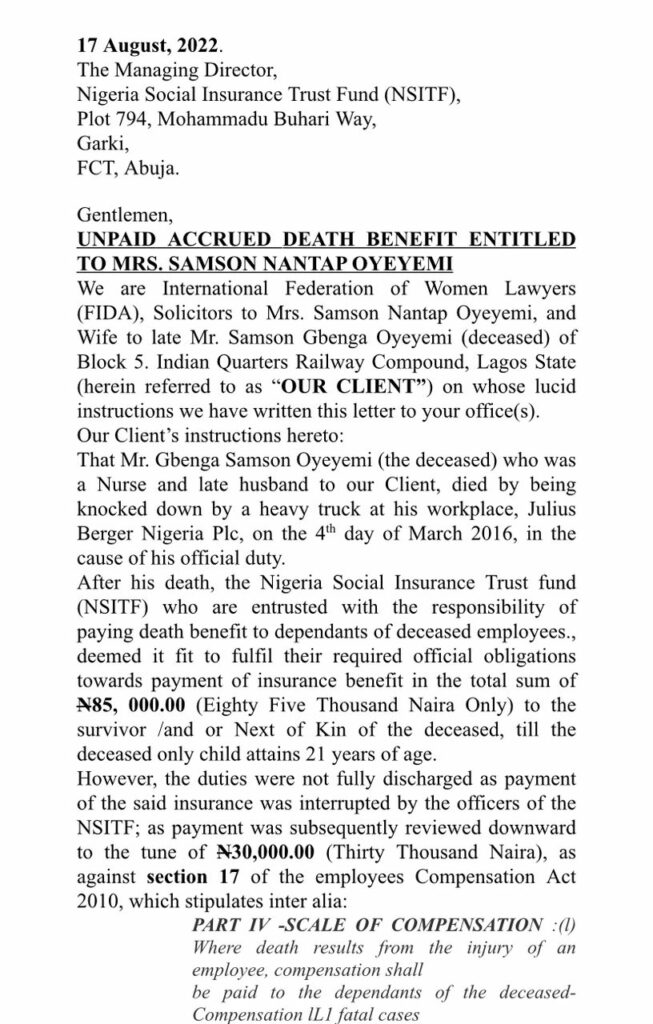

Samson said she got a lawyer to send a letter to NSITF in August 2022 but it was not responded to.

When FIJ made a phone call to NSITF via a mobile number found on its website in April, a call representative asked this reporter to inform the widow to send a letter to them.

FIJ also sent an email to the company for comments and clarity on the matter on Thursday, but it had not been responded to at press time.

However, section 17 (Part IV) of the Employees’ Compensation Act 2010, stipulates:

(l) Where death results from the injury of an employee, compensation shall

be paid to the dependants of the deceased where

(a) the deceased employee leaves dependants wholly dependent on his earnings like a widow or widower –

(ii) and one child, a monthly payment of a sum equal to 85 per cent of the total monthly remuneration of the deceased employee as at the date of death,

(c) monthly payments to eligible children under this Act shall be made to children up to the age of 21 or until they complete undergraduate studies, whichever comes first.

Subscribe

Be the first to receive special investigative reports and features in your inbox.