Emmanuel Olukoga, a civil servant, has narrated how Guaranty Trust Bank failed to help him recover his N540,000 after three unauthorised transactions impacted his account in 2020.

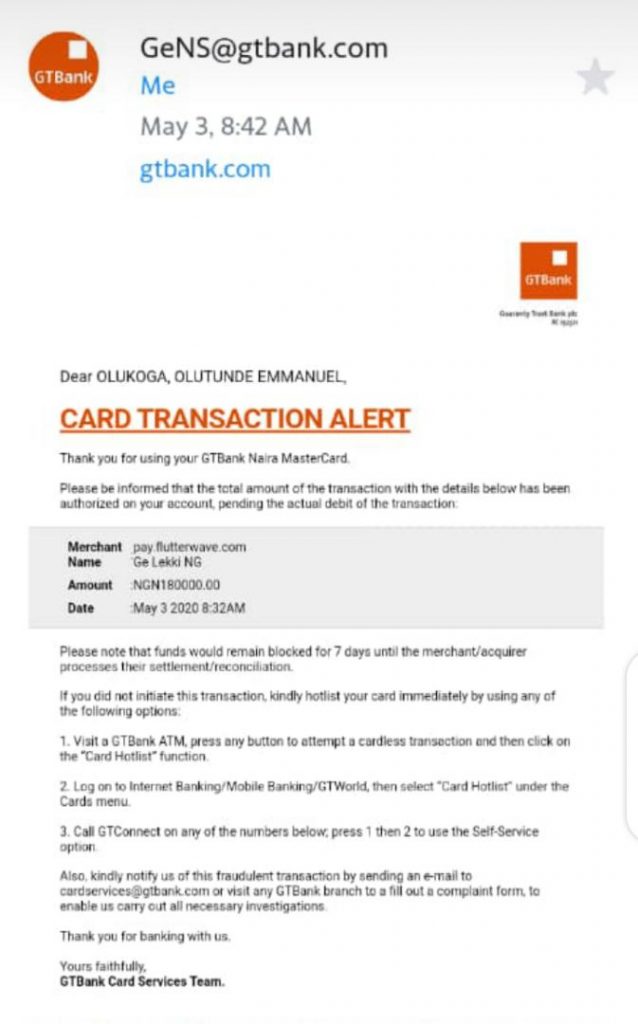

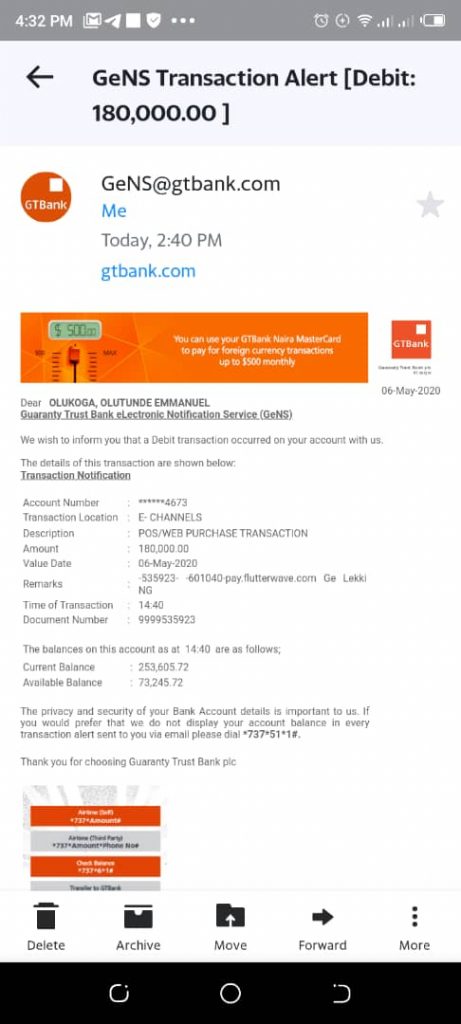

Olukoga told FIJ that he was debited of N180,000 three times, without carrying out any transaction in May 2020.

He said he quickly rushed to a GTBank branch in Abeokuta to complain, but the security officials at the entrance denied him entry because of the novel coronavirus at the time.

The civil servant said that the officials present at the bank subsequently told him to hotlist his card if it was true he did not initiate the transaction himself.

He added that he eventually managed to explain his situation to one of the bank’s officials at the branch but she did not do anything to help him.

READ ALSO: 7 Months After Failed Transaction, GT Bank Yet to Reverse Customer’s N33,000

“The customer care official who attended to me said she would stop the unauthorised transactions and sent me a dispute form to fill,” he told FIJ.

“While we were still talking and I was expecting her to send the dispute form, the next thing I saw was a debit alert of N180,000.”

Olukoga said after he received the first debit alert, he called the bank and also wrote them a mail to stop the remaining active transactions of N180,000 in two tranches, but the bank did nothing until the funds left his account.

READ ALSO: After Suspicious Midnight Debits, GT Bank Holds On to Customer’s Money

“The second day, they took another N180,000. The third day, they took the last N180,000. The bank did nothing. My annoyance is that when the transaction was carried out, I did not get a one-time password,” he said.

“The lady that chatted with me said she would call her supervisor, but never did. They rather blamed me for what happened, saying I gave someone my account details to carry out the transactions.

“I realised they did the transaction on Flutterwave, a transaction I did not authorise. There must have been an insider that did that. I emailed the central bank, but they did not act on it as well.”

FIJ made several phone calls to Cornelius Onuoha, one of the bank’s representatives, but they were not answered. The text message sent to him had not also been responded to at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.