Victoria Udom, a resident of Uyo, the capital city of Akwa Ibom State, does not engage in online purchases. One could then imagine her surprise when the United Bank for Africa (UBA) told her that the N151,000 that was fraudulently deducted from her bank account in December was for a web purchase.

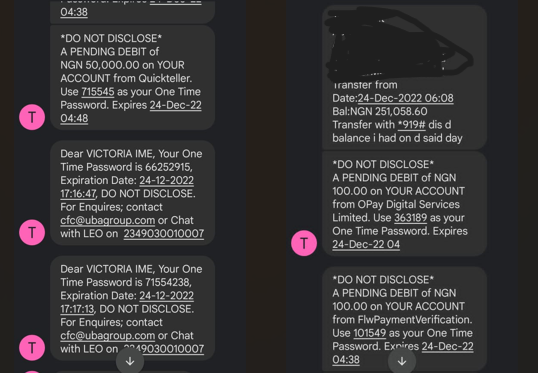

While detailing how the incident happened, Udom told FIJ that she first received three messages, each containing a pending debit information and one-time passwords (OTPs), from UBA on December 24.

“N100 each was deducted in the first two debit alerts, while the third debit alert was for N50,000,” she said.

The Uyo resident then received two different OTPs via text messages, telling her to contact UBA via email or chat with Leo, the bank’s chatbot application for its customers.

READ ALSO: Mother of 3 Turns ‘Beggar’ After Unauthorised Deduction of N425,000 From Her UBA Account

Udom told FIJ that she was not with a smartphone at that point and since she had not initiated any transaction, she never bothered to proceed with the action.

While she was still reeling in the shock of the messages, a particular number called and asked if she had received any debit alert.

The caller claimed he was from UBA, so she replied in the affirmative.

“When I asked what was going on, the guy said the first two N100 debit alerts were for my date of birth verification. He said they were trying to check my account so I could make transactions. I said I was not aware of such because my details were intact, and that they should have informed me earlier, said Udom.

“I told him that the bank should stop tampering with my money. Then I asked about the N50,000 debit, and he said it was caused by a network issue, that it would be refunded, and he ended the call.”

Udom then called UBA customer representative on that Saturday. That was when she learnt that whoever called and sent her some codes via text messages was not from the bank.

“The customer rep said they were not aware of any verification. I said I didn’t understand why he would be telling me the bank did not know the whereabouts of my money in their possession when I had not initiated any transaction. He said the money was gone and that was all,” Udom said.

“My account was credited with the N50,000.”

The UBA customer then withdrew all her money via a Point of Sale (POS) terminal to avoid another shock in the future.

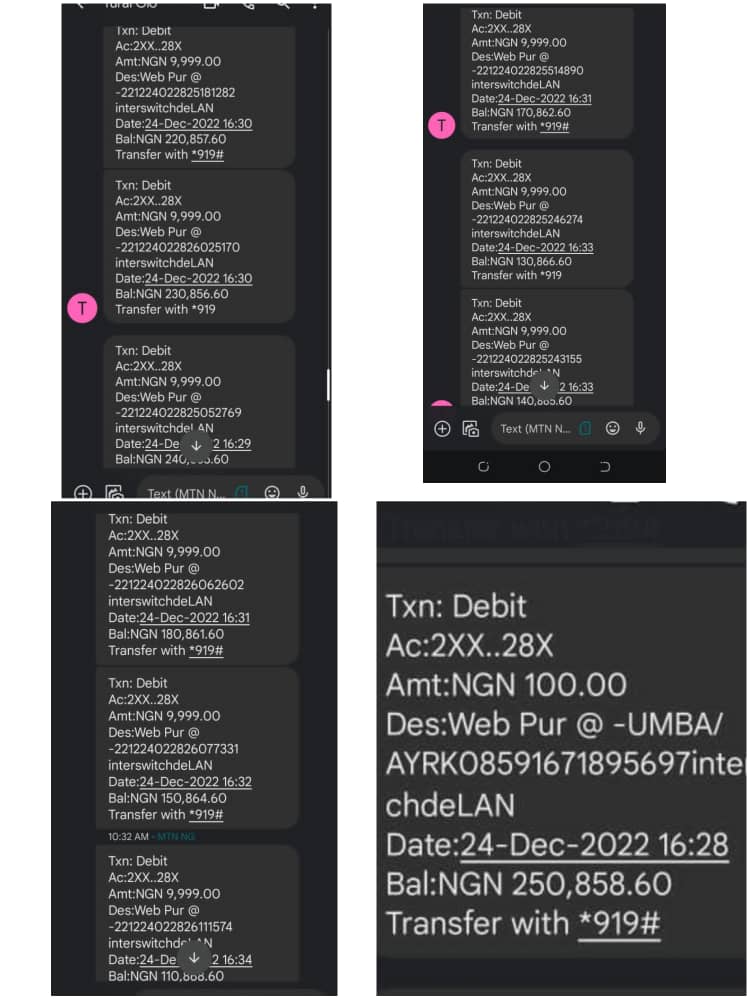

Although Udom had N251,000 in her UBA account before the unauthorised transactions, she only found N90,000, which she withdrew immediately.

This discovery baffled the Uyo resident, and all her efforts to speak with her bank’s customer care representative proved abortive.

She further told FIJ that she received another debit alert of N100.

“From there, they started debiting N9,999 until they emptied my account. Sadly, the debit alerts of the N9,999 deduction did not come in on Saturday. I only got them on Sunday morning,” she said.

“When I called UBA on Sunday, they did not answer the call. One of the N9,999 debit alerts was reversed on Sunday, but my N151,000 is yet to be returned.”

READ ALSO: Disguised as Customer Care Agent on Facebook, Fraudster Takes N158,000 From UBA Customer

UBA SAYS NOTHING CAN BE DONE

The UBA staffer who attended to Udom when she visited Nwaniba branch on Wednesday, December 28, told her nothing could be done about her situation because her money was gone.

“I could not go to the bank on Monday and Tuesday because of the public holiday, but the bank has been tossing me around since then,” she said.

“It was at the branch that I was told that my money was debited as a result of a web purchase. I told them I don’t buy things online; I buy whatever I need physically. Besides, I was not even with an android phone at that point. So, how would I have bought anything online?

“I never initiated those transactions, and UBA is saying I can’t get the money back.”

When FIJ contacted UBA for comments on the incident, the bank said, “Please be informed that investigation is still on and our customer will be advised appropriately once we come to a resolution. Thank you.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.