After FIJ’s Opeyemi Lawal got kicked out of Newedge Finance Limited (Palmcredit) for missing a day of training, she applied to work at two more loan agencies — Mayshack and Rock Financials. At Rock Financials, where she worked for three days as a collection specialist, she found that the rot of loan agencies ran deeper than expected. The second part of her undercover investigation details how the loan culture of Nigerians could force loan agencies to weaponise defamation, how Chinese slave masters set unrealistic targets and why these fintech companies should be no one’s go-to option.

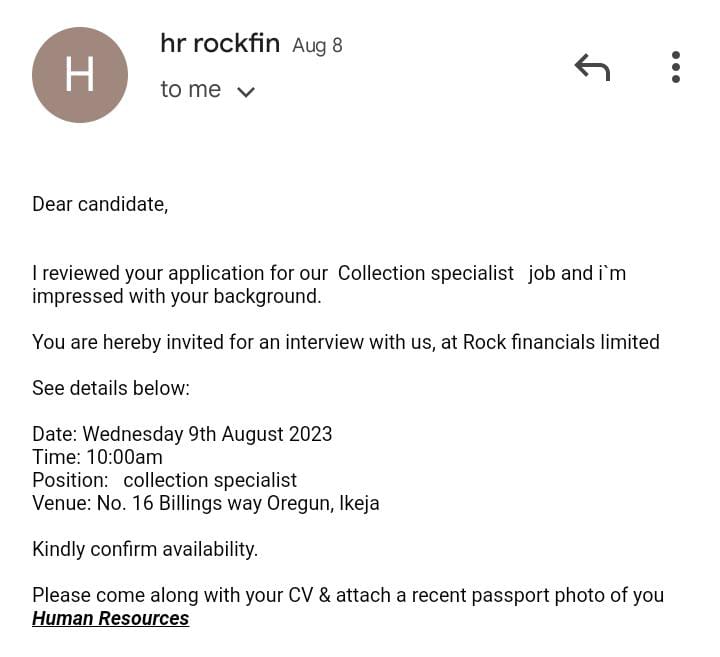

An email to the human resource manager of Rock Financials on August 8 got me the spot I needed. My fixer had supplied me with the email address after I was kicked out of Newedge Finance Limited.

“Just send them an email. They recruit every day,” he told me.

“Why?” I asked genuinely.

“This is because a lot of people disappear from the jobs daily and new people have to be brought on board to replace them. No one wants to stay on such a cursed job for a long time.”

Rock Financials responded to my mail in less than two hours, asking that I attend an interview the following day.

Before Rock Financials, I had sent an email to Mayshack, a loan company in Oregun, Lagos, and got invited for an interview on August 7 which I could not attend due to other schedules.

At 9:33 am on August 9, I walked into Rock Financials, situated on the second floor of a brown four-storey building on Billings Way, Oregun, Lagos. The young security officer who let me in had an arm badge that showed he worked with Corporate Vigils, a security outfit also situated in Lagos. A large white hall was the reception and collectors’ office. People spoke hysterically and shouted over the phone but no one thought anything was out of place. People hurled swear words and profanities freely across the room. It was a new world of madness.

While I sat waiting for my turn, I nearly jumped off my seat when a lady I would later know as Nifemi shrieked over the phone. I thought a fire accident had happened in the building and was looking for an escape when I saw that she had a phone perched to her left ear.

She told whoever was on the receiving end of her anger: “Go and repay your loan to FalconCash. Go and repay your loan to FalconCash.”

Surprisingly, I caught a smile on her face as she dropped the call, but it disappeared so fast that I wasn’t sure. I would later understand that loan collectors could switch between moods easily. They could threaten to tear down a building and be smiling the minute they terminate the call.

I was still reeling from the shock of Nifemi’s outburst when another collector went, “I will ruin you and publish your details on all socials. That hospital you want to go, you will land there. We will also design your obituary and paste it everywhere if you do not pay.”

I also figured that, while most of the defamatory words were targeted at the customers, their relatives and close contacts were not spared. Within minutes of the obituary outburst, another collector shouted over the phone: “If you do not ask the owner of the phone to repay our loan, the owner will die. We do not accept excuses from customers, especially first time customers. Just tell the owner to pay up.”

“I am going to accuse your relative of what he did not do if he does not pay my N6,870 by noon. Just tell him to pay before 12 or else I will call him more than a thief.”

While I sat processing all I was seeing, the Chinese boss, whom I would later know as Mr. Cho, sauntered in. He had a cross bag on his left shoulder and only paused for some seconds to roam the collection hall with his eyes before walking into his office.

Also, some young men whom I would later know to be the team leads walked around. I had hoped to see them call the collectors to order but they didn’t even pay any attention. Later, I found out that the team leads and supervisors encouraged and aided collectors in defaming debtors.

The rant didn’t stop even with Cho’s presence. “See, don’t dare me, because I am going to post your pictures everywhere if you do not pay me by 12,” said one collector.

“You say I am speaking Chinese? No, I will laugh in Chinese, shebi because I am working with them. You and your mother will gather slippers at your doorstep.

“You are silent and won’t say anything? See, God will be silent on your matter.

“Raheemat, if you don’t pay, I will ruin your reputation both home and abroad. I will ensure there is nothing left of you.

“If you do not repay my loan, you will be called to glory.

“That network issue you are saying is preventing you from paying will kill you.”

Every minute until my interview, someone was shouting curse words into the phone at a customer whose loan was overdue.

In March 2021, one Mr. Vik launched a petition demanding that loan companies be restricted from operating in Nigeria. The petition stated that more people were dying of depression due to extortion and the invasion of customers’ private lives by loan companies. Also, the petitioners wanted the exit of Chinese loan operators in Nigeria due to high interest rates and blackmail which had become their weapon.

‘THIS JOB IS STRESSFUL, PEOPLE DISAPPEAR FROM IT DAILY’

My interview for the role of a collection specialist was over in 13 minutes. I sat before the human resource manager, a beautiful fair-skinned lady who had a great smile and an empathic heart. She sounded hearty and genuine when I talked about my educational background. The two other people who were with her, another fair-complexioned lady and a guy I would also know as Lekan, were surprisingly warm for the chaos happening outside their door.

Right from the interview, they told me the job was stressful and asked if I could handle it as people regularly left.

“Even people who sound smarter than you just wake up and decide not to come again. Are you sure you can handle this job, because it is really stressful?” Lekan asked.

When I nodded in affirmation, the HR said I would be required to work six days a week, including Sundays. Since I told them I wasn’t doing anything at the moment, they asked if I could resume immediately as the offer was immediate. My resumption the following day was my induction into a madhouse greater than Newedge.

HARDWORK

On August 10, I started work at Rock Financials as a loan collection specialist. I was assigned to Tayo, a slim, dark-complexioned lady, who took her job seriously. She didn’t sound excited about having to train someone new as she told a colleague that all the people attached to her had absconded. She said I would be slowing down her work pace. She also said, if there was anything I didn’t understand, I could pause and ask questions. When I did, she would answer with displeasure on her face and then hold her head on hearing another question.

I didn’t understand what Tayo meant by ‘pace’ until my second day there. I was told I had to make at least three rounds of calls daily, depending on the number of orders assigned to me. Besides calling the debtors, I had to call their relatives, no matter how many, at least three times a day.

The first round of the calls were to be completed by 11 am, the second round by 3 pm and then the third round before the close of business. The calls were, however, meaningless if none of your customers repaid their loan. Every team had a target to meet and the collectors had to wield every weapon to ensure recovery.

At Rock Financials, I learnt that these weapons differ from one collector to the other. It could be lies or impersonation. It could be faking to be a stammerer or sending threats and defamatory messages to debtors and their relatives, just about anything to ensure you recover the company’s money.

Shortly after my training with Tayo began, Lekan and other team leaders announced that Cho would like to have a general meeting with us. The Chinese boss wore a brown round neck paired with dark blue jeans and spoke to us through an interpreter.

Cho complained that the company’s stats from the previous week were poor and he would like everyone to buckle up on their game and get rid of whatever was preventing them from giving the job their best shot.

“Last month, some of our employees were able to recover between N100,000 and N150,000, while the least amount recovered was N90,000, which was not so satisfactory,” he said.

“However, some employees managed to get two times their stats compared with others. Is it that the ability of the low performers are not enough or you are not as hardworking as others?

“Let everyone learn from the other person on how to improve the stats and let’s keep whatever is happening in the country outside. What is important is our hard work and attitude to work.

“Just do whatever the company asks you to do: how to make calls, when to make calls, what to say. Just follow the company’s directive and you will be rewarded at the end of the month.

“When we put in the best of our efforts, our salaries will increase in ways that please.”

Cho ended his meeting telling us that he was now around and could monitor the stats well and that he wanted us to learn gōngzuò, the Chinese word for hard work, as it was essential to any improvement we wanted to see in the company’s stats.

I returned to perch next to Tayo as she showed me the ropes. She would make calls intermittently, log them onto the system and then repeat the process.

At intervals, she would shout over the phone, adding her voice to the cacophony of insults thriving in the room. After a defamatory bout, she would laugh and giggle. Almost everyone, including her, could switch their characters well. It was about playing any game to recover the company’s money.

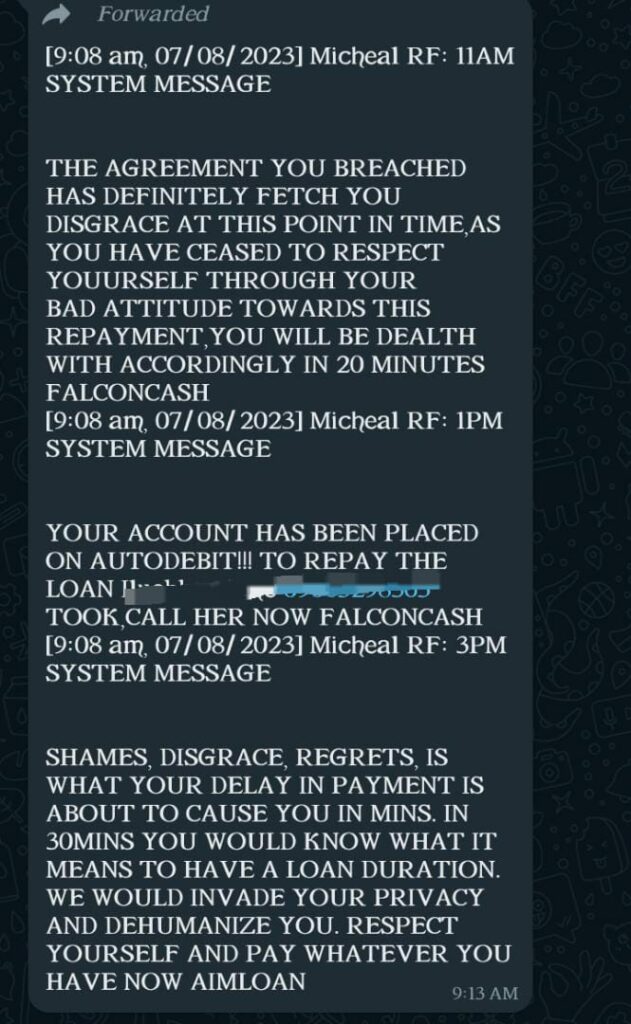

From observing her and everyone else work, I learnt that Rock Financials is the owner of PearlCash, Aim Loan, AddMoney, Anyloan, MykesPro, Spark Credit, VsNaira, OKCash, Diamond Credit and Angel Loan.

When FIJ checked Aim Loan on Google Playstore, most of the positive reviews were by foreigners and they appeared to be an intentional public relations campaign.

If I had lied to get into Rock Financials, getting in taught me more lies. I watched as collectors told lies to debtors in a bid to recover loans. Tayo told me my ability to lie well and smartly would stand me out as a performer.

They would tell debtors to repay their loans so they could access higher loan amounts. Tayo, for instance, would say she was an auditor calling from Pearlcash and the debtor was stalling her from disbursing loan to the next agent. A lot of them used these lines.

Tunde, another collector, who I would later be attached to, would also say he was the accountant of the company. Sometimes, he could pose as the lawyer of the fintech or even a military officer. The list goes on.

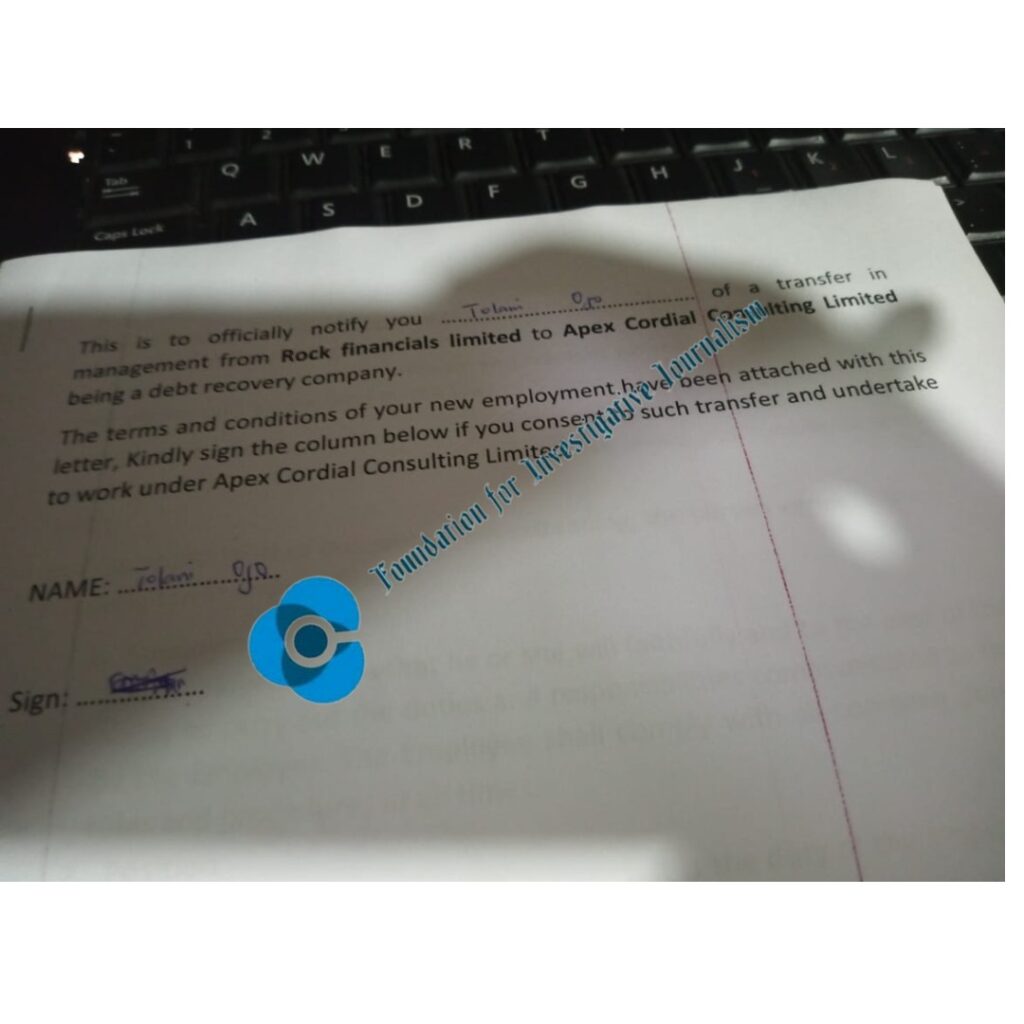

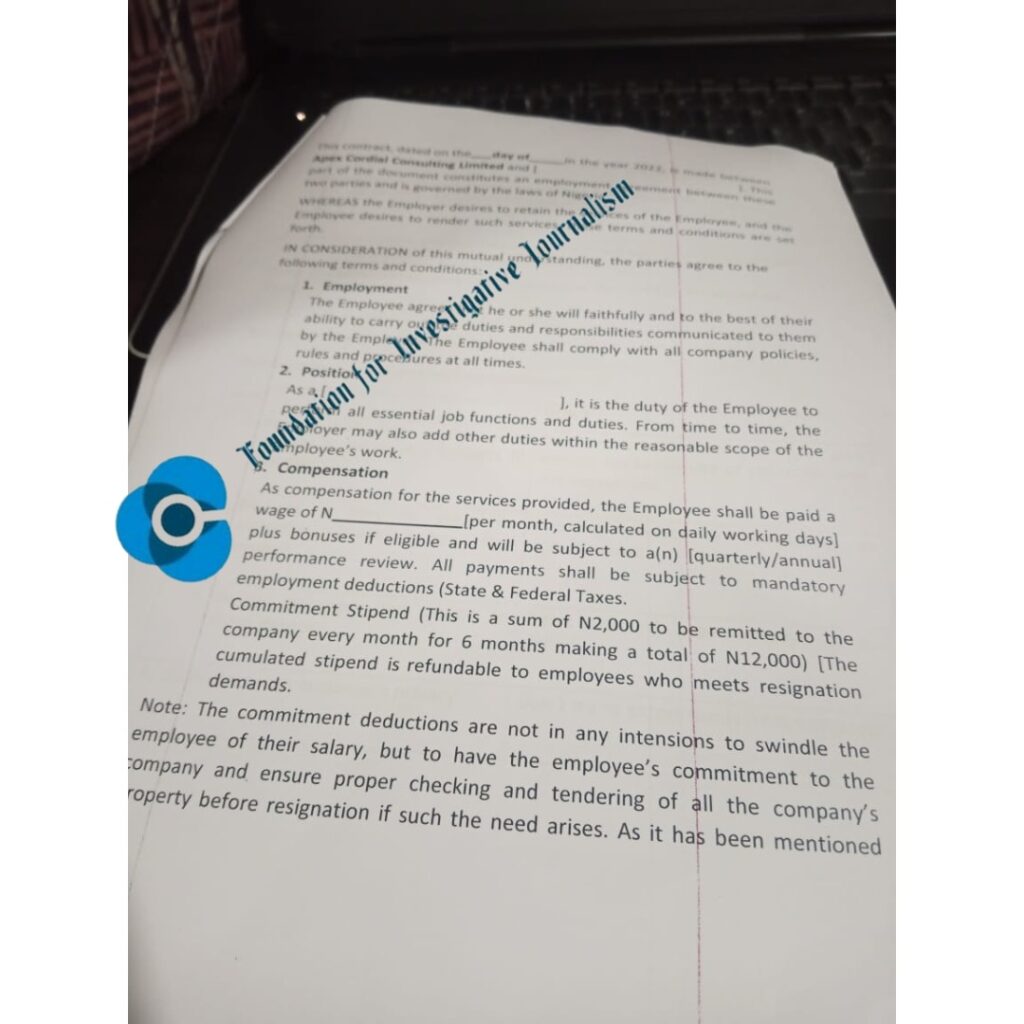

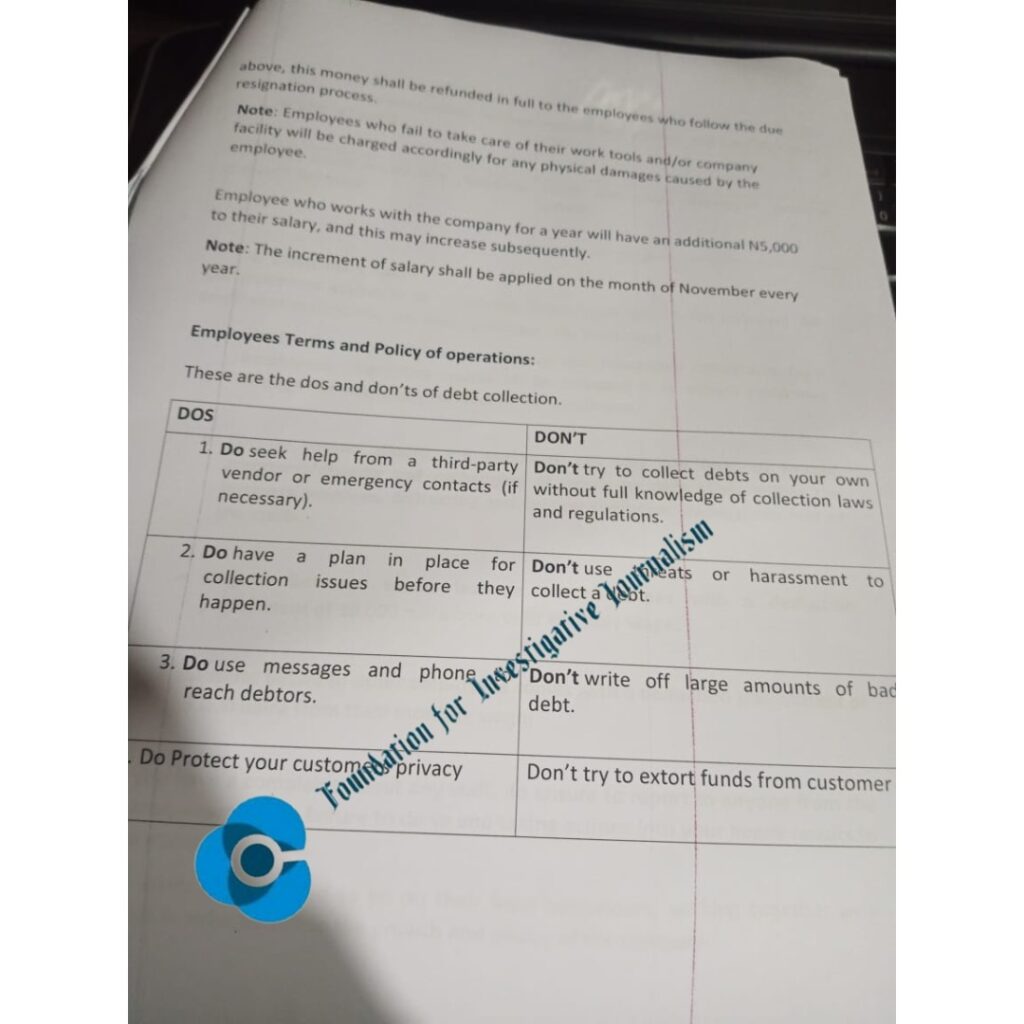

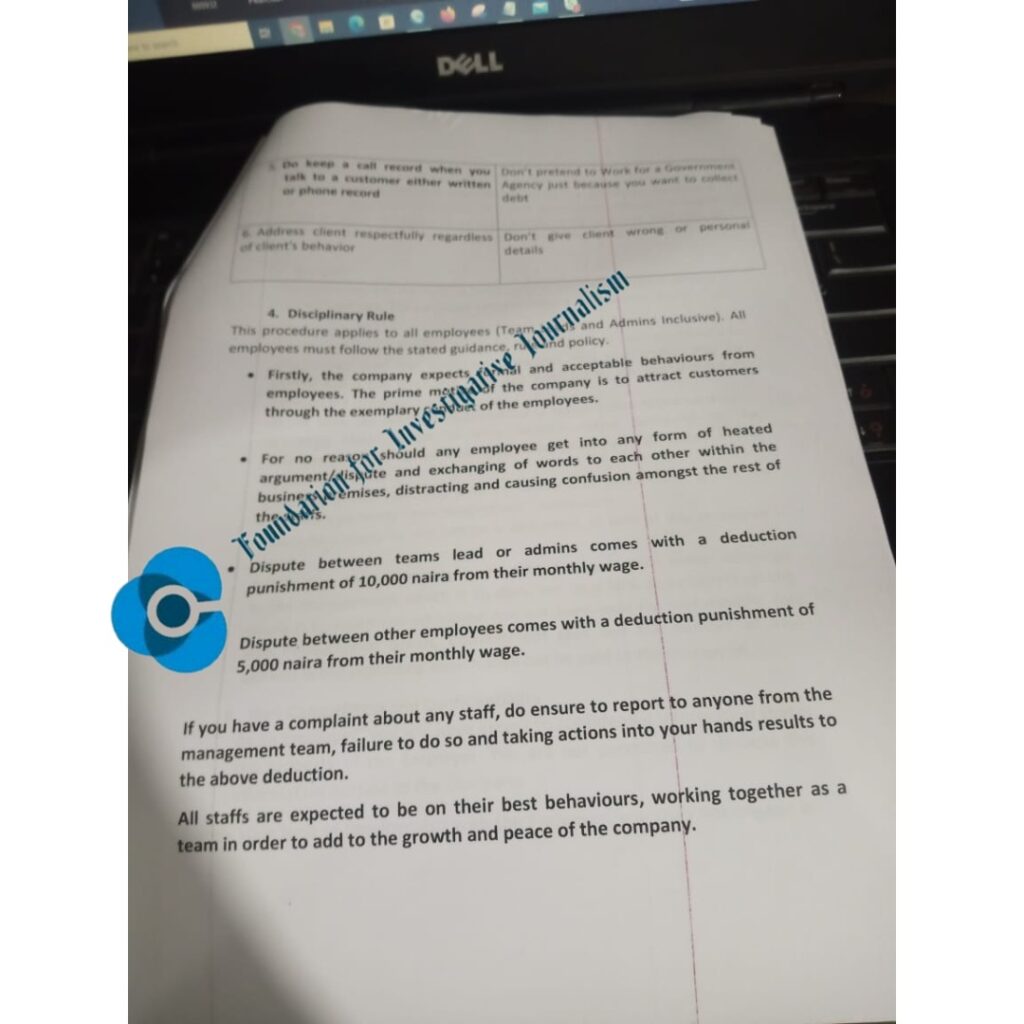

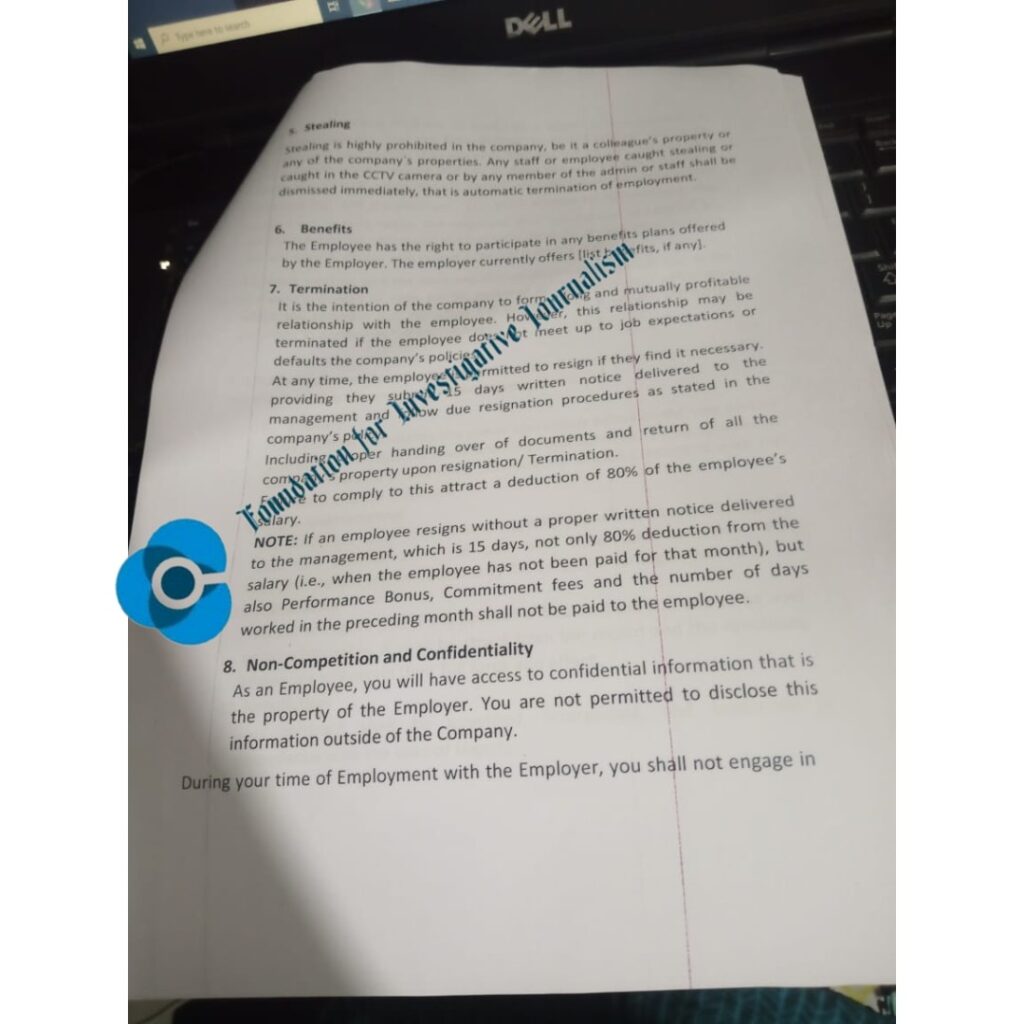

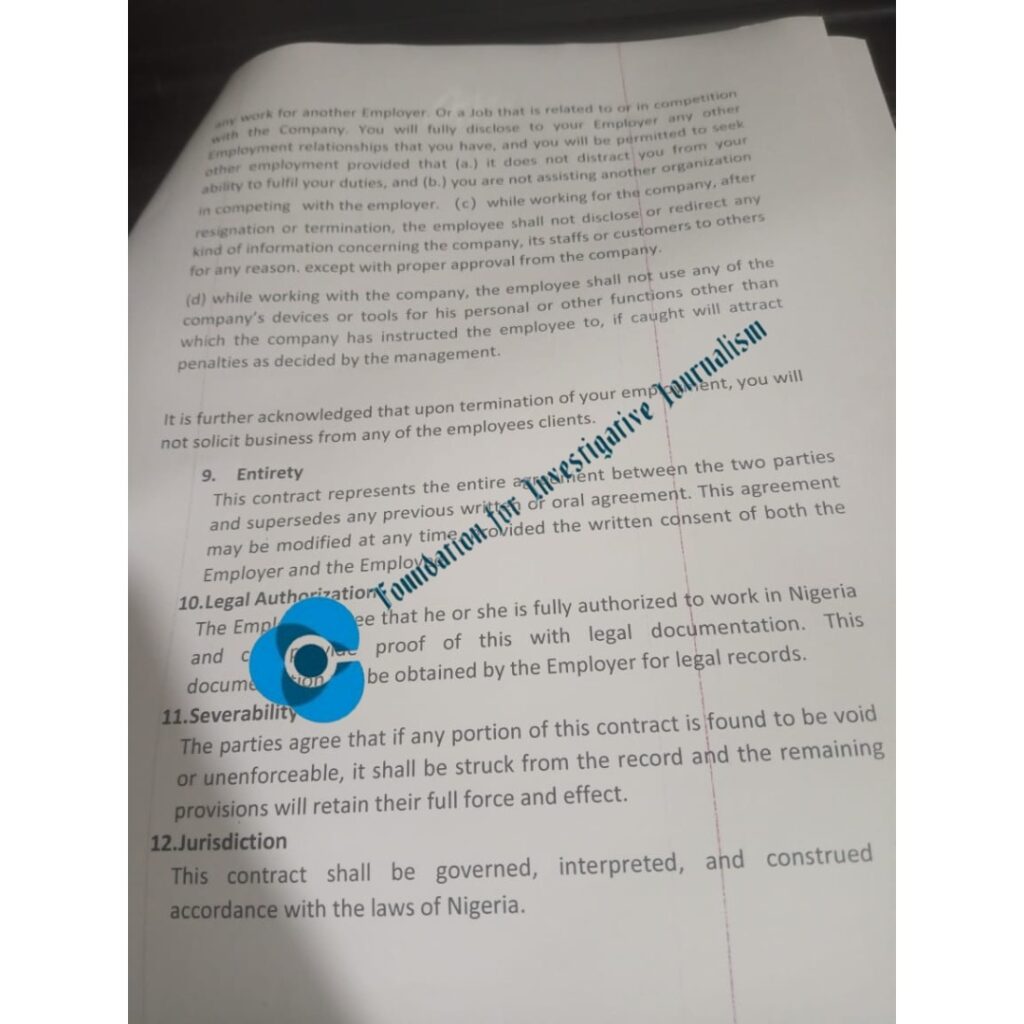

In the employment contract I signed on my second day of work there, one of the don’ts of debt collection stated: “Do not give wrong or personal details to debtors”.

Another rule stated: “Don’t pretend to work for a government agency just because you want to collect debt”. The most broken law of Rock Financials was a don’t in the employment contract, which stated: “Don’t use threats or harassments to collect a debt”.

This policy was contrary to every action I witnessed in the four days I was there. Every single time, I would turn to look at a collector throwing profanities at the top of their voice.

“If you don’t pay today, you will commit suicide. I swear to God. I will make you a living dead. Calamity will visit your home. Let me not get the payment today.”

“Go to other loan apps and borrow from them to repay your debt. Just find any means to repay the loan. If not, I will destroy you.”

“I just want to let you know that I am not a calm collector. What I do is destroy people’s destiny and reputation.”

“I will roast you today if I do not get my money back. I will roast you alive.”

“I will make you regret the day you downloaded this loan app. You will just bury yourself alive if you do not pay.”

“Your husband is in his 70’s and he is owing us 17k. I hope you know that your husband and Tinubu are mates? While the latter is president, your husband is shamelessly borrowing money on loan apps. If I do not get my money from both of you in seven minutes, he will be disgraced.”

Rock Financials’ employment contract

When I asked Tayo if she got a headache from shouting every hour of the day, she only rubbed her forehead and said, “I am used to it. Besides, it’s not as stressful as you think.”

Meanwhile, the Cleveland Clinic stated that excessive use of the vocal cord through yelling or shouting can cause injury to them.

“You can damage your vocal cords if you’re not careful. Taking care not to overuse your voice or spend too much time at the top (yelling) or bottom (whispering) of your vocal range can help prevent injury,” the clinic wrote.

Tunde, who had spent seven months there, told me that the job was demanding and could push one to be what one was not.

“This job is highly demanding. It makes you take on the form of a stranger. When you are on the job, you are someone else entirely,” he told me.

“Don’t worry, when you spend about two months, you will understand how it works.”

When I asked why he was still on the job, he shrugged his shoulders and told me, “There are not so many options out there. I have to work.”

On Saturday, the last day I spent at Rock Financials, after I received my order of 20 debtors whose loans were only a day overdue, I noticed from the debt profiles and after my first round of calls that the debtors seemed not to be able to afford repayment and yet the company kept giving out money to them.

Tunde said, “You have barely spent a week here and you’ve noticed that the telesales department complicates our work by giving out loans to every random person.

“We have had this conversation with them in times past but it hasn’t changed a thing. At some point, they were careful not to disburse loans anyhow, but soon they returned to their old ways and left the mess of the job to us.”

‘PROVOKE THEM TO ANGER’

After sitting with Tayo all day, at 3 pm, one of the senior colleagues, Mr. David, fair-skinned with eyes peered intently at ladies and hands that like to touch them flirtingly, called and assigned me to a system.

He assigned Tosin and I, alongside another young lady, to systems at the back of the hall. He gave us box phones for calls and got MTN SIM cards for the phones. He told us to get our own SIM cards so we could use it to complement the one from the office.

“You will need new SIM cards for WhatsApp. It is these SIM cards you will be using to contact your customers. It has to be different from your main line because it could be blocked,” he told us.

Soon, we were assigned to teams. Tosin and I were added to team 3, while the other lady was in team 5. Our team leader was Mr. Samuel, middle-aged, black-complexioned with beards. I had noted him before then for threatening a customer in Hausa language. My fair knowledge of the language helped me pick out the words.

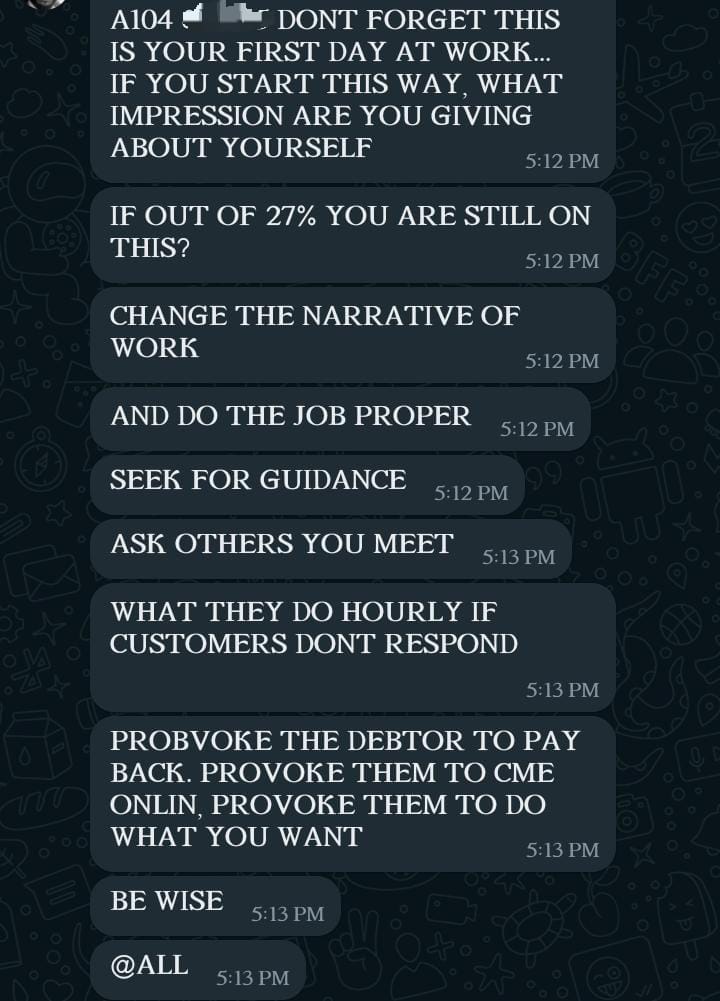

Samuel told us that the target for the team was 27 percent, and while it was attainable, we had to ensure we brought our best game forward. He spoke nicely about how we could split the targets and still meet it by the end of the month.

From him, we were moved to Ayomide, a beautiful ebony lady, who asked us to familiarise ourselves with the company’s software Asap Cash. Similar to Newedge’s Moneymaker, Asap Cash has every detail about the customer, from the debt to loan history, emergency contacts, bank verification number (BVN) and house address. The only difference is that Asap Cash has a web login and includes pictures of the debtors.

The following day, Friday, I started work fully. I had an order of 20 contacts on my dashboard whose loans were only overdue for a day. The race began and I began to call them. Each debtor I called, including their relatives, had one story or the other to tell.

I had also sent them messages. Ayomide told me that, since I had not got my SIM card, I should send them messages via the organisation’s software but I should ensure they were not defamatory as that could ruin the organisation’s image because the customer could show them to regulatory agencies.

She told me I could only defame with the new WhatsApp SIM cards I would be getting and then sent me the templates of the ‘non-defamatory’ messages.

At 1 pm, none of the customers I contacted and their relatives had repaid any loan and I had a target of N105,144 to meet. Tosin was not so lucky as well. The pressure became worse as Samuel kept sending messages on the team’s group saying that Tosin and I could ruin the efforts of others with our zero recovery by noon.

I was again moved from where I sat opposite Ayomide to Table 4, manned by Adebisi, a fair-skinned warm lady. It was at this new seat that I met Tunde.

When Adebisi asked if I had made any recovery for the day way past into noon and I answered in the negative, she looked me in the eye and said, “Nobody on this table goes home with zero. You have to do all you can to ensure your customer pays.”

When I tried to break the eye contact, she strengthened it and said, “I am not joking. You can not leave this office with zero percent,” and I genuinely wanted to cry.

Samuel would also come around to remind me that it was my first day at work and I had not recovered anything yet. He opened a profile of one of the debtors on my system and said, “Look at this one now, he is shirtless in the picture he submitted to us. Use that to insult him. Tell him he can’t afford to get clothes and he is still a debtor. Provoke him to anger. Just do anything to ensure he pays.”

Adebisi also returned. She said, “Think like your customers. Get into their heads and make them repay their debts.”

Tunde, who by now had pity written all over his face for me, said, “You need to get recovery, if not, you would be sacked.”

At 4:30 pm, I was happy to have two customers repay N2,000 and N2,500 out of their loans respectively. I was so happy that it seemed I had secured a pass to heaven. While I was basking in my relief, Samuel kept calling me out on the group. Adebisi was back to remind me that I needed to scale my percentage, which was now 3.8 percent due to the part payments, to 20 percent.

I resumed the following day, but to more pressure. My target had increased to N216,093. Even though my recovery amount increased to N11,888 and my percentage, 9.09 percent, the callouts didn’t stop and I would almost go the route of everyone else to recover the loans.

Another interesting thing about the loans at Rock Financials is that staff members are prohibited from applying for them. Tunde told me that my appointment could be terminated if I was caught applying for any of the loans.

“No staff should apply for loans via any of the apps. It is their policy,” he told me.

“If you need a normal loan, you can apply to the organisation after about six months of your stay and they might give you.

“But if you apply for any of the loans and they trace and find you out, they will sack you immediately. The company will give you personal loans, but you should not take from the app.”

A POOR DEBT CULTURE

Nigerians could be the reason loan agencies weaponise defamation and threats, as many take loans with no intent to repay.

When I made my first calls on Friday, I had three customers who promised to repay part of their debts by noon. Whenever I rang them hours before noon, they would tell me they were on their way to the PoS.

One of them, a woman, said she was going to charge her phone by 10 am and would get N6,000 out of her N11,650 in a few minutes. Her 10 am never came, and each time I called to remind her, she would shout aggressively and say, “I didn’t forget I am owing you people.”

When Samuel and Adebisi continued to mount pressure, I called one of her emergency contacts, who in turn called her. The customer then called angrily after six hours of promising to pay.

“Why did you call my guarantor? You should just have chilled. Didn’t I say I was going to pay? Well, as it is now, I can’t afford the N6,000 anymore. I can only pay N2,500,” she said.

The following day, the cycle continued as my task was to call customers who fell in the same category as the first. I thought it was going to be a good day until I called them. This time, it became so frustrating after four out of the 20 customers I called promised full repayment by 3 pm. When I called them at the time they promised, their numbers were either not existing or unreachable.

Another customer I spoke with told me in clear terms that he was not going to pay. “You can call me all you want but I won’t pay,” he said.

A collector opposite me handled the case of a 21-year-old undergraduate who had borrowed N100,000 to celebrate her birthday with her friends. The collector had a target to meet from the pressure being mounted on her by the Chinese boss and the team leaders, but the debtor had no source of income. No means of repaying the loan whatsoever.

Ayomide said, “It is probably because you were being soft with them. I didn’t even hear your voice.

“You don’t try to be polite with some debtors. Just give it to them the way they least expect.”

Soon, I caught myself lying to the customers, telling them that they needed to repay their loans so we could disburse them to other people. When I called one of them to ask him to repay, he asked if I was sick in the head and I nearly erupted in tears.

A 2021 report by Lendsqr gives the reasons most Nigerians do not repay their loans as entitlement mentality, fraud, financial illiteracy, high cost of living, ignorance of the gravity of not repaying loans and a badly-torn social fabric.

Tech Cabal, in a 2019 report, also reveals that most Nigerians struggle to repay loans because they fail to read the terms and conditions at the point of application.

READ ALSO: ARROWS OF GOD: One of Nigeria’s Biggest Orphanages Is Trading Babies for Cash

‘DEFAMATION IS NEVER AN OPTION FOR RECOVERY’

Despite the poor debt culture of Nigerians, an ex-banker FIJ spoke with said that on no grounds should debtors be defamed.

“You are not allowed to defame a debtor for no reason. What can be done is to contract the task of recovery out to a debt recovery team or firm to do that on your behalf,” he told FIJ.

“It is unlawful for a financial institution to defame a debtor or customer in a bid to recover a loan. This act is punishable by law.

“The statutory thing a commercial institution can do is to either go after the debtor by visiting their residence and getting them to agree on a payment plan.

“Besides, loan repayment in Nigeria is a civil matter, not criminal. So, the lender can not use law enforcement agencies to arrest debtors. This is because most loans that are disbursed in Nigeria are unsecured personal loans (UPL). This means that they are not secured with collateral exchanges.

“Another medium of recovery is taking the customer to court to work out modalities for recovery. Then, the court can impound the property of the debtor and order it to be sold for the lender to get back their money.

“However it goes, defamation is a no and should never be considered as an instrument of recovery.”

‘DEFAMATION IS AS SERIOUS AS MURDER’

Ayokunmi Alabi, a human rights advocate, told FIJ that defamation could be as serious as murder as it contravenes the right of a person to human dignity.

“Defamation is as serious as murder because it renders the defamed party a dead man walking and living in shame, ridicule and obloquy,” Alabi said.

“This contravenes the right to dignity of the human person as guaranteed in section 34 of the Constitution of the Federal Republic of Nigeria (as amended) 1999, and specifically, subsection (1) (a), which provides that no person shall be be subject to inhumane or degrading treatment.”

He further said that most loan companies would refrain from pursuing a case legally because of skeletons in their cupboards and their exorbitant interest rates.

“The theatrics of defamation speaks volume. It shows the lack of due diligence on the part of the company. However, on default of payment of a loan, depending on the sum involved, companies can always institute an action in court,” he said.

“Then the court will look into the terms of the contract and other evidence before it to pass judgment. Even at that, when a party disobeys an order of court, the court will never resort to defamation.

“But these companies would rather resort to defamation than go to court due to the skeleton in their cupboards, such as the exorbitant interest rate.”

ESCAPE FROM THE MADHOUSE

When I walked out of the their brown gate at 5:03 pm, I was one of the first few to exit. What I felt was a deep relief like I had never felt before. Only one thing was in my mind: “I am escaping this madhouse”.

EDITOR’S NOTE: Real names of some of the employees have been changed to protect their identities.

This is the second part of an investigative series. Read the first part here.

This story was produced with support from the Wole Soyinka Centre for Investigative Journalism (WSCIJ) under the Collaborative Media Engagement for Development Inclusivity and Accountability project (CMEDIA) funded by the MacArthur Foundation

Subscribe

Be the first to receive special investigative reports and features in your inbox.