On September 22, Kehinde Oyewole, a Lagos State resident, went for a job interview at the office of Flyhigh Capital Management, a supposed company located in the Alakuko area of the state.

Speaking with FIJ, Oyewole said she got to know of the company after she was given a flyer that stated that it was looking for marketers for its operations.

She passed the interview and was told to start work almost immediately.

When she did, she made millions for the company within three weeks. The reason it was easy for her to make that much for Flyhigh Capital was because the company sold products the public could not resist; products that were too good to be true, and products that led to many unsuspecting customers losing millions of their hard-earned savings to the fraudsters behind the company.

READ ALSO: How Retired AIG Solomon Olusegun Sacked 2 Kwara Policemen for Refusing to Implicate His Enemy

It turned out Flyhigh Capital Management was a fraudulent company that operated a Ponzi food and loan scheme, and despite working as one of its marketers, Oyewole never knew the truth.

Flyhigh Capital Management stole millions of naira from its many customers just when they were beginning to get comfortable with its existence and operations.

FLYHIGH CAPITAL MANAGEMENT’S OPERATIONS

In an interview, Oyewole told FIJ that she was first told the company was into food distribution.

“What I was told was that the company was distributing food to people. You pay for the food and after a week, you’ll collect the food items,” said Oyewole.

“The first representative I spoke with said the company was looking for people to work with them as marketers. I went to their office that same day I heard of it. They rented a shop at Haviah Complex in Alakuko, Lagos. The complex is also quite close to where I stay.

“When I got to the place, I met three other applicants there and after dropping my CV, the company’s branch manager who simply introduced himself as Mr. Bashiru, said he would get back to me.

“The following day, I got a call from Mr. Bashiru and he said his boss, who he introduced as one Mr. Lanre, said he had seen my CV and was asking if I could start work immediately.

“I pleaded with them to allow me start work the following Monday, which was September 25.

Oyewole told FIJ that Mr. Lanre told her she would earn N30,000 as her monthly salary.

“The day I started, Mr. Lanre spoke me with on the phone and said he was impressed with the CV I had submitted. He also promised he would increase my salary to N50,000 based on performance,” Oyewole said.

READ ALSO: INJURY TIME: Conjoined Twins in Ibadan Running Late for Life-Saving Surgery

“He also said each customer that patronised the company’s products through me would attract an additional commission of N200.

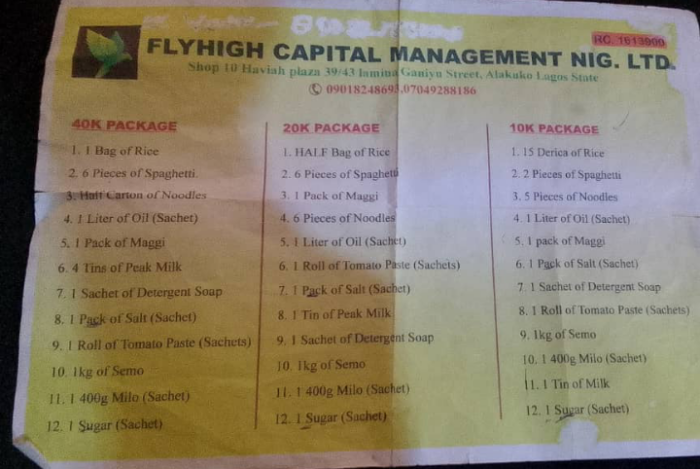

“What Flyhigh did then was that it gave food items worth more than N50,000 to customers who were willing to make an upfront N40,000 payment for it.

“Before you can stand the chance of enjoying the offer, however, you must have purchased a registration form at the cost of N1,000.

“There was also the N20,000 package and the N10,000.

“If you paid today and were issued a receipt, you would be expected to present the receipt one week later so that you would be given the food items you paid money for.”

THINGS WENT WELL FOR THREE WEEKS BEFORE THUNDER STRUCK

Oyewole told FIJ that Flyhigh Capital Management delivered the food items it promised customers during the first three weeks of her joining the company. After this, however, things took a dramatic turn.

“Three weeks after I joined the company, they stopped distributing food to the people who had already paid for food items. If you had been scheduled to collect your food item on Tuesday morning, your food item would have arrived on Monday evening, that is, a day before you were expected to take possession of your order,” said Oyewole.

“When I joined the company, I personally paid N10,000 to order for a package and when I got the package one week later, what I received was worth N17,000 after I calculated the cost of the items, using prevailing market prices.

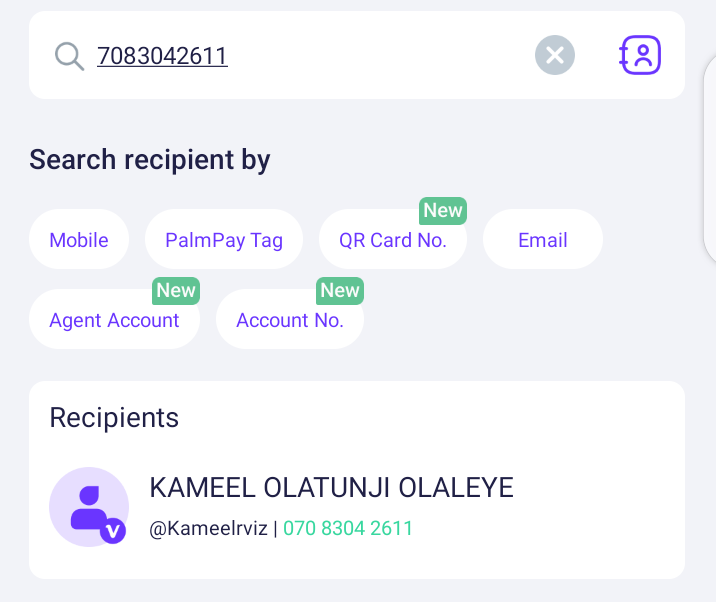

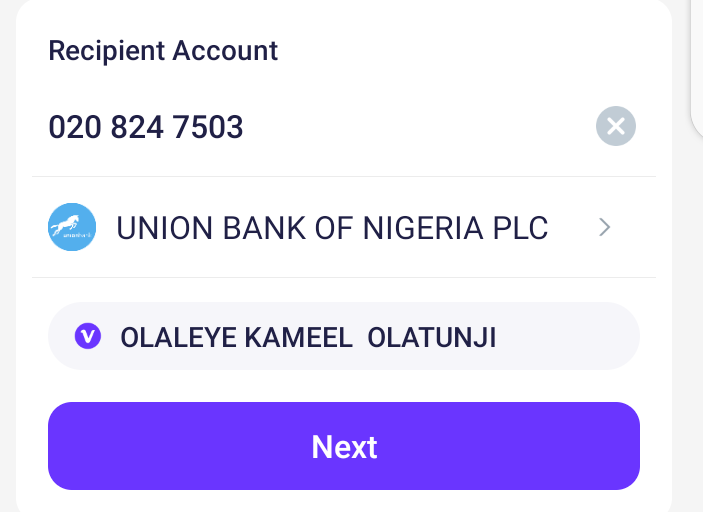

“Before things went bad, what I did was to regularly market the business to prospective customers around the Alakuko and Alagbado areas. Interested customers subsequently paid money into the Palmpay account number 7083042611 and the Union Bank account number 0208247503.

“Once monies were paid, I regularly called Mr. Lanre to confirm receipt of such payments. Once the payments were confirmed, I wrote receipts for the customers.

“On October 17, as we closed for the day and were about going home, we the staff members and marketers of the company were all called and informed that the vehicle that was supposed to bring food supplies to the office on October 18 had developed a mechanical fault while bringing the items.

“The company had two staff members who handled clerical tasks at the office and seven marketers.

“We were then advised to call and inform our customers that they should, between the evening of October 18 and October 19, come for their items. The vehicle that was supposed to bring the food items still did not show up throughout that day.

READ ALSO: How Abeokuta Farmer Kazeem Dosumu Single-Handedly Built a Bridge for His Community

“Mr. Lanre then later called all marketers to say the vehicle had been repaired and that food items would eventually get distributed to their rightful owners on October 19.

“We then had to again beg the customers who had come on the evening of October 18 to come pick up their food items on October 19.

“Remember, some customers had originally been scheduled for collection on October 19. With the new arrangement, it then meant that two batches of customers were expected to pick up their food items on the same day.”

“When I left work on the evening of October 18, I called Mr. Bashiru but his number was not going. Later on, I called Mr. Lanre and he said the vehicle was close to the office and that he would call me back.

“Later on, around 11 pm, he called me again to say the vehicle had arrived the office and that customers could now come on the morning of October 19, and as promised, for the collection of their food items.”

THE FRAUDULENT LOAN SCHEME

Oyewole also told FIJ about Flyhigh Capital’s fraudulent loan scheme.

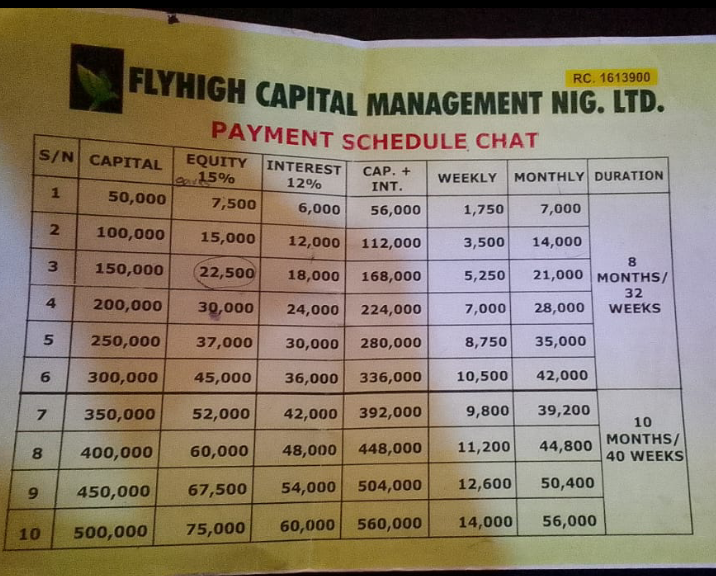

“The other part is that, after spending one week with the company, I was told to also advertise loan facilities to customers as well,” Oyewole said.

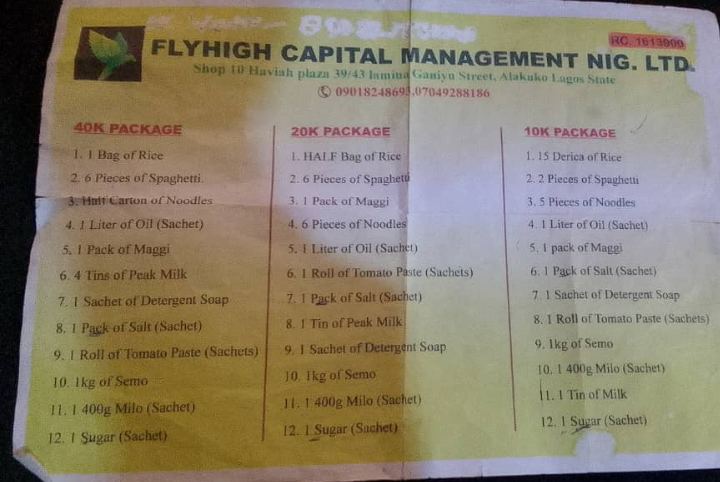

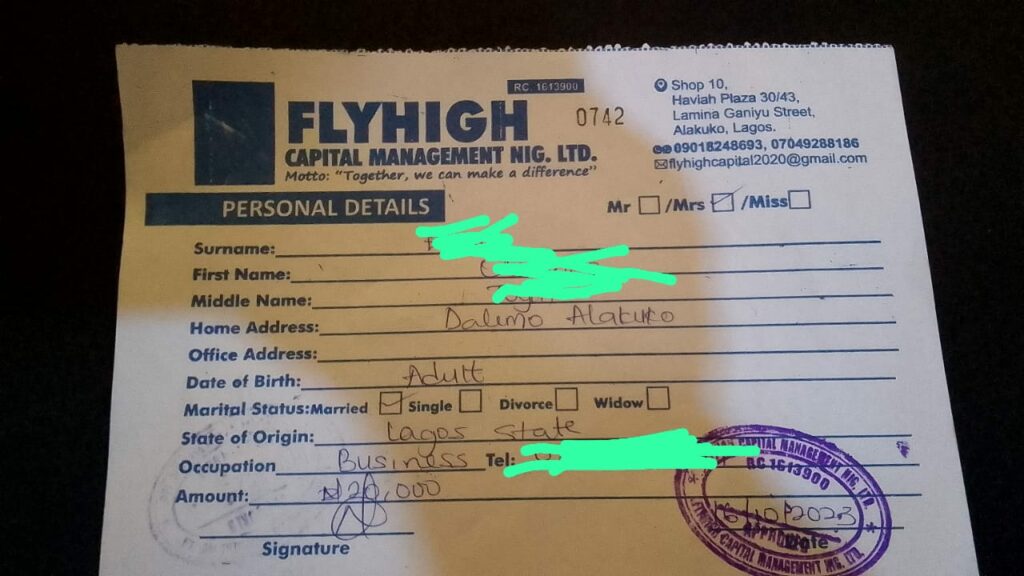

“We also shared fliers to people on that. To stand a chance, you were expected to have a little savings with us. With your savings, you would have access to bigger amounts as loans from the company. While filling your form, you were expected to include the information of a guarantor on it.

“The company also made it look so genuine that two special officers were assigned to follow us, the marketers, to the houses of interested customers just to confirm that they would not run away with the loans once they got disbursed.

READ ALSO: Angry Mother-in-Law Accused Islamic Cleric of Raping a Minor. He Proved His Innocence — But After 3 Years in Prison

“This also made the arrangement look very convincing to people and they committed various sums to the scheme with the hope of having access to huge loan facilities in return.

“Apart from the food scheme, Flyhigh Capital also made millions from the public through this.”

MR. LANRE AND FLYHIGH STEAL MILLIONS

Oyewole told FIJ how Flyhigh Capital Management stole millions from its customers.

“On the evening of October 18, Mr. Lanre called me and asked if I had received a N20,000 payment from Mr. Bashiru, but I told him I had not,” said Oyewole.

“He then said he had instructed the manager to give me the sum, and I immediately asked him for the purpose the sum was supposed to serve.

“He then said he was planning on coming down to our office himself to personally carry out the disbursement of loans and food items on October 19, and that he would tell me what the amount was meant to take care of once he was around. I told him I had not received the money.

“When I woke up around 6 am on October 19, I saw that Mr. Lanre had tried calling me again. When I tried calling him back, I discovered his number had been switched off. I then ended up concluding that it was possibly he had battery power issues.

“While getting ready for work, I received phone calls from two colleagues and they said they were already at work but the office doors had not been opened.

“They also added that the numbers belonging to Mr. Bashiru and all other principal officers of the company were switched off. To add to this, the numbers belonging to other marketers who were already working with Flyhigh before I joined were also switched off.

“The only people who ended up coming to work on October 19 were the two marketers who joined the company through me and myself. When we got to the office, we found out it was empty. There was no food truck and both Mr. Bashiru and Mr. Lanre were no where to be found.”

Oyewole told FIJ that she never physically met Mr. Lanre during her time as a marketer for the company. She said they only spoke on phone all through the three weeks she spent working as a marketer.

READ ALSO: ‘The Mark Of a Wicked Man’ — How Killer Rahmon Adedoyin Gave Rams, Cash and Cheques to Osun People

“When the customers who had paid for the food items and the group that had made advance payment for loan facilities showed up at Flyhigh Capital’s office on October 19, they also found out they had been defrauded by a crime syndicate,” said Oyewole.

MARKETER RUNS FOR SAFETY

Realising she might get lynched by the customers who were already showing signs of aggression towards her, Oyewole said, she quickly visited the Alakuko Police Station to report the incident.

“Because I happen to stay in that area and a lot of the customers knew where I stay, and because I was also one of the Flyhigh Capital marketers who had marketed products to them and made them commit payments to the scheme, I figured I was no longer safe,” said Oyewole.

“Some of them were already raining curses on me and I knew that it would not be long before I got physically attacked or even lynched. So, I quickly left the premises and went straight to report the matter at Alakuko Police Station.

“On getting to the police station, I was detained for 24 hours. They said they had to detain me and that I would have to be bailed. I eventually bailed myself with N22,000 and was told that I would have to be making appearances at the station on a daily basis.

“While I was still at the station, some of the now irate customers met me there and were pointing at me that I was part of the fraudsters. I had to continue explaining to them that I really do not know anything about the fraud and the identities of Flyhigh leaders. I also told them that I had just joined the organisation as a marketer.

“Some of the affected customers that called Palmpay and Union Bank that day were told all the monies in both accounts had been emptied.”

When fraudulent investment syndicates and companies begin business, they usually meet and exceed the expectations of their customers at the initial stage just to win their trust. As time goes on, and when the unsuspecting customers least expect it, they strike, fleeing with many customers’ life savings.

Oyewole has been in hiding since the incident happened.

“I won’t lie to you, I have been in hiding since the incident happened. On October 20, some of the irate customers visited our home, and despite meeting just my children at home, they took our TV and standing fan away,” Oyewole said.

“I had to flee our home after the incident. I took my children to my aunt’s place and right now, my husband and I have been living on our church premises. As we speak, my safety is not guaranteed. I go from church everyday to the police station.

“The company made more than N3 million through me within the three weeks I worked for them. Some workers even made more money than I did for the company.

READ ALSO: ARROWS OF GOD: One of Nigeria’s Biggest Orphanages Is Trading Babies for Cash

According to Oyewole, and based on her explanation, Flyhigh stole more than N20 million from Alakuko residents through the scheme.

FLYHIGH CAPITAL MANAGEMENT’S CAC REGISTRATION

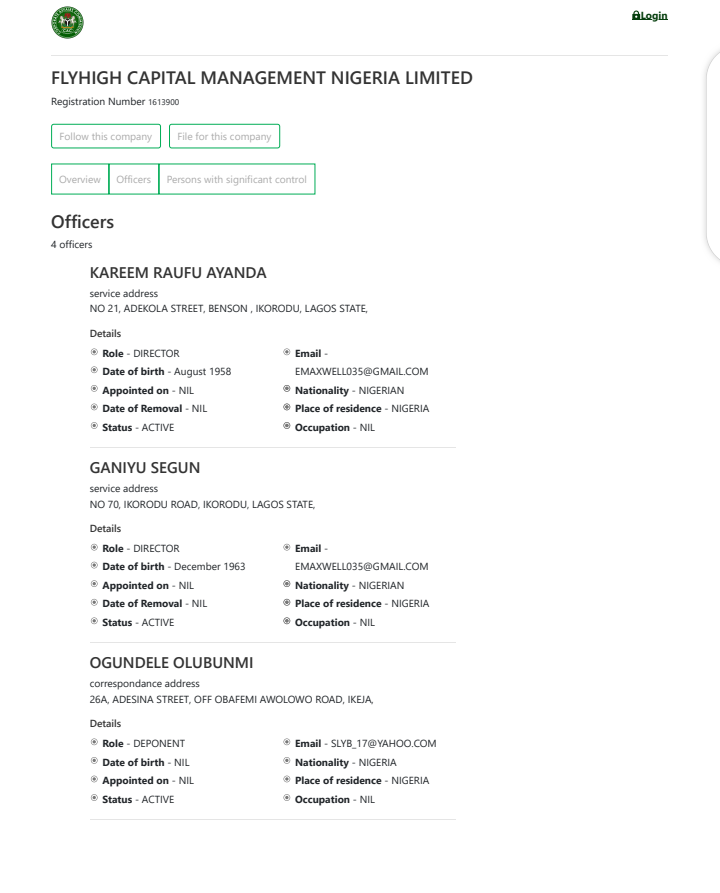

Checks by FIJ on the Corporate Affairs Commission (CAC) portal showed that Flyhigh Capital Management Ltd. was registered with the RC Number 1613900 on September 11, 2019.

The company also had the names Kareem Raufu Ayanda and Ganiyu Segun as its directors, and one Ogundele Olubunmi at its deponent.

Interestingly, the company was also registered on the portal with the address, ‘No 21, Adekola Street, Benson, Ikorodu, Lagos’.

When FIJ physically visited the area, however, no one seemed to have heard of the street before. The Okada riders, who regularly ply virtually all the streets situated in the Benson area, also said they had never heard of the street.

When FIJ tried searching for the street on Google Maps, the street could also not be located. It seems any prospective company owner can supply an imaginary information while registering with the CAC and such will be approved without proper background checks.

FIJ placed several phone calls to the three lines Flyhigh Capital Management used in perpetrating the fraud but they were switched off. Text messages sent to the numbers had also not been responded to at press time.

FINDING ‘OLALEYE KAMEEL OLATUNJI‘

The Palmpay account number 7083042611 and the Union Bank account number 0208247503 Flyhigh used in stealing millions of naira from its customers had something in common. They bore the same account name Olaleye Kameel Olatunji.

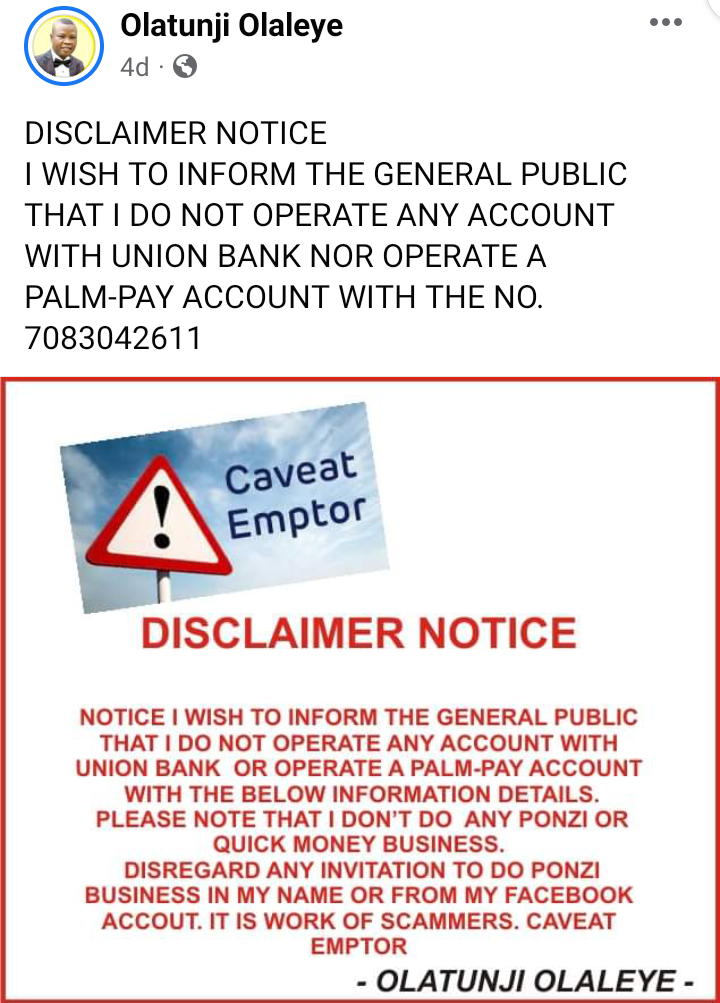

The search for the identity of the bearer of the name later led to an Oyo State-based politician. While going through his profile, FIJ discovered the politician had already posted a message on his Facebook profile. The message reads:

“I wish to inform the general public that I do not operate any account with Union Bank or operate a Palmpay account with the below information details. Please note that I don’t do any Ponzi or quick money business. Disregard any invitation to do Ponzi business in my name or from my Facebook account. It is work of scammers. Caveat emptor.”

READ ALSO: From Nigeria Airways to Nigeria Air, the Dwindling Fortunes of National Carriers in 52 Years

After an intense search for the politician’s phone contact, FIJ spoke with him.

“I do not know anything about that account,” the politician said.

“I do not operate any account with Union Bank. I have actually spoken to my lawyer on the incident and we have resolved to take the matter to the police so that an investigation can be conducted on the matter.

“I am working on it and I am going to get to the root of the matter. Although I am aware that names (account names) can be the same, things like BVN, signature and thumbprints can never be the same. So, whoever is using that name, whether it is a coincidence or not, we will soon find out.

“One thing I know is that I don’t operate any account number with Union Bank.”

Checks and events have shown that different individuals can indeed bear similar names and name arrangements on their official documents and even as account names in Nigeria.

When FIJ made a phone call to Margaret Okonkwo, the DPO of Alakuko Police Station, on Friday morning for comments on the matter, she said she was in a training and that she would call back.

READ ALSO: Green Space Recyling’s Yemi Megbope Collected N42m to Deliver a N15m Equipment. Still, She Didn’t

When she did not call back as promised, FIJ sent her a text message for her comments on the incident. The text message had, however, not been responded to at press time.

Presently, Oyewunmi remains in hiding, scared she might be lynched by the already agitated customers.

Subscribe

Be the first to receive special investigative reports and features in your inbox.