Wema Bank wants Abdulazeez Olaonipekun, a Lagos-based medical doctor, to repay the N583,000 loan taken from his account by a fraudster who stole his smartphone.

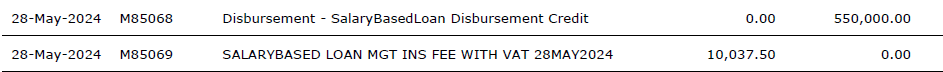

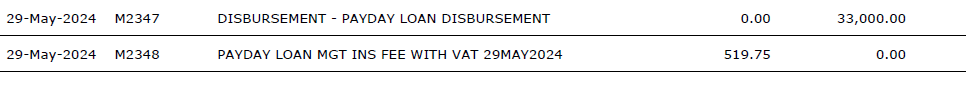

Abdulazeez told FIJ that he was returning home from work around 7.30 pm on May 28 when his smartphone was stolen. After the phone theft, the perpetrators first took a N550,000 salary advance loan via his bank account on that day, followed by a payday loan of N33,000 on May 29 without his authorisation.

FIJ gathered that the money was then transferred into an Opay account belonging to one Sunday Ozoh between May 28 and May 29, pushing the doctor into debt, as the bank expects repayment.

READ ALSO: N248,000 Leaves Bride’s Account After Theft of Phone in Church

“I was going home from work on that day. Unknown to me, my phone had been picked up from my bag when I alighted from the bus from Orile to Suru Alaba. I got to know when I boarded another bus. I saw that my bag’s zip was opened. When a fellow passenger on the new bus dialled the number, it rang. But on the second dial, it was switched off,” he told FIJ.

As soon as the doctor got home on that Tuesday, he made efforts to block all his bank accounts linked to the two MTN lines in the stolen phone by borrowing a neighbour’s phone. However, he was unable to block the Wema Bank account because the customer care service was unresponsive.

“I was able to make a call to block my Jaiz account and that of First Bank. Unfortunately, all the contacts I got online to communicate with Wema Bank customer care were not going forth,” the doctor said.

“I decided to call MTN to block the two MTN numbers in the phone because I believed if the numbers were blocked, fraudsters would not be able to do anything with the SIM card. MTN customer care asked me several questions, which I provided answers to.

“But surprisingly, I was told that not all the answers I provided were right. I remember they asked me when I registered my SIM card. Though I could not remember precisely because I got it a very long time ago, I used the events of that time to describe when I possibly got the line, which was either 2004, 2005 or thereabouts. I was denied the opportunity to block the line because of this.”

Given that it was too late for the doctor to visit any bank or MTN centre that night, he waited until the following day. Before he went to retrieve his stolen lines on May 29, he first used his Wema Bank card at the ATM gallery of a First Bank branch at Signal Barracks to check his account balance.

“I saw about N33,000 and thought everything was okay because I knew I did not have up to N50,000 in my account. I withdrew N10,000 on the spot so I could do the runnings for retrieving the numbers. I went to the MTN office afterwards. When I got home after the main line was active, I tried recharging with Wema Bank’s USSD code, but the PIN I normally used when transacting was denied with a notification saying it was the wrong PIN.”

After Abdulazeez’s PIN was denied on that ground, he became suspicious and feared the worst. Then it occurred to him to check his emails via his laptop since Wema Bank often emailed him with details of transactions carried out on his account. He checked his email with the help of a neighbour’s Wi-Fi.

“When I checked my email, I found that my SIM had been used to take two loans transferred to an Opay account. All the transactions happened between 10.00 pm and 1.00 am. By the time I discovered this on May 29, it was around closing hours, so I could not go to the bank physically. However, I was able to get a customer care number from the email, which I called,” the doctor disclosed.

“I also could not go to Wema Bank that day because after I left the MTN office, I had to do some things on the Island. I had to go to Jaiz to block my account. Besides, the amount I saw that morning when I used my debit card in an ATM gallery was not suspicious, as it was around the amount I felt I had left in the account.

“Also, I had already blocked the line and even had the newly retrieved SIM with me. It was on getting home to use my USSD to recharge that I discovered the unauthorised loan. I have never taken loans from Wema Bank.”

FIJ gathered that the doctor went to the Wema Bank branch inside the Ajeromi local government secretariat on May 30 to report the incident and the bank said they were going to investigate it.

“I also got an affidavit and a police report on that day. I kept checking back at the bank whenever I had the time to. I had to report the same case to the Wema branch where my account was domiciled, which is in Ibadan. They also said they would work on it and see what they could do,” said Olanipekun.

“I wondered how the fraudsters could get a loan and bypass the security measures just by dialling a code. The bank later said they had investigated it and communicated with OPay. But they said I would need a court order before anything could be done on the account the money was transferred into.”

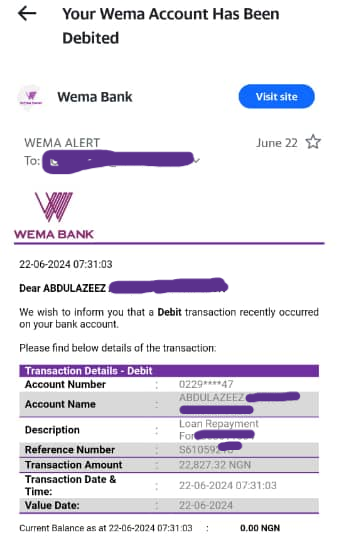

According to the doctor, getting a court order would cost him at least N100,000, which is more than he bargained for. He also revealed that since the bank expects repayment for the loan, a deduction was made in June.

“I received two reminder emails in my spam folder. I didn’t even know until I checked the folder, and on June 22, I was debited. I had stopped using the account since the incident,” the doctor said.

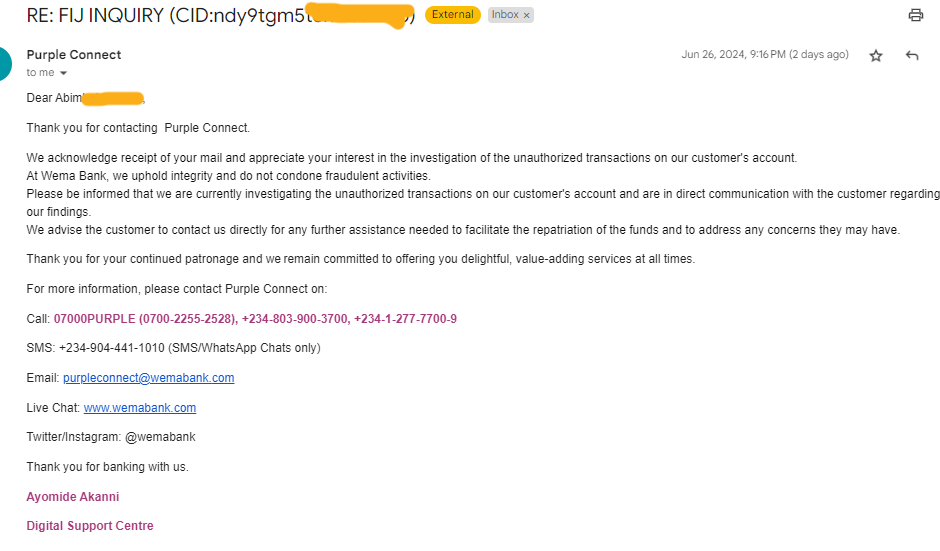

Ayomide Akanni, one of the bank’s digital support centre agents, told FIJ via an email that the issue was currently under investigation.

“We acknowledge receipt of your mail and appreciate your interest in the investigation of the unauthorised transactions on our customer’s account. At Wema Bank, we uphold integrity and do not condone fraudulent activities,” he said.

“Please be informed that we are currently investigating the unauthorised transactions on our customer’s account and are in direct communication with the customer regarding our findings. We advise the customer to contact us directly for any further assistance needed to facilitate the repatriation of the funds and to address any concerns they may have.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.