On February 27, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held its first meeting in the 2024 fiscal year to address inflationary pressures and reverse the rising inflation.

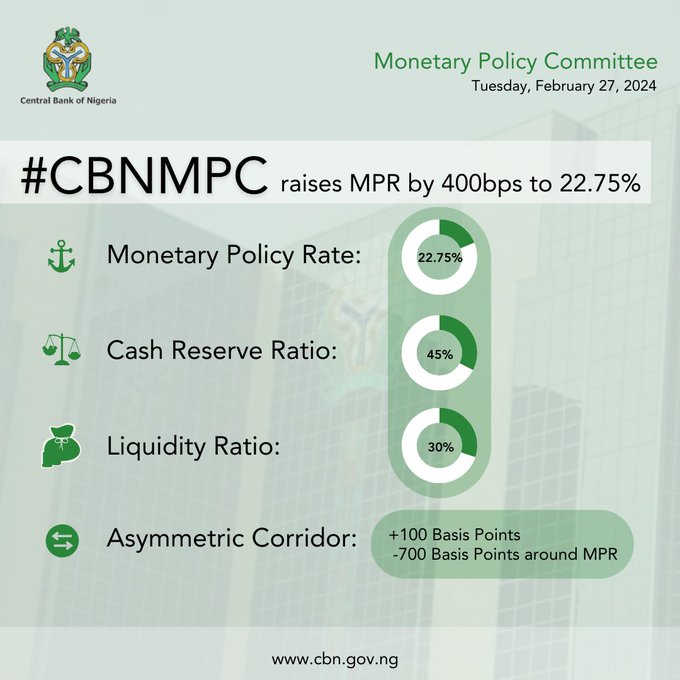

The committee, headed by Olayemi Cardoso, the Governor of the CBN, made four key decisions, one of which was to increase the benchmark interest rate by 400 basis points from 18.75 percent to 22.75 percent. This, by implication, means that the CBN increased the benchmark interest rate at which it lends money to commercial banks.

FIJ understands that this is not the first time the MPC has adjusted the interest rate to curb inflation. An analysis by Channels Television, for instance, reveals that the MPC has increased the interest rate nine times in its last twenty meetings.

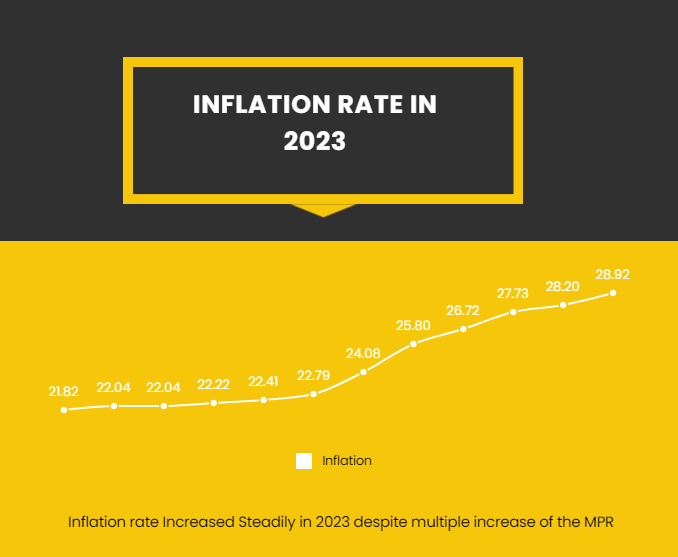

For context, the MPC meets bimonthly. Out of the six times it met in 2023, the committee raised the interest rate four times to address inflation. To see if this monetary policy had translated to any positive change, FIJ compared inflation figures before and after the four times the CBN increased the interest rate in 2023.

READ ALSO: Analyst: How CBN’s Proposed $20,000 Sales to BDCs Can Mess Naira Up

JANUARY 2023: MPC RAISED LENDING RATE TO 17.5 PERCENT

In January 2023, the MPC raised its lending rate from 16.5 percent to 17.5 percent to contain inflationary pressure. Godwin Emefiele, the CBN governor at the time, announced an increase of 100 basis points while reading the communiqué of the MPC meeting in January.

As of January 2023, the headline inflation rate, according to the National Bureau of Statistics, stood at 21.84 percent. By February 2023, however, the inflation rate had jerked up to 21.94 percent.

MARCH 2023: MPC RAISED INTEREST RATE TO 18 PERCENT

January wasn’t the only time the CBN raised its lending rate in 2023. On March 21, 2023, the MPC announced another increase from 17.5 percent to 18 percent. The committee, still under the leadership of Emefiele, increased the lending rate to address inflation and curb inflationary pressures.

According to the NBS, the headline inflation rate as of March 2023 was 22.04 percent. Between March and May, when the MPC held another meeting, the inflation rate had increased to 22.22 percent and 22.41 percent, respectively.

MAY 2023: MPC ANNOUNCED 18.50 PERCENT AS THE NEW LENDING RATE

In the 291st meeting chaired by Godwin Emefiele, the CBN increased the interest rate from 18 percent to 18.50 percent. However, like the previous attempts, this did not curb inflation.

The headline inflation rate as of May 2023, according to the NBS, was 22.41 percent. It jumped significantly higher than it had been. The NBS recorded 22.22 percent in April. But between the 291st MPC meeting in May and the 292nd meeting in July, the inflation rate rose to 24.08 percent.

JULY 2023:MPC INCREASED INTEREST RATE TO 18.75 PERCENT

On July 25, the MPC, under Folashodun Shonubi, the acting CBN governor at the time, raised the interest rate from 18.50 percent to 18.75 percent in a bid to offset or at least reduce headline inflation in the country.

According to the National Bureau of Statistics (NBS), Nigeria’s headline inflation rate was galloping at a significant 24.08 percent as of July 2023. In the month before, Nigeria had an inflation rate of 22.79 percent.

By August 2023, however, the inflation rate had increased to 25.08 percent, despite the CBN’s decision to raise the interest rate. Nigeria started 2023 with a 21.48 percent headline inflation rate. Despite increasing the interest rate multiple times, however, it ended the year with a headline inflation rate of 28.92 percent.

READ ALSO: CBN: Nigerian Recipients of International Money Transfers Will No Longer Get Dollars

Experts and government critics have voiced dissenting opinions, saying that Nigeria doesn’t need a higher interest rate now. Peter Obi, the presidential candidate of the Labour Party, for instance, believes that increasing the lending rate is detrimental to the economy.

“I am of the strong opinion that the recent decision of the Monetary Policy Committee to increase the Monetary Policy Rate, MPR, to 22.5% and the Cash Reserve Ratio, CRR, to 45% will further worsen the economic situation of most Nigerian households,” he said.

According to Bismarck Rewane, a financial expert, the immediate impact of the policy will be significant increases in the cost of goods, especially food, and services. Bismarck predicted, for instance, that the cost of rent would increase by almost 100 percent in the coming months.

Subscribe

Be the first to receive special investigative reports and features in your inbox.