Two months after the United Bank for Africa (UBA) returned stolen N169,000 to Ibrahim Gaya, a Port Harcourt resident, his N20,726 was deducted without his consent.

His N169,000, which was all he had in his account, was earlier stolen by a fake UBA customer care agent and refunded 28 days later, after a report by FIJ.

Unlike the previous incident where Gaya’s money was deducted after he unknowingly filled his personal banking information via a link the fraudster provided, someone signed in to his mobile banking app and initiated the latest deduction.

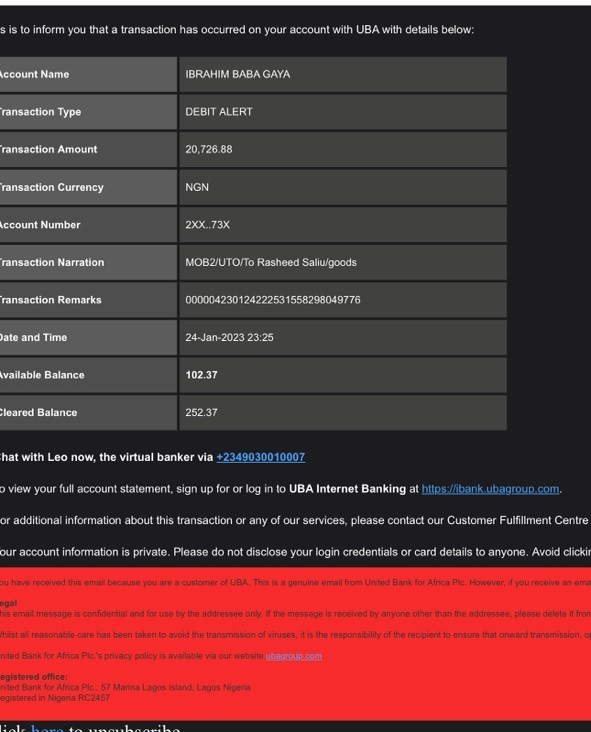

While speaking with FIJ, the Port Harcourt resident said his UBA bank account was emptied the second time on January 24, 2023.

According to Gaya, UBA had frozen his bank account and blocked his mobile banking app and debit card since November, when he reported the first incident.

“I went to the bank on November 2, and the customer care agent assured me that all had been blocked. My phone number was also disconnected from my account,” he said.

“Even after getting the money back, I had no access to it because my account was still frozen,” he disclosed.

He then noted that he could not access the money until he visited the bank on December 2 to unfreeze his account.

“While my account had been unfrozen, my phone number was still not connected to my account, my ATM card was still blocked, and my mobile banking app was still inaccessible. I could only make transactions over the counter.”

Gaya further explained that when he decided to activate his mobile banking app, he learnt he would need an ATM card or token to do that. He also said he was not comfortable doing that, considering the earlier unauthorised deduction from his account.

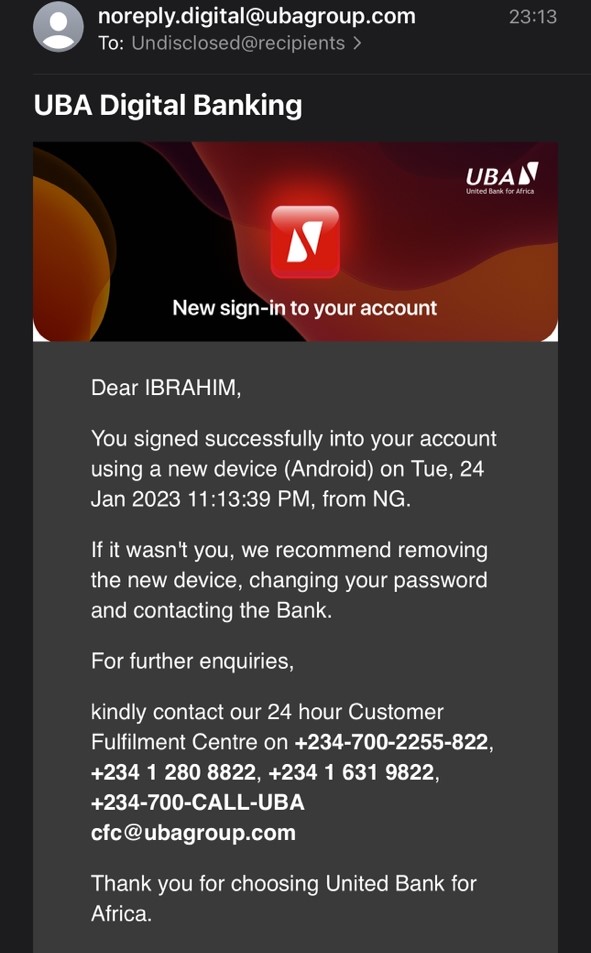

Gaya visited the UBA branch along Refinery Road, Eleme, Port Harcourt, to activate his mobile banking app on January 6. However, 18 days later, he received an email notification at 11:13 pm that he had successfully signed in to his digital banking account with a new device.

While Gaya was trying to make sense of the email, his money was deducted.

“I never signed in to the mobile banking app. Besides, the bank had told me I could not do anything on it without my ATM card or a token, so how did the person access my money and my mobile app?”Asked Gaya.

“I called the bank immediately the incident happened. I also went to the bank the following day to report it. That was when they told me that the person used a mobile app different from the one I normally use.

“How did the person authenticate the mobile app without my sim card? I use an e-sim, so the person could not have removed it from my phone. I was alone in my house, and there is even no option of using phone number to authenticate the app. So, how did the person access my account without a bank card or token?”

When contacted, UBA said its investigation showed hat the repudiated transaction was duly initiated and authorised with the banking information known to the customer alone.

“The unauthorised debit was a card-not-present (CNP) WEB transaction carried out with the debit card issued to and collected by the customer.

“United Bank for Africa was not negligent as the repudiated transaction was duly initiated and authorised with the card PAN details in custody. We humbly request that the client further ensure proper safety of banking details to avoid a compromise and unauthorised transactions as a result,” wrote UBA.

Subscribe

Be the first to receive special investigative reports and features in your inbox.