Nigerians who fell victim to PECO, a Ponzi scheme, have revealed to FIJ the tactics used by its masterminds in compelling people to invest in their products and how it rebranded after it successfully carted their money away.

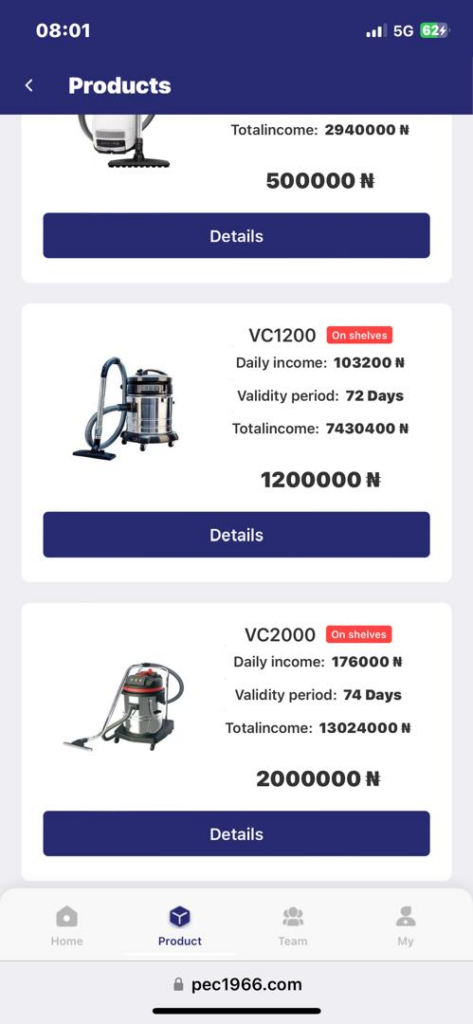

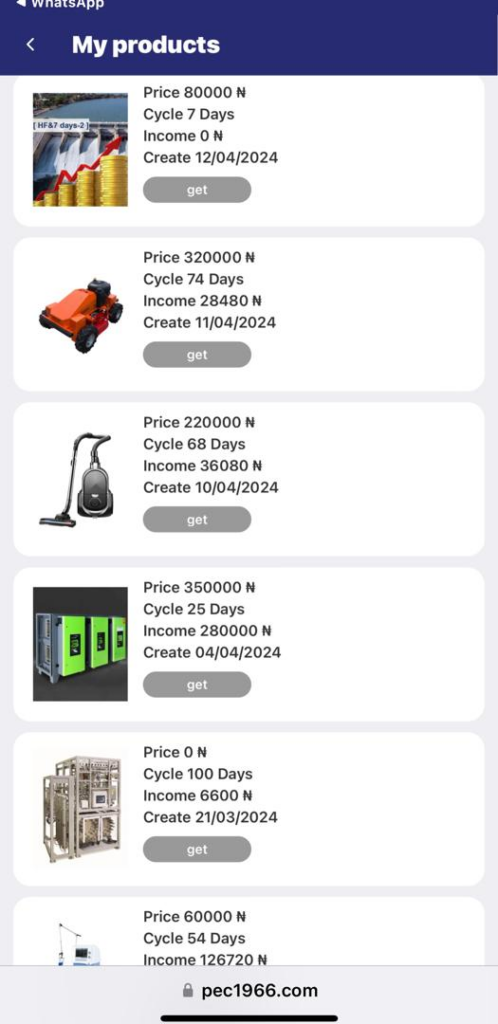

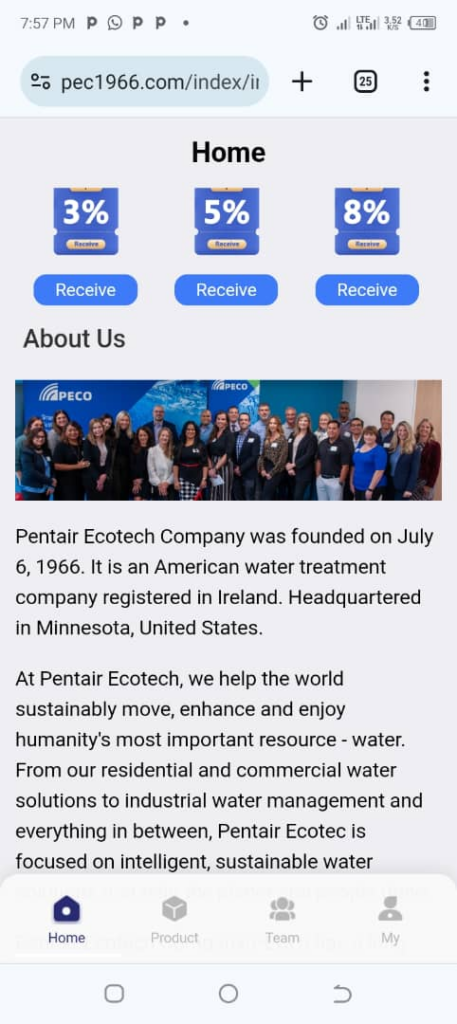

Before its rebranding, it was just another Ponzi scheme that promised Nigerians returns for investing or buying specific products, such as solar panels and vacuum cleaners, on its platform. The returns varied depending on the product or package purchased.

On its website, PECO claims to be Pentair Ecotech Company, a water treatment company registered in Ireland with headquarters in Minnesota, US.

READ ALSO: NITDA: Scammers Using QR Codes to Lure Victims

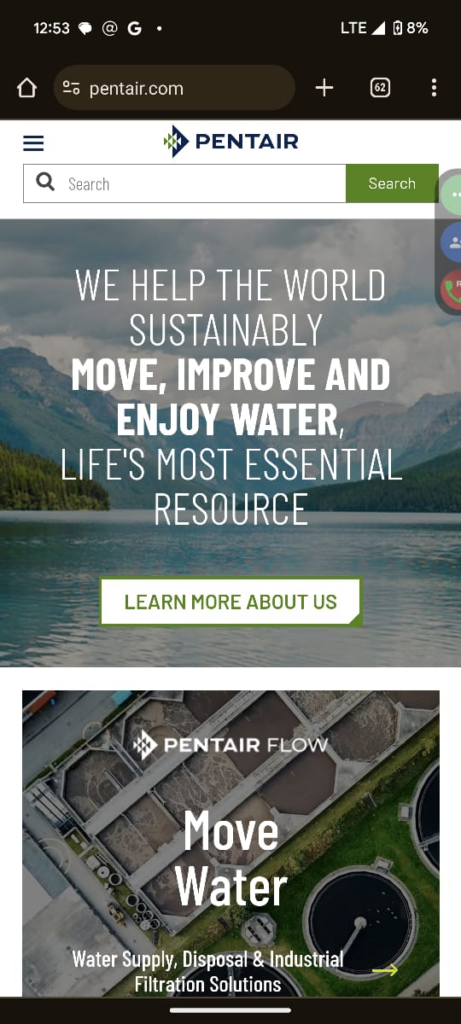

FIJ learned that this Ponzi scheme impersonated Pentair, a water treatment company headquartered in the United Kingdom with an office in the United States.

A victim who wishes to be identified as David told FIJ that he was introduced to the scheme by his childhood friend, who assured him it was a well-paying platform with no risks involved.

READ ALSO: How Scammer Made Opay Customer Transfer Additional N890,000 After Stealing His N1m

After registering, he was added to a group chat on WhatsApp, where one of the masterminds, who introduced herself as Emily, addressed him and others.

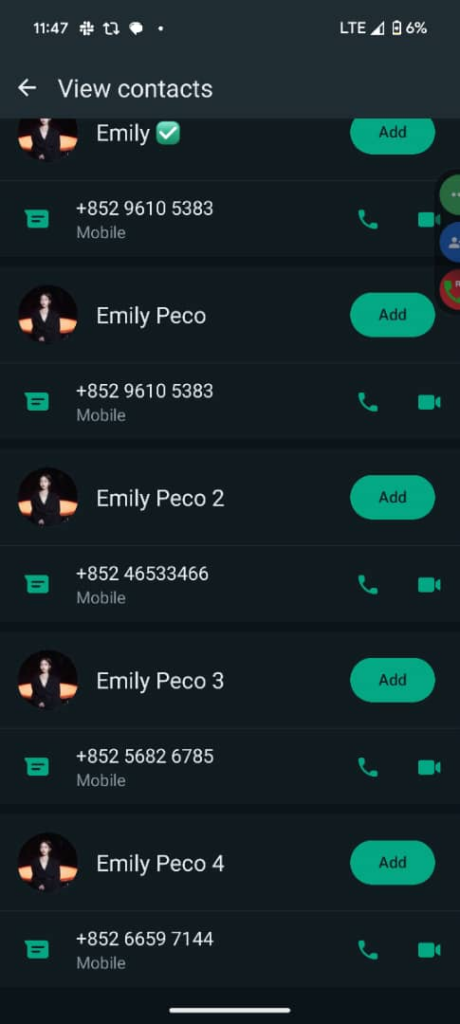

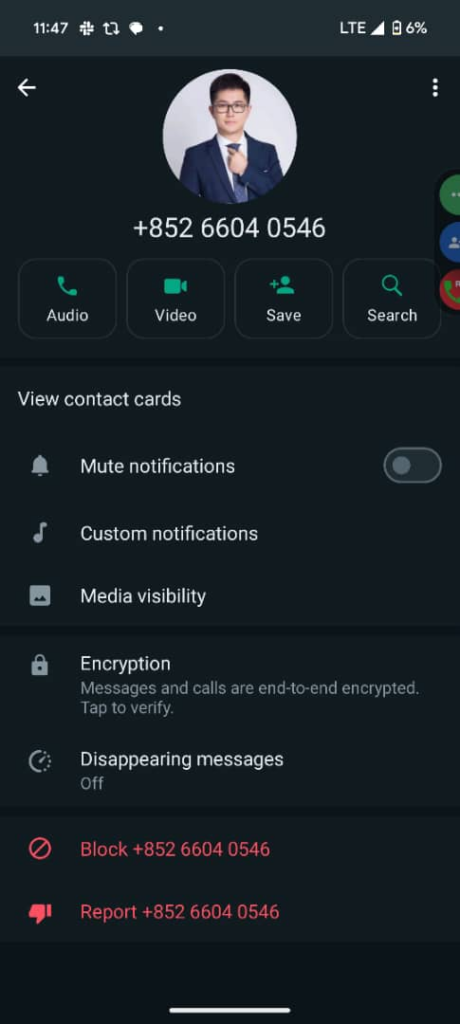

Emily uses the image of an Asian woman as her profile picture on WhatsApp. When FIJ checked the phone number on Truecaller, the app revealed it was a Hong Kong phone number.

“I joined on April 3 after my childhood friend convinced me. He told me his elder sister joined in February and she had been receiving money from it,” said David.

“There are different packages, like the one of N70,000 up to N2 million. They would show you products. I believed them because I saw the products I was paying for.”

Another victim told FIJ that she joined through a link sent to her by one of the masterminds on WhatsApp.

READ ALSO: More Victims of ‘Hong Kong Investors’ Reveal AIM Investment Scam Tactics

“I was one of the people who was duped. They started by sending a link to us to register with and refer people to get a bonus,” she said.

David also told FIJ that the platform’s masterminds told him the products he was paying for generated an ROI and would pay him N4800 daily for 68 days for investing in the N70,000 package.

“They said they were using the money to produce these products and send it out there. I thought it was a trading platform that would use your money to trade and pay your interest. I assumed this because there are trading platforms like this worldwide,” he said.

Two days after registering, PECO began paying him N4,570 every day between April 5 and April 10, and he was excited to have discovered the platform. Unbeknownst to David, he was neck-deep in a scam, and he referred his fiance, her younger sister, and others.

“I told them it was a business that would pay them daily after investing and that the ROI would be over N300,000,” David told FIJ.

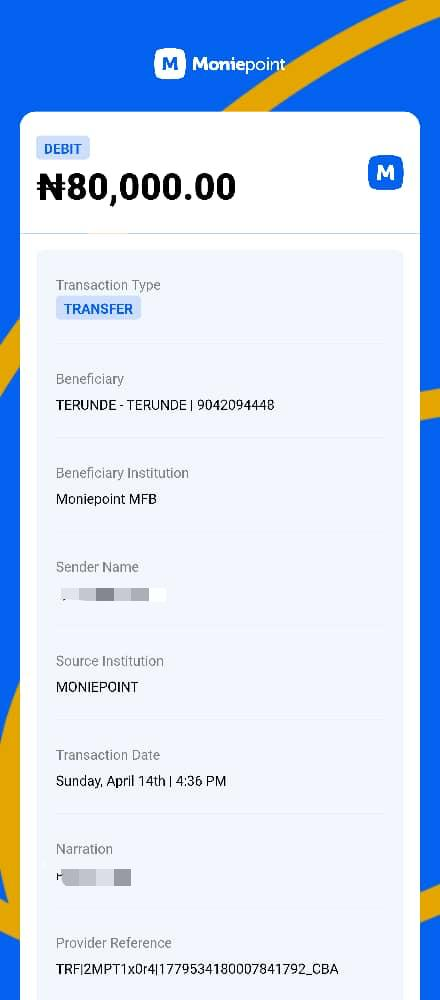

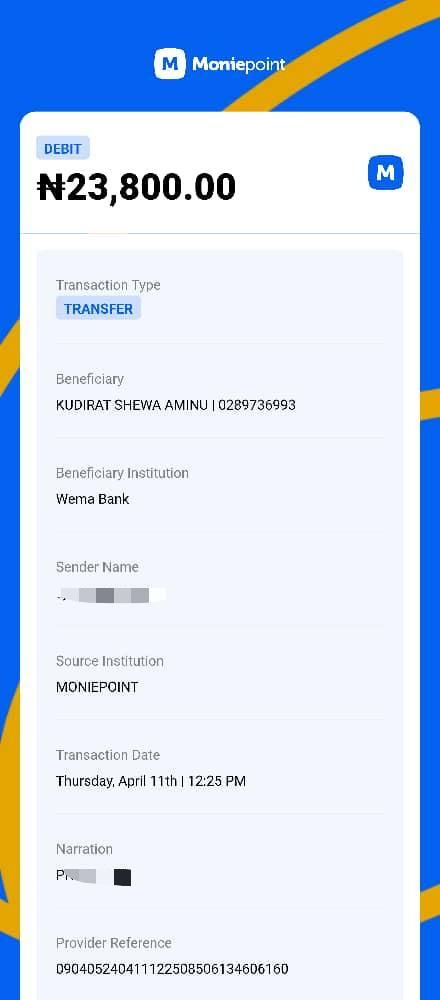

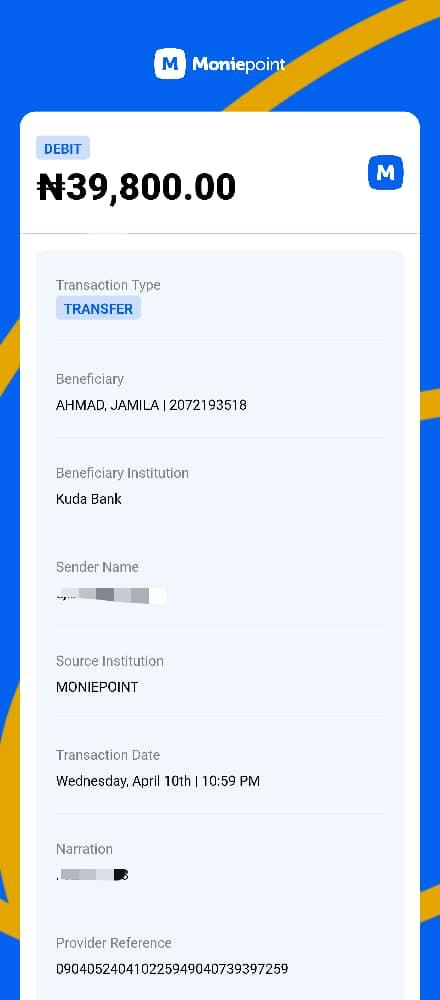

Although the masterminds used a Hong Kong phone number, the victims were asked to pay into Nigerian bank accounts. Some of the bank accounts the scheme received money into were 2072193518, a Kuda Bank account named Ahmad Jamila; 9042094448, a Moniepoint account named Terunde-Terunde; and 0289736993, a Wema account named Kudirat Shewa Aminu, among others.

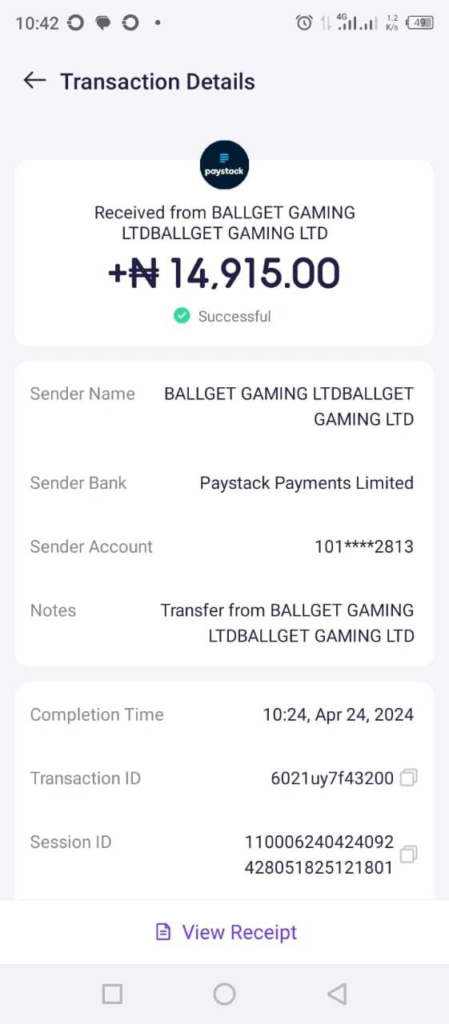

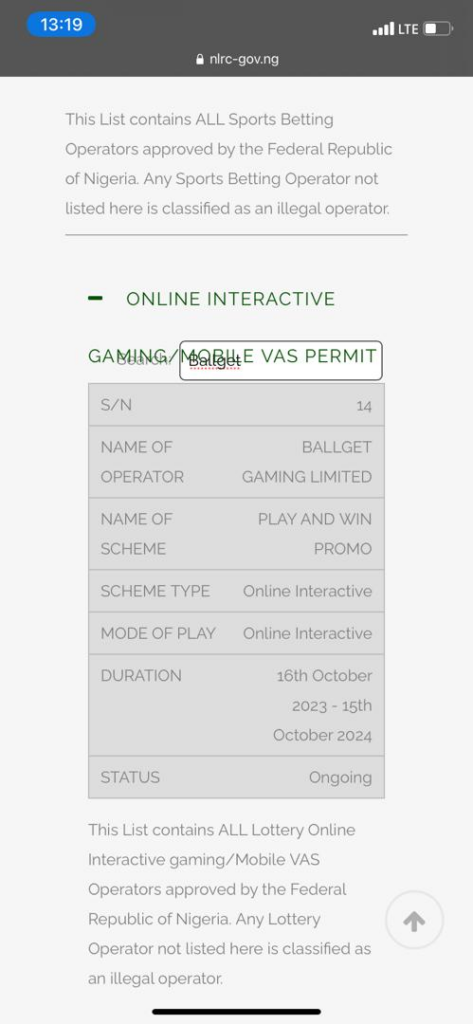

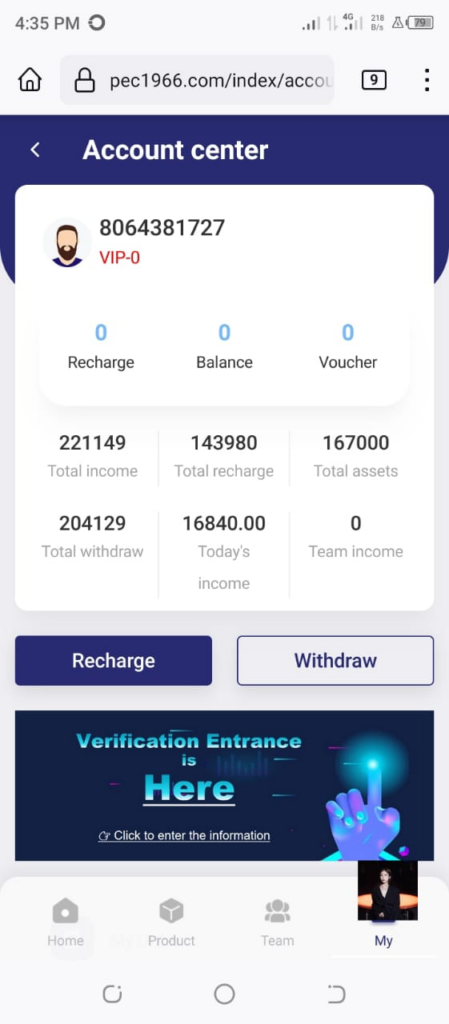

In addition, David and other victims who got paid by the platform were paid by Ballget Gaming Ltd. via Paystack, a fintech. A simple search on Google revealed that Ballget Gaming Ltd. is a gaming operator registered with the National Lottery Gaming Commission.

Emily convinced him to upgrade to another package, and he obliged, hoping it would help him generate more income. After paying for two new packages, no money was disbursed into his account.

On April 11, Emily and her cohorts began pleading with David and other victims to exercise patience because they were updating their server and would resolve all pending transactions afterwards.

READ ALSO: Boat Passengers Say Lagos Gov’t Scams Them Through Extra Card Charges

Emily returned on April 19 to inform them that their server had been updated and that they wanted to know their “genuine” members because there were over 6 million registered users on the platform. So, she told them to pay N30,000 each for membership cards or else they would forfeit their earnings.

“I had over N800,000 on the platform and did not want to lose money. My friend invested over N700,000 in it, and none of us wanted to lose our money, so we paid another N30,000 that very day,” said David.

It began to dawn on David that he had been lured into a scam on April 20. That day, he logged in to the platform and was notified he had to pay N160,000 to access his earnings.

“This was where I sensed something fishy. I had to call my friend, and he was surprised. Everyone began calling the people who had referred them. How do you tell us to pay to withdraw our own money? That was when we realised we had been scammed.”

Shortly afterwards, Emily and her cohorts informed David and other people who had fallen victim that PECO was a project with a lifespan of 6 months and they had to shut it down as it was already the sixth month.

Eze Nwanyioma (not real name) told FIJ that she registered in March and invested over N1 million but did not receive up to N200,000. Some other victims told FIJ they were not paid a dime.

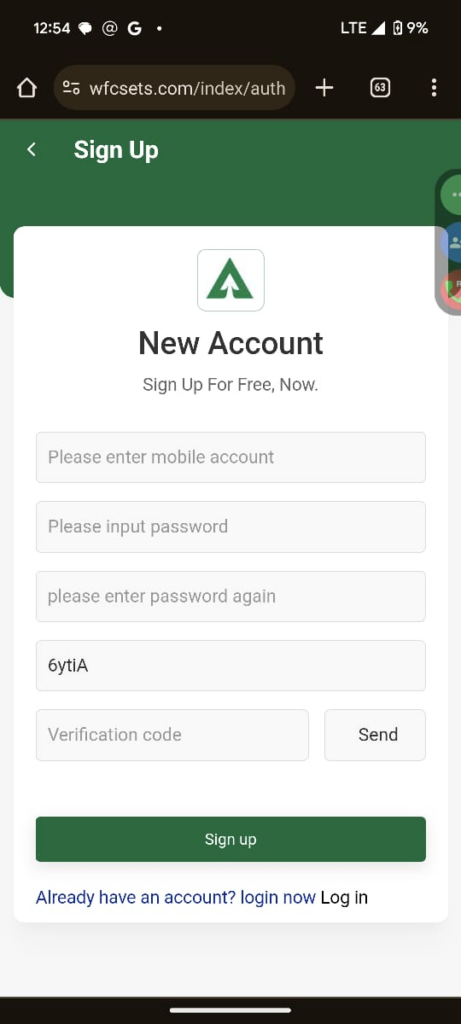

“Emily told us how they operated. She said some would lose and some would gain. That was her last statement before closing the WhatsApp group. Some days later, she opened the group and changed the display picture to one bearing WFC’s logo. She said we should forget about PECO because it was gone for good,” Nwanyioma said.

Emily is convincing and luring these victims to re-invest in WFC, the rebranded version of PECO.

VICTIM CONTEMPLATES SUICIDE

Life has not been the same for many of these victims after losing so much money.

Aliyu (not real name), a victim who has lost over N800,000 to the scam, told FIJ that another victim was currently contemplating suicide after losing his money.

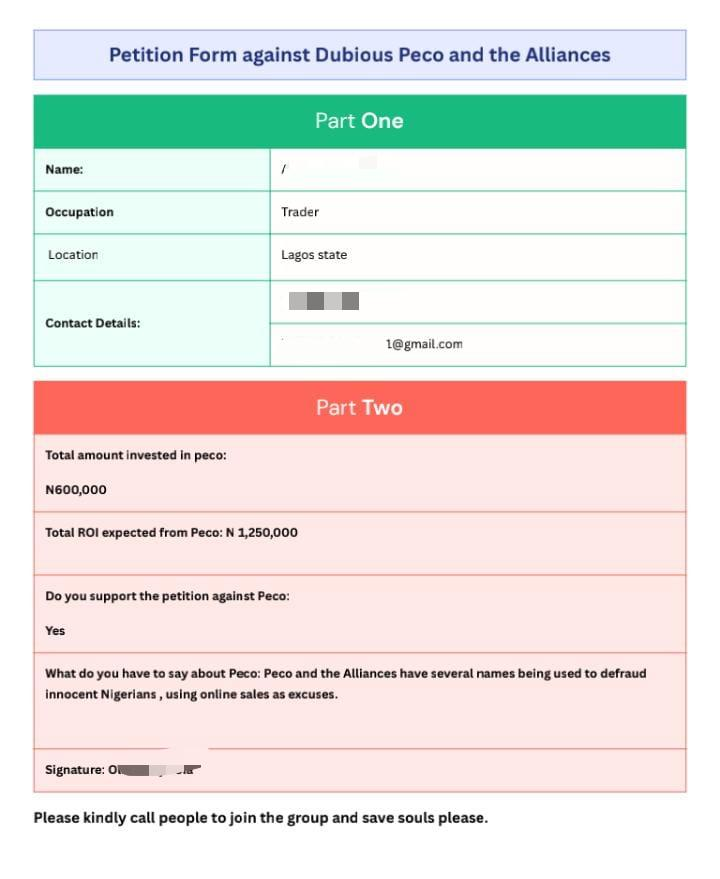

Dejected and disappointed, these victims are utilising available weapons in their arsenal to seek justice and recover their money. They’re trying to achieve this by filing a petition against PECO.

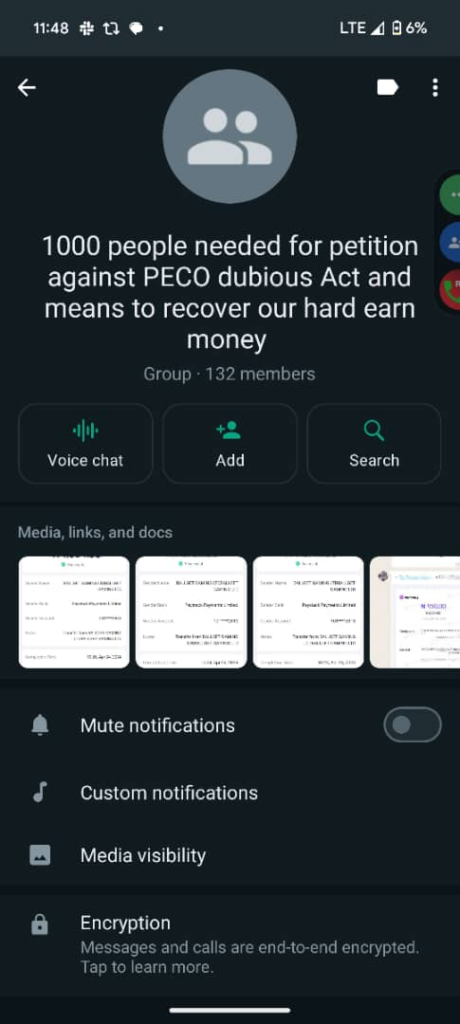

On April 21, one of the victims created a WhatsApp group for other victims. The goal is to get 1000 people to file petitions against PECO. Currently, there are less than 150 members in the group.

Every day, they assure one another that Emily and her cohorts will face the wrath of the law someday.

Subscribe

Be the first to receive special investigative reports and features in your inbox.