Mobolaji Abi, a sales executive in Lagos, has told FIJ how he and others wallow in a multimillion naira debt after a failed investment plan by Sam Afolabi’s EatRich Farms.

Abi told FIJ on Tuesday that he learnt about Sam Afolabi and EatRich on Facebook.

“Seeing all the things he was doing in the agricultural space as a young person, and because I’m an agricultural enthusiast, I decided to move close to the company. Fortunately, the EatRich/SWAY AGFIN programme came through from Sterling Bank and a lot of people decided to join,” Abi said.

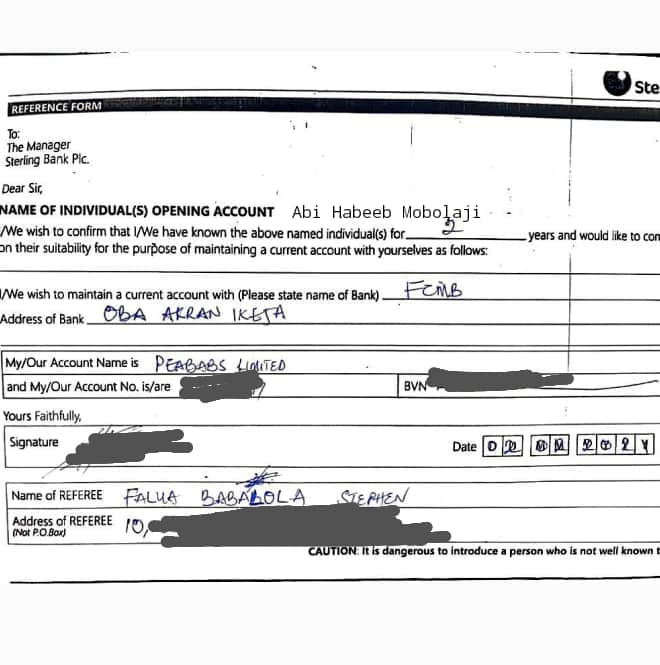

“I found a friend working with EatRich and discovered that Sterling Bank was supporting the Sterling Women and Youth Agricultural Finance programme (SWAY AGFIN) with the company. Seeing how much attention the programme got, I applied and even invited my brother to join too. Even some of Sam Afolabi’s employees joined.

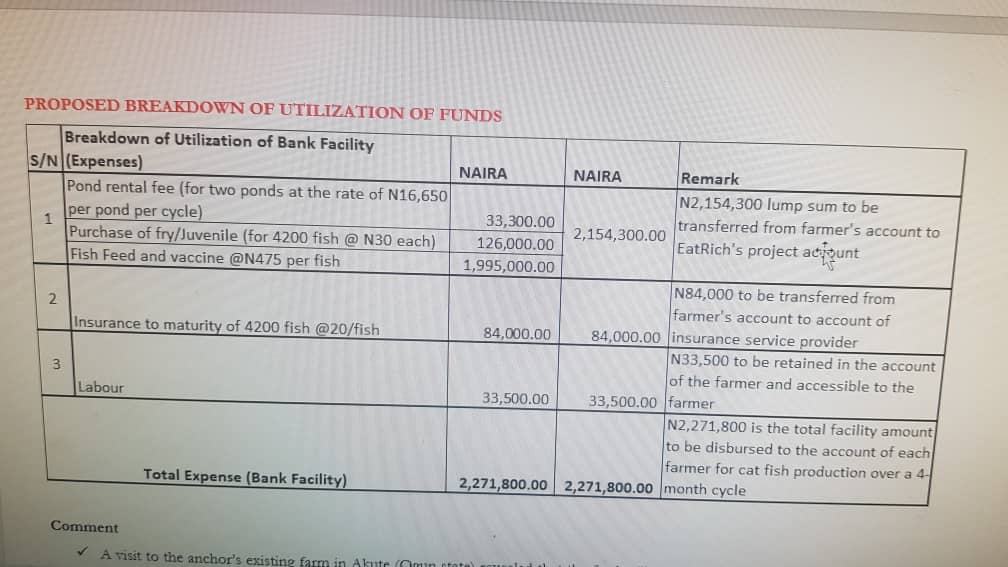

“EatRich wanted to fund the Green Africa Project it started in Odogbolu, Ogun State. This project aimed to establish a catfish farming industry on several acres of land. We were used to collect the funds from Sterling Bank. EatRich used about 100 of us to collect N2.3 million each.”

Abi told FIJ that EatRich failed to pay up the loans it took for the Green Africa project and the debts incurred fell back on the people who registered with the company in 2020.

“Just last month, I received a mail from Sterling Bank that I owe N2.3 million, a sum of money I did not spend. The Green Africa project in Odogbolu was a good project, but they ended up ruining it. Sam Afolabi, the Chief Executive Officer of EatRich, has been on the run ever since. We cannot contact the owner of the company anymore,” Abi explained.

FIJ called EatRich Farms on Tuesday but its official phone number was switched off. It had not responded to a mail and text message sent to its official communication channels at press time.

READ ALSO: Sam Afolabi’s Eatrich Farms Owes Staff and Investors N1bn but Arrests them for Protesting

Afolabi, EatRich’s CEO, absconded in the midst of chaos and clients are left to answer to Sterling Bank alone. Femi Abegunde, a consultant for EatRich, told FIJ that Afolabi had cut off all forms of communication for months.

“I gave EatRich my services as a consultant, but I did not work with the company as a staff member. I have been unable to contact the CEO Afolabi for months. He’s gone incommunicado. There was also a call from Alagbon (the Nigeria Police Force Criminal Investigation Department (FCID) about six months ago. They wanted to know about the same thing,” Abegunde told FIJ.

FIJ had published a report revealing how EatRich’s Afolabi mandated his employees to open a Sterling Bank account in March 2021 to apply for loans without their knowledge.

In October 2021, over 250 investors lost their savings to Afolabi’s EatRich Farms and Food Ltd. Afolabi has disappeared into thin air ever since.

Subscribe

Be the first to receive special investigative reports and features in your inbox.