Jedidiah James, a content writer, has narrated how Sam Afolabi, founder of the Eatrich Farms, connived with Sterling Bank officials to get loans of over N88 million with his former employees’ accounts without their knowledge.

James told FIJ that Afolabi mandated every employee to open a Sterling Bank account in March 2021. He said the staff members thought Afolabi wanted to pay them via the new accounts, only for them to realise that he wanted them to apply for loans.

He said Afolabi told them to apply for a Sterling Bank Sway Loan, a type of agricultural loan, to help fund one of his projects.

“The company wanted to set up a fish farm in Odogbolu. The agreement was that the company would set up a farm for us using the loan. When the fish farm boomed, they would take the fish and sell them, returning the capital to Sterling Bank with interest. They would also pay us a share of the profit,” James told FIJ.

He said shortly after they agreed to fill out the forms for the loans, Eatrich Farms crashed. He stated that all the junior staff members then realised that Afolabi was running a Ponzi scheme.

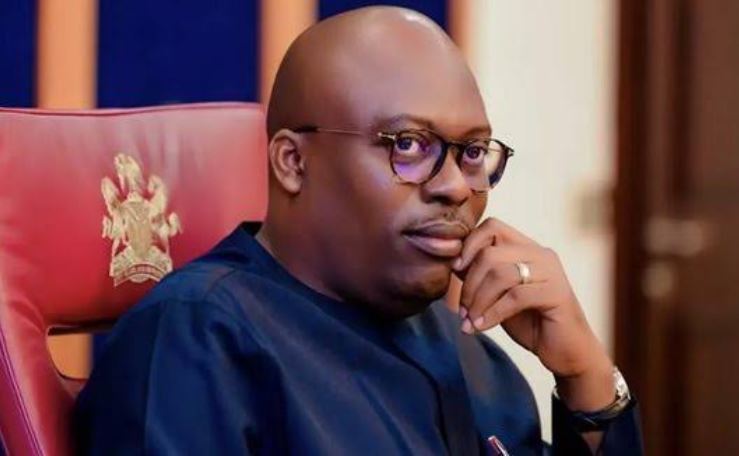

READ ALSO: Sam Afolabi’s Eatrich Farms Owes Staff and Investors N1bn but Arrests them for Protesting

“After the company crashed, we created a WhatsApp group, added the Sterling Bank staff, and told them we were no longer interested in getting loans from them. At the time, they had not disbursed the loan. Afterwards, we sent links to many reports about Afolabi’s fraudulent acts,” said James.

He said he woke up to the rudest shock of his life in December 2021 when Sterling Bank sent a reminder that he had not made a payment out of his N2.2 million loan. He stated that he was surprised because he had not applied for a loan.

He said he did not understand how Sterling Bank claimed he borrowed N2.2 million because he told the account officers he no longer needed a loan.

Later, James said he realised that the bank staff had gone ahead to process the loan. He said they processed the loans without informing the owners of the accounts, and when the loans were disbursed, Sterling Bank did not alert them, either by email or via SMS.

READ ALSO: After FIJ’s Report, Police Release Ex-Workers, Investors Detained by Eatrich Farms

“It was when they had moved the money out of our accounts that we saw the alerts. Some didn’t even get the alerts until the banks started notifying them that they should pay what they owed. This was when the loan date was almost due,” he said.

“The Sterling Bank staff cannot say they didn’t know he was fraudulent. It took two months after media houses reported Afolabi’s fraud before they disbursed the loan so they had more than enough time.”

“In the WhatsApp group of ex-staff I belong to, over 40 people are there. As of now, others are not aware that such has happened. And right now, those Sterling officials have left the group.”

FIJ contacted Sterling Bank via one of their customer care lines, but it did not connect the reporter to a call representative. At press time, they had not responded to an e-mail sent to them.

Also, FIJ contacted Sam Afolabi, but his line was switched off. He had not replied to a text message sent to him at press time.

In October 2021, over 250 investors lost their savings to Sam Afolabi’s Eatrich Farms and Food Ltd. Following the crash of his company, Afolabi disappeared into thin air with investors’ money.

In September 2021, FIJ reported how he arrested his now ex-staff members for protesting against his unwillingness to pay what he owed them.

Subscribe

Be the first to receive special investigative reports and features in your inbox.