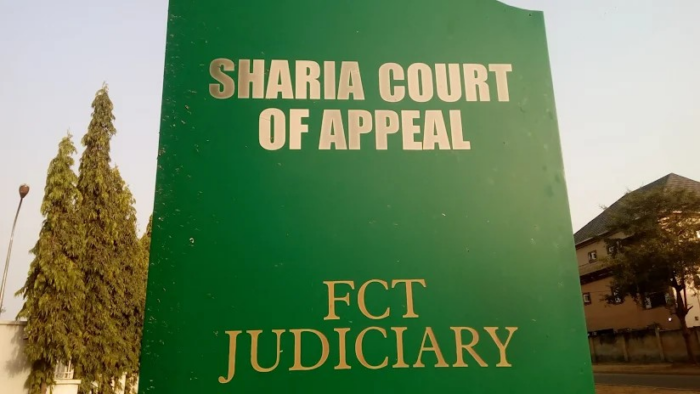

Usman Labaran, a Kano State-based agro-entrepreneur, has narrated how Ramatu Yakubu Yusuf, a senior employee of Abuja Sharia Court of Appeal; and one Mohammad Umar Bala, failed to refund his ₦900,000 after failing to facilitate a CBN loan for him.

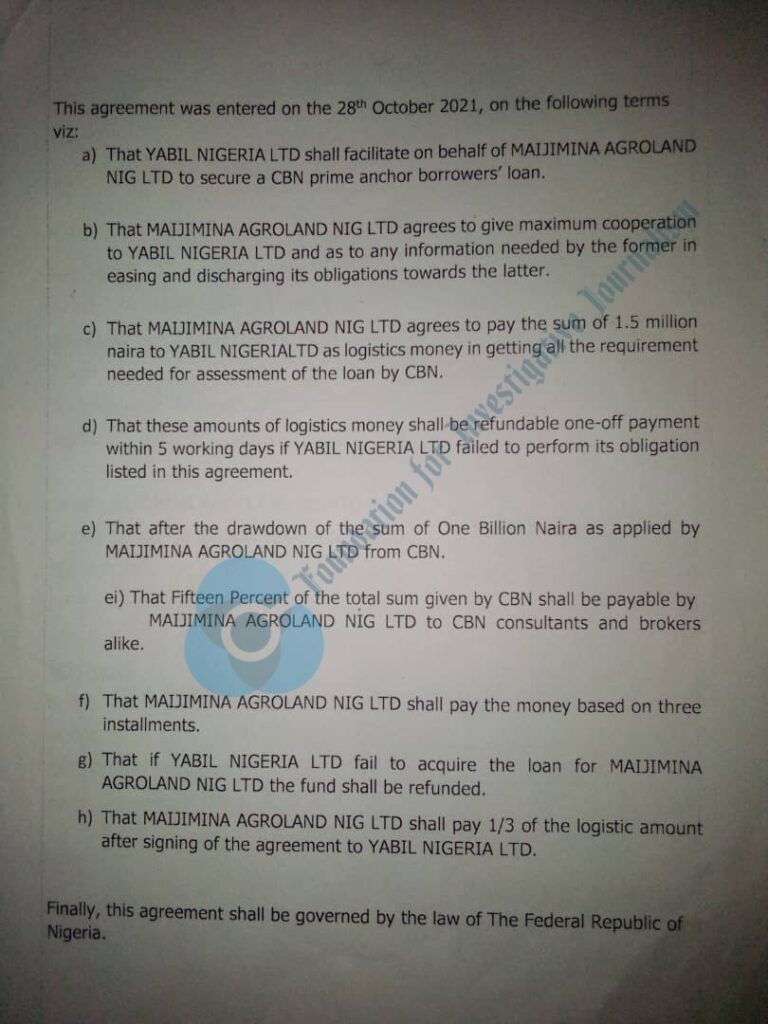

Labaran told FIJ that he heard about the Central Bank of Nigeria’s Anchor Borrowers’ Programme (ABP) and the duo told him they could help him facilitate the loan to augment his small scale enterprise.

According to the Kano State resident, they told him the facilitation process would cost him N1.2 million, and he transferred same into Yusuf’s Stanbic IBTC Bank account.

Following the payment, Yusuf, in her capacity as a commissioner for oath at the Sharia Court of Abuja formalised the deal.

“I own Maijimina Agroland Nigeria Ltd., a company operating within the agricultural value chain. In 2021, I heard about the CBN’s Anchor Borrowers’ Programme. While seeking more information about the application, I met Ramatu Yakubu Yusuf, a senior employee of the Sharia Court of Appeal, Abuja, and Mohammad Umas Bala,” Labaran explained to FIJ.

“We discussed at length on how to go about the government’s business incentive. They told me they had a track record in such application and assured that they would successfully facilitate the loan for me.

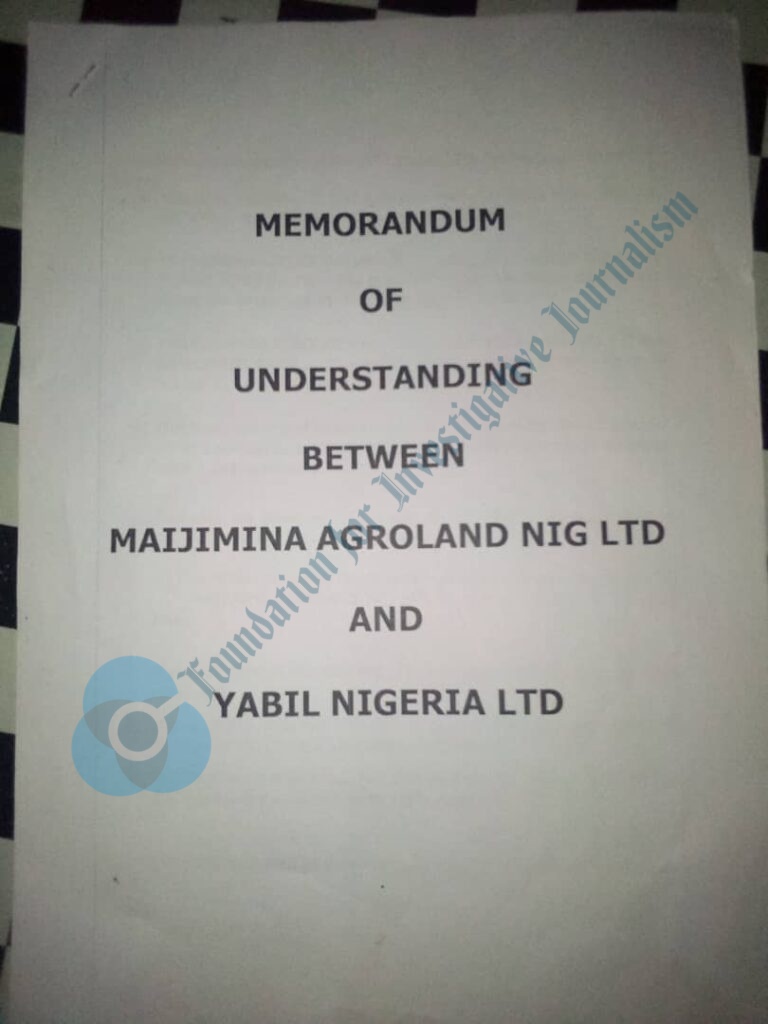

“I became convinced about their expertise and went ahead to pay the N1.2 million they asked me to pay into Yusuf’s Stanbic IBTC Bank account as their professional charge. We further entered a memorandum of understanding stamped by Yusuf in her official capacity as the commissioner for oath at the Sharia Court of Appeal, Abuja.”

Labaran said that the agreement was executed in the name of his company and Yusuf’s company, Yabil Nigeria Ltd.

As part of the terms of the MoU, the facilitators would get N1 billion for Labaran within two months. Also, the “logistics money shall be refundable one-off payment within 5 working days if YABIL NIG LTD failed to perform its obligation listed in this agreement”.

The entrepreneur also explained that he neither received any correspondence from the Nigerian Incentive-based Risk Sharing System for Agricultural Lending’s microfinance bank supposedly handling the loan assessment nor evidence of application from the consultants.

“The two-month period they promised elapsed, and I did not get any message from NIRSAL. They also failed to show me evidence of the loan processing,” said Labaran.

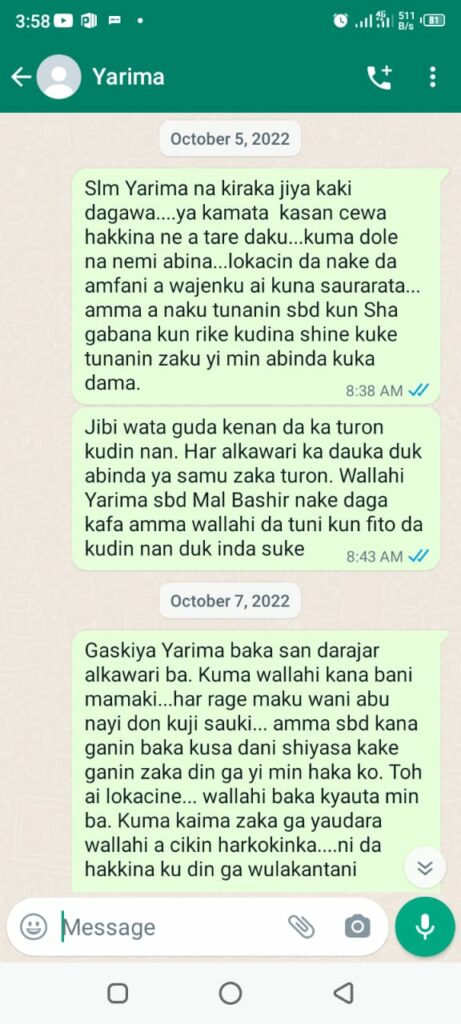

“At that point, I requested for a refund of my money and they promised to pay me. After many months, they paid me N300,000 in tranches in June and September 2022. Both of them stopped responding to my calls and messages afterwards.”

He also said, “If I called the woman, who is a legal practitioner, she would tell me she didn’t have my time. At a point, she told me point-blank not to ever call her again.

“As I speak with you, they have blocked me from contacting them. My business is bleeding; I am in debt. I have suffered too much in the hands of these people.”

READ ALSO: After FIJ’s Story, GTB Releases Canadian Student’s N3m

Responding to FIJ’s phone call, Bala confirmed the story and said he had messed up with and disappointed Labaran whom he described as “my very patient and good customer”.

“I have serially failed on my promises to refund his money. But I assure you that I will talk to Barrister Ramatu Yusuf on how we would quickly pay his money,” he said.

Yusuf, who became a lawyer in 2006, failed to respond to FIJ’s mobile call on Tuesday, but sent a text saying, “I will like to have a meeting with you.”

Bala and Yusuf did not respond to FIJ’s subsequent telephone calls and text messages.

Subscribe

Be the first to receive special investigative reports and features in your inbox.