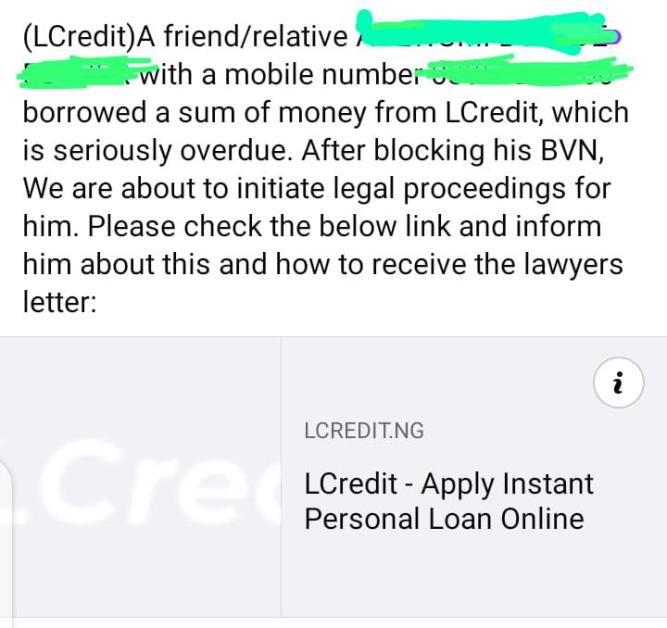

When Akpan Douglas (not real name) was unable to promptly repay a N12,000 loan he borrowed from LCredit, a quick loan company, in December 2021, majority of the contacts on his phone were sent messages on the incident.

According to the 33-year-old plumber, the defamatory messages sent to his family members and customers by the company brought him so much shame to the point that he was unable to leave his apartment for weeks.

“The incident was so depressing that for weeks, I was too ashamed to leave my house. I was always indoors and would only come out at night when I know that most people would not see me,” Douglas told FIJ.

READ ALSO: ‘He Is HIV Positive’ — Quick Loan Company’s Message to Defaulting Customer’s Contacts

“It got so embarrassing for me that my landlord, who was also a recipient of the message, called me to ask if he should be worried about his rent as well when the time comes for renewal.”

After the incident, the plumber resolved never to repay the loan.

“After a while, I decided to come out of my shell. The deed had been done already,” he said.

“I also made up my mind never to repay the N12,000 plus the interest. It wasn’t as if they would go back to tell all the contacts they had sent those messages to that I have finally paid, if and when I repay.”

Since December, Douglas told FIJ that he had received many calls from the company, advising him to make the repayment.

READ ALSO: Despite Gov’t Fine, Sokoloan Defames Debtors, Brands Them Criminals

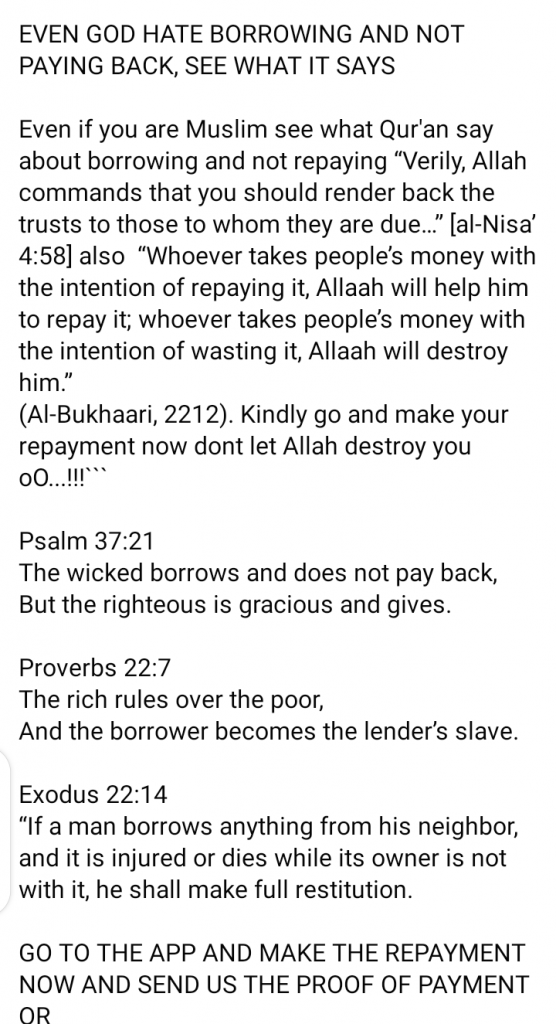

“I found the WhatsApp message I received from the company yesterday very laughable. They sent several scriptures to me from the Quran and the Bible, advising to make repayments as any refusal to repay my debt is deemed unscriptural.

“I see this as hypocrisy because if they are the type that practice what they preach, they would have been lenient and patient by giving me more time, and not send out those messages when they did. I questioned my existence and almost committed suicide when the matter was still very ‘hot’. Nobody enjoys being a debtor.”

On November 15, 2021, the Federal Competition and Consumer Protection Commission (FCCPC) issued a statement announcing the beginning of an investigation into rights violations in the money-lending industry.

This came after the National Information Technology Development Agency (NITDA) fined Sokoloan, another moneylender, for breaching its customers’ data privacy, an action that clearly violates Article 2.2 of the Nigeria Data Protection Regulation (NDPR), which bans illegal data sharing with third parties.

Despite the fines and sanctions, the lending firms have continued to devise new means of harassing their debtors.

FIJ made several calls to the service line of LCredit, but they were not answered. A text message sent to the company was also not responded to.

Subscribe

Be the first to receive special investigative reports and features in your inbox.