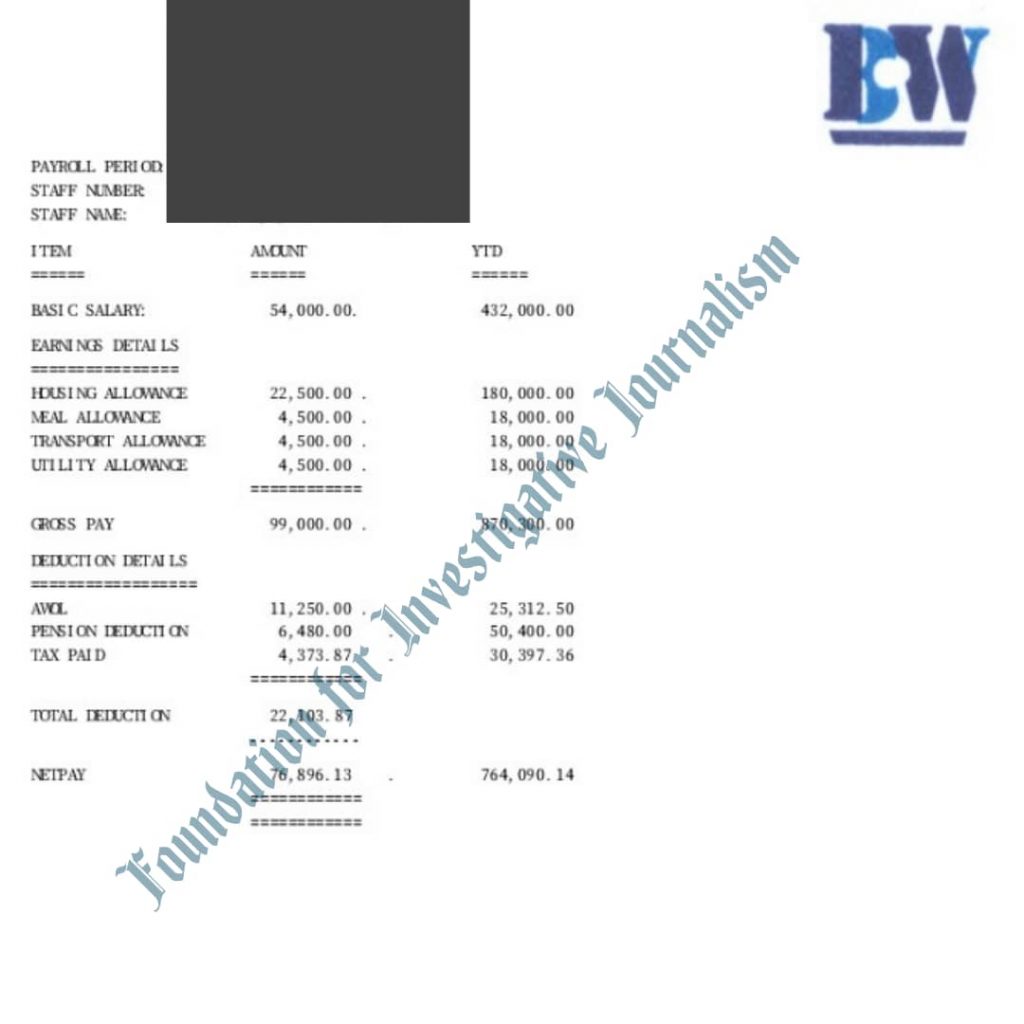

Bankers Warehouse Plc., a CBN-approved company responsible for receiving, processing, sorting, storing and moving money to and from banks across Nigeria, has been accused by some of its former workers of non-remittance of the monthly pension deductions into their Retirement Savings Accounts (RSAs).

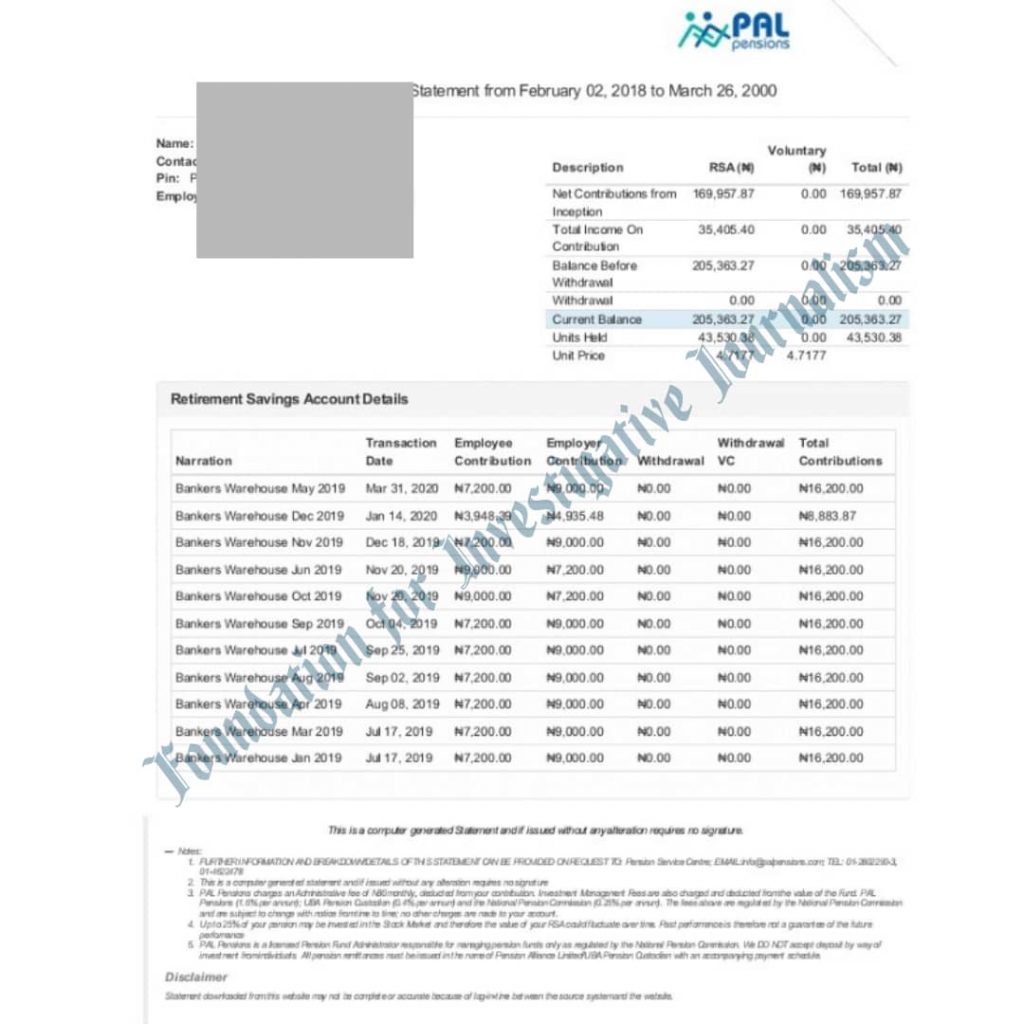

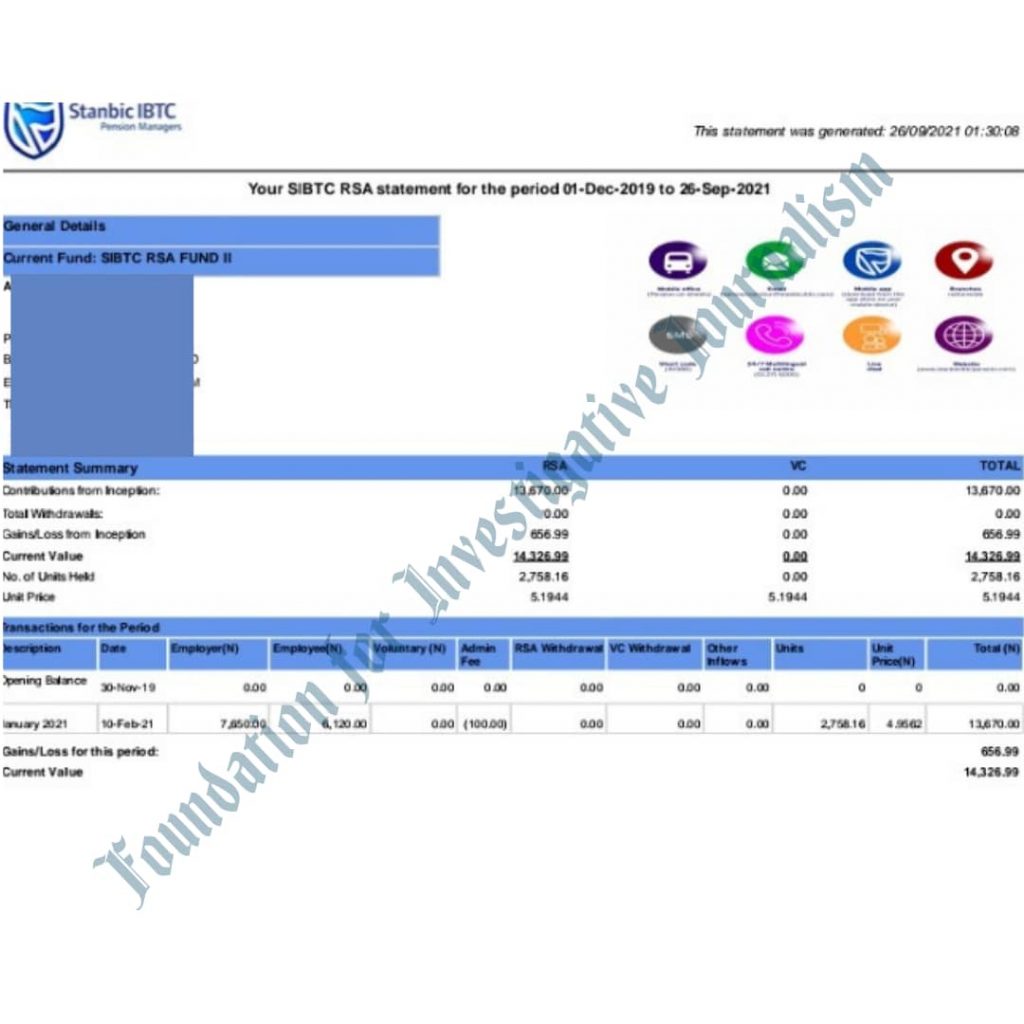

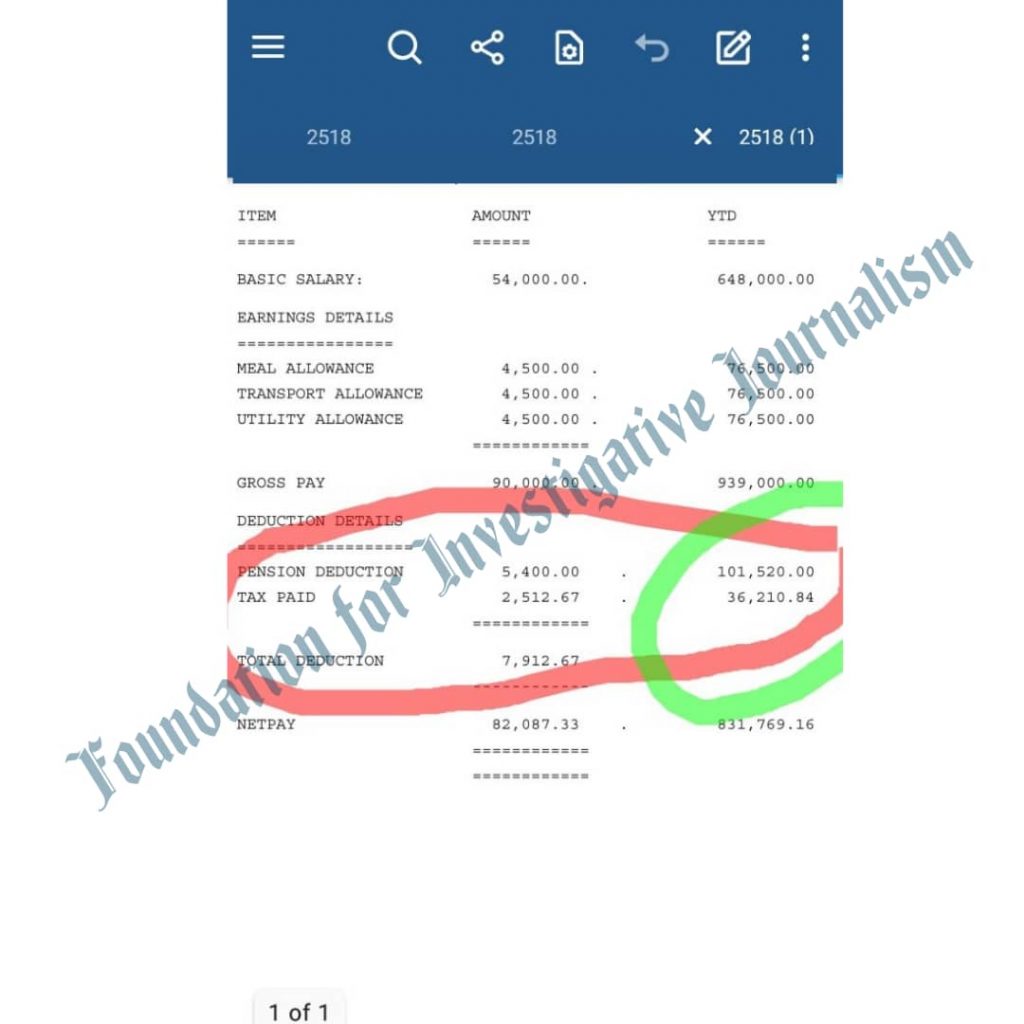

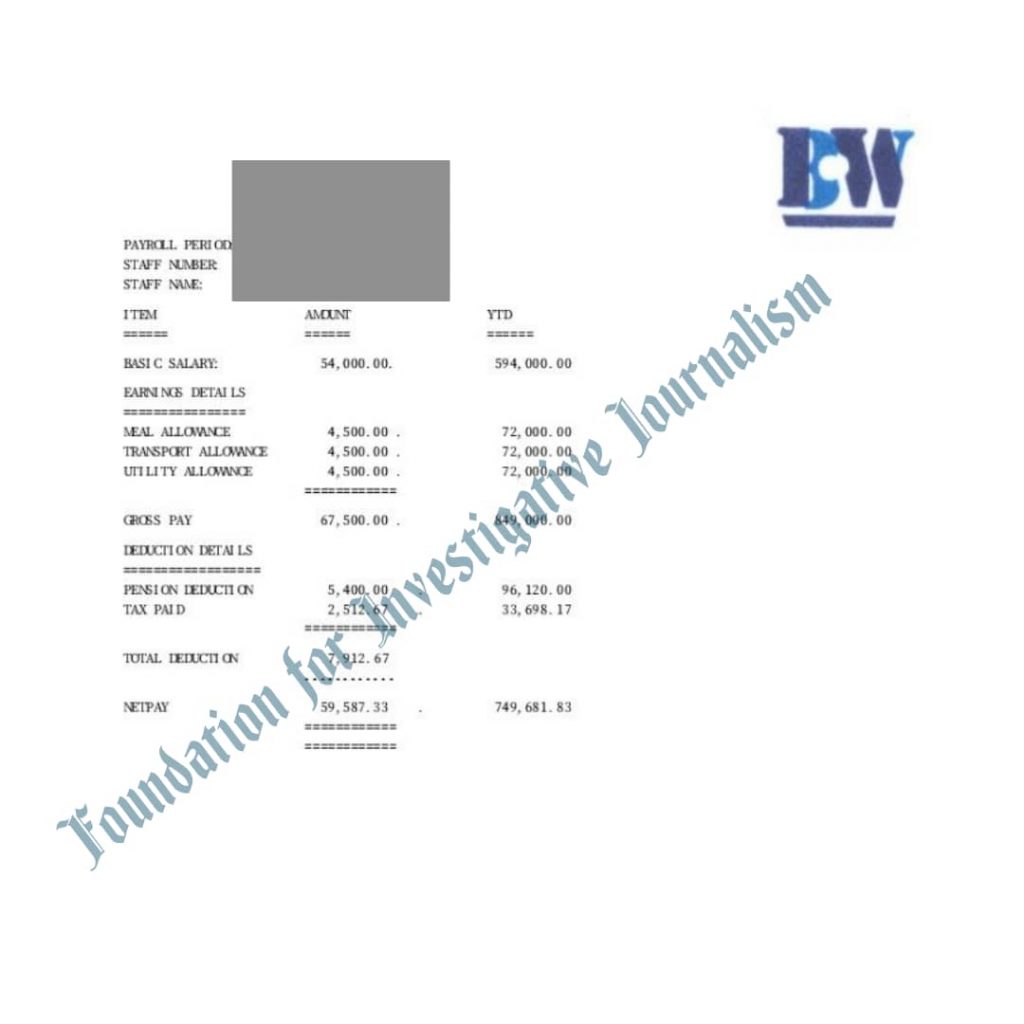

Speaking with FIJ, the ex-workers said the amounts they had in their RSAs were not equivalent to the deductions.

They said the company regularly deducted specific amounts from their wages as pension contributions each month without paying them to their pension fund administrators.

READ ALSO: Seyi Beckely’s Phresh Farms, Church Ministers Rob 1,500 Investors of Over N500m

“I joined the company in December 2019, and in January 2020, the company made a payment on the deduction of my December salary to my RSA. However, from that time until my resignation in August, no other payments were made, despite the constant monthly deductions from my salary,” said one of the ex-workers.

Another former employee of the company, who asked not to be named, said, “I joined the company in February 2018, and it started making pension deductions from my salary in March of the same year. Despite this, the company did not start making regular payments to my RSA until 2019.”

An aggrieved pensioner also said several other people who had served Bankers Warehouse were in the same situation.

“As we speak, I know of more than 20 people who are affected by this. But I am sure that the number is far higher than that,” he said.

READ ALSO: Dapo Abiola’s Voltac Global Capital Robs Investors, Including Students, of N1.8bn

According to the penalties for non-compliance with the Pension Reform Act, 2004, employers with a history of pension default over a period of seven business days from the day salaries are paid risk being sued by aggrieved parties.

FIJ emailed Paula Ohiwerei, Head of Human Resources and Corporate Administration at Bankers Warehouse, but did not receive a response.

Subscribe

Be the first to receive special investigative reports and features in your inbox.

3 replies on “Bankers Warehouse Deducts but ‘Refuses’ to Remit Ex-Workers’ Pension”

I worked there for 3years and 8 months.

No dim was paid into my pension account.

Even those who have spent 10years are in the same situation. You have to get a lawyer after the resignation before, you can get paid. Including Tax. None of the staff of the BW has a tax clearance certificate. And a certain amount is been deducteded monthly just like a pension.

Every complaint laid is true about BANKERS WAREHOUSE plc. It’s a things of dismay that such a profit making company still deprive it workers of their entitlement What a wicked company. Ppl work tireless with all their strength but still yet the company fail to improve staff welfare. I av worked with them and I have resigned but my pension remittance is yet to be cleared. It’s not fair. We worked towards d development of this company but the company keep punishing us.

I think this issue should be taken seriously. We keep saying the government is bad, but here is a company who hire innocent staff and treat them like they are trash that can be disposed anytime. They don’t even care about staff welfare and even the so called deduction are not been remitted. Bankers warehouse is a fraudulent organisation