Adenike Okekporo has narrated how the United Bank of Africa (UBA)’s slow response to inquiries and lack of action allowed suspected fraudsters to make away with her N1.61 million.

Adenike told FIJ that the thread of events leading to the disappearance of her money began last November, after a percentage of her tuition fee at a UK school was refunded.

READ ALSO: Abuja Resident ‘Disarmed Police Officers He Mistook for Criminals’. Now, He’s in Trouble

“I had made the complete payment for my tuition via Form A, so when my sponsor for a scholarship paid their part, the school refunded $1050 to me, and it was sent to my UBA account,” she said.

“UBA created a pound account for me, but to access my money in the UK, I asked that the money be transferred to my UK account where I would have access to it. We were on that before this SportyBet issue.”

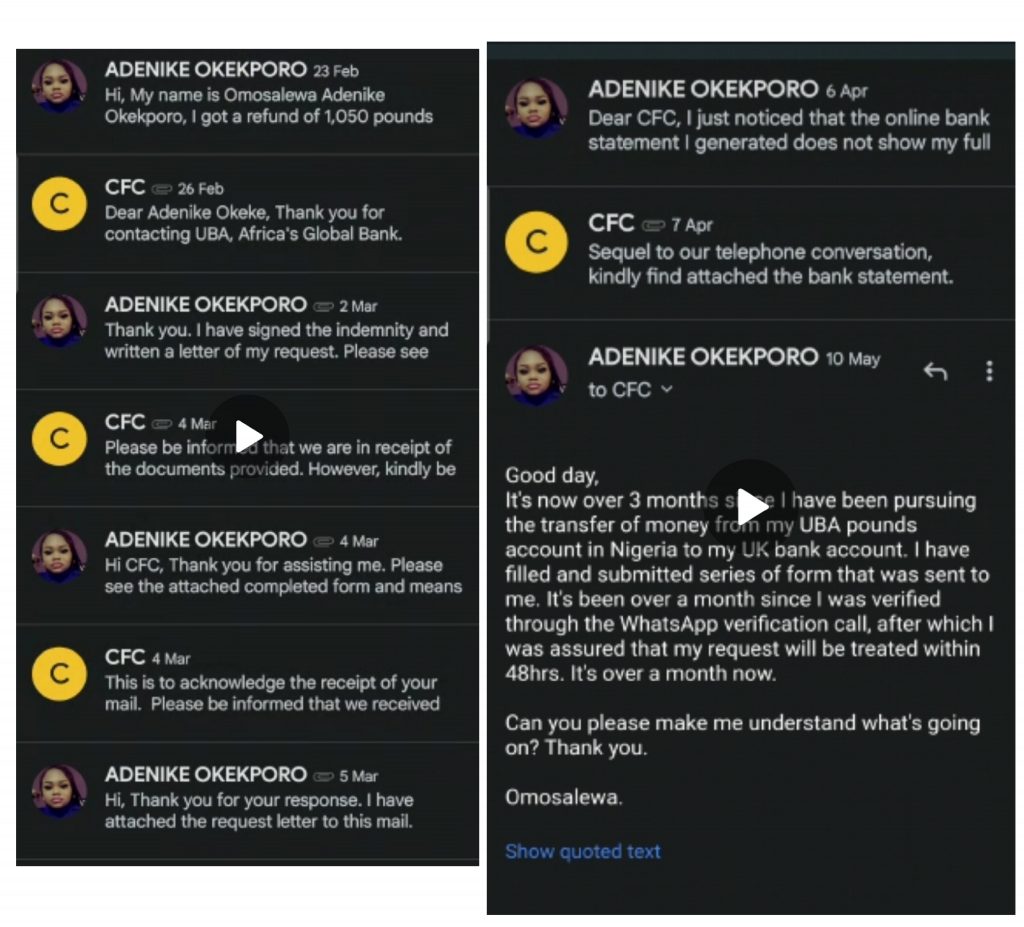

Adenike explained that she had been having a lot of back and forth with UBA customer care where she had been asked to fill out different forms and complete various verifications, including a video verification.

“During this period, I often spent up to N5000 on airtime to talk to their customer care. After they stopped replying to my emails, I sent a message on their official Twitter page, and it was like I was talking to a robot. I didn’t get a good reply, even after I sent all the screenshots of my details that were requested,” she said.

READ ALSO: VIDEO: Inside Two-Camera LTV Where News Can’t Be Cast Once It’s Night

Adenike said she was in class on Tuesday when she received a first debit alert of N500,000 from her UBA naira account. She suspected that it was fraudulent as she had not initiated any transaction, and she quickly reached out to UBA customer care.

“The lady kept telling me to hold on as I tried to explain to her. If she had acted the minutes I made the call, probably the other money wouldn’t have left the account. At a point, she even put me on hold, but it was useless. I received another alert of N500,000, then a million naira and N110,000,” she explained.

Adenike said she did not comprise her account details in any way and did her part to inform the bank of suspected fraudulent activities on time.

When FIJ contacted UBA, the bank said a customer experience expert would be in touch with us.

Subscribe

Be the first to receive special investigative reports and features in your inbox.