Ademola Abolaji, an Abuja-based civil servant, has detailed how N399,907 disappeared from his United Bank of Africa (UBA) account without performing any transaction.

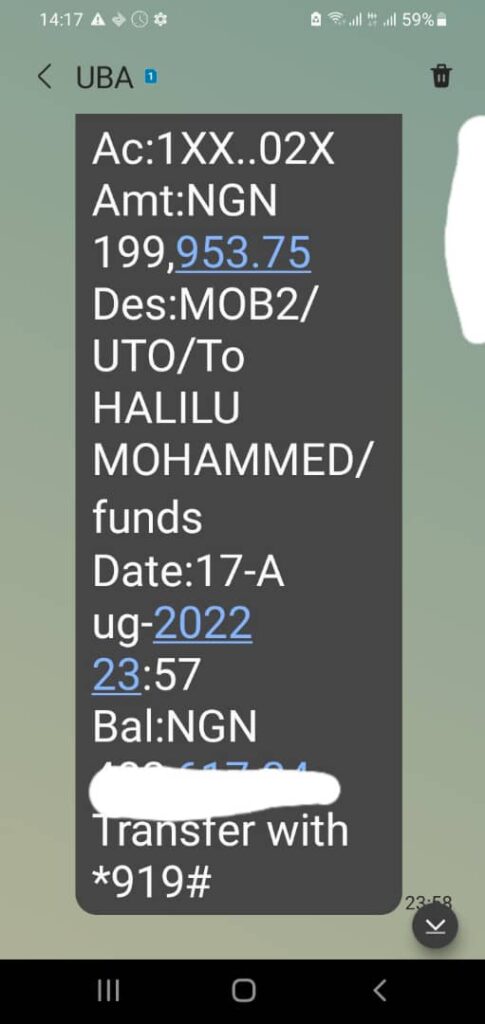

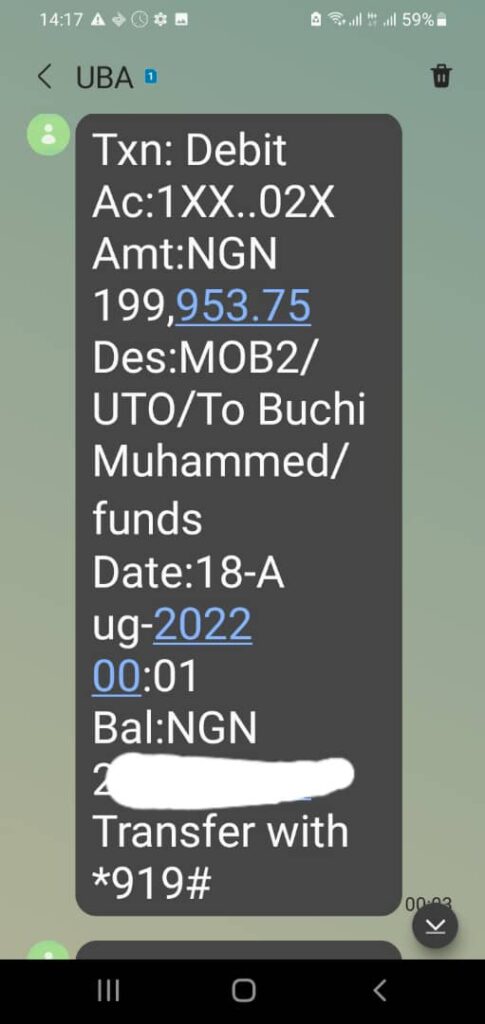

Abolaji told FIJ that he had shockingly received the two unauthorised debit alerts totalling N399,907 on August 17 and that all the attempts he subsequently made to get the bank to reverse the sum had proved futile.

The civil servant said he later reported the case to the Central Bank of Nigeria (CBN), Nigeria Deposit Insurance Corporation (NDIC) and Consumer Protection Council (CPC), but all three institutions also did not do anything in assisting him to get a positive resolution.

“I woke up one morning and saw two debit alerts to the tune of N399,907. When I did not get any explanation from UBA on why my money disappeared, I decided to report the matter to CBN, NDIC, CPC as well. In the end, I also did not get any favourable response from all three.

“I have, on several occasions, written letters to UBA. Their response was that I transferred the money to Fidelity Bank, which I never did. I was still asleep at the time, and I can’t imagine how two debit alerts at 11 pm and 12 am would emanate from a transaction I personally did not do. I have not heard anything from UBA since they said they wrote a letter to Fidelity, and they have even blocked me from sending emails to them.”

READ ALSO: Access Bank Wants Customer to Repay Loan Taken by a Thief

When FIJ placed a phone call to UBA for comments on the matter, one of its officials, who preferred not to be named, said Abolaji “may never get his money back because he personally compromised his account details”.

“Someone could have gained access to Abolaji’s account details after he had compromised them. UBA would not be responsible for it. I’m sorry,” the official said.

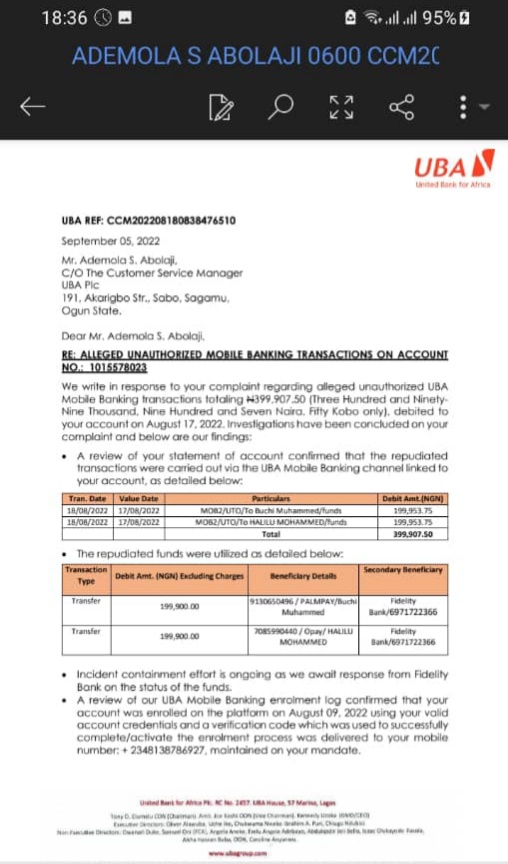

The bank had also, in an email it sent to the customer on September 5, said someone had used the customer’s login details to transfer money from his account to the Fidelity Bank account.

“In the light of the above, we advise that United Bank for Africa Plc was neither negligent nor liable as successful enrolment on the UBA Mobile platform was carried out using your valid account credentials.” the mail reads.

“The repudiated transactions were possible due to the activation code delivered to your registered mobile line that is required to set up the mobile banking platform and initiate transactions.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.