Ogechi Elijah, a Zenith Bank customer, has narrated how a fraudster who posed as her bank’s representative online ripped her off her hard-earned N1 million on January 5, 2023.

Elijah, who resides in Lagos, explained that she paid to renew her DStv subscription via the bank’s mobile app on January 4, but 24 hours later, the subscription was not activated, prompting her to contact the bank via its Twitter page.

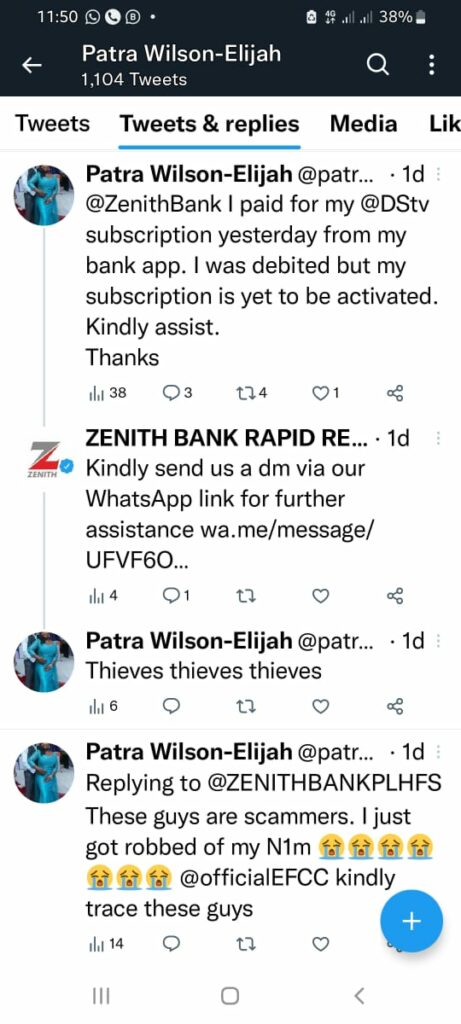

She said that after she had commented on the bank’s handle, the cyber fraudster responded to her tweet, asking her to hit them up on WhatsApp for further assistance.

“After failing to activate my DStv subscription despite paying via Zenith Bank app, I decided to complain to them via their account on Twitter because I thought I could get it resolved there,” Elijah explained.

She said she got a response from a page bearing the bank’s name with a blue check, giving her confidence that she was communicating with the right channel.

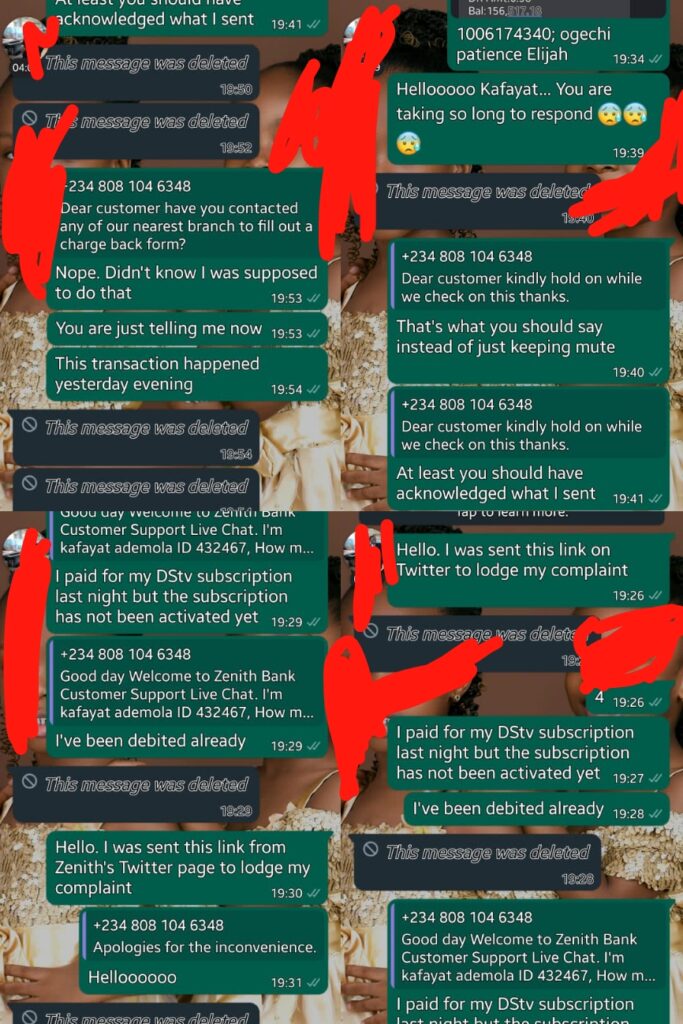

“Not long after my comment, I got a response from a lookalike handle, Zenith Bank Rapid Response, apologising to me while asking me to send WhatsApp chats to them for further assistance,” she said.

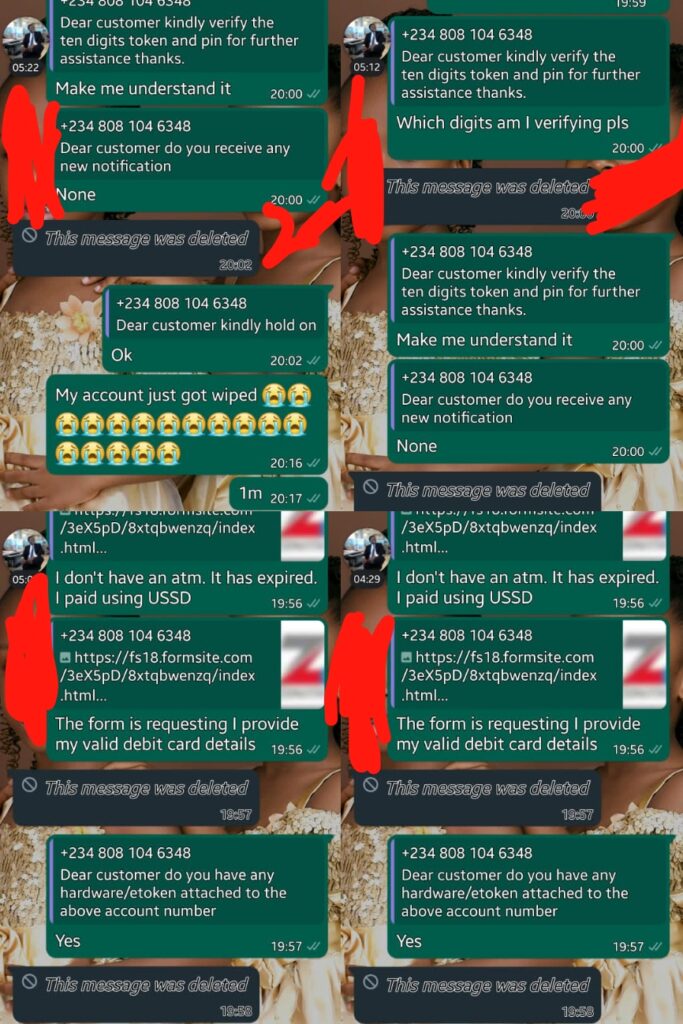

“All along, I never suspected foul play. They requested me to fill an electronic form wherein I was to input sensitive information, but I was reluctant and didn’t fill the form.

“Before I could realise what they were up to, I had got debit alerts for amounts totalling N1,000,000 from my bank, taken from both my savings and current accounts.

“The way the impostor conversed with me was similar to the manner in which the bank later responded to me via their original Twitter account, which did not make me get an inkling that I was in a wrong hand.”

Elijah said she contacted the bank and they promised to investigate or trace the conman.

“When I contacted the bank, they promised to look into the transactions through the channels through which the scammer snitched the money.

“One of my younger ones, Innocent Nwosu, also contacted the bank to plead with them to thoroughly investigate it. Some days later, the bank reverted with a response that the money was wired through Paystack into a SportyBet account by one Adesola Adejoko with the phone number +2348144217164, and Wema Bank account 2086402239 owned by Olubunmi Efejhero Abusule.

“The bank added that Paystack said the money had been delivered to the beneficiary. The branch manager in Ikota called the Wema Bank’s customer and she confirmed the receipt of N100,000 but claimed it was immediately withdrawn from her account by an unknown person.”

CALLS TO SPORTYBET

Nwosu told FIJ that he called SportyBet and they told him that if Zenith had contacted them before the money was moved out, they would have investigated the deduction and place a lien on the account involved.

READ ALSO: After FIJ’s Story, Zenith Bank, Parkway ReadyCash Refund Customer’s N30,000

“Since this fraud took place,” said Elijah, “I have not been at ease. I have lost sleep as I keep hoping for the day I would get my money back. I want the bank to get to the root of this incident. My life is shaking,” said Elijah with a sombre voice.

Checks by FIJ revealed that the hoax account had been suspended by Twitter upon numerous complaints by tweeps for its nefarious activities.

A customer service officer, who gave his name as Waheed, responded to FIJ’s phone call on Wednesday for comments and he confirmed that the fraud desk was working on the incident, promising to send the customer a reminder and get back to her with updates.

Subscribe

Be the first to receive special investigative reports and features in your inbox.