Baba Isa, a lawyer, has promised to sue Procash Loan, a quick loan company in Nigeria, for using his photo to threaten loan defaulters.

He told FIJ that Procash Loan gave the impression that he was their lawyer and that their communications were coming from a legal department that he oversaw.

Isa said he learnt the company was impersonating him on Saturday when one of his Facebook friends asked to be sure if he worked with the company.

READ ALSO: Quick Loan Company Announces Customer’s Obituary for Missing Payment Deadline

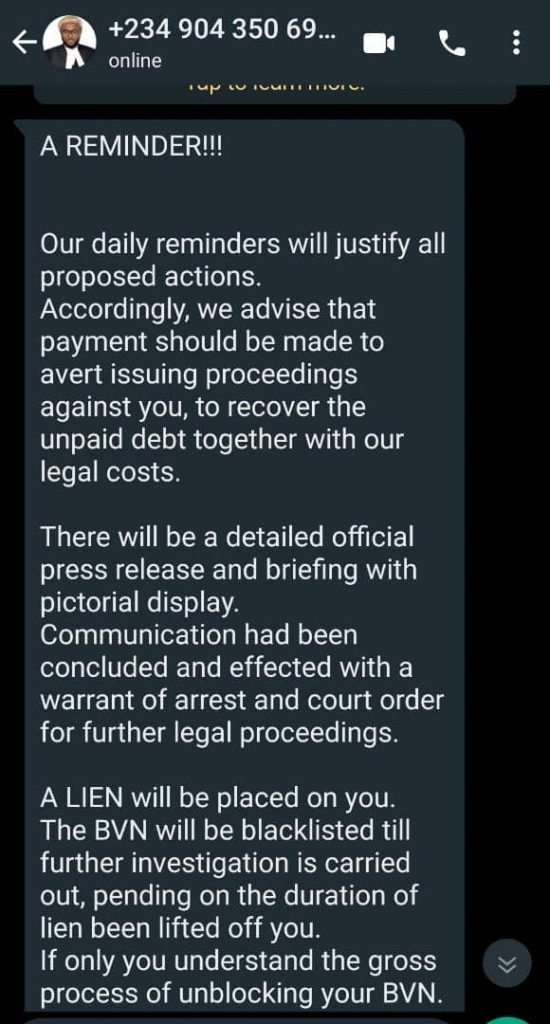

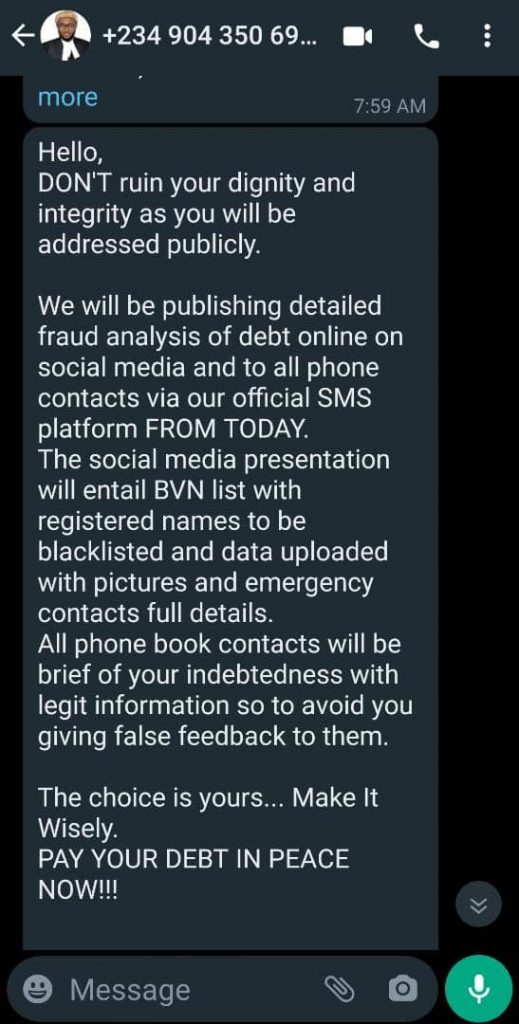

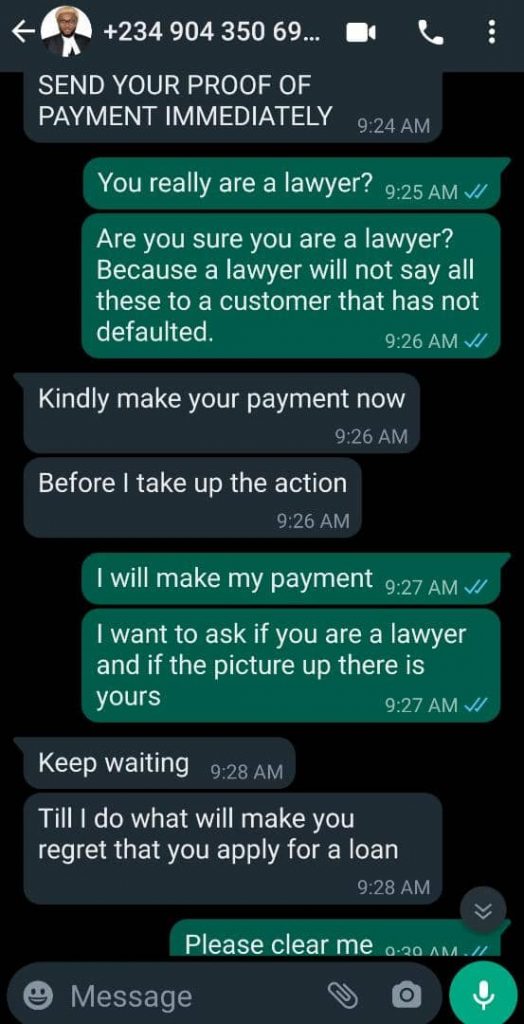

He explained that his friend, whose due date to repay her loan was Saturday, stumbled on several WhatsApp messages that indicated the company would sue her for “defaulting on payment”.

“They threatened her and wrote a lot of legal jargon and pieces that a competent lawyer would not even write. They threatened to take legal steps, but the steps they wrote are not legal steps and are not due process of law,” he told FIJ.

“Incidentally, she is also a lawyer. As a Facebook friend, she reached out to me and asked if I worked with them. She sent me their messages and I saw my picture there.”

READ ALSO: Nairaplus, 9Cash… Quick Loan Apps Driving Nigerians to Suicide

Being a lawyer also, Isa said the lady told him he could neither write nor speak the way the loan company approached the issue, as the steps in the messages were not the regular debt collection process.

He said he had spoken with his colleagues at his law firm and they would take the matter up both at the criminal and civil level with Procash Loan.

When contacted via the phone number used to harass Isa’s friend, a representative of the company insulted this reporter.

“This is a wrong number,” he said. “Just get off my phone with your bad luck.”

READ ALSO: N450,000 Loan Disappears From Retiree’s Wema Bank Account

Procash Loan is a Nigerian personal loan platform that gives short-term loans to its customers. The company uses artificial intelligence to collect prospective customers’ information, including phone records, bank transaction alerts, and BVNs, to build the credit score of each borrower.

Lately, loan companies in Nigeria have adopted crude measures to make sure customers repay their loans. They send disgraceful messages to loan defaulters’ contacts and post their private information online.

On Friday, FIJ reported how Deloan, an online loan company, posted obituaries of living customers who missed their payments.

Subscribe

Be the first to receive special investigative reports and features in your inbox.