Olufemi Akinyemi, a Lagos State-based businessman, has detailed how N1,311,200 mysteriously left his Guaranty Trust Bank (GTB) account.

Akinyemi told FIJ that he woke up in the early hours of January 19 to discover that the bank had sent several debit alerts to his phone.

“In April 2023, one of my customers got a loan from GTB,” Akinyemi told FIJ.

“This was unknown to me, and to be quite candid, I am not sure that should even be my business.

“But shockingly, some officials from the bank reached out to me later in the year to say that they discovered that a customer of mine who was owing them had been using my account to secure a quick credit loan from them.

“The allegation sounded funny to me, and I made GTB understand that I had been using the account, which is a savings account, for 15 years without any problem.

READ ALSO: GTB Places Restriction on Customer’s Accounts Over N586,000 Fraud He Self-Reported

“I also made them understand that I had never secured any loan from or for anyone and wouldn’t start now. It was an embarrassing allegation, and I really gave the officials a piece of my mind.”

THE RESTRICTION ON AKINYEMI’S ACCOUNT

Akinyemi said he visited a GTB branch in Abule Egba to further complain to the bank’s officials about the allegation that was made on the account and to also ascertain that the money in his own account had not been tampered with. To his surprise, he discovered while he was still in the banking hall that the bank had placed a restriction on his account.

“Despite all my explanations, GTB had gone ahead to place a restriction on my account,” Akinyemi said.

“At that point, I had N1.3 million in the account. It was also the same money that I had been using to run my small business.

“Because I knew I had not done anything criminal or fraudulent with the account, I started going to the bank every day to demand that the unlawful restriction on the account be lifted.

“When they saw that I was not about to relent in making sure I continued to have access to the money in my account, they eventually lifted the restriction they had placed on it. The restriction was lifted on January 18 of this year.”

Akinyemi said that to confirm that the account was restriction-free, he immediately transferred N100,000 to one of his clients.

“Because they had made me go through a lot with the restriction, I made up my mind that I would close the account once the matter was resolved,” Akinyemi said.

READ ALSO: Abuja Contractor Borrowed N3m to Pay Brother’s Tuition in Canada. GTB Withheld It

“So, after I discovered that the account was now fine, and because I got to know that I could now have access to my money quite late on January 18, I decided to wait till the morning of January 19 to carry out my plans for closing the account.”

That was, however, not to be, as things took a different turn before dawn.

OVERNIGHT MONEY HEIST

Akinyemi said he received multiple debit alerts on his phone at about 3 am on January 19.

“Around 3 am, multiple sounds from my phone woke me up,” he said.

“When I first stared at my phone from afar, I saw that I had received several messages. When I eventually picked it up to check, I discovered they were debit alerts.

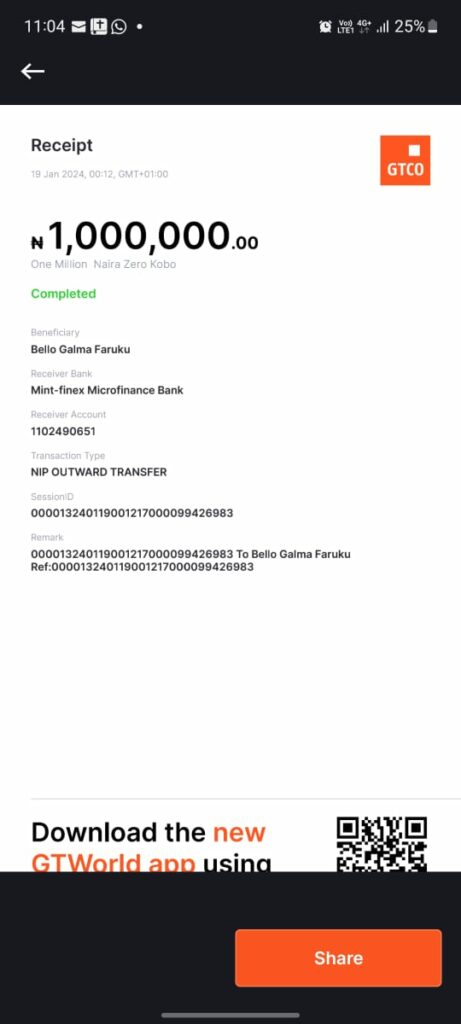

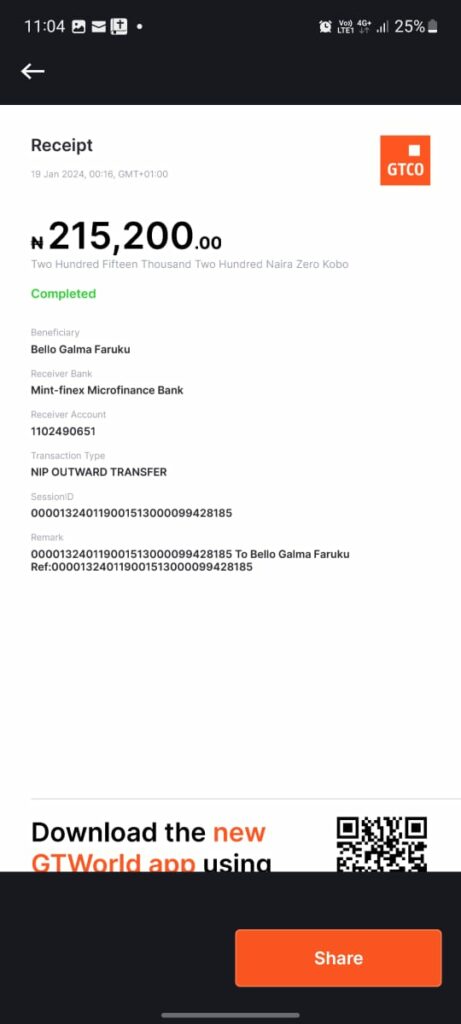

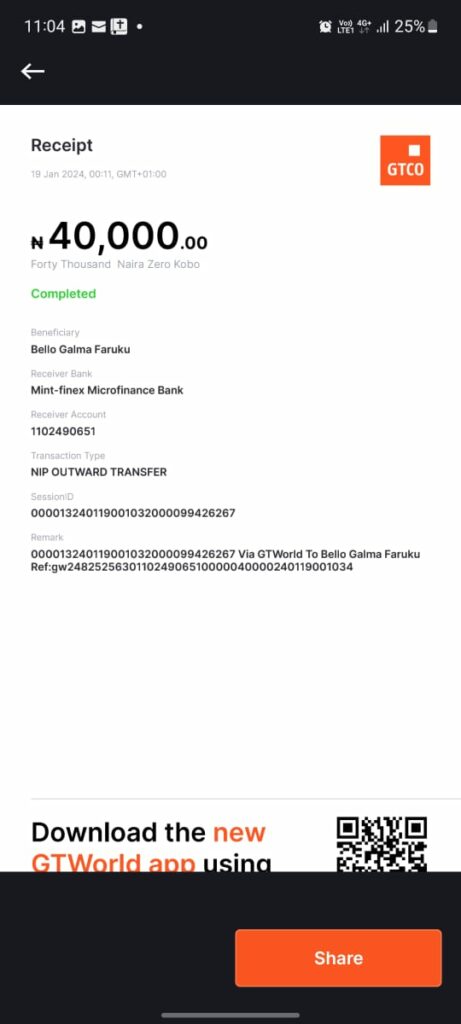

“The alerts showed that N1 million, N215,200, N40,000 and 20,000 had been stolen from my account by unknown persons.

“This was one account I had not transacted on in a long time. I do not even have a debit card on it anymore. I nearly collapsed.

“With that, I could not sleep. I quickly ran to a friend to tell him what had happened. He was the person that got me to calm myself a bit till morning.”

When Akinyemi visited the GTB branch in Abule Egba on January 19, he demanded to know why the amount was stolen from his account in less than 24 hours after a restriction was lifted on it.

“They asked me whether I had compromised my debit card or account details, and I found that to be absurd – an account you had practically restricted me from using for months,” Akinyemi said.

“Is it not an account that is active that you’ll have a debit card on?

“The GTB officials then traced where the money went and discovered it had been moved to a Mint-Finex Microfinance Bank account 1102490651 belonging to one Bello Galma Faruku.

“When GTB would not act swiftly in helping me recover the money, I personally reached out to the MFB and got to speak with one of their customer care officials.

“It was the MFB that told me that the fraudster had further moved the money to about nine other accounts.

READ ALSO: N2.95m Vanished From GTB Customer’s Account. He Fainted

“The official then told me that for them to attempt to help me get my money back, GTB needed to formally reach out to them so they could initiate a recovery process for me.”

GET THE POLICE TO RECOVER THE MONEY

When Akinyemi went back to GTB to get its officials to initiate a recovery process, he got a reassuring response.

“The GTB official I met told me that they had escalated the matter and that it was being worked on,” Akinyemi said.

“The response I got gave me a bit of comfort. I also thought a restriction would have been placed back on my account because of the theft.

“I, however, lost my mind when a customer sent N36,000 into the account a few days later and the money got stolen again by the same fraudster.

“The most shocking part when I returned to GTB to complain about the additional theft was that their official had to be telling me that I should get the police to accompany me to the MFB so that the person who stole my money could be fished out.

“I was expecting them to tell me to get a court order or any other document that could assist me in helping me get my money back, but that was what I was told and it’s quite surprising.

“Now, a total of N1,311,200 has been stolen from my account and GTB has apparently not done anything to help me recover it.

READ ALSO: One Arrested As GTB Refunds Customer’s Missing N2.95m After FIJ’s Story

“Sadly, this is the money I use to run my business. It is like my livelihood.”

FIJ sent an email to GTB’s customer care and fraud desks on Monday morning for comments on the matter, but it had not been responded to at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.