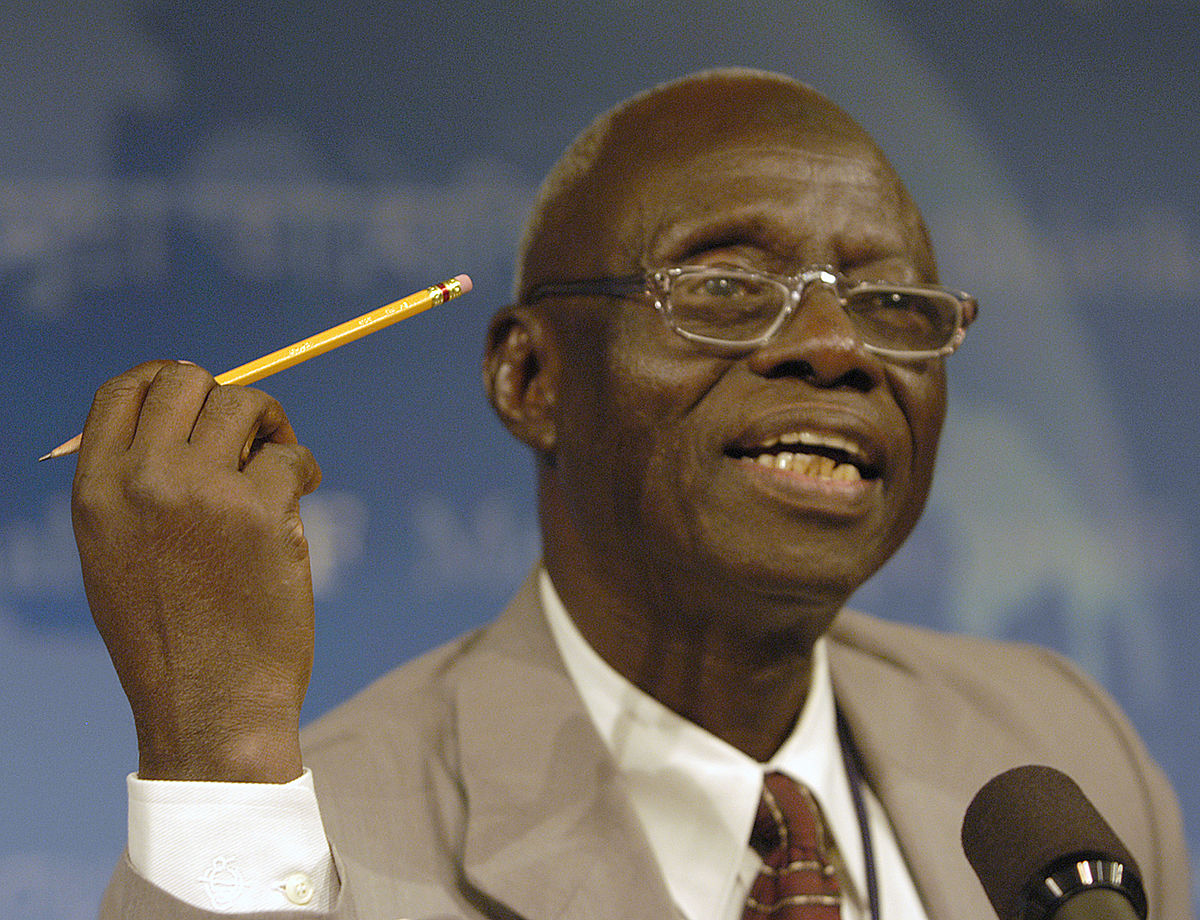

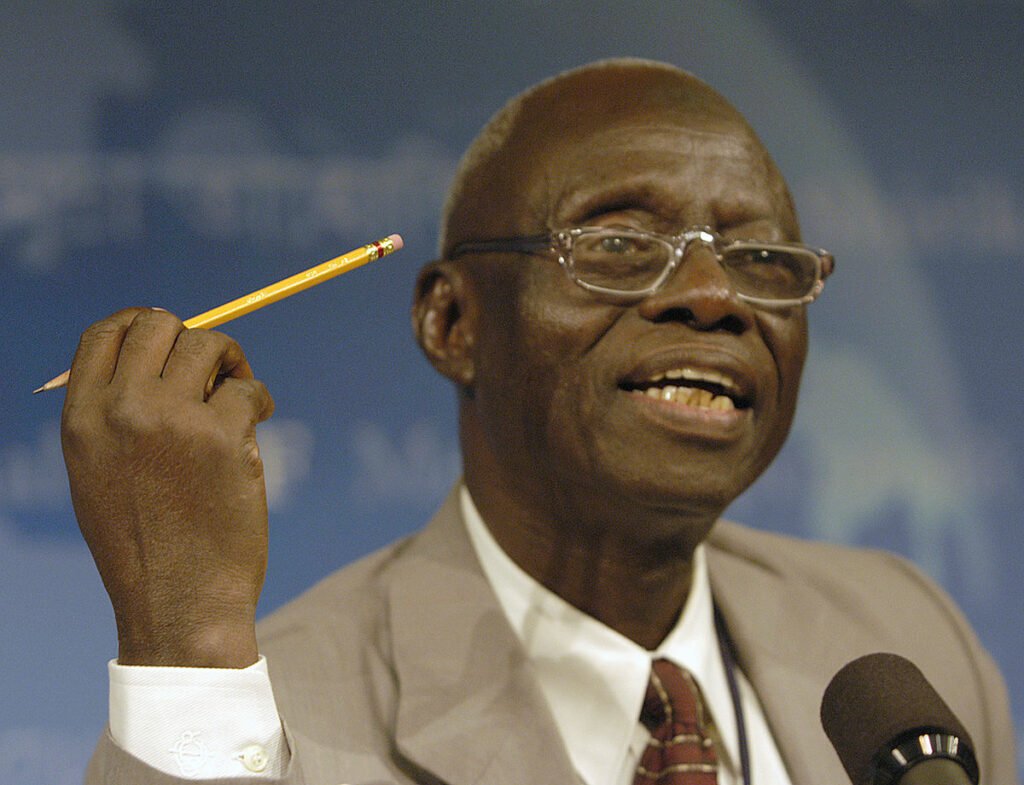

On June 4, 2014, Godwin Emefiele, the 10th indigenous Governor of the Central Bank of Nigeria (CBN), succeeded Sanusi Lamido Sanusi.

Since assuming office, Emefiele has taken numerous actions, made several policies and implemented many initiatives.

However, these actions, policies and interventions were often met with heavy criticism from the Nigerian public, and some of them caused a lot of outcry and calls for the governor’s removal from office.

The policies and interventions made by the apex bank on Emefiele’s watch include the suspension of foreign exchange sales to the bureau de change operators. Emefiele directed that all forex sales be done directly by the commercial banks. He also introduced the Anchor Borrowers’ Programme (ABP), an initiative riddled with debtors’ refusal to repay loans, and in 2021, the e-Naira, the controversial apex bank’s digital currency, was launched.

In October 26, 2022, the CBN announced that it would be redesigning the N200, N500 and N1,000 notes.

The bank said that the move became imperative because the country needed to improve on its currencies’ security and features, mitigate counterfeiting, preserve the collective national heritage, control the banknotes in circulation and reduce the overall cost of currency management.

It also stressed that the exercise was long overdue as international best practices required central banks all around the world to redesign banknotes every five to eight years.

The CBN also noted that the new banknotes would start circulating from December 15, 2022, and that the old notes would cease to have value on January 31, 2023.

However, since deposition began, Nigerians have continued to encounter challenges in their bid to have access to funds.

Nigeria’s cash-dependent informal economy and ordinary citizens have had to scramble for the new notes and this has led to violent protests in some parts of the country.

After several “conceited” statements by the CBN governor, the apex bank eventually decided to extend the deadline to February 10.

READ ALSO: 14 Times Nigeria Redesigned Banknotes in the Past

On Wednesday, the Supreme Court suspended the CBN deadline for demonetisation policy and fixed February 15 for a hearing on the matter.

Before the present problem of non-circulation of cash, Emefiele had been labelled the worst CBN governor a few times.

Here are nine other indigenous governors that have held the position since Nigeria gained independence in 1960, and the impacts they made while in office.

ALIYU MAI-BORNU (1963 – 1967)

On July 25, 1963, Aliyu Mai-Bornu, an economist from Borno State, became Nigeria’s first indigenous CBN governor. With Agriculture accounting for a large share of Nigeria’s GDP, and going by the monetary policies by the CBN, the country witnessed an annual growth of 3.1 per cent while Mai-Bornu was in office.

CLEMENT NYONG ISONG (1967 – 1975)

On August 15, 1967, a banker and politician, succeeded Mai-Bornu as the country’s second indigenous CBN governor.

During his tenure, Nigeria changed its currency name from pound, shillings and pence to naira and kobo. With the change, a naira at the time was equal to 10 shillings, while 100 kobo became one naira.

This era brought an end to the pound being used as the dominant legal tender in the country.

ADAMU CIROMA (1975 – 1977)

Adamu Ciroma’s tenure as Nigeria’s third indigenous CBN governor coincided with the country’s “oil boom era”. During Ciroma’s tenure, the N20 note was introduced on February 11, 1977.

The new currency immediately became Nigeria’s highest denomination and its emergence also coincided with the period the country experienced economic growth.

The preference for cash transactions and the need to conveniently move around with cash made the introduction of the denomination a highly welcome development among Nigerians.

OLA VINCENT (1977 – 1982)

On June 28, 1977, Olatunde Olabode Vincent, a Lagos State-born economist, popularly known as Ola Vincent, succeeded Adamu Ciroma as Nigeria’s fourth indigenous CBN governor.

During Vincent’s tenure, three new banknotes – one naira, five naira and 10 naira – were introduced to Nigerians in 1979. In order to facilitate identification, distinctive colours were used for the various denominations.

The notes bore the portraits of three eminent Nigerians, who were declared national heroes on October 1, 1978. The one naira note had the portrait of Herbert Macaulay, a Nigerian nationalist. On the five naira note was Tafawa Balewa, Nigeria’s Prime Minister during the independence era, and on 10 naira was Alvan Ikoku, a foremost Nigerian educationist.

Following Vincent’s retirement from the CBN, he recommended the establishment of the Nigeria Deposit Insurance Corporation (NDIC) to the federal government in 1983.

The NDIC, which provides a safety net for depositors in the banking sector, was eventually established in 1988.

ABDULKADIR AHMED (1982 – 1993)

Abdulkadir Ahmed, Vincent’s successor, remains the longest serving CBN governor Nigeria has ever had. While in office, all the colours of the country’s banknotes were changed except for the 50 kobo note in 1984.

According to the then government, the redesign became necessary in order to control the trafficking of the naira to foreign countries. On his watch, the N50 note, popularly known as ‘Better Life’ among Nigerians, was introduced in 1991. The banknote had the portraits of four ordinary Nigerians who represented various ethnic groups and cultures. During the same period, N1 and 50 kobo notes were changed to coins.

READ ALSO: Protest Over Scarcity of Fuel and New Banknotes Turns Violent in Ibadan

In 1986, the Bauchi State-born businessman was a part of a delegation that controversially engineered Nigeria joining the Organisation of the Islamic Conference (OIC) without the country being aware of it. At the time, Commodore Ebitu Ukiwe, Ibrahim Babangida’s second in command, Professor Bolaji Akinyemi, the then Minister of Foreign Affairs, and Colonel Anthony Ukpo, the Information Minister at the time, all said they were not carried along.

PAUL AGBAI OGWUMA (1993 – 1999)

On October 1, 1993, Paul Agbai Ogwuma, an Abia State-born seasoned accountant became Nigeria’s sixth indigenous apex bank governor. Ogwuma liquidated 20 distressed banks over a three-year period in an effort to clean up the financial system and restore confidence.

Ogwuma’s office was also notable for being used as a source of personal funds and looting of Nigeria’s treasury by the late Sani Abacha, who was Nigeria’s military head of state from 1993 to 1998. Ogwuma was said to have repeatedly released funds to the Abacha family whenever it was requested for.

Upon leaving office, the Olusegun Obasanjo-led government claimed it recovered over $2 billion and £100 million from the Abacha family abroad, and N10 billion in cash and properties locally. Also, former president Goodluck Jonathan’s administration reportedly recovered $226.3 million and €7.5 million from Liechtenstein at different times.

The same Jonathan government claimed it recovered £22.5 million Abacha loot from the Island of Jersey, while $322 million and £5.5 million were reportedly returned to Nigeria by foreign governments at different times.

Buhari’s regime has also recovered several millions of dollars of Abacha loot since assuming office in May 2015, including $321 million from Switzerland, and $300 million from the US and Jersey.

READ ALSO: VIDEO: Lagos Residents Storm Into Zenith Bank Over Scarcity of New Naira Notes

While in office, Ogwuma was unknowingly involved in a massive fraud totalling $242 million. Emmanuel Nwude, a fraudster, impersonated Ogwuma and convinced a senior officer of a Brazilian bank to pay the amount to fund a fictitious contract with Nigeria’s ministry of aviation. Nwude, the fraudster, and his gang were eventually arrested in 2004.

It was also once alleged that Ogwuma and his wife bought a N15.6 billion property in the UK.

JOSEPH SANUSI (1999 – 2004)

In 1999, Joseph Oladele Sanusi, an accountant from Ondo State, succeeded Ogwuma.

While in office, and in response to the expansion of economic activities aimed at facilitating an efficient payment system, the N100, N200, and N500 banknotes were introduced in December 1999, November 2000 and April 2001 respectively.

Known for his conservativeness, Sanusi quickly took foreign exchange control during his tenure, to reduce the drain on foreign reserves which had fallen from over $7 billion to under $4 billion under Ogwuma.

CHARLES CHUKWUMA SOLUDO (2004 – 2009)

On May 30, 2004, Charles Chukwuma Soludo, an Anambra State-born economics professor, became Nigeria’s eighth indigenous CBN governor. The N1000 note was introduced during Soludo’s tenure.

Soludo’s administration insisted on the growth and financial trust of Nigerian commercial banks by ensuring that all the banks in Nigeria had enough capital bases.

This move ensured that the banks’ customers did not bear losses alone in the event of a collapse. The policy led to the collapse of some commercial banks due to their inability to meet the required capital base of N25 billion.

READ ALSO: CONFIRMED: APC Crediting Voters With N10,000 Online in Exchange for Their Data

The policy solidified the commercial banks in Nigeria and ensured that individuals and organisations without financial stability did not operate banks in the country.

Soludo is the current governor of Anambra State.

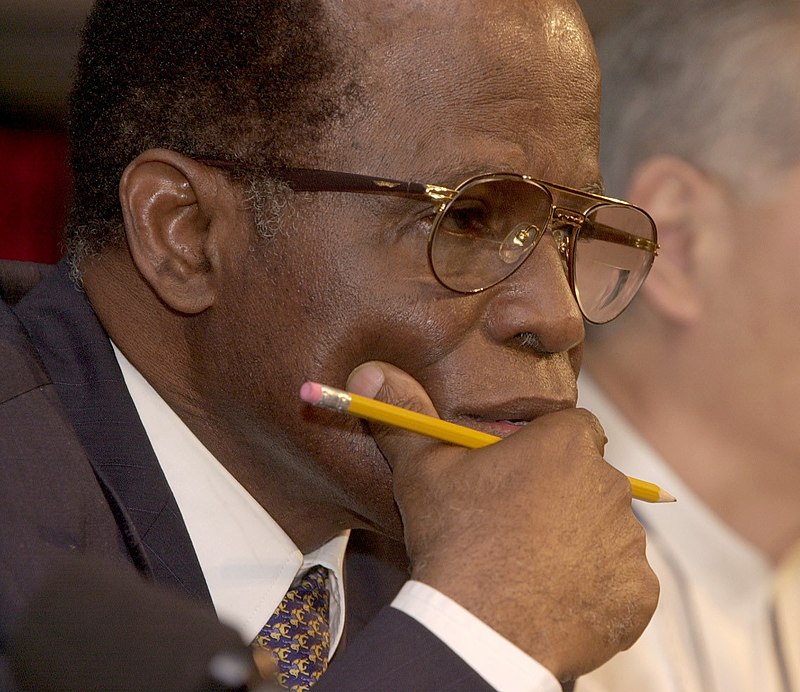

SANUSI LAMIDO SANUSI (2009 – 2014)

In 2009, Sanusi Lamido Sanusi, a Kano State-born economist and banker, took over office from Soludo. While in office, Sanusi built on the policies of his predecessor and this led to the sacking, arrest and prosecution of many bank CEOs and executive directors of commercial banks in Nigeria.

The executives were alleged to have mismanaged customers’ loans and deposits, forcing their banks to be over-dependent on the CBN.

Sanusi is widely recognised for his fight against the overtly corrupt banking industry and his contribution to a risk management culture in the Nigerian banking system.

After a fall-out with the then government of Goodluck Ebele Jonathan, he was suspended on the allegations of financial recklessness.

He was succeeded by Godwin Emefiele.

Sanusi is now a former Emir of Kano.

Subscribe

Be the first to receive special investigative reports and features in your inbox.