OPay has refused to pay David Orere Ben his ₦84,575 several days after he discontinued a savings plan with the company.

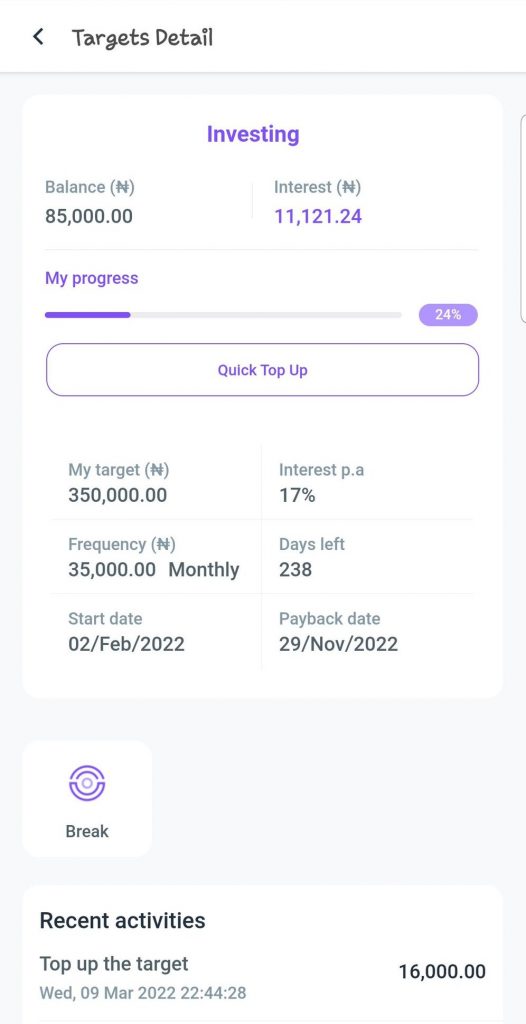

In February 2022, David initiated a target savings account plan which requires a client to pay an amount in installments over a fixed period of time and then receive an accumulated payment with interest at the end of the set period.

David planned to save ₦35,000 monthly between February and November to reach a target of ₦350,000 and accrue a 17 percent interest by November 29. However, he changed his mind after two months and requested for what he had saved so far.

READ ALSO: Hackers Take Over OPay Twitter Account, Direct NFT Owners to Fake Website

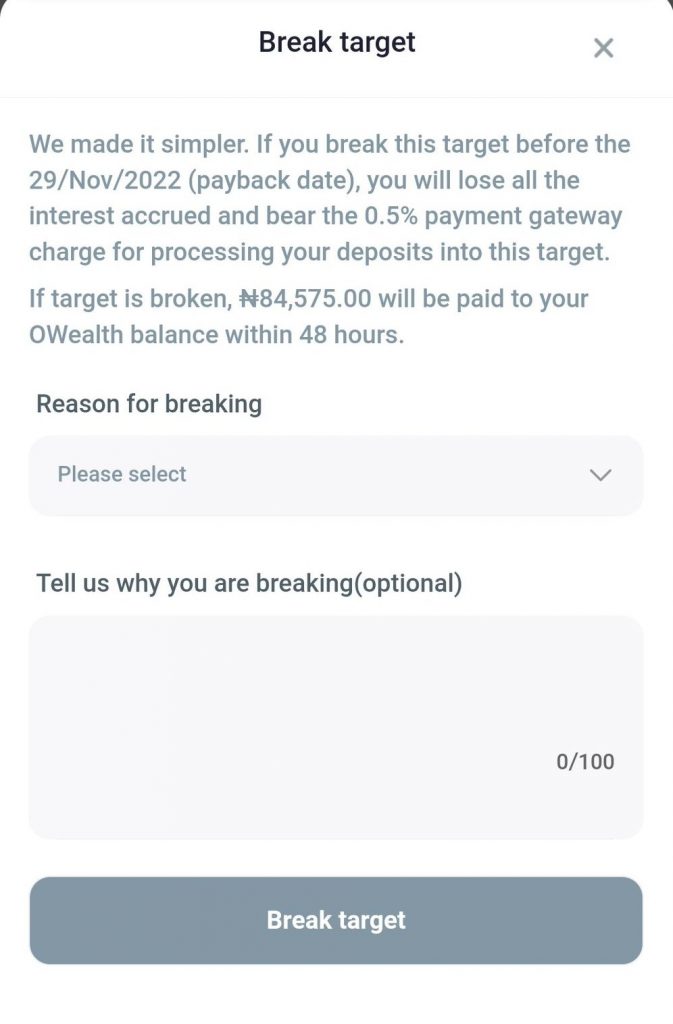

“It was stated that if for any reason I wanted to break the account, a percentage would been withdrawn and it would take at most two days to release the money,” David told FIJ.

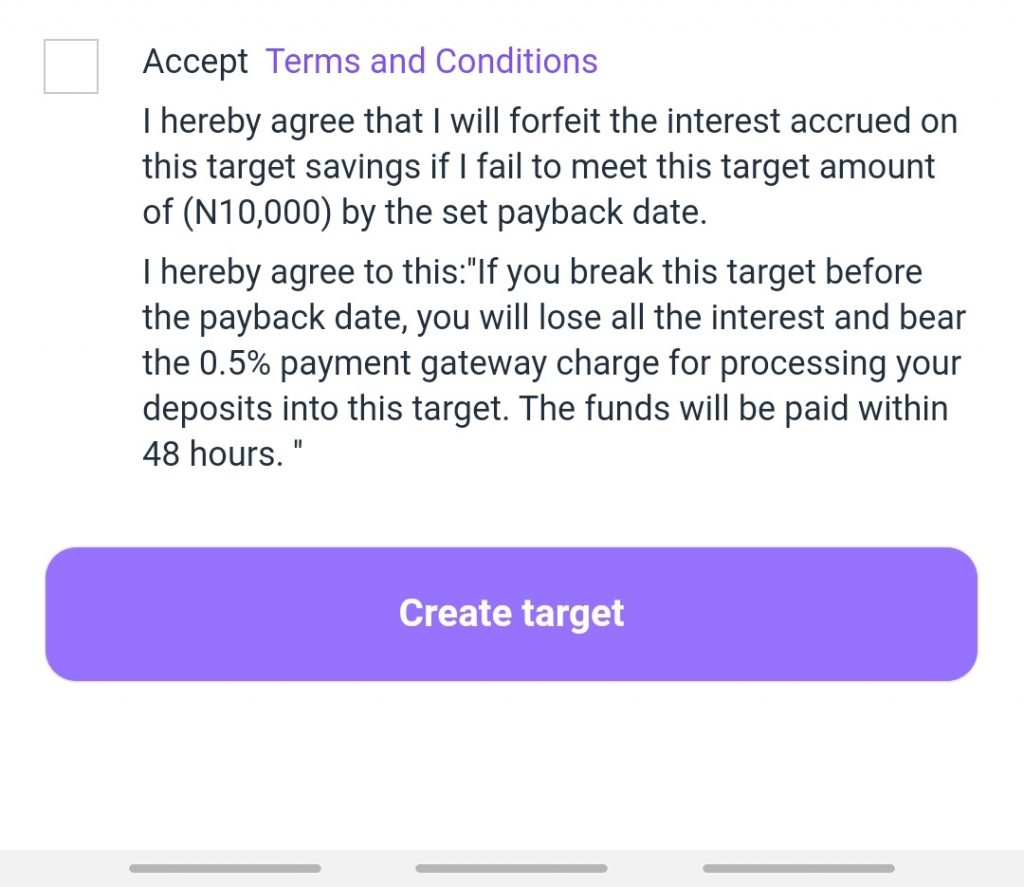

David had also been told he would part with “all the interest accrued” and bear a 0.5 percent payment gateway charge if he decided to opt out of the plan.

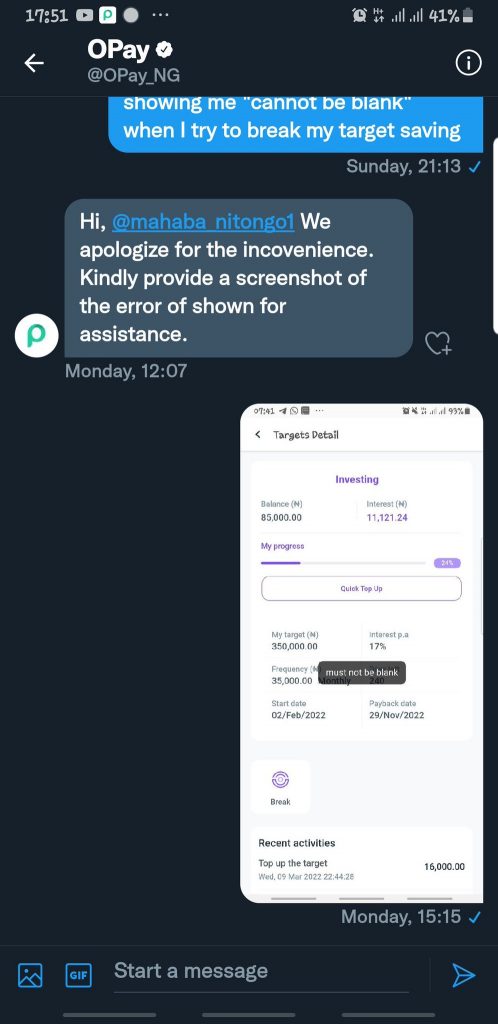

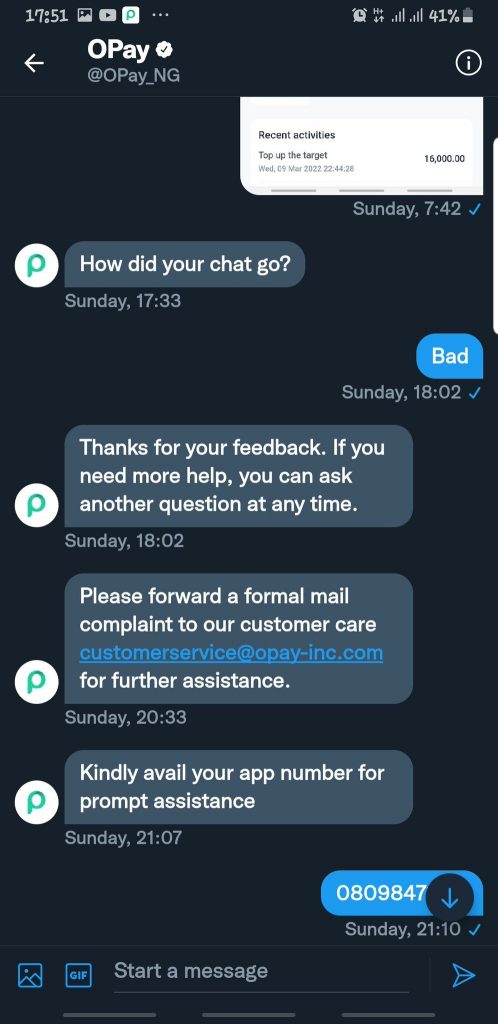

David attempted to discontinue his savings account plan but was denied on his OPay application. He then contacted OPay to complain and was promised a quick resolution. Every time David contacted OPay, he was asked to provide his account details, but nothing happened afterward.

“It’s been going on for days now. I’ve been reaching out to them but they keep asking to send details, and I’ve sent it to them repeatedly but they just ignored me,” David said.

An OPay customer care representative said David should be able to receive his money. “Depending on the agreement, a customer can break a savings plan. He has to fulfill the requirements as stipulated in the OPay app. Once he does this, he should get his money within the next few days,” he said.

“He can break the savings depending on the due date. He cannot withdraw from a savings account until a due date within the set duration,” another OPay customer care agent said.

Subscribe

Be the first to receive special investigative reports and features in your inbox.